Field Study: Virtual Real Estate & The Metaverse

Written by Andrew Peng & Daniel Fetner

Introduction

These days, it seems that everyone and their corporate parent company is talking about the metaverse, from Microsoft to Roblox to fka Facebook. The metaverse has been broadly described as the successor to the internet, and a merging of the physical and virtual worlds. While this technology is sure to produce surprises that nobody can predict, at Alpaca we believe there are clear investable traits in the sector that we can start acting on now.

At the beginning of 2021, we determined that digital platforms would not only become key gateways to the metaverse, but that ownership of land on those platforms would come into crucial play. Furthermore, we believe that this ecosystem will be at least partially driven by NFT technology. Over the past several months, we scoured the AR/VR, blockchain gaming, and metaverse landscapes to better understand the future of virtual real estate.

Sector Trends and Value Drivers

Virtual real estate sits at the convergence of three tailwinds, each presenting strong opportunities but also incumbent challenges.

Popularity of virtual world gaming. The global gaming market is expected to generate $175B in revenue in 2021. Among these, virtual world platforms driven by user-generated content are especially popular, such as Minecraft or Roblox. However, in the current game market, centralized ownership and control over the trading of virtual goods restricts the value of in-game activity; at any time, users may have their assets frozen or accounts deleted.

Increasing virtualization of the physical world. AR/VR and digital twin technologies are slowly increasing in adoption, with AR/VR now the fastest growing media market. In the real estate industry, current applications include virtual tours, construction staging, commerce, and advertising. However, physical property rights are not yet tied to digital property rights, leaving owners unable to adequately track, control, or monetize digital activity.

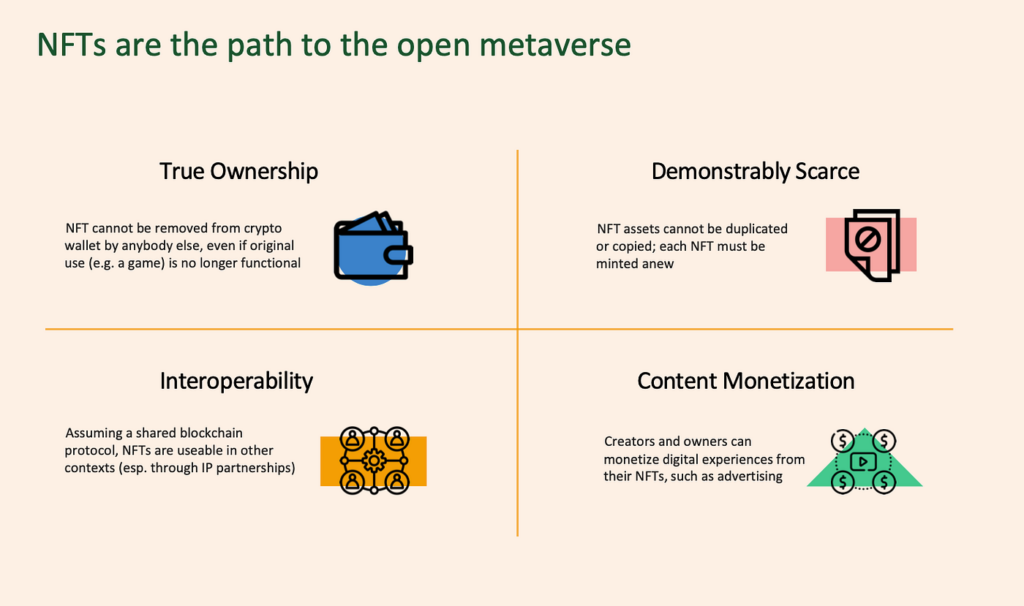

Meteoric rise of NFTs and emerging use cases. While most people think of NFTs as synonymous with JPEGs or memes, NFT technology promises something radical: a framework for the ownership of digital assets. Already, NFT popularity has surged exponentially, with $2.5B spent in the first half of 2021 alone — a 131x YoY increase. However, NFT adoption is still low, leading to unproven usability. So far, the trendiest NFT types such as collectibles, art, and avatars have exhibited extreme volatility.

Putting it all together: blockchain-based virtual platforms overcome the limitations of traditional gaming and digital platforms by taking on a decentralized structure, where all tradeable assets are tokenized as NFTs, and all transactions are recorded on the blockchain.

Two core value drivers for metaverse platforms will be the ability to create true value through digital land and the ability to sustain a digital labor economy.

In metaverse platforms where land is a scarce and tradeable asset, virtual real estate investments can bear many similarities to physical real estate:

- Virtual lands that are undervalued based on market comps or that have a unique market angle can be capitalized on and flipped

- Owners can act as a GP and “develop” income-generating components such as games or shops

- Parcels can be fractionalized and sold as condos or rented for advertising space and other uses

- Teams of traditional architects, 3D game developers, and analysts can provide build-to-suit development services for brands looking to access virtual platforms

From this market activity, there will be a whole slew of job categories supporting this ecosystem — some resembling existing real estate jobs, such as digital investors, architects, and brokers, and some in entirely new categories like token economists, DAO moderators, and defi farmers. While right now virtual real estate is still a niche asset class powered by a limited roster of investors and enthusiasts, it’s possible in the future that the metaverse will be expansive enough to power an entire ecosystem of job types dedicated to building it.

We believe the startups and technologies that directly or indirectly address these labor and land value drivers will have the greatest chance of consumer adoption and achieving network effects.

Traditional Internet Incumbents

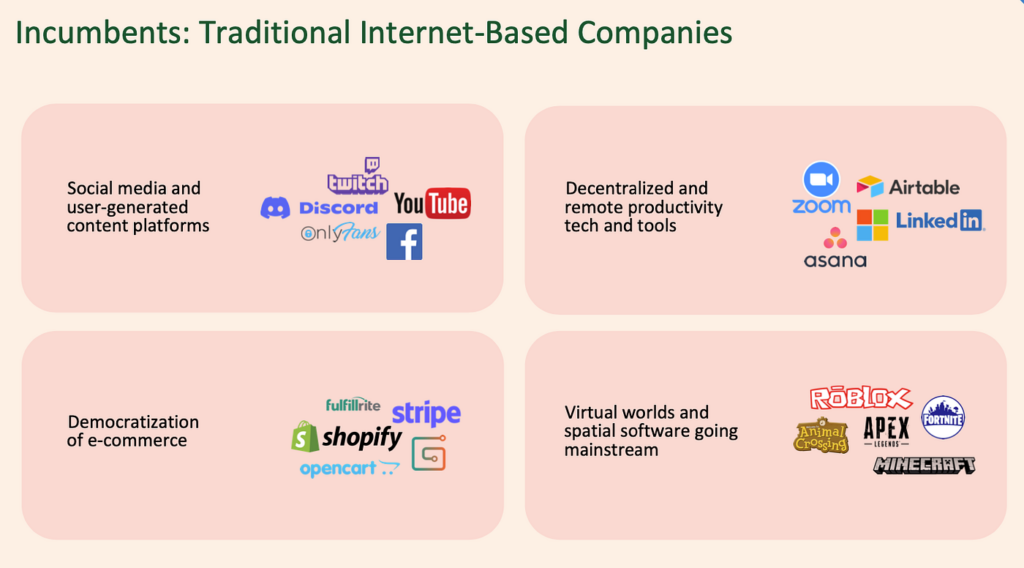

If we’re going to call the metaverse the successor to the internet, we should be clear about what it’s succeeding. We identified four main functions of some early metaverse platforms, and mapped the clusters of some of the internet incumbents currently occupying those functions.

The big question is, what will be the role of these tech incumbents in building the metaverse? We think Facebook is the perfect case study here. Facebook has bold intentions to expand up and down the metaverse stack, with growing investments in consumer hardware and computing interfaces; it’s clear that they want to become the operating system on top of which the entire metaverse is built. However, Facebook also has the most to lose, as the metaverse can easily usurp it as a social engagement platform — and the company’s shoddy track record in third-party development and user data will continue to be a huge barrier.

It’s a similar story with other major incumbents. Apple is well-positioned to become a dominant provider of access points to the metaverse, as it has been with the internet — but building an open platform for creation is entirely contrary to Apple’s centralized ethos. Google has been the market leader in indexing both the digital and physical worlds — but its bread and butter of monetizing data faces threats from both democratization and regulation.

The bottom line is, while tech incumbents with massive resources and user bases have already started making major metaverse plays, many of the promises of the metaverse are entirely antithetical to how they are run. They are likely to be resistant to cross-integrating systems and sharing data, which will devalue their current network effects. As a result, they are limited by their centralized development models and relationship with users — leaving whitespace for more flexible startups to emerge.

Analyzing the Startup Ecosystem

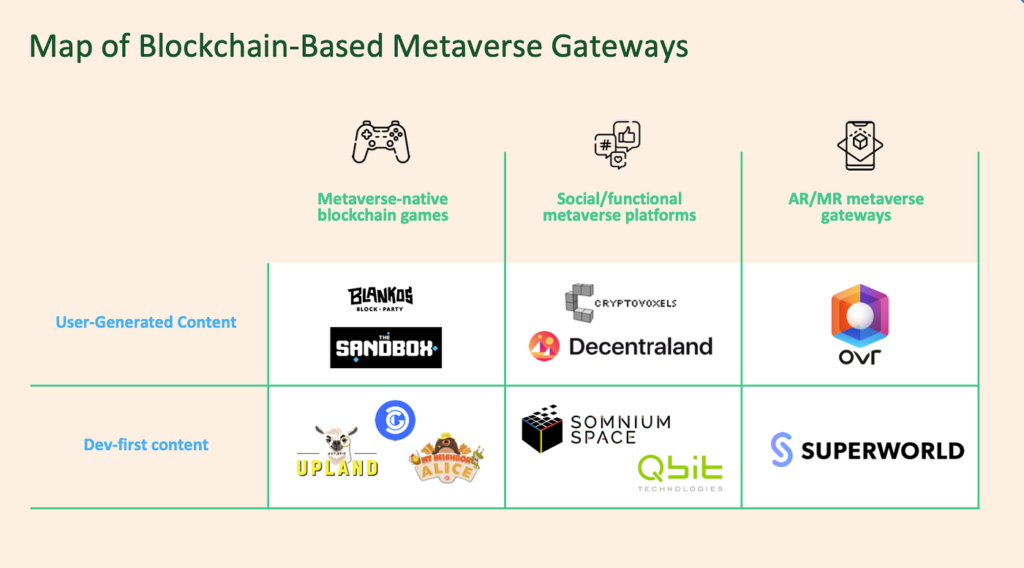

We identified startups acting as access points to the metaverse that are also addressing functions across the value chain, from advertising to socializing to gaming. From there, we mapped the ones that had begun to exhibit early traction. In nearly all of these examples, virtual land parcels are tokenized as NFTs, allowing users to literally own a piece of the platform — however, the monetization and content-generation models vary widely. The mental model that we employed to segment blockchain metaverse gateways is as follows:

Metaverse-native blockchain games. These platforms build on the booming popularity of virtual economies and sandbox gaming within the $176B global games market. Their value-add over incumbent gaming is true legal ownership of in-game assets and reliable monetization. From an adoption standpoint, we view these platforms as the easiest entrance to the metaverse, as the gaming community is already fluent with virtual platforms.

Example: The Sandbox is a community-governed gaming platform with a user-regulated digital economy. The world is divided into 166,464 land parcels, which allows users to own, develop, and monetize virtual gaming experiences through a user-friendly development platform.

Social/functional metaverse platforms. Platforms where the primary focus is on productivity or socializing (including platforms with no explicitly defined purpose). Emergent uses include microblogging, networking, retail, and limited gaming. These companies ride a strong legacy from existing social media and user-generated content platforms; however, they also face the strongest competition from these incumbents entering the space. While this segment has attracted the most media and early investor attention, accounting for 67% of virtual land trading volume to date, limited creation tools and a lack of engaging content can result in low return user engagement.

Example: Decentraland is a virtual 3D world divided into 90,601 parcels of land. While users can develop experiences on their parcels, the platform’s software development kit is relatively complex, so the majority of content is produced by larger brands and professional teams. Major experiences thus far include art galleries, shopping districts, and music festivals.

AR/MR Metaverse Gateways. These platforms map a virtual layer around the physical world, which is then fractionalized into land NFTs that can host digital content such as objects, advertising, games, and events. There is a strong reliance on mobile immersion. As a result, for users not already fluent with crypto or virtual platforms, these companies feature the shallowest learning curve in terms of user experience due to the tangible, online-offline component. However, we also view this to be the most nascent segment of the three.

Example: Superworld is an AR virtual world geographically mapped onto the real world. The platform is divided into 64 billion tradeable plots of virtual land corresponding with the entire Earth, allowing users to create, discover and monetize AR content around the world. Landowners do not need to actively develop content themselves, but instead get a share of any revenue that results from user activity that occurs on their parcel

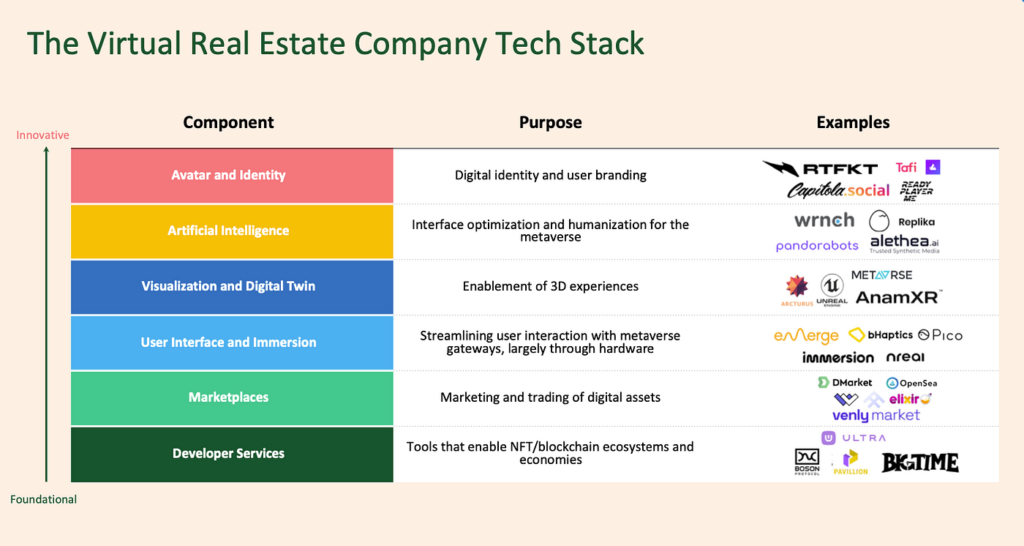

In addition to the gateway applications listed above, we also identified that investing in infrastructure is a much more important consideration for blockchain than it is for internet companies; this is similar to the argument of the Fat Protocol Thesis. Regardless of which platforms emerge in this space, whether one of the startups described above or an existing tech incumbent, all companies are going to be reliant on a strong infrastructure of supportive technology.

To this end, we devised a tech stack for virtual real estate companies, ranging from foundational functions to more innovative services:

Alpaca VC’s Summary and Outlook

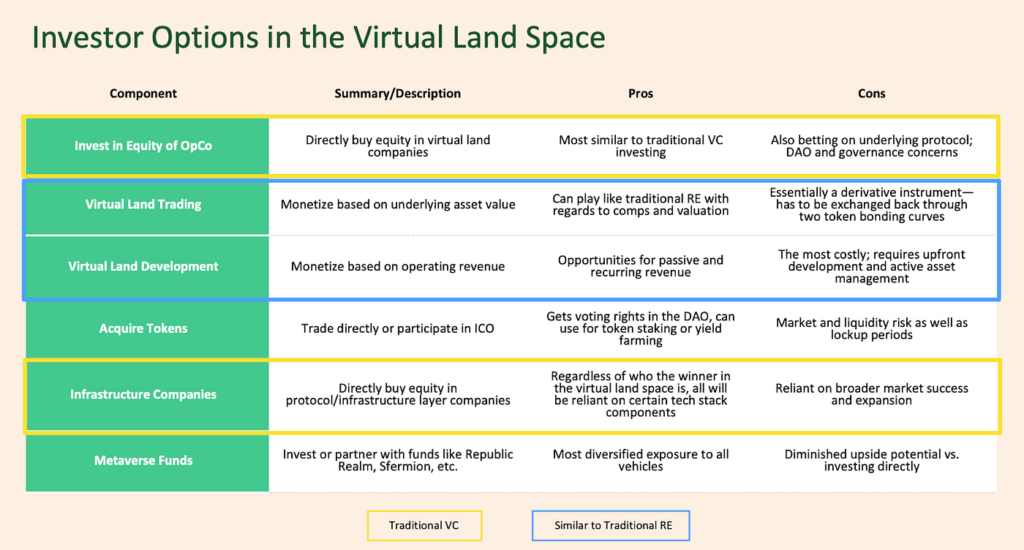

Reviewing everything we learned in this field study, we determined six distinct avenues for investors to gain exposure to the space, some of which resemble traditional VC and traditional real estate investing:

While all options carry their own risks and upsides, all investors should be aware of the interconnected relationship between applications and protocols; for example, buying a parcel of virtual land is taking a bet not only on the parcel itself, but also the underlying platform, as well as the underlying blockchain protocol. Similarly, metaverse gateway applications and infrastructure companies will be reliant on each other for success.

It is impossible to know when the promises of the metaverse will emerge — in 5, 10, 20 years, or maybe never. However, there are clear tailwinds emerging from industries as varied as real estate, gaming, and ecommerce that are getting technology incumbents, new challengers, and longstanding industries to start thinking about virtual real estate and their role in building the metaverse. One thing we’ve learned is the best companies are ones that can keep the promises of the metaverse in mind, but that capitalize in the short-term on these existing trends.

Our summarized slide deck:

https://cdn.embedly.com/widgets/media.html?src=https%3A%2F%2Fwww.slideshare.net%2Fslideshow%2Fembed_code%2Fkey%2FMCqYYXxkvp1Rh3&display_name=SlideShare&url=https%3A%2F%2Fwww.slideshare.net%2FDanielFetner%2Falpaca-field-study-virtual-real-estate-the-metaverse&image=https%3A%2F%2Fcdn.slidesharecdn.com%2Fss_thumbnails%2Fmetaversefieldstudyfinal-externalversion12-211208181845-thumbnail-4.jpg%3Fcb%3D1638987664&key=a19fcc184b9711e1b4764040d3dc5c07&type=text%2Fhtml&schema=slideshare

Subscribe to our newsletter for tech updates, events, open roles, and portfolio news. Follow Alpaca on Twitter, Instagram, or LinkedIn.

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.