Field Study: The Rise of Recommerce

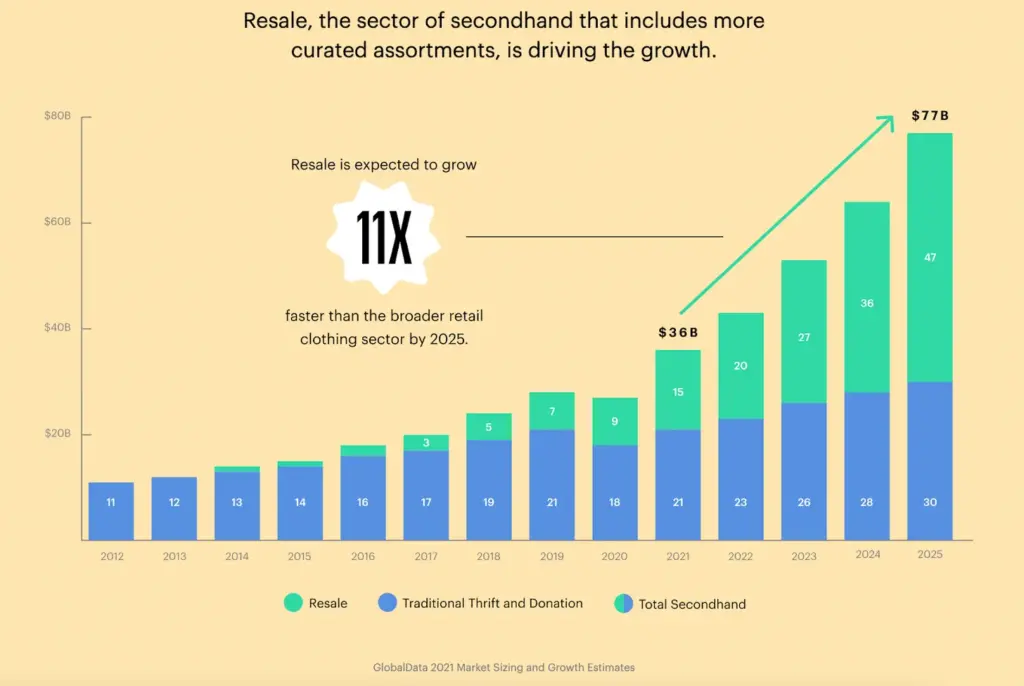

For any investor, this stat should stop you dead in your tracks: The Secondhand Market is projected to double in the next 5 years, reaching $77B.

Secondhand, or recommerce, will grow at 11x the rate of regular retail. If that doesn’t smell like opportunity, I don’t know what does. We at Alpaca wanted to investigate the white space in the recommerce market, which has matured over the last decade, but is seemingly poised for future incremental growth.

What is Recommerce

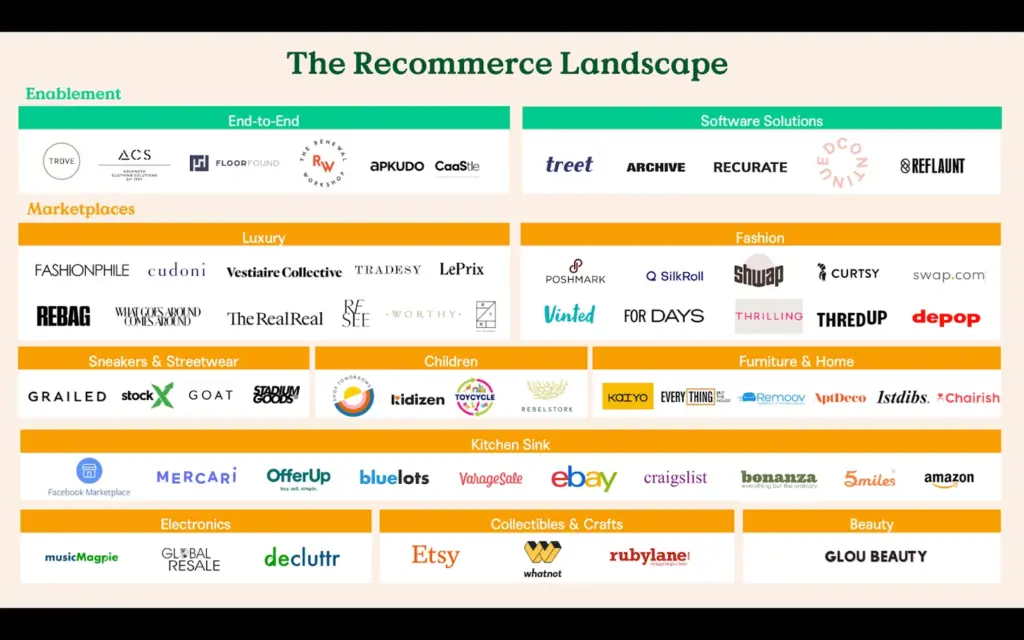

This is such a big topic to cover, but generally recommerce is defined as powering the re-use of goods. That can mean both reselling as well as renting of goods; that can mean everything from fashion to furniture; that can mean a merchant, brand or consumer as the seller; that can mean a business model that is P2P (peer to peer), a managed marketplace, or a layer of the tech enablement stack. When it comes to recommerce, I like to take the simplified view and split the market into two big buckets: marketplaces where goods are bought/sold, and the enablement layer of recommerce where companies are powering the reuse of goods via technology and logistics.

A quick history lesson here. Second hand P2P marketplaces have been around for decades, with players like eBay, Craigslist, and Etsy driving significant volume for resale transactions. To me, these are the 1.0 recommerce marketplaces. Over the last decade, new P2P entrants have emerged amid the move to a mobile-first consumer, with the likes of Poshmark, Threadup, and Depop leading the charge. Managed marketplaces have also grown, with entrants like The RealReal, StockX, Rent The Runway, and 1stdibs gaining significant traction and funding. I consider this the 2.0 wave of recommerce. We are now on 3.0 recommerce and there are a few key reasons that this will be a bigger wave than ever before.

3.0 Recommerce: Why Now

Several economic, social and technological trends are driving the pervasiveness of recommerce.

- COVID-19 has disproportionately affected the financial situation of many Americans. The pandemic has also prompted many people to rethink their spending habits. In a LEK survey, 57% said that COVID-19 helped them realize that some of their pre-pandemic discretionary spending was unnecessary.

- Retailers have also had to rethink their business models during COVID. In 2020, the US saw a total of 12,200 store closures — a record high — and many brands launched resale sites (Lululemon Like New, Levis Secondhand, Eileen Fisher Renew).

- People are more open to buying second hand clothing than they have been in the past. ThredUp’s annual report notes that in 2020, 33 million people purchased secondhand apparel for the first time and in the next five years, 76% of them are planning to increase their spend on resale.

- Price is the main motivator for Gen Z in deciding where to shop. Since they are price sensitive, but value new products, recommerce offers an affordable, sustainable alternative (we also know Gen Z cares tremendously about sustainability).

- Consumers are less concerned with owning the latest trends and there’s been a shift in consumer behavior towards “less is more”: 1 in 4 are not as concerned with wearing the latest trends now versus before the pandemic, and Millennials and Gen Z in particular value owning high-quality products that last a long time.

- Moreover, ecommerce adoption is at a high and is expected to remain strong. Global ecommerce retail sales grew 27.6% in 2020 and is expected to increase 14.3% this year. Online platforms have the benefit of attracting a wide variety of products that would otherwise be difficult to acquire and merchandise in a physical store.

- Lastly, authentication technology and refurbishment is getting better and more efficient, giving customers more confidence in shopping second-hand. For example, Mercari uses photos to authenticate items, while Grailed uses in-house moderators that analyze digital listings. Renewal Workshop works with brands like Eagle Creek and The North Face to collect used products, refurbish them, and then resell them. They also offer a one-year warranty on products they’ve refurbished.

What are the Benefits?

If you are a brand in particular, there are several benefits to considering recommerce as a part — if not all — of your business:

- Partnering with marketplaces or tech players to offer recommerce unlocks more value with existing customers. 62% of consumers said that they’d purchase more from a brand that officially partners with a secondhand platform or company. Managed marketplaces collaborating together with brands provide a “stamp of approval” on both the products being resold and the concept of resale more broadly (e.g., Gucci x The RealReal), which is particularly true for luxury because there is more of a stigma here around second hand.

- Importantly, many of these tools also allow the brand to own their customer data. First party data is increasingly important, and a brand’s ability to understand their cusotmer’s buying patterns and behavior — even through recommerce — will be a meaningful set of insights for future merchandising and marketing decisions. For example, Fendi decided to re-invent its signature “Zucca” monogram print following a surge in demand for pre-owned, vintage Fendi pieces in the iconic print.

- Adding recommerce or selling via recommerce unlocks new customers for brands. 50% of secondhand shoppers tried a new brand and so it stands to reason an easy avenue for customer acquisition (or, trying product at a lower price point) will be through recommerce. If a Gen Z shopper can’t afford an Off White shoulder bag off-the-rack, they can more likely afford it used. So offering that chance to a younger and less affluent customer (which is the increasing share of the US retail economy) is important for a brand to gain exposure to new potential customers. For example, Harrods recently launched a rental platform for statement pieces, catering to a younger and less-affluent demographic than their traditional customer.

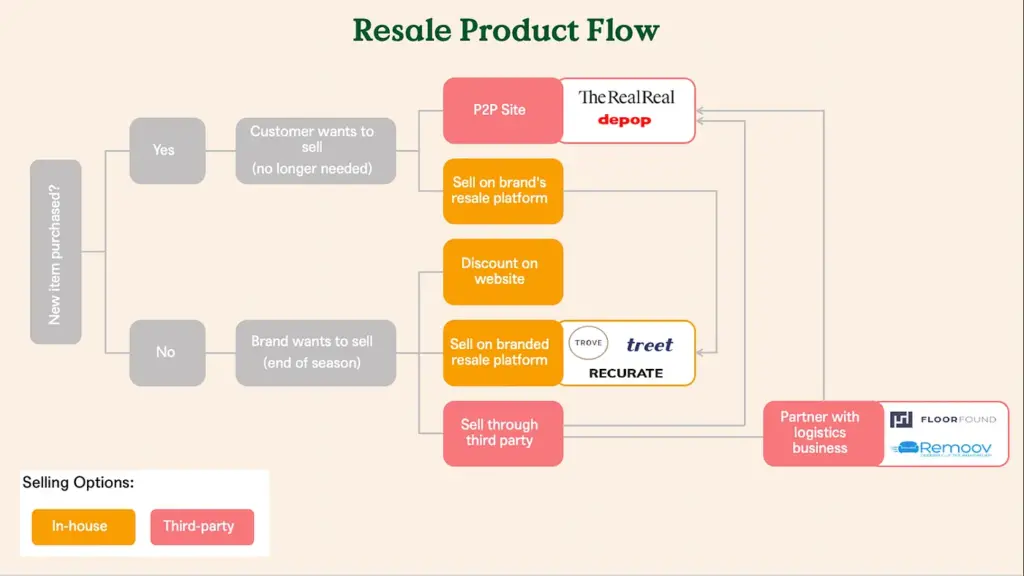

- Enabling recommerce provides greater sell-through in a cost-effective manner. Trove estimates that it would cost a brand $50 million to build their own resale platform, whereas through enablement vendors, a brand can easily “set and forget” live or dead stock through a recommerce marketplace, or enable exchanges or trade-ins. Platforms like Recurate, Archive, and Trove provide white-labeled tech solutions to brands, allowing them to control the experience and first-party data of a customer resale transaction. If a customer is going to shop second hand anyway, might as well own that experience as a brand, right? These platforms also serve as a masking function where brands can sell through dead stock without the brand dilution of a site-wide sale. I predict for this reason that recommerce will overtake sales and discount channels as a mechanism to sell through end-of-season product.

What are the challenges?

There are several challenges to scaling recommerce for any brand to consider. These center around product and marketplace margin, authentication, bulky goods, and integrations + APIs.

- Selling recommerce can lead to slim margins if not managed properly. Some product categories have slimmer margins than others (for example, children’s apparel) and it is generally safe to assume recommerce will provide a smaller profit overall, between selling fees and additional logistics — the cost of receiving, QA-ing, authenticating, packaging, and shipping product can be very high. So it’s important to understand margin structure and total loaded cost, whether using your own fulfillment + selling via a white labeled site, outsourcing recommerce entirely (a la Trove), or selling through another marketplace (whether managed or not).

- Authentication in particular is a hard problem to solve, especially if selling P2P. If a brand is re-selling returns or deadstock, they themselves can authenticate their own items. However, if a customer is selling an item to another customer, either via the brand’s website or a managed marketplace, authenticating that item becomes a challenge because the product is not onhand for inspection. One option is for the item to be shipped to a location where it can be authenticated, but that is more costly. The other alternative is that technology can help a customer authenticate their item without shipping it in, either via RFID, computer vision, or another protocol. These, too, are costly and challenging to build in house.

- A lot of work has been done on recommerce in the fashion space, but less has been done for bulk items (that don’t fit inside a poly mailer or an old Amazon box). Bulky goods are more logistically complex, because they require a network of warehouses for local pickup and delivery, and inspection is also harder to do remotely because, well, there’s more surface area and it’s all 3D (versus QA-ing a flat t-shirt on a table).

- The last challenge here is the nearly ever-present threat of Big Tech: Facebook and Amazon in particular. Facebook marketplace grew 53% last year to $20.4B and Amazon always follows suit well, just last month opening up a new section of their website for pre-owned items called Amazon Warehouse. Staying ahead of these giants is important, but it’s also important to note that their APIs aren’t open, so brands and tech players looking to offload goods via other marketplaces will need workarounds for the largest retailers on the planet.

How we think about Recommerce

As I have looked across the landscape over the last several months, there are several emergent areas where I believe there is white space, potential for disruption, and big dollars.

First, resale, versus rental recommerce, is most interesting to me. This is largely due to the sustainability mindset of both brands and younger consumers. According to Sustainable Brands, more than 160 fashion labels have committed to participate in its 2020 Circular Fashion Pledge (note: founded by Adam Siegel of Recurate) to enable take-back or resale, increase recycled content, or design for durability. 45% of millennials and Gen Z refuse to purchase from brands and retailers that are not sustainable. If a brand is not sustainable on first principles, it will be left in the dust.

Second, it’s time for brands to get in on the act. For the last decade at least, managed marketplaces have taken and resold products on behalf of brands and customers, and built large public entities. As consumer demand for second hand grows, it only stands to reason that brands should capture this experience within their own ecosystem, showing re-sellable products as an extension of their own websites. There are a couple ways this could happen, as outlined below in this graph and my comments:

- 3.0 P2P recommerce enablement: The future of recommerce will be allowing brands to own their own recommerce experience, end to end. That means brands managing their own recommerce marketplaces, where they control the assortment, the product photography, the pricing, the CX and messaging, the authentication process, and the ultimate customer data. Especially for medium to enterprise brands, control over this experience is paramount, and more established brands care a lot about product adjacency (for example, on somewhere like Poshmark, their Italian-made stiletto could be sitting next to a ratty LL Bean boot) and the experience a customer has both purchasing and receiving goods they’ve approved for resale. From an investment perspective, more lightweight tech solutions — versus the full fulfillment layer businesses — will be quicker to scale and afford better exit valuations.

- Recommerce for bulky goods — No one has really solved the issue of reselling odd-shaped, bulky products, especially for retailers and brands. What happens when you want to resell a crib or a leather sectional? Who picks it up locally? How is it transported and dropped off successfully without dings or scratches? Who inspects the goods to ensure they are ‘as described’? These are all real logisticial, QA, and geographic issues that need to be solved to enable recommerce for bulky goods. Companies like FloorFound and Rebelstork are making strides here, but we think more opportunity for optimization exists especially at the intersection of retailers and resell, where companies can power giants like Macy’s and West Elm to move through stock or use real estate creatively.

- Authentication innovation — One of the largest problems for P2P marketplaces is authentication. Some companies are solving this on the front end by using RFID and computer vision, combined with blockchain, to embed authentication at the manufacturing site (e.g., Burberry implants a Homer device or sticker in its purse). Others are trying to enable resellers to authenticate product directly via an app, using computer vision, so the resale platform doesn’t need to physically inspect the product, or use infrared technology onsite — so the box doesn’t even need to be opened — Veracity Protocol and Thruwave are some interesting new examples here.

In sum, I’m long on recommerce. If you are working on anything in this space, I am always looking to back amazing retail founders. Please DM me.

Lastly, we are hosting a virtual panel on this exact topic on July 28th where we will bring together founders in the space who are all thinking through recommerce.

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.