Field Study: Sustainable Building Materials 2.0

During the summer of 2022, the severe droughts and heatwaves affecting virtually all corners of the world served as a stark reminder of the effects of climate change. While climate change itself has become a norm of global proportions, here’s what is surprising:

With roughly 37 percent of CO2 emissions being attributed globally to buildings — through direct (e.g., heating) and indirect (e.g., electricity generated to power appliances) energy use — a high portion of climate change-inducing greenhouse gas emissions (GHGs) comes from the places where we live and work.

By comparison, emissions produced by the entire transportation sector (including cars, trucks, ships and planes) account to just over a quarter.

Clearly, to make a dent in the fight against climate change, huge investments need to pour into how we live and work and not only into how we move. Venture capital investments have so far not reflected this, with less than three percent of climate tech investments going into buildings according to the PwC State of Climate 2021 report.

It is against this backdrop that we analyzed the emerging technologies and innovation that will power the transition to net zero emissions buildings. We see climate as a tangible investment trend, with shareholders increasingly committing to ambitious emissions reduction targets, governments investing heavily in subsidizing clean technologies (say hi to the $369bn climate investments in the Inflation Reduction Act) and customers putting a premium on green buildings that minimize operating costs.

Framework

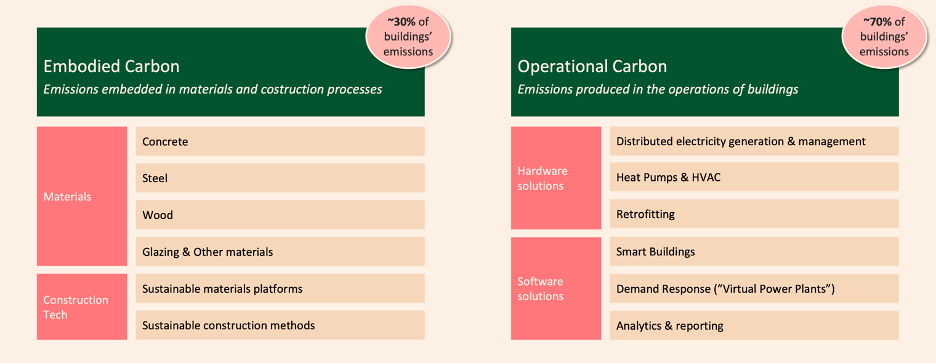

When you estimate the lifetime impact of a building, roughly 70 percent of its emissions come from operations (“operational carbon”) and 30 percent from the carbon released in the construction and production of building materials (“embodied carbon”). Perhaps for this reason, investments in solutions to make buildings “smarter” and reduce operational emissions (and costs) have largely outnumbered those in embodied carbon technologies so far. In addition, decarbonizing embodied carbon means tackling some of the most challenging tasks, such as producing low-CO2 cement or steel, with significant higher technology and scaling risks than, say, B2B SaaS energy efficiency solutions.

By using an emissions-based approach, we have segmented the sustainable buildings market further along the embodied/operational carbon split (see chart below). Enriching the current understanding of embodied carbon, we see software opportunities in this vertical and not only sustainable building materials. In operational carbon, conversely, it’s not a software-only story, with many hardware solutions such as heat pumps and low-carbon HVAC required.

Opportunities in embodied carbon

Embodied emissions have long been a tough problem for Real Estate companies. But given embodied carbon emissions happen now vs. operational emissions that are spread over decades, regulators and shareholders will likely accelerate the push for more climate-friendly new constructions. Luckily, a few solutions are gathering momentum in this space.

When it comes to decarbonizing buildings, cement and steel are the elephants in the room.

Together they account for roughly 15 percent of global CO2 emissions (though it’s important to note that not all is attributed to buildings: also cement for infrastructure and steel for cars).

We see different approaches trying to make concrete (which is the end-product where cement is used) greener. The first is by injecting CO2 to accelerate the curing phase of concrete, i.e. when concrete is left to solidify after placing. Companies like Carbon Cure and Carbon Built have been successfully using this approach and scaled it significantly already, making the concrete produced a carbon sink. However, given the controlled environment CO2 curing requires, so far this technology can be applied only to precast products, thus limiting the reach of this solution.

Another approach focuses on the chemical reaction at the base of cement production, which produces clinker releasing CO2 into the atmosphere as a by-product on top of the CO2 used to reach the high temperatures required. Players like Brimstone Energy and BioMason have different innovative approaches, and both have attracted significant interest recently.

Wood is seen by many as a growing alternative to traditional reinforced concrete buildings. We see engineered wood building adoption at a tipping point, with cross-laminated timber (CLT) now mature and with promising new wood-based technologies emerging to make buildings more energy efficient (see LEKO labs) or even modifying wood chemically to acquire steel-like strength.

But as highlighted above, embodied carbon is not only about building materials. Much is happening in construction tech to improve the sustainability of buildings by understanding, designing and procuring materials for new developments with their carbon footprint in mind. Similarly, advancements in construction technologies including prefabricated housing and robotics now show significant momentum.

Opportunities in operational carbon

Energy efficiency software solutions for residential and commercial buildings have literally exploded over the last few years, with countless ventures and investment in this space. While some have successfully scaled and exited (e.g. Nest) we see this market as relatively crowded and overheated. However, strong CAGR will be a significant tailwind for these solutions, which we expect will gradually permeate the Real Estate market much further, in particular in conjunction with more efficient hardware.

When looking at operational carbon, hardware is forgotten too often. Heating and cooling, the most significant sources of CO2 emissions as the grid gradually becomes greener and appliances run on renewable power, both present significant opportunities. In particular, cooling and low carbon HVAC systems both present a high degree of technological innovation and are expected to grow dramatically over the next decades. In fact, in a perverse climate feedback loop, as we take refuge from heatwaves in A/C-powered homes and buildings, cooling is expected to grow into the single biggest electricity demand driver (the IEA estimates that by 2050 cooling will absorb 37 percent of electricity demand up from ca. 20 percent now). In addition, growth in developing markets is expected to skyrocket as cooling becomes a necessity and incomes rise. The global stock of ACs is expected to triple by 2050 to 6 billion.

This threatens further global warming, as cooling significantly contributes to peak energy use, for which often dirty power generation is used, and the majority of low-cost refrigerants used have global warming potentials (GWPs) thousand times higher than CO2 in the short term.

Luckily, low carbon solutions are emerging, combining innovative cooling technologies with peak load management to dramatically lower CO2 intensity and energy bills. Blue Frontier, for instance, uses a desiccant-based technology to improve the efficiency of cooling and store energy to use it when needed, allowing its HVAC system to potentially concentrate energy usage when the grid is greener — and cheaper. Heat pumps, a mature technology traditionally associated to heating, can be utilized for cooling, too. But its high installation costs make a challenge, and companies like Gradient are trying to tackle this problem by developing an easily-installable, sleek heat pump-based AC unit for residential use.

In addition, HVAC systems can be a very convenient place to capture CO2, given their high constant air flow (used for cooling) means lower energy costs compared to traditional Direct Air Capture (DAC). Companies such as Noya and Carbon Reform are working on this technology, and the recent coronavirus-induced focus on air quality has only added interest.

Extensive cooling and heating upgrades will be required to reach global climate goals. The IEA estimates that to be in line with the Paris Agreement objectives, 20 percent of existing buildings need to be zero-carbon by 2030.

Currently, that number stands below 1 percent, highlighting the magnitude of the challenge.

Retrofitting will thus need to accelerate dramatically, and solutions that solve or manage the traditional split incentive issue and the governance of interventions will benefit from an incredible tailwind. Companies such as EnergyRM and Bloc Power are widely considered leaders in this field, but we also see attractive niches in Fintech solutions that will power these “retrofit-as-a-service” business models.

Conclusion

We see the decarbonization of buildings as a key trend that will drive significant opportunities in both hardware and software solutions over the next decade. Buildings are a relatively under-invested vertical — even for specialized climate impact investors. While certain technologies are still early-stage, we expect this funding gap to be bridged soon. If you are working on a solution for these problems, please reach out to our team.

To keep up with the latest from Alpaca, connect with us on Twitter, Instagram and LinkedIn @alpacavc, subscribe to our bi-weekly newsletter The Rundown here or reaching out directly to [email protected].

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.