Field Study: EV and the Future of Mobility

Introduction

With gas prices hitting $7 a barrel in California this year, people are reminded once again that the future of transportation is electric. Last year, 2021 closed as an extraordinary for electric vehicles, with the market nearly doubling year-over-year. To put it in perspective: electric vehicles made up approximately 4% of new vehicle sales in 2021, compared to about 2% in 2020.

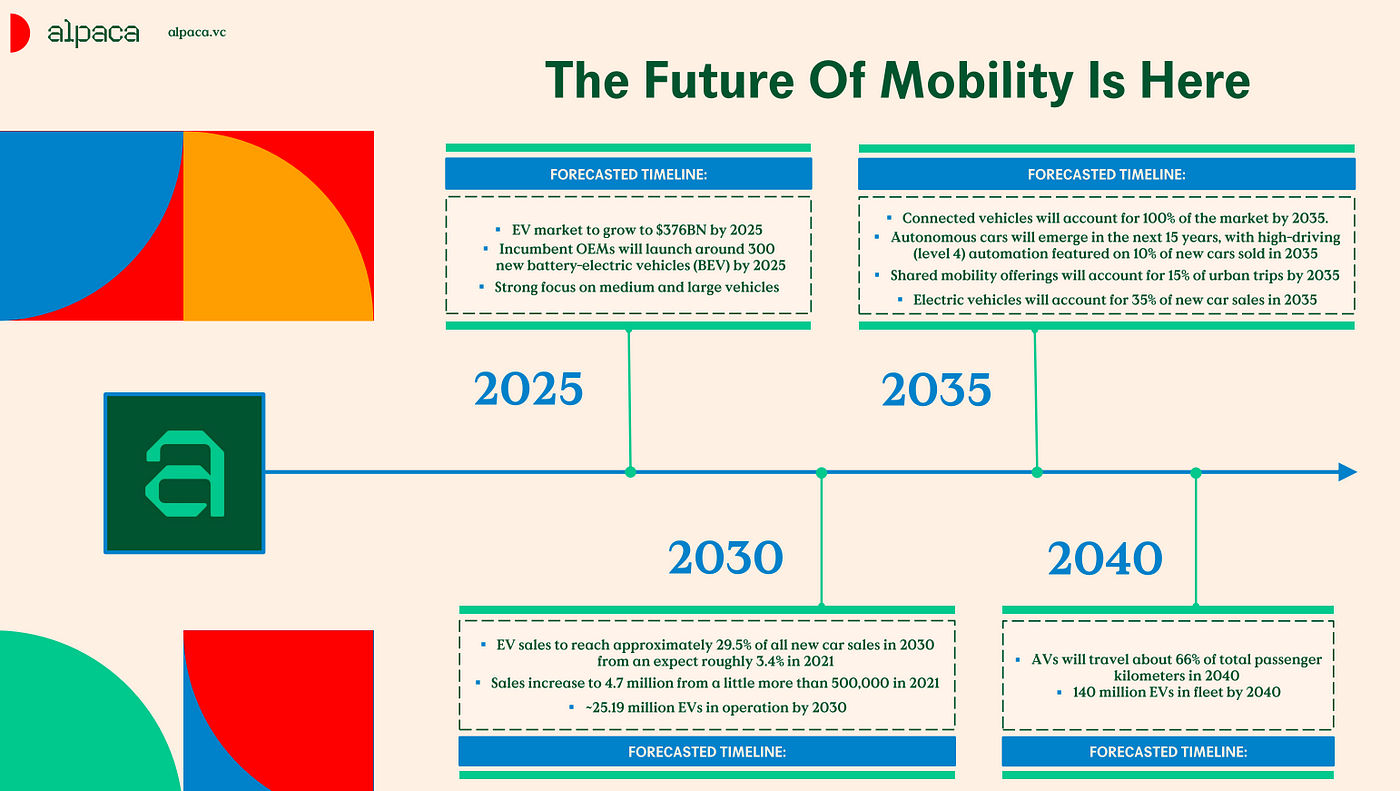

Though we have been hearing about EVs for a while, lightning is about to strike in the electric vehicle industry over the next few years — thanks to drivers ranging from President Biden proposing new guidelines to achieve 50% of new vehicle sales being EVs by 2030 to incumbent OEMs launching over 300 new models by 2025.

At Alpaca, we believe in the strong tailwind generated by the EV industry. As PropTech investors, we see and seize unique opportunities that accelerate the future growth of charging infrastructure, smart platforms, parking technologies and more. Over the past three months, we scoured the EV and parking tech landscape to better understand how technology can play a role in improving customers’ driving, parking and charging experiences.

We’re excited to share our summary findings and report below.

Sector Trends

We believe the following macroeconomic drivers will have significant implications on the EV sector:

- As electric vehicle sales take off, demand for public charging will explode

- The Biden Administration presents historic infrastructure investments in charging

- Existing OEMs have committed to increase the offer and sales of EVs

- Electrification in the medium-and heavy-duty sector is on the rise in the United States

Thanks to the supportive policies such as subsidies, tax credits, and infrastructure bills that promote the use of EVs, the demand for charging stations continues to grow. Today, two-thirds of the electricity demand for EV charging is private, whether at home or in company parking lots. We believe that over time, the proportion of public charging — at service stations, public parking spaces, and retailers’ parking lots — will explode. By 2030, the share of electricity demand from public charging will be close to that of private vehicle charging.

This heightened growth is fueled by the Biden Administration’s historic investments in EV charging infrastructure — $7.5 billion to build out the first-ever national network of 500,000 electric vehicle chargers along America’s highways and in communities, a key piece of the Bipartisan Infrastructure Law.

Of course, EV start-ups and existing OEMs’ commitment to promote the offer and sales of EVs is a critical part of the EV adoption as well. Thus far, 18 of the 20 largest OEMs have announced intentions to increase the number of available models and boost production of EVs. Furthermore, electrification of medium and heavy duty trucks are on the rise in the US. Many companies are growing their electric vehicle fleets. For example, FedEx has committed to 100% of new-vehicle purchases being electric by 2030.

In a nutshell, for real estate owners, the time to invest in the future of mobility and EV charging infrastructure is here. Electrification is top of mind for this administration, and with electric vehicle sales set to take off, demand for public charging will balloon.

First movers will have tremendous advantage over technology adaptation and customer acquisitions.

Value Drivers

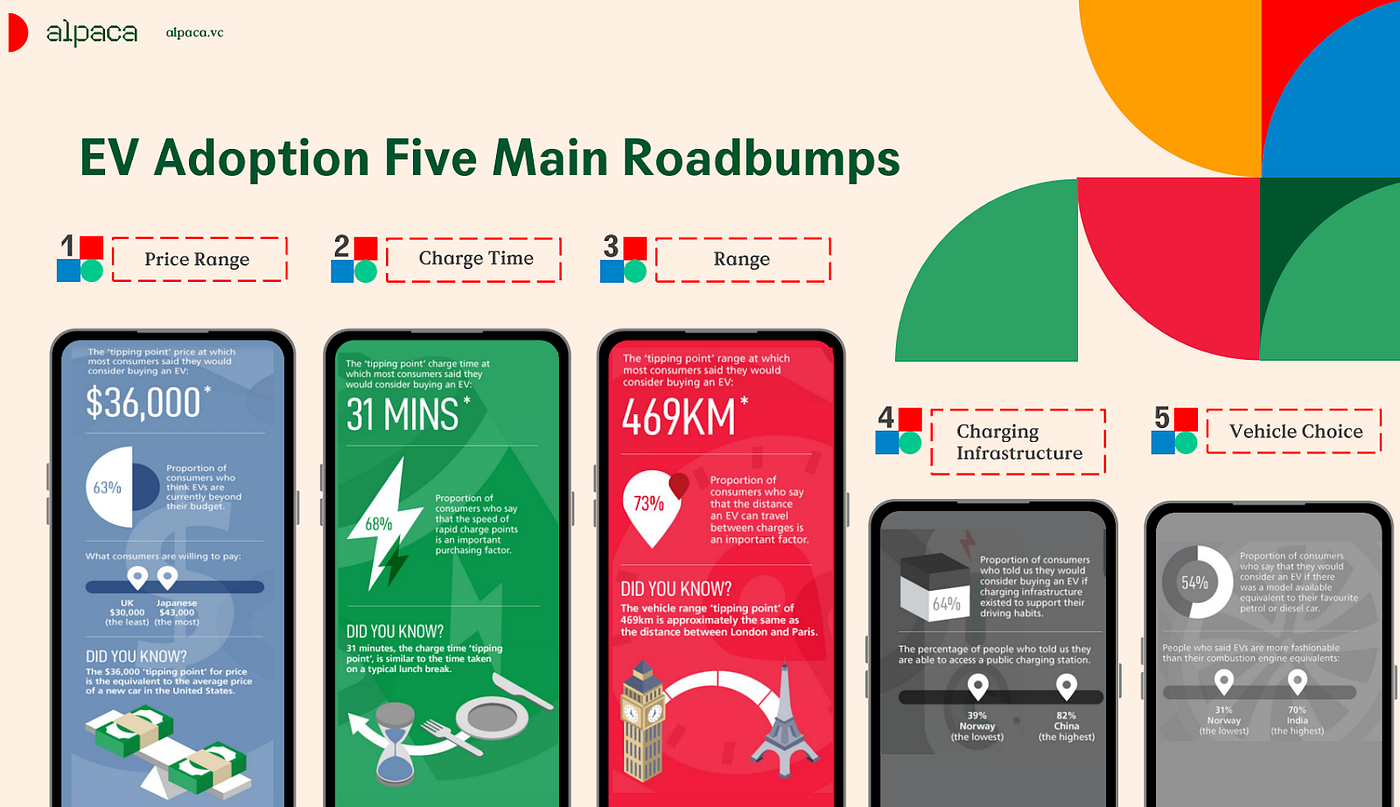

In our opinion, EV adoption faces five main challenges. They are:

- Price

- Charge time

- Range

- Charging infrastructure

- Vehicle size/choice.

These value drivers determine customers’ purchasing behaviors. Startups, however, are trying to solve these road bumps through three major buckets: hardware, software, and service.

We believe that startups and technologies that directly or indirectly address these value levers will have the greatest chance at adoption.

As sales of electric vehicles rise, customers will develop a broad range of needs — from private charging at home and at work to public charging while traveling and at destinations.

Unlike home charging, customers’ needs en route and at destinations are different. En route, customers need easy search and quick access to chargers, high-speed charging to minimize wait time, reliable network coverage, and simple payment mechanism. For destination charging, users expect convenient access and attractive locations and offerings.

To meet these needs, a value chain has emerged. It includes:

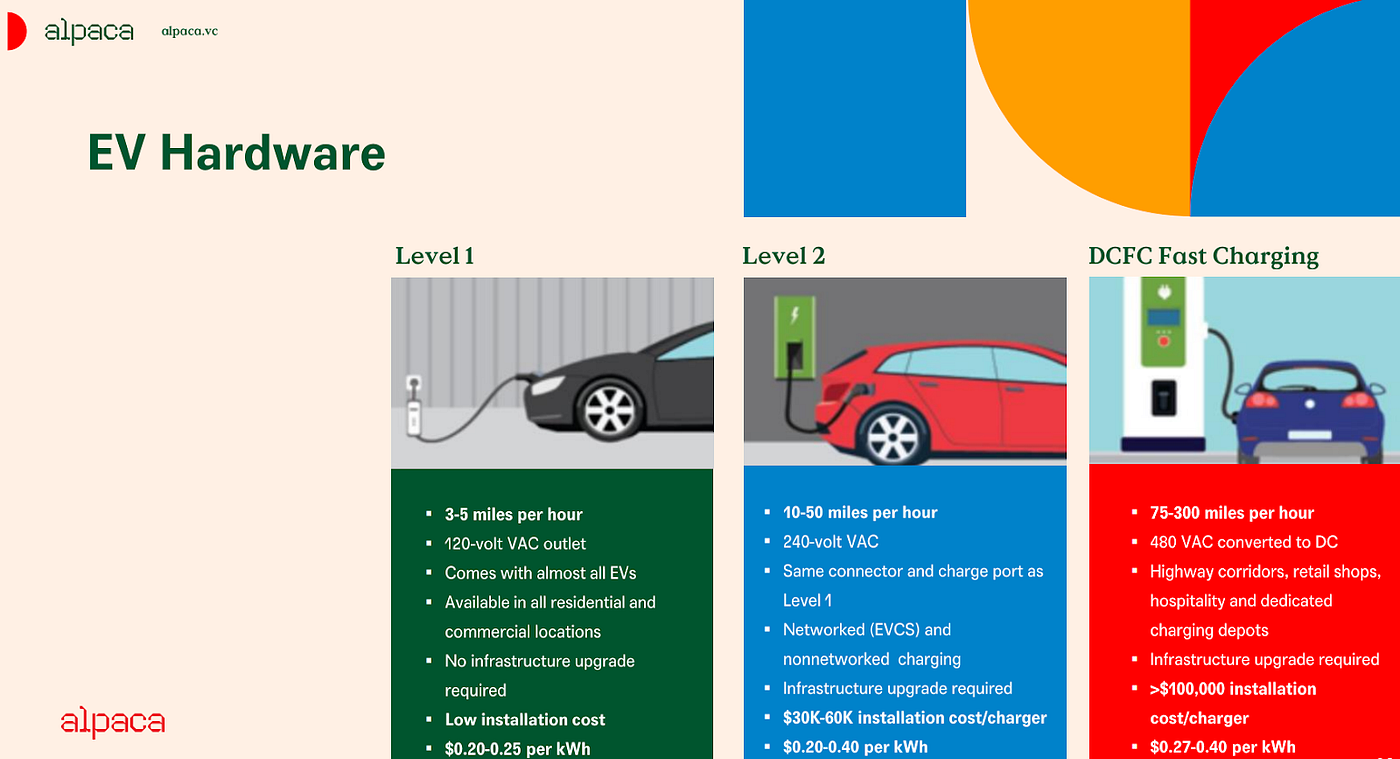

- Equipment Supply. Engineering, manufacturing, and selling AC and DC chargers.

- Installation and Field Services. Preparing sites and installing the chargers, routinely checking them, making repairs, and providing cleaning services.

- Charge Point Operation. Running the charge points at stations. Connecting chargers to mobility service providers, monitoring charger status, and coordinating maintenance.

- Site Ownership. Investing in sites and chargers, sourcing electricity from utilities, and selling it to end users at a markup.

- E-Mobility Services. Providing charging and other mobility services to end users. These app-based services include service maps, payment mechanisms, and roaming services, in which the end user can charge at different charging networks with one charging card.

Analyzing the Startup Ecosystem

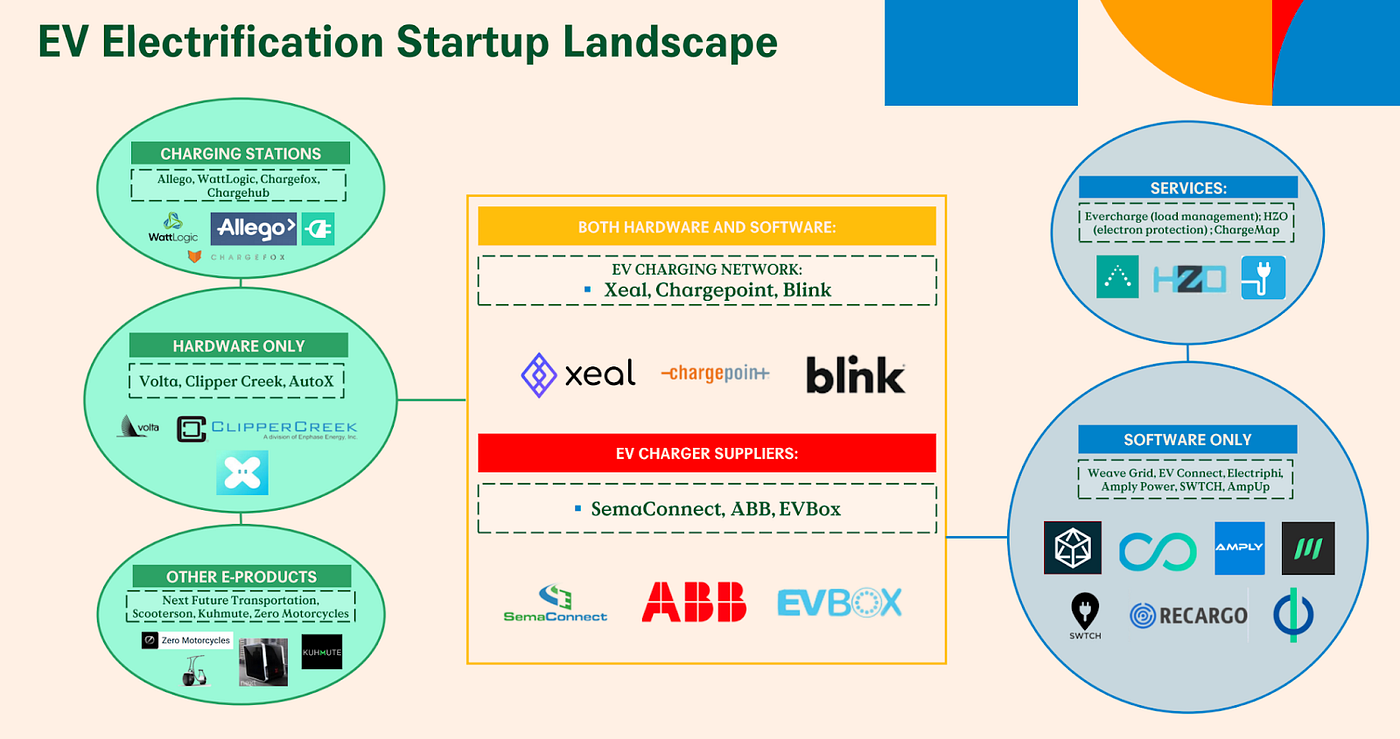

We identified over 125 startups operating in the EV and smart parking ecosystem. These companies are addressing challenges across the entire EV value chain, from hardware and software to fully integrated service providers.

We mapped these startups based on the value chain positions and three major components: hardware, software, and service. From there, we mapped the ones that are integrated services with both hardware and software solutions as either equipment suppliers and/or network providers.

The mental model we developed to segment the EV startup ecosystem is shown below.

Hardware innovation around connectivity — Certain startups aim to solve the connectivity challenges of EV chargers. Currently, ~50% of the EV charges on the market do not work due to connectivity issues.

Example: Xeal: Xeal provides EV charging solutions for apartments, condos, and workplaces. Developer of an electric vehicle charging system designed to make lean energy work anywhere for anyone. Xeal sells chargers that bypass Wi-Fi connectivity entirely, at least at the point of sale.

EV charging network for fleets — Propco / Opco structure where PropCo builds and develops EV charging stations for fleets and OpCo manages the assets and business development partnerships. It is challenging for traditional PE developers to build EV charging stations with industry knowledge.

Example: TeraWatt: Owner and operator of electric vehicle charging infrastructure intended to be the intermediary between capital markets, utilities and organizations of all types looking to electrify their fleets. The company develops, owns and finances electric vehicle charging infrastructure and provides property assets, financing and infrastructure energy management solutions, thereby serving a wide range of industries across the USA.

Smart services platforms — Softwares that compliment current EV charging technologies and infrastructure by mapping out charging stations, creating simple payment, etc.

Example: Parkade: Parkade helps modernize how parking works at multi-family buildings and offices, allowing management to easily lease spots digitally through their app to residents, guests and employees. And, when people lease assigned spots long-term, they can reshare their spot when it’s vacant — hugely increasing parking capacity and reliability.

Parking Tech

The need for evolution and adaptation has never been as pressing for the parking industry. Even before Covid, there was an acute need for technological advancement in the parking industry. Today, there are a number of technological trends on the rise— parking assistance, automated parking lots, and the Internet of Things (IoT) —just to name a few that are among the most promising for the future of parking.

Sector Trends

With digitalization, smart parking systems are starting to offer solutions for urban mobility. This is a system which, thanks to the Internet of Things (IoT) and sensor technology, allows real-time data to be obtained about parking availability, both outside and inside, and regarding traffic and road conditions.

The rise of ride-hailing, autonomous vehicles, and micro-mobility devices are set to lower rates of car ownership among younger generations.

This, alongside increasing electric vehicle ownership, has building owners thinking about parking garages and how they will need to adapt — “Today a Garage, Tomorrow a Tennis Court?” There are four major trends evolving for the future of parking garages:

- They are not just for cars

- They are laboratories for parking tech

- They include EV charging stations

- They have routes for autonomous fleets

Tech Stack

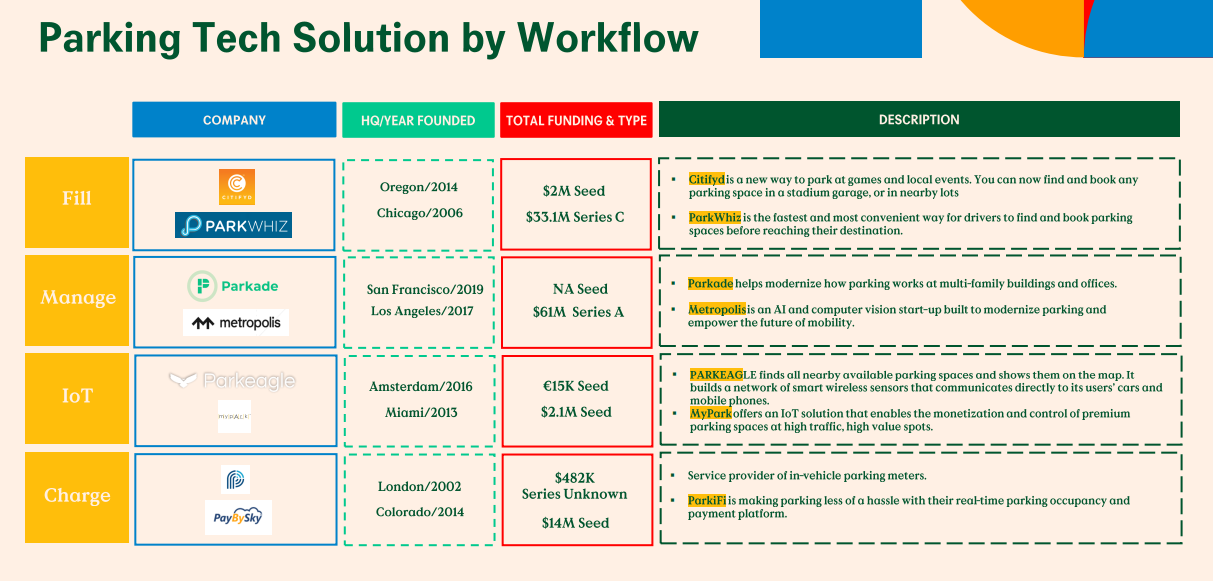

Based on the major industry trends, we developed the below tech stack to capture the tech solutions based on parking workflow. We determined four distinct avenues for investors to gain exposure to this space, some of which resemble traditional VC and traditional real estate investing:

Alpaca VC’s Summary and Outlook

Years ago, parking might not have been real estate owners and investors’ top priority. Yet with the latest mobility trends in autonomous, connectivity, electrification, and shared mobility, building owners are more and more aware of the disruption and transformation the real estate industry is about to experience.

If your company wants to be part of the future of mobility, then it’s time to embrace open innovation with manufacturers, software companies, e-mobility service providers, investors, and startups. If there’s one thing we learned it’s this: the market is still fragmented and in its early stage of adoption. We firmly believe first movers will benefit tremendously from building technology tools to support EV operations along the value chain.

Our Summarized Slide Deck:

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.