Playbook: How to Set Meaningful OKRs

You probably have several goals for your startup — hiring star talent, being recognized as a top company in your industry, launching a revolutionary product, securing an early-stage investment from a top VC — the list goes on. And while it’s good to be ambitious, it can be easy to find yourself pulled in a variety of directions trying to make all those goals happen at once.

Enter Objectives and Key Results (OKRs). Setting clear OKRs for yourself and your business will ensure you stay focused on actionable steps toward your goals and provide much-needed clarity for your entire company.

What are OKRs and why are they important?

OKRs are more than just a goal — they’re a form of communication among leadership and employees alike. By setting clear OKRs, you’ll ensure accountability and collaboration at all levels of the business. Everything in this guide can also be found in John Doerr’s book Measure What Matters, which we highly encourage everyone to read.

Let’s break down what a strong OKR looks like:

First, you’ll want to focus on the Objective. This should be the ultimate goal of all your hard work and objectives should be identified at both the organizational and individual level. That way, people are encouraged to connect self-identified objectives back to the company’s broader mission. This not only makes it clear to employees what their value is to the company but also the value of their teammates. Noticing that value also makes for more opportunities for employees to give and ask for help.

When developing your objectives, be sure to push for ones you would otherwise consider a stretch (but also achievable). By setting stretch goals, you’ll force difficult questions and conversations among your team and determine whether or not this is actually the way forward. If they are not achievable though, you run the risk of demotivating your team — so striking a balance is key.

Here’s an example of an objective a marketing team might set: “Increase email subscriptions by x%.”

It’s clear, has a quantifiable goal, and ideally is an increase beyond the team’s normal output. This objective should spark conversations around strategy and help the team determine whether this is the right channel to serve the company’s mission. And these conversations should happen with each new objective.

Next, you’ll set your Key Results. These are the actions you’ll take to reach the previously set objective and each should be deliverable or quantitative in some way.

If we go with the marketing team objective above, some key results the team might explore would be:

• Perform user research with 50 current customers to determine what’s currently working and what they’d like to see more of

• Launch redesigned newsletter by [MM/DD/YY]

• A/B test sign-up buttons on the company’s homepage

Notice how these examples are specific and quantifiable — it’s clear what needs to happen to achieve the key result in question.

You can imagine then that a lesser OKR would be more vague like “Perform user research.” It prompts more questions than answers (“What type of user research? How many customers do we need to speak to?”) and every person that comes across this key result will have a different idea in their mind. So staying specific will not only help you, but the rest of your team, stay on track.

Achieving each of these key results should get the team that much closer to reaching their objective. And if the objective isn’t hit, use it as a moment to motivate employees rather than punish — discuss what can be done differently next time and what support is needed to finally see it through. Again, the aim is to prompt challenging conversations, which may ultimately lead to new opportunities or even new objectives leadership otherwise wouldn’t have considered.

Still need some guidance on drafting and reviewing your OKRs? Here is a quick must-have checklist to keep in mind:

• Quantitatively trackable

• Habit-creating (i.e. top of mind all the time)

• Stretch goal (Rule: 70% completion = great job)

• Continuous check-ins, communication, and feedback, leading to iterative adjustments along the way

Why a VC fund should care about portfolio OKRs

Determining and setting OKRs goes far beyond an organization’s internal needs and is in fact a great way for a VC fund to evaluate the strength of their portfolio company. By regularly tracking a portfolio’s OKRs, VCs can understand the performance of their investments in real-time and make the highest ROI follow-on decisions as a result. This could take shape in the following ways:

• Assisting founders to stay on track and ensuring that they are focusing on the most important key drivers of their business

• Forming opinions on businesses before they raise subsequent rounds of capital and using these indicators of success to be proactive versus reactive about follow-on decisions

• Helping portfolio companies raise from top-tier investors by previewing performance metrics to Series A investors.

But this can only happen when a company’s objectives are clear and quantifiable, so it’s absolutely crucial that the lines of communication remain open and that there is shared accountability from top to bottom. (You’re probably sensing a pattern here.)

How to build an OKR framework and schedule

Now that you have a solid understanding of OKRs and have likely given some thought to what yours could look like, it’s time to establish an OKR framework for your entire company. An agreed upon structure will give your teams a jump start on the OKR process and ensure everyone is working toward your biggest goals.

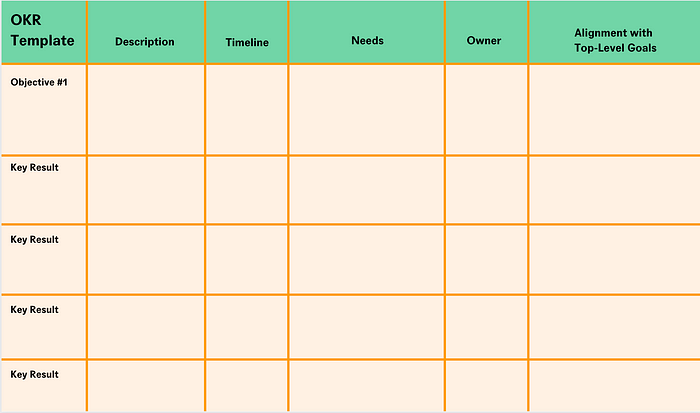

Here’s an example template of what that might look like below:

For each objective, you’ll want to draft a longer description that includes how it ladders back up to the company goals. Next, you’ll need a timeline. Be realistic, but ambitious — ask yourself how urgent this objective is or isn’t and where it will rank among your laundry list of priorities.

Once these are locked, move on to your needs to bring this to life. Are there particular KPIs that need to be tracked or benchmarked against? Perhaps additional processes need to be defined. Whatever would be necessary to make this objective a reality, note it in this column.

No objective would be complete without defining its owner. While it may be tempting to name multiple people here, the goal is to identify a singular owner who is responsible for seeing the objective from beginning to end. That way, if things go awry or further direction is needed, everyone involved knows who to turn to for support.

Finally, you’ll want to detail your objective’s alignment with top-level company drivers and goals. This should be built upon your note within the description and clearly identify the value a completed objective would bring to the company’s grander mission.

Once those elements are locked and entered into your template, you’ll move on to detailing the key result(s) for each objective. Reminder, these should describe key outcomes and not activities. (Feel free to detail out the specific to-do’s for each key result on a separate tab within your template to avoid confusion.)

To encourage transparency and collaboration, consider also developing a schedule of updating and refining OKRs on a regular basis. What that timeline looks like for you and your company will depend on a variety of factors, but here is a suggested cycle from Measure What Matters:

This will keep individual and company goals top of mind for everyone and should spark new ways of problem-solving throughout the quarter.

The Alpaca OKR process with portfolio companies

OKR tracking at a VC fund level will differ from organization to organization, but at Alpaca, we stick to the following framework to support our founders and startups:

- Post onboarding, the Alpaca team member who owns the portfolio company relationship is responsible for creating 4 to 5 metrics that we care most about tracking. Ideally, these are closely tied to a company’s own OKRs, which we work with the founders to shape.

- At the end of each quarter, this team member will assess results with the founder and compare the forecasted vs. actual numbers. Based on those numbers and our interactions with the founders, we assign the company a score on a ranking from 1 to 5 (1 being a terrible quarter, 5 being a record-setting quarter). This is kept internal to our team.

- After assigning a score, we write a short paragraph summarizing the previous quarter and discuss actual metrics, what went well or didn’t, and any intangibles that don’t make it into the numbers, such as “made a key hire and ran a great process,” “communicated well when something went wrong,” etc.

- We then record the above in the summary tab (as shown below with companies not in our portfolio as an example) and input new goals for the new quarter. The summary tab is intended to be a brief snapshot of each company’s performance. Other information captured includes the date of the seed investment and the expected date for Series A.

- When a company goes out to raise a Series A, we utilize the summary tab to create an abbreviated investment memo. This memo links back to our initial 19-Factor Matrix and the key metrics set from the original investment.

Once this framework is set up, it’s easy for our team to stay on top of portfolio company goals and metrics. And it’s these key metrics that provide us with a massive amount of information arbitrage that not only affects the way we deploy follow-on capital, but also ensures we can set clear expectations with our founders for the future.

…

While setting OKRs can seem overwhelming at first, just remind yourself they’re part of an ongoing process of communication rather than something set in stone. Draft some options out, discuss them with your team, and if they don’t quite fit or no longer work for you or your company’s goals, make adjustments and keep it moving. Remember — if your OKRs encourage a conversation, you’re doing it right.

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.