Field Study: DAOs and Tools for DAOs

Our exploration into decentralized autonomous organizations, on-chain organizations, and the tooling that powers them

Web3 has given us a lot to talk about over the past couple of years. One of the hottest topics to occupy media and popular mindshare was Decentralized Autonomous Organizations or DAOs, as they’re commonly referred to. These types of organizations have been present in Web3 for years, but most individuals started to see their potential in November 2021 after a group of internet enthusiasts set up a DAO, raised more than $40M in a week and almost bought one of the 13 original copies of the US constitution (read more about the story of ConstitutionDAO here).

DAOs have proliferated exponentially over the past five years and are starting to occupy a central role in Web3 activity despite having started off on the wrong foot (read more here about The DAO, which raised $150M and got hacked 2 months after its inception). The exact number of active DAOs isn’t clear, but current estimates go as high as 5,000 organizations. It is safe to say there are at least 1000 active DAOs, up from <10 in 2017.

As of September 2022, these DAOs held a total of over $10B in assets under management (AUM), a number which has increased more than twenty-fold since January 2021. And there are over 3.8 million unique wallets holding DAO governance tokens (tokens to vote on the organizations’ plans — loosely similar to traditional shares).

Note: if you’re a pro on DAOs and just want to learn our critical views on DAOs and tooling opportunities, skip the next two sections.

Part I: What are DAOs exactly?

Defining DAOs

In short, DAOs are organizations composed of participants who discuss and vote online — often with tokens — to decide on the best course of action for their organization. Now, for some extra context:

- DAOs are a novel means of organization, enabled by blockchain, cryptocurrencies, and smart contracts (public code in the blockchain). At its core, a DAO is a type of organization deployed as smart contracts on top of existing blockchains (e.g. Ethereum, Polygon, Solana). Those smart contracts establish governance rules on how the organization operates, and the DAOs members decide on the organization’s future by voting through their individual wallets.

- Like traditional companies, DAOs have specific purposes (for example, buying the US constitution or investing in NFT collectibles), labor resources (people contributing to the organization for compensation), and assets (aka treasuries, kept in cryptocurrencies). However, in general, they resemble more cooperatives than traditional companies and are remote-first organizations that carry out most of their activities through online platforms that enable communication, collaboration, and coordination.

- If we break down the acronym, Decentralized stands for distribution of power, governance, and resources within the organization, Autonomous stands for a self-governed body, with rules defined by smart contracts (public code in the blockchain), Organization signifies the structural makeup, internal processes, and execution of a group that shares a joint mission.

- Like all organizations, DAOs come in many shapes and sizes. DAOs are wildly different from each other in the way they organize their activities. Some are far more decentralized; some are far more anonymous; and others are barely DAOs at all, following a centrally-governed system in which nothing is truly decentralized, though the organization operates via smart contract interaction.

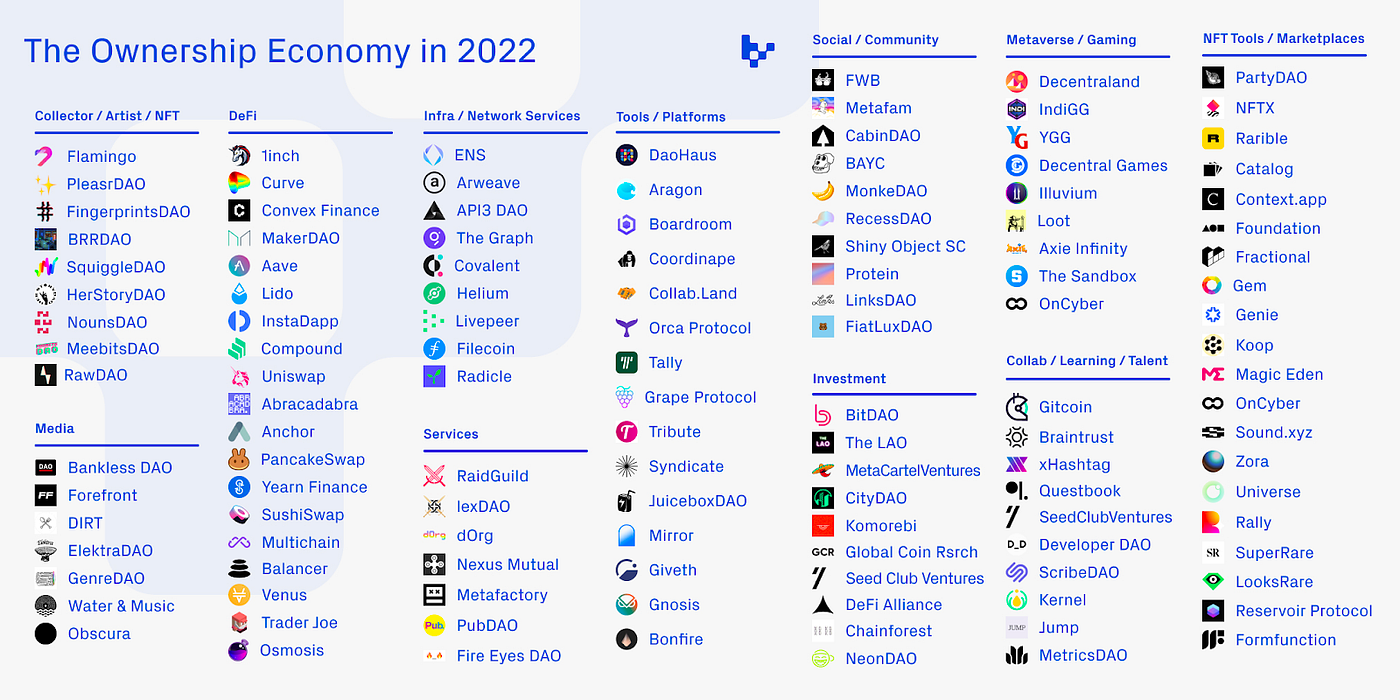

The truth is that DAOs have proliferated across Web3 in multiple sectors, and it’s hard to keep up with new ones popping up day by day. We found Variant’s cataloging of the most important DAOs in April 2022 to be a worthy resource (check out the full publication here).

Where do we see potential?

DAOs have been lauded by many in the crypto/Web3 community as the next stage in the evolutionary phase of organizations. Here at Alpaca, we think this is an overstatement. However, given DAOs’ ease of setup, focus on the democratic processes, and bottom-up incentive alignments, we believe DAO structures can have great potential to:

- Rapidly form and test online communities. Given how easy it is to set up a DAO (through apps such as Upstream, part of our portfolio), allocate budgets and member responsibilities, DAOs are a great way to lower the barriers of entry for pseudo-anonymous collaboration while protecting individuals’ property rights. A DAO can be set up in minutes, and work can start from the get-go, with immediate pecuniary or non-pecuniary compensation. As inspiring examples, we identified how rapid and strong the BAYC community grew, or how gaming guilds (YGG, Merit Circle) became large and intricate in such a short time span.

- Jumpstart network effects. An online, community-owned organization with flat hierarchies can have strong incentive alignments and offers a good sell to spark people’s imaginations. Online networks can create higher levels of interaction than more linear distribution channels. We can picture a DAO in a permissionless blockchain spreading online like wildfire. As inspiring examples, we identified how quickly The DAO and ConstitutionDAO raised $150m and $45m, respectively.

- Enhance trust and transparency in pseudonymous environments where consensus is a relevant priority. Because DAOs focus on democratic processes through on-chain voting, decision-making is generally more transparent than in traditional organizations: Proposals have to be shared with the community, discussions are had, and voting periods must be respected. Dissent finds its way earlier in the decision-making process, and the reasons behind important decisions are clear and available to the wider community, implying less potential for unvocalized grunts and higher levels of trust.

With these benefits, it’s not that hard to imagine setting up a DAO to handle community-first, consensus-driven affairs, where operational efficacy is not the main priority. We wouldn’t be surprised to see DAOs in realms of our lives such as:

- Gaming communities: Picture guild management in World of Warcraft, or voting mechanisms launched by the studios to prioritize new feature releases in community-loved games.

- Neighborly and non-profit collectives: Picture neighbors debating whether to install mandatory solar panels in their units or introduce a fine for littering, or student-run school organizations deciding on yearly activities and budgets.

- Small-scale investment and/or collector groups: See FlamingoDAO or the LAO.

- Fandoms, affinity, or pressure groups: Picture a Bon Jovi fan group organizing swag sales, NFT drops, and bidding for a private concert; or a union deciding yearly benefits and compensations.

- Grants allocation: Think of company-sponsored internal grant systems, philanthropic associations, or strategic grant programs.

- Public Institutions’ long-term strategies: Imagine a referendum on long-term mandates for public institutions from the general public or from individuals with proper credentials and track records. For example, UNESCO could launch a referendum to accredited historians and anthropologists for the selection of their next batch of World Heritage Sites.

- Large network management: Think of extremely large networks in which trust in the system is far more important than innovation and speed of execution. For example, the Ethereum Foundation orBitcoin.

Have you come up with scenarios where DAOs will thrive? Share them with us!

Limitations of DAOs

Amid this discussion, there is one important realization we keep coming back to: things are usually centralized for a reason. Through our conversation with experts in the space, active involvement in several DAOs, and studying general organizational theory, we have identified several limitations for these types of organizations.

We think these limitations are material and can fall into one of two groups:

We can call the first set contextual limitations, as they are linked to the general incipiency of the movement along with the nascent Web3 environment.

We can think of the second set of limitations as innate — or fixed — limitations, as they are linked to what defines DAOs vis-a-vis companies.

Below is a brief descriptive analysis of both groups.

Contextual Limitations:

- Regulatory Landscape: Regulation around DAOs is still unclear. There are several bills and conversations being currently discussed in congress — including Sen. Lummis and Gillibrand’s Responsible Financial Innovation Act — aimed at incorporating DAOs as organizations recognized by law and dealing with their respective tokens. It’s still unclear if the resulting effects of the potential law’s bureaucracy, taxation rules, and liability recognition will make DAOs practical at all within the next few years.

- Organizational Immaturity: DAOs are still young and developing. There aren’t enough successful frameworks to implement in the myriad of environments DAOs are popping up in, nor software tools to solve all the challenges these new organizations face. The variance across the operational efficiency of these organizations is huge, given the lack of standards and best practices to enforce. We expect these massive gaps to shrink over the next few years, with emerging best practices finding their way into the most serious DAOs.

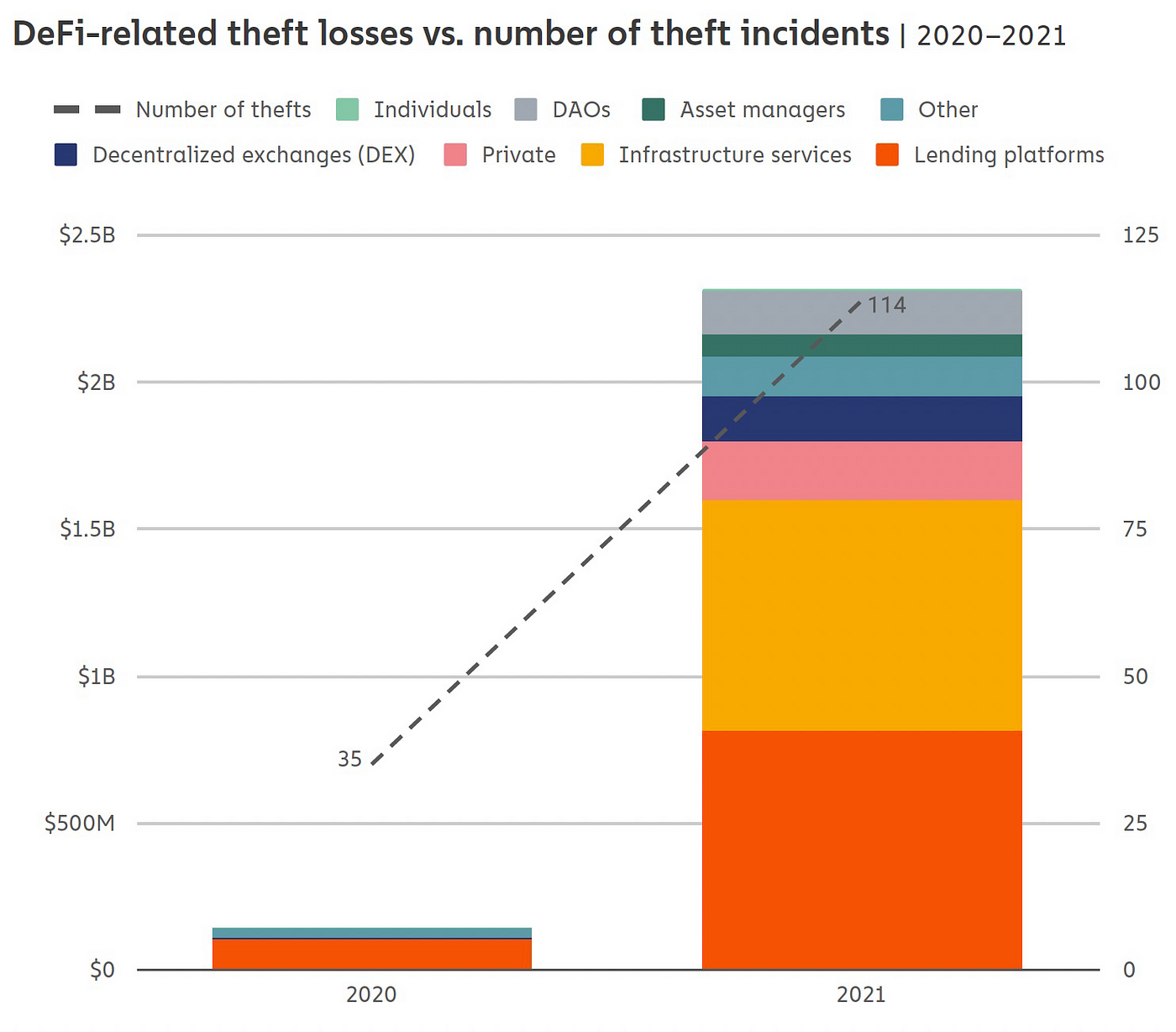

- Security & Fraud: Crypto has been struck by 6 out of the top 10 money heists in modern history, and DAOs are no exception. In fact, the statistic is even grimmer for DAOs, since they had an outweighed participation in total value hacked, given their entire treasuries sit on-chain. In addition, frauds and rug pulls are common things in crypto. Major DAO founders had been convicted fraudsters (see the case of Wonderland). The problem has only grown worse over the past few years, and for treasuries to be truly safe to guarantee organizational sustainability, much progress must be made on this front.

- User Experience: Although we are seeing advances in user experience across Web3, and in DAO participation, there is still a long way to reach the point in which people can actively and seamlessly participate in DAO governance. Lots of users, processes, and decisions must be brought on-chain, and while wallets/tokens have to date, DAO infrastructure and tooling has been mainly optimized for monetary means of exchange. Exclusively on the DAO front, we are very proud of what Upstream — one of our portfolio companies — is doing to make this happen.

Innate Limitations:

Loss of operational efficiencies: Although sometimes the payoff outweighs the costs, decentralizing is in many cases costly from an operational perspective. Let’s consider some operational implications for DAOs:

- Mismanaged decentralization can lead to a lack of planning and execution, and/or duplication and improper prioritization of tasks. Most DAOs have poor contributor onboarding and management policies, resulting in underwhelming retention rates (in some cases >80% churn in just a few weeks).

- Democratic processes are often unnecessarily tedious and lead to inaction paralysis. Compound took almost 50 days to approve Open Zeppelin as its smart contract security auditor, and although the contract wasn’t monetarily meaningless, it never should’ve taken as much time. Although systems that can improve the voting process will be put in place, there’ll be unavoidable friction and extra effort until we can develop extremely advanced mechanisms for seamless contract execution (for example AI-enhanced bots that automatically vote for us).

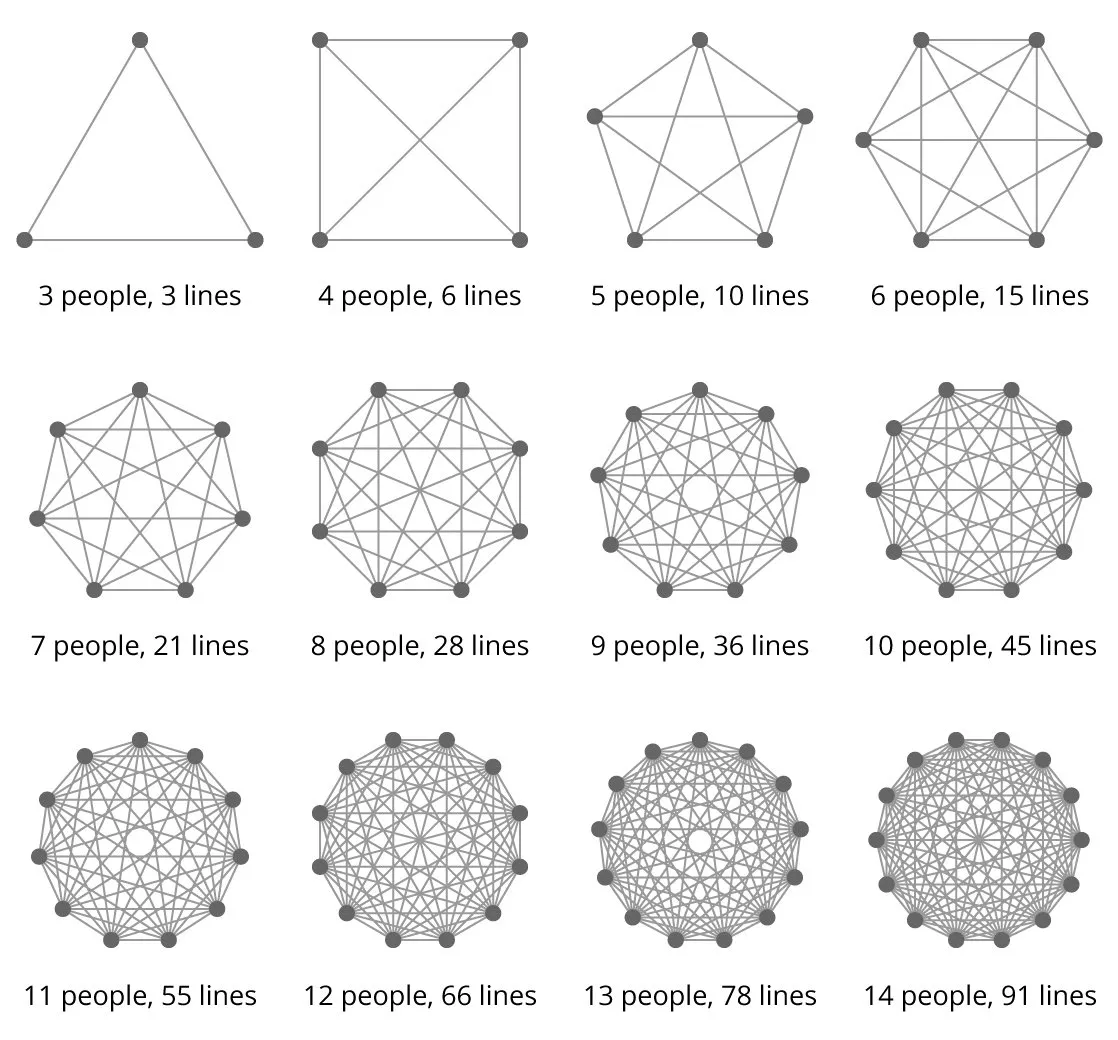

- Centralization of resources and power can oftentimes reduce the cost of action when scaling. Consider Solana’s transaction per second capabilities, which hover around >50k, or Visa’s 1.7k vs. Bitcoin’s non-lightning meager 7 (for background on this, read more here). Think how readily individuals with full information and relevant judgment make fast decisions without needing to seek approval from the rest of the organization. Now think about distributed information and consensus building, and how long decisions can take. Consider Brooks’ Law (illustrated by the graph below), and the challenge of solving this problem without extreme resource consumption or centralized communications.

- Strategic Disadvantages: DAOs are all about transparency, trust, and openness. These are all usually great characteristics for many organizations, but they are extremely ineffective in situations in which stealth, timing, and laser focus are required. By announcing plans before they materialize, third parties will act accordingly. These challenges are undesirable in most private endeavors — and anything involving innovation.

- Dangerous Incentive Structures: What is often praised as a benefit of DAOs can also lead to organizational failure. In a world where decisions must be voted on by all the members of the organization, politics undoubtedly start coming into play, and manipulative actions start to look more appealing when the stakes are high. Misinformation, side meetings, social validation, and “an agenda” start to blossom in even the most well-functioning systems. The Convex Wars have taught us to the extent to which seemingly harmless mechanisms can be corrupted.

- Unclear Down-Cycle Resiliency: During down-cycles in traditional companies and start-ups, founders are usually critical to the survival of the business. In eventual successful scenarios, they’re the main source of directed effort and the driving force of contagion to come up with new ideas, strategies, and keep the team focused and motivated. Often, founders’ motivation comes from deep intrinsic personal belief in the company, and an extremely large potential compensation if the effort pays off. DAOs often lack this structural dynamic. Although they could potentially adapt to a tough situation and strongly reward a set of driving individuals, it’s reasonable to be skeptical about orderly transitions towards centralized authorities -with the accompanying compensation structures- in a context where hundreds of voters (usually with incomplete information and judgment) must decide on the organization’s future. It is no wonder DAO activity plummeted since crypto entered a bear market.

In a sense, by highlighting DAOs’ innate limitations, we recognize that DAOs are not companies, and are not superior to companies in most scenarios.

Although companies have limitations, their managerial structures evolved over hundreds of years to their current form, perfecting structures decade by decade, and will be extremely difficult to overtake. We do, however, believe there are interesting applications in other domains, with investable opportunities in companies that solve some of the contextual limitations these types of organizations are facing.

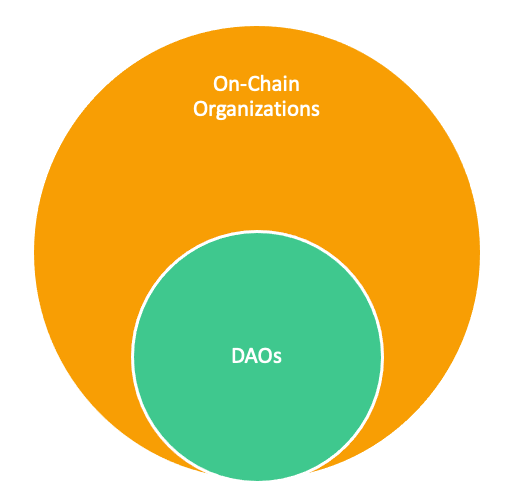

A useful distinction: DAOs vs. On-Chain Organizations

This is a term we borrowed from Graham Novak because we think it sheds light on a common misunderstanding when defining and analyzing DAOs: Confusing any crypto organization with a DAO. Additionally, it provides a key framework to understand the target market of DAO tools.

- We define an on-chain organization as an organization that has a sizable portion of its operations on-chain (core business, payments, contributor management) yet is not necessarily governed in a decentralized manner nor autonomous. As a matter of simplicity, we can identify on-chain organizations as either DAOs or on-chain companies.

- On-chain organizations can be centrally governed through clear ownership and management hierarchies, and their composition and rules can be easily changed by the managing directors (just like a traditional company — we’re not reinventing the wheel here). On-chain organizations have many of the benefits that DAOs present (global nature, transparency, ease of setup and interoperability), forgo some benefits decentralization can achieve and bypass many operational hurdles DAOs encounter.

This distinction implies two things:

DAOs are a subset of on-chain organizations. They might become the new standard for all organizations operating on-chain, but it seems highly unlikely based on our research. If we believe the premise that DAOs will only occupy a fraction of on-chain activity, then tools aimed at providing services and solving hurdles towards all on-chain organizations will have a larger addressable market to serve.

There are opportunities to bring traditional organizations on-chain without having to drastically modify the paradigm in which they operate. There is no need to tokenize the company’s equity nor subject its decision-making processes through on-chain voting, but companies will need to operate in the new internet ecosystem through digital asset transfers and more if blockchain adoption takes off. There’ll be plenty of opportunities to serve their needs. Companies will need to manage their on-chain treasuries, engage their clients through NFT drops and sophisticated marketing analytics, easily transfer digital assets to their providers and employees, and ensure all their operations are safe.

Thus far this has mainly been a theoretical article, and we certainly hope not to have lost you yet, but when deciding to investigate actual tools and companies, we realized we needed to become organizational experts to better judge the direction in which the space is most likely to evolve.

Now onto the next section.

Part II: Tools

What do we mean by tools?

We define tools as software products built on top of existing infrastructure to facilitate operational processes or create operational opportunities for on-chain organizations.

Tools will service DAOs, on-chain companies, or both. For the purpose of this Field Study, we spent a lot of time analyzing tools focused on servicing DAOs, but inevitably came across wider latent needs.

Categories

With the number of identified tools for DAOs alone (excluding the ones exclusive to on-chain companies) stretching to more than 400*, there are naturally many different ways to categorize them. We divided the tools we oversaw into 10 categories corresponding to either tools servicing DAOs or broader tools for on-chain organizations, and investigated the potential of each category.

- DAO-Focused Tools: Frameworks (Operating Systems), Governance & Voting management, Knowledge Management, Communications

- Broader tools for On-chain Organizations: Treasury Management, Payments, Security, Identity Management, Token Management, Analytics

In this post, we’ll only cover the ones that interested us the most and that we spent the most time on:

- Frameworks

- Treasury Management

- Payments

Sources: Messari governor, DAO Masters, DeepDAO

Frameworks (or Operating Systems)

These are the tools offering DAO formation and operating solutions. They are the first step to transforming an informal organization into a DAO, and they deploy the smart contracts into a blockchain, easily giving birth to the on-chain organization. The most popular frameworks are either open-sourced projects catered for developers and crypto natives, or projects catered towards smaller-scale DAOs or non-crypto native communities. Frameworks are essential to DAO formation since they remove the excessively complicated technical processes and allow to easily create DAOs with implemented best practices.

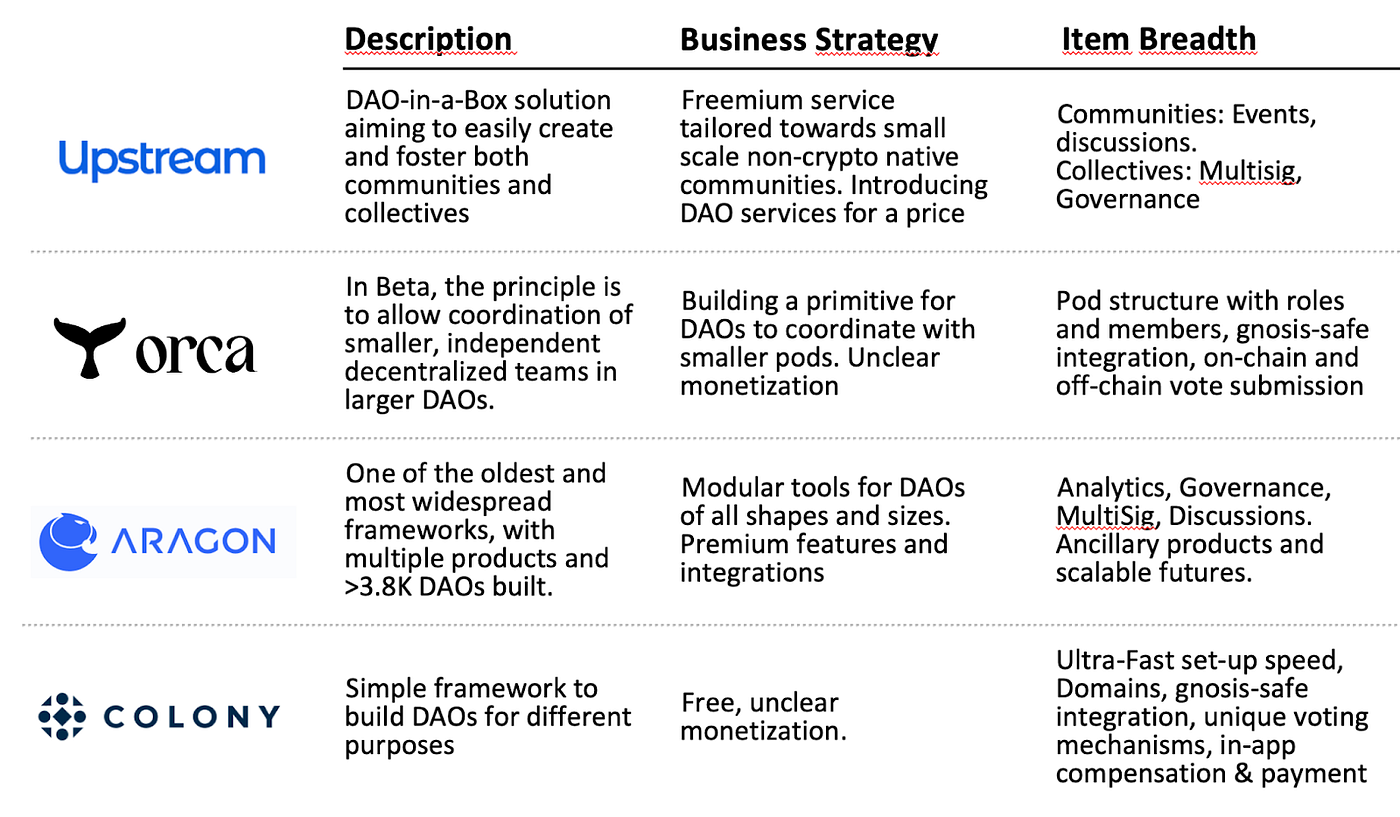

We explored over 20 frameworks/OS and below share a list of the ones we found more relevant/interesting (disclaimer: we are active investors in Upstream).

Opportunities we see for this segment

- We believe that if DAOs are to become widespread and prevalent, frameworks must necessarily occupy a central role in the play.

- Frameworks should become the main command center for the organization’s management and should have a moat if the services provided are good.

- Frameworks will have early access to customers and will be able to up/cross-sell other necessary DAO applications with little to no friction.

- We particularly like and invested in Upstream because it focuses on relatively simple DAO use cases in informal, small-scale non-native communities. We think it’s a business model that has great potential for scaling as more communities become involved in the space and the average technical knowledge of Web3 users declines.

Challenges to consider

- Frameworks have a DAO-focused approach, and their current purpose would be defeated if DAOs fail to materialize as a long-term viable organization type.

- Frameworks are breeding grounds for organizational innovation experimentation, and it is likely most experiments will fail. In addition, DAOs are vastly different in purpose and size, and it’s extremely hard to build an operating system that is flexible enough and yet leaves little space for substantial sector-based innovation from competitors.

Treasury Management

These are the companies, tools, and protocols working on allowing on-chain companies to manage, deploy and diversify their treasuries in the best way for the organizational objectives.

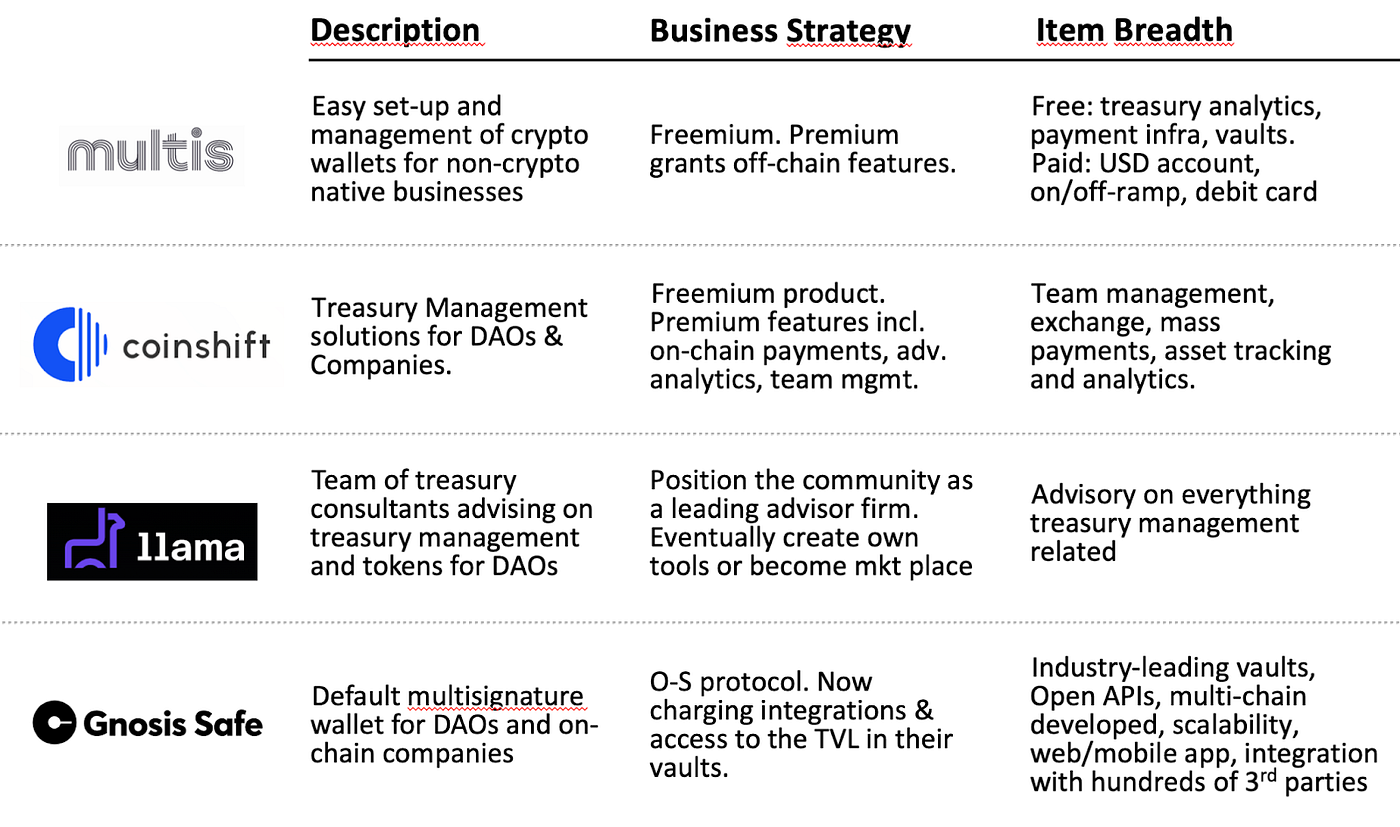

When analyzing this segment, we decided to investigate both DAO-focused tools and broad-based ones. We explored over 30 treasury management-related solutions and below share a list of the ones we found more relevant/interesting. We believe the most interesting opportunities lie in either:

Company-oriented blockchain finance hubs (for which brokers/exchanges seem like a natural complementary business model)

OR

Highly secure open-source fundamental plug-ins that become basic block pieces (resembling pretty much what gnosis.safe achieved). We are skeptical about the market size and strategic positioning of treasury management tools exclusively focusing on DAOs.

Opportunities we see for this segment

- Lack of knowledge on crypto investment strategies creates opportunities for dedicated financial managers/tools. Increasing DeFi complexity and multi-chain asset management options increase the demand for sophisticated, targeted solutions.

- Increased use of crypto equals larger amounts of on-chain transfers, allowing for both transaction-based take-rates and demanding organizations to deploy larger on-chain treasuries.

- Security concerns: with hacks occurring on a daily basis, platforms that can provide additional security fundamentals, are likely to maintain a large customer base while obtaining additional premiums.

Challenges to consider

- The market size is still very small. In comparison to traditional companies’ liquid asset balance sheets, and financial markets. When only taking into consideration DAOs, the problem is evident, given DAO treasuries are still minuscule, and a generous 2% take-rate would currently imply a meager $20M TAM.

- Value add might not be crystal clear. The basics of treasury financial management are easy to set, and this can enhance competition, even with firms providing low-quality service. It is hard to judge investment returns without allowing adequate time to pass by, and as such, even firms with the best product/strategies might find a hard footing in the first few years.

Learn more about the basics of Treasury Management by reviewing our summarized slide deck.

Payments

We think this vertical is extremely interesting beyond DAO tools (read until the end to see our wider views on the possibilities of the space). However, for the purposes of this post, we’ve focused on tools that allow on-chain organizations to streamline on-chain and off-chain payments for employees, contributors, service providers, and partnerships.

In short, these tools provide DAOs and companies with more efficient ways to handle their increasing crypto payment transaction volume and complexity. To date, most on-chain payments rely on self-composed spreadsheets coupled with simple transactions from many self-created and administered wallets.

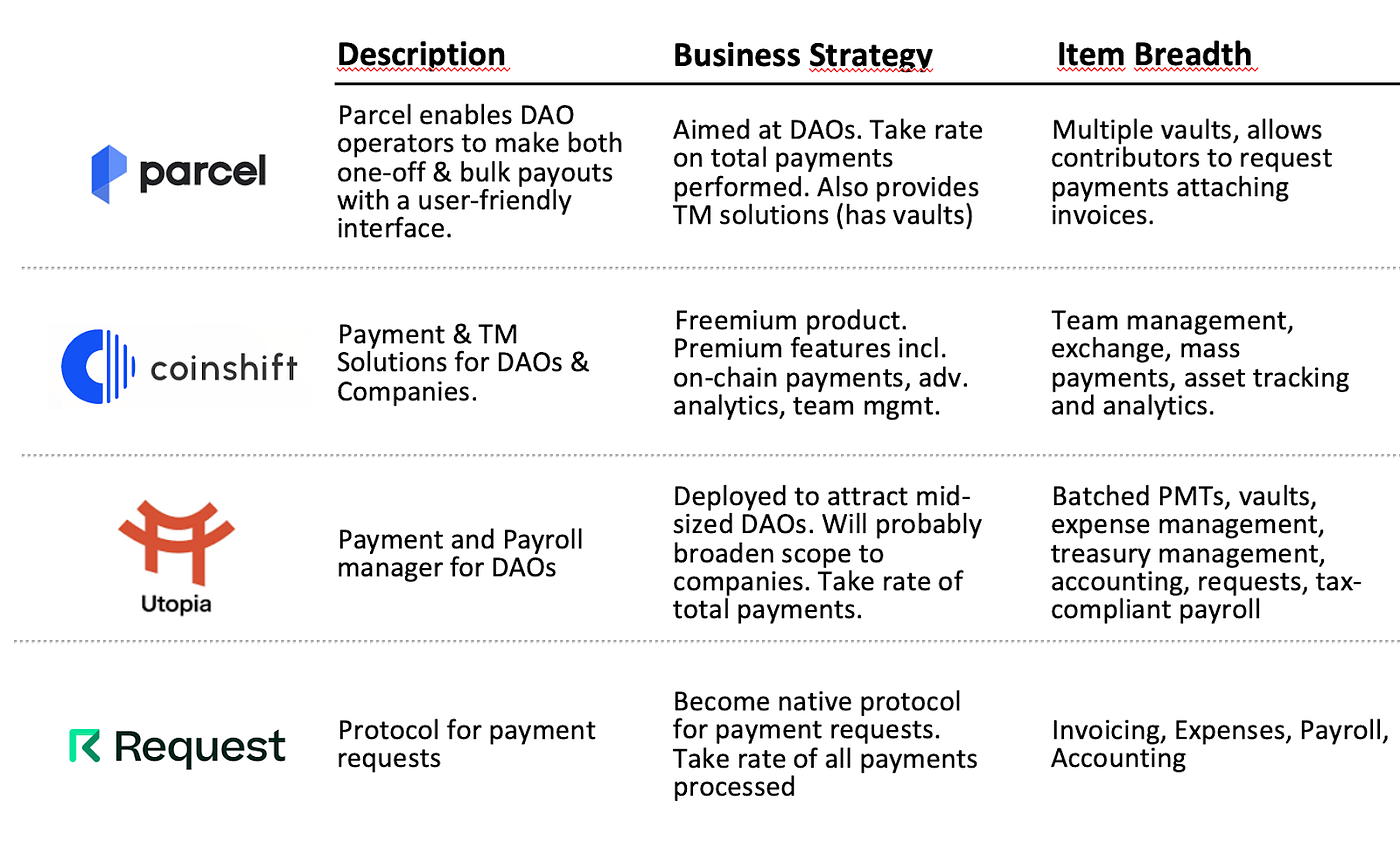

When analyzing this segment, we reviewed more than 20 payment and compensation tools, and below have shared a list of the ones we found most relevant/interesting. We found a significant overlap or potential synergies from tools offering payment services to those offering treasury management ones, and believe that there are significant strategic advantages for companies offering both. Again, similar to our conclusion for the treasury management section, we see considerably more value in non-DAO-specific approaches, although we decided to include some interesting DAO-focused profiles.

Opportunities we see for this segment

- Current user experience for mass-disbursement of crypto payments is extremely poor for users without technical knowledge. There is plenty of low-hanging fruit in building user-friendly approaches, similar to what we’ve seen modern B2B fintech companies do in recent years.

- Ancillary services linked to payment management (currency conversions, investments, bridging money between blockchains) can be steady and lucrative sources of income in a base-free product.

- Payment history and smart tracking can prove relevant data points to start assessing on-chain organizations’ potential credit risks and be a key piece to solving the over-collateralization paradigm in Web3’s lending space.

Challenges to consider

- It might be very hard to penetrate the large-payment volume business segment, and more so maintain a volume-based take-rate, given the benefits of building a solution in-house will outweigh the costs for these firms.

- Competition with exchanges could be brutal if they start to develop in-house solutions to offer the organizations that operate with them.

- Given we really liked the opportunities present in the payments space, we will briefly share some of the views we have beyond tools that enable on-chain organizations to more efficiently handle their payment transactions.

We see that crypto has a real and current use case in easily enabling cross-border payments for many industries, bypassing the prohibitive fees the payment processing industry has set. We see some strong short-term use cases for crypto gateways in mass-based global consumer industries such as gaming or digital asset purchase (NFTs, fashion items). Furthermore, we believe this movement could potentially disrupt the global payment industries and to us, it’s no surprise that Moonpay managed to raise $555m at a more than $3.4b valuation, that Circle is one of Coinbase’s best-performing bets, or that late-stage VCs are pouring billions in remittance-based crypto businesses (Chipper, Kushki, Omise).

We still believe there is a lot of whitespace for firms assembling the crypto payment infrastructure, particularly to those that will offer businesses products such as fraud prevention, KYC, credit gateways, or blockchain payment routing with automatic currency conversions. We think firms building in the space should be extremely cognizant and have built strategies around:

The natural advantages crypto exchanges and brokers might find when moving into the space

AND

The implications of the potential advent of the Stripes of this world into web3 payments

Summary and Concluding Thoughts

DAOs were on virtually no one’s radar a few years ago and, in an instant, became one of the hottest topics in Web3. After spending several months investigating the DAO space, we explored the use cases in which DAOs might thrive, exposed several structural and contextual limitations they face, and discovered software tools that would be critical for their proliferation.

We conclude that it is still too early for most DAO-focused tooling spaces since there are still major challenges to be resolved before an abundance of profitable business models can arise. We are, however, very interested in SaaS tools that are flexible enough to target DAOs and on-chain organizations, given that if crypto becomes a new financial paradigm for businesses, companies will need a lot of help in navigating these waters.

Reach Out

If you’re building in any of these spaces, reach out to us! We’re definitely interested in meeting exciting projects and are actively investing in star founders.

Subscribe to our newsletter for tech updates, events, open roles, and portfolio news. Follow Alpaca on Twitter, Instagram, or LinkedIn.

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.