Founder Playbook: When & Why to Raise from Equity Crowdfunding Platforms

Authors:

Democratization is a powerful tool. We’ve seen democratization play out in various industries, with technology (almost) always playing a major role in enablement. In addition, the number of technology companies that have incorporated “democratization” into their mission statement as of late has been exponential.

- Democratization of data

- Democratization of information

- Democratization of access

- Democratization of energy

- Democratization of finance

- Democratization of investing > Democratization of alternative investing…

The democratization of alternative investments, in particular, has been a theme that we at Alpaca have paid close attention to for the last 3–4 years. In 2018 we published a Field Study on Real Estate Crowdfunding, and in 2020 we invested in MoneyMade, whose mission is to make alternative investing simple, fun, and approachable.

Quick History + Statistics:

The JOBS ACT regulation (specifically the adoption of equity crowdfunding on 10/30/2015) made it easier for retail/non-accredited investors to invest in private companies and helped democratize access to investments that historically were only available to accredited and institutional investors. The funding figures resulting from crowdfunding and other alternative investment democratization platforms are astonishing:

- Crowdfunding platforms raised $34B globally in 2020 (source: Fundly)

- Equity crowdfunding geared toward startups/small businesses raised $2.5B in 2020 (source: Fundly)

- There were 6,455,080 worldwide crowdfunding campaigns last year (source: Fundera)

- SeedInvest, one of the leading equity crowdfunding platforms, has funded over $400M into about 250 startups (source: SeedInvest)

The resulting wealth generation for angel investors over the last decade has been tremendous, and the rise of retail investors in alternatives is well documented (Forbes, January 2022). While many startup founders have taken advantage of this non-traditional funding outlet, the majority of entrepreneurs are still unsure of what is really involved and are not well-educated around the benefits.

Crowdfunding 101 — The Basics:

Crowdfunding platforms provide entrepreneurs with a streamlined structure, which offers consumers (both accredited + retail investors) the ability to invest small-dollar amounts and show up as one line item on the cap table. There are many forms of crowdfunding; however, for our purposes, we will focus on securities-based crowdfunding. The process works as follows:

- Pitch/DD: Startup pitches their business to the crowdfunding platform investor rep, the same they would to any VC. Most crowdfunding platforms are structured similarly to VCs in which they have an Investment Committee and require due diligence/conviction prior to approving a deal.

- Campaign: Once a deal is approved, startups set up a “campaign” to raise capital from investors who have already been verified/vetted by the crowdfunding platform. The startup provides information such as: Investment Round Terms, Other investors (including lead investor), Total Investment round amount, Minimum investment threshold, Company profile (including deck + highlights)

- Browse/Invest: Investors can browse company profiles and choose to invest or not. Investments can be tracked so that users (investors) can monitor the performance of their portfolios.

- Receive Capital: Startups receive the investment capital from the platform’s escrow account and proceed to utilize the funds to grow their business.

- Annual Update: Startup agrees to provide annual updates to the crowdfunding platform, which in turn relays to investors. The depth/detail of these annual updates are typically much lighter than the update that the startup sends to its large institutional investors.

SeedInvest recently published a blog post, “What is Equity Crowdfunding? The Ultimate Guide for Founders.” This is a helpful resource that peels back a few layers and dives further into the details.

So, when and why should founders use equity crowdfunding platforms?

In our early-stage seed fund, we will typically lead/co-lead deals and are usually one of a handful of institutional VCs writing a 7-digit check. The role we play in these rounds typically consists of helping to set terms and institute governance, as well as working with founders to fill out the remainder of the syndicate, always optimizing for the most value-added investors.

While VCs add value in a variety of ways including capital networks, talent networks, category expertise, operating expertise, institutional credibility, etc., there are many reasons why it makes sense to look outside the traditional VC ecosystem to fill out the remainder of a round.

Let me pose a question: if you are a founder, would you rather have 1K existing/prospective customers invest $1K each, OR have one investment firm invest $1M?

With all due respect to VCs (we are one), I’d much rather have the former. Especially if I have a VC as my lead investor and multiple other VCs already on the cap table. And the fact that this structure allows all 1K users to show up as just one line item on the cap table makes it a much easier decision.

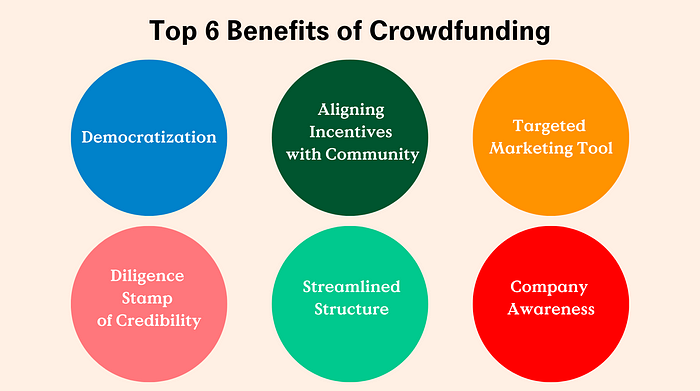

Here are the Top 6 Benefits of Crowdfunding:

- Democratization > provides retail/non-accredited investors with access to private investments that have historically been unavailable to them.

- Aligning Incentives with Community > makes company users and customers “true owners” by offering them the ability to be small shareholders in the business.

- Targeted Marketing Tool > reach a specific audience by leveraging platforms that “tag” their investors by sector, interest, profession, etc.

- Diligence Stamp of Credibility > due to the nature of marketing to non-accredited investors, crowdfunding platforms must register the security with the SEC and therefore face a high degree of scrutiny related to investment due diligence. Any startup that makes it through this burdensome process unscathed can wear it as a badge of honor. Other investors in the round know the company went through the wringer.

- Company Awareness > provides companies a “platform” to get the word out about their product/service; this is especially powerful for consumer companies who have a huge audience and can relate with a large percentage of the population.

- Streamlined Structure > Platforms like SeedInvest provide an easy/templatized structure for startups to offer their community the ability to invest small amounts (i.e., SeedInvest’s minimums are generally $1,000–25x lower than the average angel investment) (source: Forbes)

VCs & Crowdfunding play two unique, complementary roles

3–4 years ago, I think many institutional VCs looked down on companies that raised from crowdfunding platforms, often citing “negative signaling.” The assumption was that the startup previously tried going the traditional VC route but could not attract any firms to buy into their vision.

While each circumstance is different — and there could be some truth to that — our take is that there is a role for both venture and crowdfunding investors. Each brings a different value-add to the table. Whereas VCs bring experience, networks, and expertise, crowdfunding harnesses the power of amassing hundreds or thousands of investors to be brand ambassadors… The resulting network effects that come from sharing the company’s product with their respective customer base are incredibly powerful and often create a viral loop.

Over the last 2–3 years, we’ve also seen crowdfunding platforms become especially more advanced in streamlining their processes/structure as well as their ability to be precise in who they market to. By focusing on investors who will add value to the company, mainly in the form of using the product/good/service, founders are creating networks of believers who take an ownership stake in their business.

Not only have founders become much more comfortable seeking capital from crowdfunding platforms, but professional investors (VCs) have also come to realize the value and that it’s a unique offering that they cannot replicate themselves. In addition, VCs have begun using crowdfunding to raise capital for their own funds (source: Protocol), utilizing the same grassroots power of crowdfunding and equitable ownership.

The Costs & Considerations

Most crowdfunding platforms charge between 5–10% of the capital raised. While that could seem like a high number, remember that the average underwriting fee by an Investment Bank to take a company public is ~5–7% (slightly lower if raising >$1B+) and that doesn’t even factor in the legal costs (source: PWC).

In addition to dollars, there is a substantial time commitment to go through the due diligence process as well as plan/execute a well-thought-out marketing/PR strategy. The highest caliber crowdfunding platforms require a cumbersome due diligence process before they provide the company access to the hundreds of thousands of investors on their platform. They’ll review startups’ financials, projections, cap tables, company-sector-specific KPIs, teams and track records, existing investors, use of funds, corporate structure and related documentation, and supporting docs. As a result of this due diligence, the cream rises to the top and the quality of deals listed on their platform is higher.

Given that timing could take anywhere between 6–12 weeks, our recommendation to founders is to leverage crowdfunding during “flexible” investment rounds > typically SAFEs or Convertible Notes that can be left open for an extended period of time.

The last consideration is that there is no guarantee of capital. While many crowdfunding platforms have side vehicles of committed capital that they allocate, the majority of funds come from investors on their platform who commit their own personal capital.

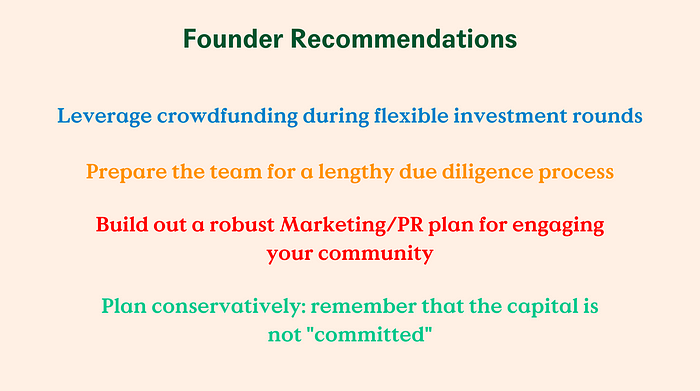

Founder Recommendations

To conclude, we believe that Equity Crowdfunding will continue to grow in popularity as a tool for founders to raise capital and align incentives with their users and community. Below are a handful of recommendations to entrepreneurs who are considering this avenue.

- Flexible Structure: Leverage crowdfunding during “flexible” investment rounds > typically SAFEs or Convertible Notes, which can be left open for an extended period of time.

- Preparation: Prepare the team for a lengthy due diligence process; the leading equity crowdfunding platforms only select <1% of deals and they have a responsibility to non-accredited investors to dot all i’s and cross all t’s

- Marketing: Build out a robust Marketing/PR plan for engaging your community (users, customers, prospective customers and industry at large). As part-owners, your community can be a powerful ally in sharing your product with their network as well as providing critical feedback to help make the product better.

- Plan Conservatively: remember that the capital is not “committed” (like it is with most traditional VCs); the capital needs to be raised and therefore there is no “guarantee” of how much money the offering will ultimately raise.

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.