Field Study: The Transformation of Senior Living Through Technology

Unfortunately, the COVID-19 pandemic has shone a harsh light on the challenges that many senior living communities are facing, from social isolation to inaccessible quality of care. The industry’s historical lack of innovation and technology adoption has left many facilities ill-equipped to manage the pandemic’s many curveballs.

That said, with vaccine distribution in full force, we are looking towards a brighter future for residents of senior living facilities and believe that these communities are the next great frontier of digital transformation. We trust that facility owners and caregivers will invest in technologies that bring the living back into senior living — from social platforms and virtual reality travel experiences to online fitness classes and gamified retirement savings software — to reshape the narrative for aging.

Over the past three months, we scoured the senior living landscape to better understand how technology can play a role in improving the quality of life and outcomes for our nation’s seniors. Our summary findings and report are below.

Our Identified Secular Themes

We believe that there are four macroeconomic drivers that will have significant downstream implications on technology innovation and adoption in senior living:

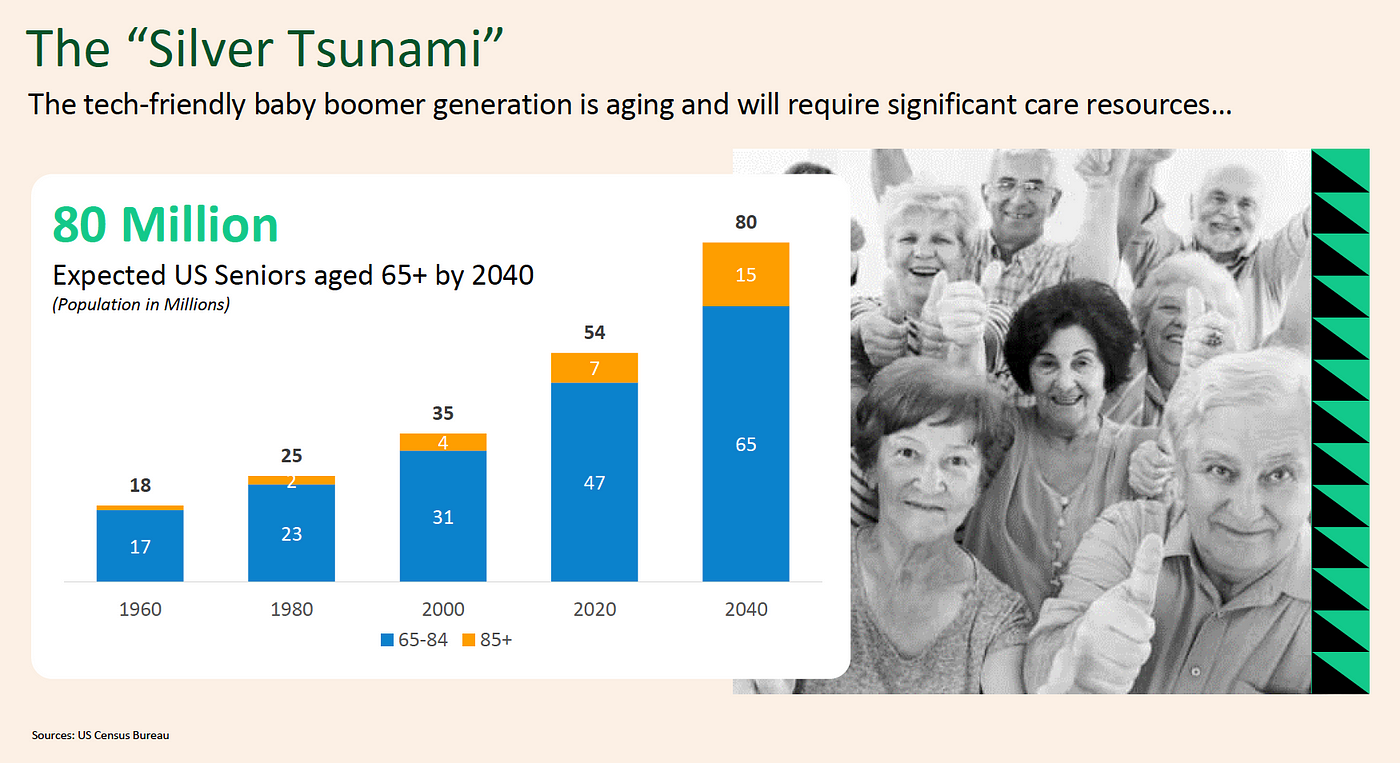

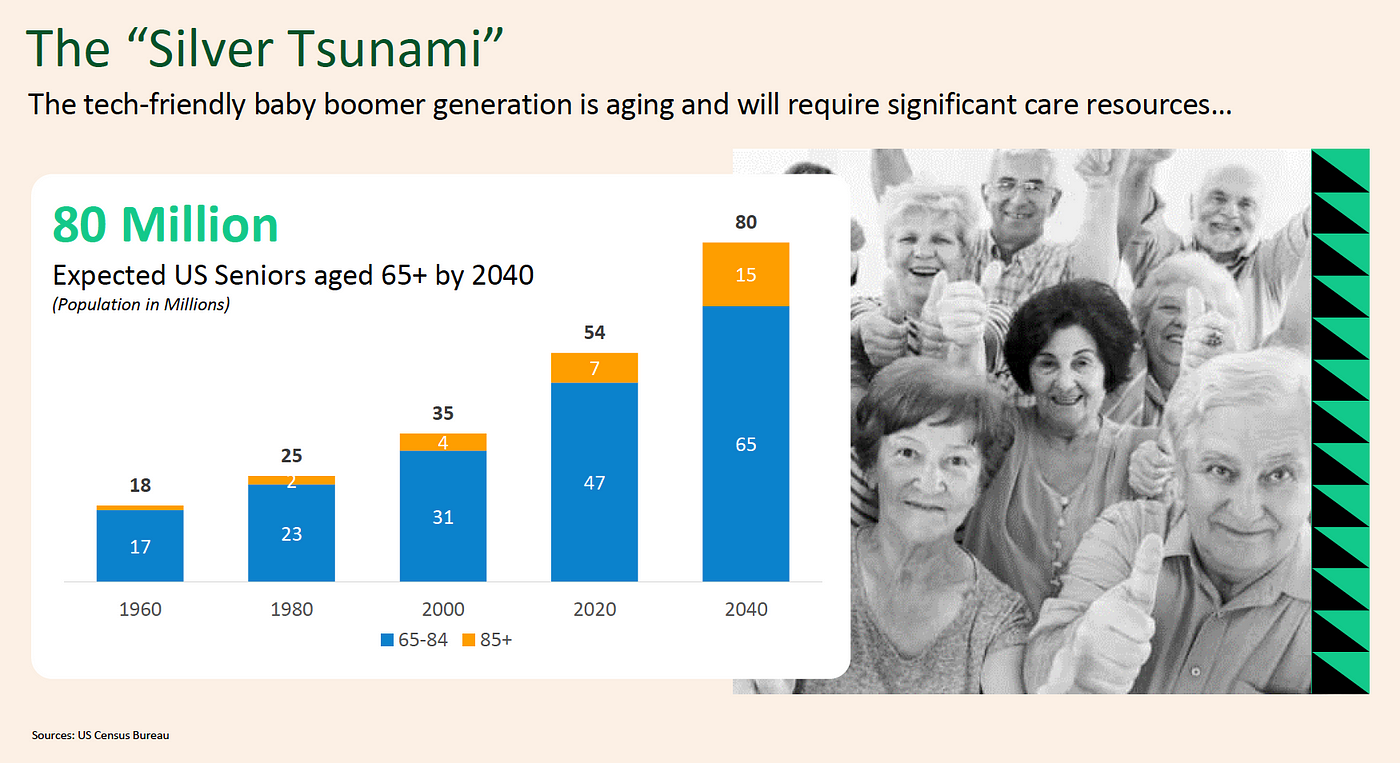

- The Silver Tsunami: The US census estimates that the population of adults over 65 will reach 80 million by 2040, representing a 66% increase in the size of that demographic.

- The Caregiver Dilemma: In the US, there are currently 7 eligible caregivers (adults aged 45–65) for every 1 senior (aged 80+). This ratio will shrink to 4 to 1 by 2030, putting stress on an already underpaid, high-churn, caregiver profession.

- The Social Determinants of Care: Recent research suggests that 80% of an individual’s health is influenced by social determinants, such as exercise, nutrition, housing, financial stability, and community.

- The COVID-19 Pandemic: During the pandemic, 76% of senior care residents report feeling lonelier due to isolation from friends and family. The pandemic with drive families to home care, accelerate technology adoption in facilities, and further highlight the importance of wellness.

The Industry’s Value Drivers

The senior living ecosystem is comprised of a unique combination of diverse stakeholders, from real estate developers deploying capital for their next senior care facility to registered nurses administering care to residents. In our conversations with various industry participants, we identified four core value drivers for the senior care industry:

- Occupancy: Average occupancy at senior care facilities ranges from 80–90%. Increasing occupancy helps owners cover fixed costs.

- Length of Stay: The average length of stay in US nursing homes is 2 years and 4 months. Improving length of stay reduces sales and advertising costs associated with soliciting new residents.

- Operational/Variable Costs: Variable costs such as labor and food are estimated to make up ~35% of a senior care facility’s cost structure. Reductions in variable costs without sacrificing quality can significantly improve an owner’s bottom line

- Resident/Family Satisfaction: Satisfaction surveys and metrics can have government funding implications and can impact a facility’s attractiveness to prospective families/residents.

We believe that startups and technologies that directly or indirectly address these value levers will have the greatest chance at adoption.

Analyzing the Startup Ecosystem

We identified over 180 startups operating in the SeniorTech ecosystem that have raised over $4 billion in capital. These companies are addressing challenges across the entire senior living value chain, from communication to care. The mental model that we employed to segment SeniorTech startups is as follows:

- Maintaining Independence: Technology that enables physical, psychological, and financial independence (e.g. retirement planning apps).

- Physical Health: Technology that facilitates more effective and faster treatment of injuries and illnesses (e.g. telemedicine).

- General Wellness: Technologies that improve non-medical cognitive and physical wellness of residents (e.g. wearables).

- Social and Engagement: Technology that helps residents better engage and communicate with their peers, family, and caregivers (e.g. digital content apps).

From a funding perspective, our research suggests that the venture-backed SeniorTech landscape is fairly nascent and that there are not yet any ‘breakout winners’ in the Independence, Wellness, and Social segments, in particular.

Alpaca VC’s Summary and Outlook

Thesis: The pandemic has shown the world that technology innovation and adoption in senior living is long overdue. Founders are flocking to SeniorTech as they acknowledge the opportunity in the aging population. Families and caregivers alike are continuing to seek out technology solutions that enable cheaper, more effective medical care and increasingly comprehensive psychological, social, and emotional care.

Research: Our analysis of 180+ startups led us to classify the technologies that help seniors maintain their independence, improve the physical healthcare they receive, improve their general well-being, and better connect them with the world. The most mature solutions by far are those technologies that work to improve physical healthcare outcomes.

Conclusion/Outlook: In the near term, Senior living facilities will unsurprisingly continue to emphasize and invest in safety measures to reduce the spread and risk of COVID-19. However, we believe there is an appetite to use this time for piloting new technologies that solve communication and care challenges, which will likely persist well after the pandemic.

In the medium term, we believe that post-pandemic fears will drive families (and investors) towards home care and away from in-facility care. As occupancy falls, facility operators will need to find ways to leverage technology to reduce variable costs.

In the long term, facility operators will put as much, if not more, emphasis on the social determinants of health as they do medical care. The labor market for caregivers will tighten and operators will need to find ways to augment their workforce with technology. A “shakeout” of startups will occur, but those that can take advantage of the value levers previously discussed will win.

Our Summarized Slide Deck:

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.