Field Study: Food Supply Chain Tech

As a firm, we’ve been interested in Food Supply Chain Tech and the infrastructure used to allocate food resources in a safe, efficient, reliable and sustainable manner. As a partner with experience in E-commerce supply chain technology, I also took a liking to Food Supply Chain Tech as it rhymes with the mechanics of shipping internet goods in many ways. Now more than ever (thanks COVID), it’s important to invest in the global food logistics market, which is projected to reach around $162B by 2024. The lasting effects of the pandemic, plus a potential economic downturn and margin pressures, have urged food supply chain actors to pursue technology strategies to bolster efficiency and throughput.

Alpaca is not new to the Food Supply Chain Tech scene, but we’re certainly not known for it. We’ve made several investments spanning producers and distributors (notably Imperfect Foods, Brad’s, Aloha, Yay Lunch) and I have personally invested in several female founders (Tiny Organics, Shiru, Pod Foods, Foodology). As such, we wanted to investigate the future investment opportunity in the space.

From our research, we gauged the importance and weight of this market. The global food system accounts for 10% of the world’s GDP and employs as many as 1.5 billion people. The global food logistics market reached a value of $100B (2018), projected to reach around $162B by 2024 (CAGR over 8%). Technology adoption has driven cost competitiveness up and trading margins down over the last ten years. However, less than one-quarter of executives feel that they’ve made significant progress in developing a playbook for the future.

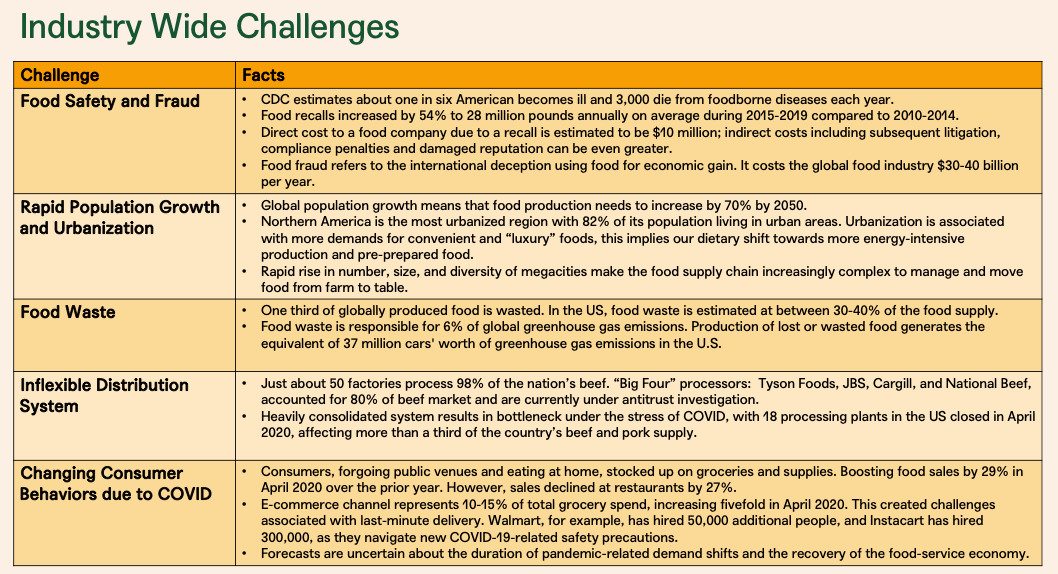

The impetus for new technology adoption deepens as we investigate the industry wide challenges faced by executives, producers, processors, distributors, regulators, and consumers. See below:

As new challenges arise within the sector, new opportunities for solutions also emerge. Innovations in Food Supply Chain Tech are developing quickly as available capital increases each year (42 deals in 2018 and 33 deals in 2019, with over $3B capital raised each year). We believe investment opportunities will arise from these challenges and usher in a new reality post pandemic:

- Changing consumer preferences will continue to boost organic and healthier food markets.

- Food safety regulation will lead to product/menu expansion, higher standards, and a more intense focus on traceability.

- Increased appetite for convenience food will catalyze innovation in packaging, and operational challenges and cost pressures (including rising labor costs) among equipment users are set to accelerate automation.

- COVID changed 85% of consumer’s food habits. The lasting effect of the pandemic, as well as a potential economic downturn, urge food supply chain players to pursue robust and resilient strategies.

Our View of the Future of Food Supply Chain Tech

Because the sector is so vast, we have focused on five key technology trends that will catalyze the industry and present attractive investment opportunities. Let’s dig into these below.

- Digital Marketplace & E-commerce: Online platforms that change food wholesaling and retailing experiences for stakeholders, allowing a shorter time to market and the ability to meet buyer demand and reduce food waste. These platforms are designed to sell a broad range of products or specialized types of products. Continued development of tech enablement, such as payment and security, as well as shifts in consumer behavior, have fueled the growth of startups in this ecosystem. Food and Beverage, still the least-penetrated category online, is expected to grow 58.5% in online sales in 2020.

- Automation & Robotics: Technology and hardware used to reduce labor costs, improve ecommerce delivery times, and alleviate labor constraints. COVID accelerated automation technology to assist the human worker, make warehouses safer and ensure continuity of operations. Because of the capital intensity and maturity of this market, we spent less time here.

- AI/ML Analytics SaaS: Enhancing supply chain efficiency and operational optimization through data collection along the supply chain, in order to provide valuable insights and facilitate data-driven decision making. Using predictive and prescriptive analytics to improve areas such as supply chain transparency, demand planning, pricing and end-of-life product management could bring social, economic, and environmental benefits.

- Food Traceability System: Tracing the flow of foods throughout the production, processing and distribution stages, helping food companies and governments more efficiently identify, isolate and respond to the source of a food safety issue and food fraud concerns. Because of the regulatory complexity of this space, along with the use of blockchain and IoT, we spent less time here.

- Food Repurpose: Uses ingredients that otherwise would have not gone to human consumption, are procured and produced using verifiable supply chains, and have a positive impact on the environment. About 30–40% of all food produced in the United States, worth an estimated $218 billion (1.3% of GDP), is wasted. Food repurpose addresses the food waste problem directly and is one way to solve the food urgency problem as the population grows. Upcycled food makes a more sustainable and resilient food system for all players along the supply chain and can help reduce 70B tons of greenhouse gases from food loss and waste while creating economic opportunity and jobs for people around the world.

After investigating the major technology trends, and assessing their relative attractiveness given our own investment criteria, we believe opportunities exist in three key areas: Digital Marketplaces, AI/ML Analytics, and Food Repurpose. Our analysis details our rationale for these areas, as well as qualities that we look for in potential investments.

Key Takeaways

Macro/Thesis: Food supply chain technology is transforming the way that e-commerce supply chains have over the past two decades. The global food system accounts for 10% of the world’s GDP and employs as many as 1.5 billion people, and as such presents a massive market opportunity where technology can drive margin, speed/convenience, safety, waste reduction, flexibility, and healthiness.

Research: We investigated the funding landscape, key industry challenges and technology trends driving investment opportunities forward. From this research, and digging into specific examples, we concluded there are a small set of investable areas for us to play.

Conclusion/Opportunities: We believe investable opportunities exist in three key areas: Digital Marketplaces, AI/ML Analytics, and Food Repurpose. Because these areas are asset light, growing quickly, agile, and largely unregulated, we believe they can generate venture returns for a fund like Alpaca.

Our Summarized Slide Deck:

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.