Field Study: Rooftop Solar Energy

I. Introduction

As discussed in our earlier blog post, the Alpaca team kicked off a new Field Study in May focused on solar energy. In particular, we were interested to learn more about rooftop solar installations for multi-family buildings, as well as commercial and industrial (‘C&I’) properties. Historically, most of the growth in US solar capacity has come from small-scale single-family homes on one end and large utility-scale developments on the other. Multi-family and C&I have been stuck in the middle — a solar ‘no man’s land’ — but we believe this is about to change.

We’ve had dozens of conversations with founders, operators, investors, LPs, industry consultants and regulatory experts to better understand the solar landscape and the secular trends behind it.

We at Alpaca believe that the explosive growth in solar energy is poised to continue. For multi-family buildings and C&I properties specifically, we think rooftop solar has reached a critical inflection point and will experience strong, accelerating growth in the years ahead.

II. Solar 101

Before diving into emerging trends, it’s important to first understand how the solar energy industry is defined and segmented. Solar arrays can be installed in a variety of different settings. For the purposes of this Field Study, we have focused primarily on rooftop solar.

All solar installations are classified as either “front-of-the-meter” (FTM) or “behind-the-meter” (BTM). At a high level:

- FTM installations are typically utility-owned, sit off-site and flow to the end customer through a meter (so they can be billed appropriately).

- By contrast, BTM installations are independently owned, sit on-premise, and are used primarily to meet the building owner’s energy needs.

Solar installations can be further grouped into one of three buckets:

- Residential

- Commercial & industrial (C&I)

- Utility-scale

A fourth — called community solar — is considered a hybrid that straddles these buckets. While community solar projects are generally off-site FTM installations, they are not limited to one asset type. They can be hosted on a multi-family building, a big-box retailer, a warehouse rooftop, or constructed as a ground-mounted solar farm.

Community solar was introduced as a concept about a decade ago to democratize access to solar energy. Millions of households and small businesses in the US are unable to install rooftop solar on-site either because they rent, have inadequate roof space, live in an unsuitable location, or simply cannot afford the capital expense. In a community program, a large solar array is installed in off-site locations and connected to the grid. Eligible households and businesses can buy a stake in the project and then receive a credit on their utility bill for the electricity generated by their share in the system.

III. Solar Sector Trends

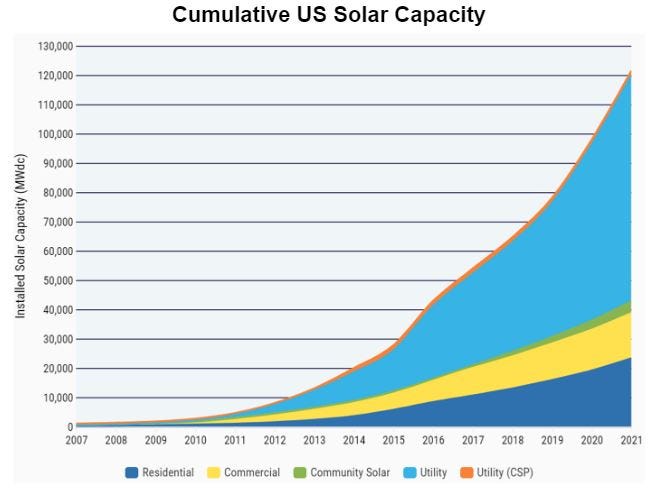

Since the turn of the century, solar energy has grown at a breakneck pace. Consider the following statistics:

- In the last 10 years alone, solar capacity in the US has increased at a staggering 33 percent CAGR.

- Last year, despite the supply chain chaos, solar capacity still grew 20 percent year-on-year.

- Today, the US has more than 120 GW of installed capacity, enough to power 23M homes.

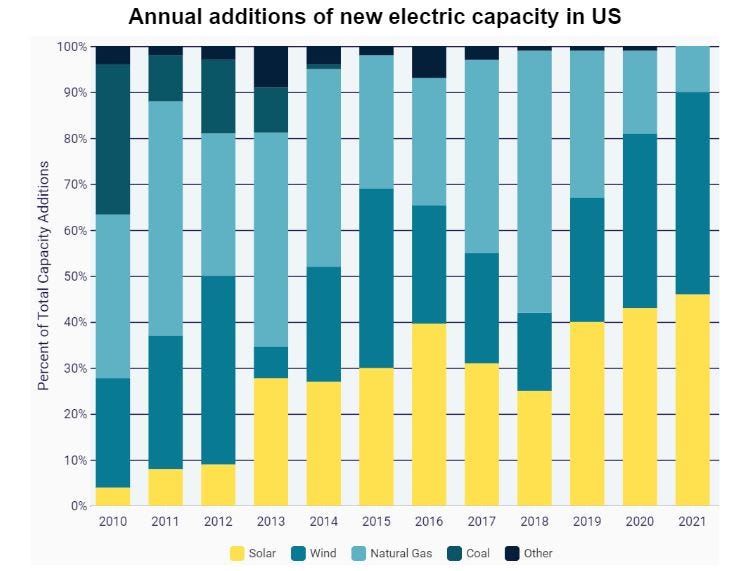

As a result, solar’s share of total US electrical generation has increased from just 0.1 percent in 2010 to roughly four percent today. And this mix shift is gaining speed. For the past three consecutive years, solar has been the number one source of new electric capacity added to the grid. In 2021, nearly half (46 percent) of all new electric capacity came from solar, the highest level on record.

This rapid growth shows no signs of stopping. In Q1 of this year (prior to the passage of the Inflation Reduction Act), Wood Mackenzie’s base case predicted US solar capacity would more than triple from 120 GW today to 460 GW by 2032. But after the extension of the federal investment tax credit (ITC), the energy consultancy now believes solar installations will grow by a further 66 percent over the next decade (relative to baseline projections).

IV. Rooftop Solar for Multi-Family and C&I Assets

As we mentioned above, to date, the vast majority of solar capacity in the US has come from:

- Single-family owner-occupied homes

- Large utility-scale developments.

By comparison, multi-family and C&I growth have been modest, even though many of these sites (e.g, industrial warehouses) are perfectly suited to host rooftop solar systems.

This dynamic has been driven by a few factors:

> ‘Split incentive’ problem: Traditional leasing agreements for these assets result in a ‘split incentive’ situation. Owners are responsible for investing in the solar system, while the cost savings mainly accrue to tenants. In other words, owners are not incentivized to make capital investments since they do not share equally (or at all) in the benefits.

> Financing hurdles: Multi-family and C&I installations often face challenges with respect to financing. Projects are too large to access loans from single-family providers, but too small to access more institutionalized project financing.

> Complex, piecemeal deployment: Large real estate owners/operators are typically looking to deploy rooftop solar across multiple properties at the same time. However, when it comes to solar, the US is in fact a patchwork of 50 smaller markets. Because incentives and regulations can vary significantly from state to state — often requiring local expertise and one-off underwritings — they struggle to find a scalable solution that can be used across the full portfolio.

That said, we believe that this segment is finally reaching an inflection point, and we expect to see a step change in growth.

Key drivers include:

√ Technological advancements: Advances in material science and manufacturing processes continue to push out the frontier of photovoltaic (PV) efficiency. As PVs become increasingly efficient, real estate owners require fewer panels to meet their energy needs, thereby reducing the all-in cost per watt.

√ Financial drivers: With COVID disruptions and inflationary pressures impacting their bottom line, real estate owners are exploring new ways to maximize NOI. Solar arrays can reduce operating expenses (by offsetting energy costs) and/or generate revenue (if net metering is possible).

√ Government incentives: A broad range of incentives exist at the federal, state, and city levels to reduce the upfront investment and shorten the payback period. The recent passage of the Inflation Reduction Act has expanded and extended some of these incentives.

√ Regulatory compliance: In addition to these carrots, governments are using mandates and other sticks to encourage solar adoption. California has been the pace-setter here, but other states like New York, New Jersey, and Massachusetts have followed suit. Earlier this year, the SEC proposed a new rule related to climate disclosures that will also likely spur C&I adoption.

√ Energy hedging: In the months following the Russian invasion of Ukraine, we saw energy prices soar and supplies dwindle. In Europe, some countries even face the prospect of rationing this winter. Now more than ever, real estate owners are looking to reduce their exposure to volatile oil and gas prices.

√ Capital raising: Real estate capital allocators — from publicly traded REITs to private equity giants — are increasingly considering ESG factors when making investment decisions. Developers who fail to prioritize environmental sustainability in their projects will face a rising cost of capital.

√ Tenant demands: Corporate tenants — and to some degree, even apartment hunters — are more environmentally conscious than ever. According to Net Zero Tracker, a research consortium, a third of the world’s largest public companies have made ‘net zero’ pledges and many are looking to cut emissions from their real estate portfolios.

In addition to these key drivers, we’ve repeatedly heard about two other enablers that are driving growth in multi-family and C&I. They are:

> Community solar: Community solar lends itself particularly well to multi-family and C&I projects. Currently, just three states make up three-quarters of the market: New York, Massachusetts and Minnesota. However, 22 states (plus DC), have now passed laws to support community programs, either through incentives, mandates or a mix of the two. Experts expect the US to add about 5 Gigawatts (GW) of community solar over the next five years (2X the current capacity).

> Tech-enabled startups: A number of climate-tech startups are focused on taking the pain out of solar deployment — whether it’s identifying eligible sites, lining up financing, navigating permits, or streamlining installation. Wunder Capital, Ivy Energy, PearlX, Lumen Energy, and Moneytree Power are just a few of the startups that are eliminating the friction with C&I and rental properties.

V. Risks & Recent Developments

When we first began this Field Study in May, there were several risks on the horizon that threatened to derail industry growth:

→ Sunsetting of the federal investment tax credit (ITC): Of the many government incentives and rebates that exist, the federal investment tax credit (ITC) is the single greatest driver of adoption. As of July, the ITC stood at 26 percent but was scheduled to step down to 22 percent in 2023 before finally expiring in 2024. However, as part of the Inflation Reduction Act passed in August, the ITC was increased from 26 percent to 30 percent and extended for another decade (running through 2032).

→ US investigation into solar panel imports: Since 2012, the US has imposed tariffs on Chinese-made solar panels to prevent China from “flooding” the US market and driving domestic manufacturers out of business. As a result, most US installers buy solar panels from Southeast Asia (i.e., Cambodia, Malaysia, Thailand and Vietnam). Together, these four countries account for about 80 percent of the panels imported. But earlier this year, a small US-based manufacturer alleged that these panels in fact use Chinese-made wafers and accused China of circumventing anti-dumping laws, prompting a federal investigation. Faced with the threat of retroactive tariffs, installers effectively froze all Asian imports and more than 300 solar projects nationwide were either postponed or canceled. In June, however, the Biden administration announced a two-year pause on any new tariffs, easing installers’ concerns.

→ Potential changes to net metering laws: Currently, about 40 states (plus DC), have mandatory net metering rules, which require utilities to compensate rooftop solar owners for excess electricity put back into the grid. However, several US states are under pressure from local utilities to alter these rules and decrease their payouts. In California, for instance, the Public Utilities Commission is considering a plan that would charge customers a $50 monthly “grid participation charge” and reduce net metering credits by as much as 80 percent. Recently though, opposition has been building. Florida was considering a similar bill that would make net metering less attractive, but Governor DeSantis vetoed it citing concerns about inflation.

In short, Congress has resolved the uncertainty surrounding the ITC, the Biden administration has halted new PV tariffs for at least 24 months, and any net metering changes are unlikely to gain widespread traction in the near term. With these risks off the table, solar energy has a lot of runway remaining.

VI. Closing

Solar energy has had a remarkable run over the past 10 years — and the next 10 years are looking even brighter. Generous incentives, stricter regulations, ESG guardrails, and a volatile geopolitical climate have made solar more attractive than ever. And although multi-family buildings and C&I properties have historically been more on the sidelines, we at Alpaca believe they could soon have their ‘day in the sun’.

Take a closer look below:

Please Reach Out

If you are an entrepreneur or an industry expert exploring this space who’s actively working with solar, please reach out to [email protected] and [email protected]. We’d love to speak with you.

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.