Founder Playbook: What Matters Most for B2B Marketplaces Right Now

Author: Eric Schoenbach

Last spring, I shared some thoughts on the challenges and considerations many founders face when trying to build a B2B marketplace. In recent months, I’ve continued to go down the rabbit hole and spoken to dozens of startups building in the space. Our team at Alpaca remains incredibly interested in investing in B2B marketplaces and we’ve added a new portco to the herd since my original post (welcome Acelab!). In spending time here, I’ve started to notice some additional themes across these businesses that are noteworthy — either because they excite us or because they give us some pause.

I plan to continue to spend time here and write more on this topic, so if this space is interesting to you or you’re currently building something, I’d love to chat! I’ll also preface this discussion by saying it’s not meant to be exhaustive, but I wanted to highlight some thoughts and questions that have stuck out to me lately.

- Is a Workflow First Approach Enough Right Now? Workflow software is often the right place to start for many of these businesses, but when is the right time to launch a full-blown marketplace on top of the original product?

- What’s the Importance of Customer Success in B2B Marketplaces? When founders are too focused on sales growth, they often overlook the equally important customer success function that can really be the engine for the big unlock they’re after.

- What are the Opportunities for Creating Demand-Side Distribution Advantages? The supply side is generally easier to find and access, but what about the demand side? Is there a more efficient way to find and access those users to speed up the path to liquidity?

Is a Workflow First Approach Enough Right Now?

In my last post, I wrote about how many founders don’t launch a marketplace out of the gate but instead opt to start with a workflow tool that gets them access to and familiarity with ultimate marketplace participants, often on the supply side first. While I still see this being true with most of the founders I’ve spoken to, I’ve been questioning whether this is still the right sequencing and whether workflow tools are enough early on to create something truly special in today’s landscape.

There’s a plausible reason most companies aiming to become B2B marketplaces start with the workflow element: they’re often trying to disrupt businesses that have a longstanding way of doing things. By building a workflow solution that improves their operations, these startups are able to build trust and gain credibility with potential marketplace participants. Because of this, most teams start with the workflow tool for a period of time before layering on additional functionality and subsequently launching the marketplace itself.

While that makes sense in terms of trying to have a more built-out product along with an established relationship with partners, we’re seeing less and less benefit to delaying a marketplace launch and more advantages to introducing marketplace functionality sooner than many founders are currently choosing to do.

It’s true workflow tools help attract and engage users, and I fully acknowledge that these industries are complex and require feature-rich tools to even have a conversation with a potential partner in the first place. But the reality is, it’s getting increasingly difficult for startups to get early adopters on board — and keep them engaged — with workflow software alone. When companies aren’t following up quickly with marketplace functionality, even in a basic form, they miss opportunities to move faster — and that will have significant fundraising implications. Yes, building B2B marketplaces takes time, but in this current market, investors’ expectations are sky high. They’re not willing to wait as long as they once might have been to see real marketplace revenue and the network effects kicking in.

Not surprisingly, we’re seeing successful companies these days take the opposite approach and demonstrate that the workflow followed by marketplace strategy is hardly the only tried and true playbook. In these cases, it’s worth noting that leading with a marketplace value prop followed up with lightweight workflow tools typically works best where there’s a ton of fragmentation on the demand side (often selling to SMBs). One such example is the beverage alcohol industry marketplace Provi, which this fall raised a $75M Series C at 3.5x its previous valuation, just six months following their Series B.

Provi spotted its wedge by allowing distributors and retailers to aggregate all of their accounts in a single place, leading to near-immediate adoption. Over time, the company followed up with workflow tools such as streamlined order management for distributors. Provi saw an opportunity and moved incredibly quickly to fill a gap. It was this choice to launch quickly with something good enough and perfect the experience and product later that allowed them to head off competitors and seize a huge market opportunity.

The Provi example demonstrates how the initial marketplace doesn’t need to be fully fleshed out or even that complex in the early days. But having even a simple marketplace component live is highly valuable in that it introduces the concept while also allowing for iteration based on customer feedback. And that, in turn, helps push the company forward and lays the foundation for the next phase of growth.

While teams face the challenges of limited time and resources, balancing all they have to build in the early days alongside the difficulties that come with introducing a marketplace to old-school customers who are afraid of being disintermediated, the companies that stay super close to early marketplace adopters and bring them on more as partners to better inform the product can see huge dividends down the road. From my vantage point, the best companies are capitalizing on the moment when they have customers’ attention and shipping products at breakneck speed.

What’s the Importance of Customer Success in B2B Marketplace Success?

One of the most important things I consider when speaking with founders about a fundraiser is their hiring strategy post-raise. Speaking with them about who they plan to bring on and how they’re thinking about growing the team in their early stages helps me understand where the gaps are on the existing team, but, more importantly, it helps me understand how they think strategically and how far in advance they are planning. Founders themselves typically lead sales at the beginning and, while they know it’s a crucial core competency, they generally can’t wait to bring in a sales leader so that they have more time to focus on other priorities. What I’m noticing more and more, however, is that teams are actually too focused on sales post-seed and don’t have plans to bring on customer success seats until it’s too late.

Once a marketplace has some initial customers onboard, I think that customer success, not sales, becomes the crucial part of the equation. At this point in their growth, founders have likely built a workflow tool and have some marketplace functionality in place, but their customers still need to be trained on how to utilize all of the product features properly. In order to change their existing habits and adopt something significantly better, even the most engaged users need to be handheld. Oftentimes this means walking them through the onboarding step by step, following up with a full demo showing the various features of the workflow, and spending more time to show how the workflow actually connects into the marketplace, not to mention answering various questions along the way. This requires a ton of time, and attention to detail, and prevents the sales team from finding and qualifying the next lead that is required to reach liquidity.

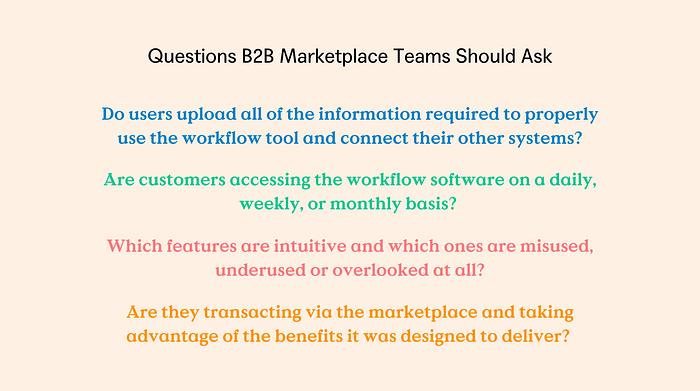

Sure, the long-term goal of most of these B2B marketplaces is to be self-serve, but that is an unrealistic expectation early on. Teams need to stay laser-focused on their funnel and monitor how efficiently early customers are utilizing the various features available to them. Once a new user sets up an account, the team should be asking tons of questions constantly and making decisions based on the feedback. For example, do users upload all of the information required to properly use the workflow tool and connect their other systems? If they’re on the workflow software, are they accessing it on a daily, weekly, or monthly basis? Which features are intuitive and which ones are being misused, underused or overlooked entirely? Are they transacting via the marketplace and taking advantage of the benefits it was designed to deliver?

The only way to find out the answers to these questions is to talk to customers directly — that’s accomplished best by a dedicated customer success seat, not a salesperson. Bringing somebody on board earlier allows these companies to function more like a managed marketplace with top-quality customer support even if they’re not actually taking on some of the added components of a transaction like providing logistics or vetting provider quality.

Yes, scaling the sales team is incredibly important, but I believe that companies are best served by over-servicing their early customers, gaining their trust, and turning them into brand champions. Before putting gasoline on the fire, B2B marketplaces need to ensure there isn’t a leaky bucket. Additionally, if early customers love the product and are seeing a ton of value, they’ll serve as case studies and likely refer the marketplace to other companies as well. As we’ll see below, prioritizing early customer success can result in unique advantages and an opportunity to grow with speed that a sales team alone will be hard-pressed to do.

What are the Opportunities for Creating Demand-Side Distribution Advantages?

In my previous post, I talked about the supply side first approach to building a B2B marketplace. This time, I’ll focus on demand-side distribution and the advantages there. A universal challenge for B2B marketplaces is ensuring participants see value almost immediately. Otherwise, there’s really very little reason for them to stick around and transact. Given that, not surprisingly, our team at Alpaca takes notice when we see a company that’s been able to unlock a unique distribution channel that helps them reach scale significantly faster than they would have without it. After all, the faster a marketplace can reach liquidity, the faster network effects kick in, and that’s ultimately what we’re looking for.

While it’s rare to see true network effects at play at the Seed stage, having a unique distribution strategy on the demand side helps increase our confidence that the marketplace will reach liquidity sooner rather than later so the flywheel can start spinning. Following the general theme thus far, successful demand-side distribution has everything to do with speed and execution.

There is, of course, no one-size-fits-all approach to distribution. Each industry has its own culture and nuances. That said, I’m seeing an increasing success rate with a handful of strategies that work across different industries.

- Turn supply side customers into brand champions

The first strategy is turning existing customers from the supply side into brand champions who then facilitate demand-side distribution by either making introductions on behalf of the marketplace or providing a list of potential leads. This strategy has the benefit of adding value for everyone involved while significantly reducing the sales cycle. It’s of course still on the company to go and close the sale, but taking the prospecting and qualification steps out of the process saves a ton of time, especially when the introduction or recommendation comes from a known partner.

This is a much more powerful way to build demand-side participation than direct sales. Given how long sales motions take in a B2B setting, direct sales alone usually doesn’t move the needle fast enough in the early days.

This strategy works best in situations where suppliers are already seeing value, don’t feel like they’re being disintermediated by a marketplace, and are instead gaining net new transactions that wouldn’t have occurred previously. One of the best examples here is Faire, a B2B marketplace that connects local, independent retailers with brands and has seen tremendous success lately.

For Faire, the strategy plays out like this: retailers benefit quickly from being on the platform because they get access to free returns on new orders and payment terms that they were previously too small to access. In turn, that allows them to better manage their existing business and take a chance on new brands. With downside protection, the supply-side retailers only benefit from having more brands on the platform because they’re able to create more choices for consumers. They’re also able to move quicker than they would with traditional sales as they effectively do trials with brands prior to making a larger order. The brands see meaningful benefits as well like being able to manage their wholesale business on a single platform. With everyone benefitting, the network effects take over from there and the platform continues to become even more useful for all parties.

2) Leverage strategic partnerships

The second successful strategy we’ve seen is finding a partnership with a business that provides a crucial service to many demand-side users but isn’t an actual marketplace participant itself. Ideally, the partner gains something that isn’t revenue. Most often, it’s data that can’t be accessed elsewhere. That’s a very specific profile, and that means these partnerships are rare to find, but when they happen, they become an extremely powerful avenue for marketplaces to find and access a lot of demand-side users very quickly through introductions from known, trusted entities and the implicit stamp of approval that comes with it. With this unique demand-side distribution channel in place, the marketplace is able to get many skeptical customers over the finish line in a way that just can’t be replicated through direct sales.

So where do we go from here? I think we’re in the early phases of the next generation of marketplaces and there are massive outcomes to be had. These observations and questions are just a couple of the things that we’re thinking about when it comes to B2B marketplaces today while keeping in mind the complexity of the space, how much there is to balance in the early days, and the reality that there’s no one-size-fits-all formula for getting it right. One thing’s certain: I will continue spending a lot of time in this space. If you’re an early-stage founder building in this space or you’re passionate about investing in marketplaces, I’d love to speak with you at [email protected] or @EricSchoenbach. Thanks for reading!

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.