Field Study: ESG Data & Reporting in Real Estate

Authors: Daniel Dart, Kasey Mann, Daniel Fetner, Ryan Freedman

I. Introduction

Environmental, Social, Governance (ESG) has been a buzz term across the real estate industry for years, but the emphasis on ESG accelerated in 2020 when the COVID-19 pandemic and widespread social justice protests put an additional spotlight on each of these three factors. The dust is still settling around ESG, but in the years since 2020, shifting worker-employer relationships and our continued climate crisis have drawn further attention to ESG factors among investors, regulators, and consumers. This recent attention on ESG has driven changes in real estate reporting and management practices.

We believe these adjustments are just the beginning.

In this Field Study, we conducted dozens of conversations with founders, researchers, operators, investors, and regulatory experts to examine these shifts. First, we’ll begin with a macro-overview of ESG in real estate and a particular focus on the Environmental factor, or the “E,” because it currently receives the most attention from regulators and investors.

Next, we look at the corporate ecosystems that have emerged to support new environmental reporting requirements and to serve businesses that are looking to manage environmental risks, achieve savings through sustainability, and/or generate positive environmental impact.

We believe that ESG’s influence in real estate will continue to grow over time, thanks to new regulations for operators and investors at municipal, state, and federal levels. The definition and application of ESG in real estate are still broad and shifting, but in the long run, are poised to drive changes that will create growth opportunities for startups and operators alike.

II. ESG 101

(TLDR: if you already know the basics of ESG, scroll down to the ‘Deep Dive — Environmental Factors’ below.)

Before delving into the future of ESG in real estate, it’s helpful to understand what ESG in real estate represents and to review a high-level history of ESG standards.

To start, what is ESG? This is a simple initial question, but it is one that’s deceptively difficult to answer.

ESG is an acronym that stands for Environmental, Social, and Governance, but beyond that definition, the details depend on the context and stakeholder.

ESG can refer to a screening tool for investors, a risk disclosure framework for regulators, or a catch-all term covering a variety of impact-focused initiatives for operators.

Within real estate, ESG is generally a framework to understand how an organization manages each category of Environmental, Social, and Governance factors, both individually and collectively.

Let’s look further into each category:

Environmental: The Environmental factor in ESG represents the evaluation of a company’s environmental footprint and environmental risks. This encompasses both the direct and indirect effects that an organization has on the environment. Key factors include: carbon emissions (scope 1–3), electricity usage, waste management, water usage, HVAC systems, refrigerant management, and more.

Social: Social factors measure the societal impact of the business, in particular impact on shareholders and stakeholders. Includes affordable housing decisions, employee relations (e.g. fair labor practices and Diversity, Equity, and Inclusion (DEI) initiatives), residential treatment, and impact on local communities. Includes both measurement of impact and assessment of risk (how well is the company adhering to laws and regulations surrounding social factors).

Governance: Governance refers to an organization’s corporate practices and how decisions are made — from corporate structure to reporting and oversight. It begins at the board level and monitors all operating and management practices. Governance includes board practices and procedures, management accountability, business codes and values, and safety and security standards. Note that ESG management itself is part of governance, so within ESG, Governance is often seen as an “input” which drives the other two factors as “outputs”.

The term ESG was first coined in 2005 in an International Finance Corporation (IFC) report called “Who Cares Wins.” However, this was not the beginning of ESG influence in the corporate world, and there have always been calls (in some form) for businesses to monitor, report on, and be responsible for their broader societal impact.

In recent years, trends such as climate change have driven major business leaders and regulators to reconsider the Friedman Doctrine, which posits that a business’ sole responsibility is to generate profit. The Global Reporting Initiative (GRI), which now manages the world’s most prevalent ESG framework — covering >80% of companies that report on ESG — was founded in 1997 as an independent organization to measure societal impact.

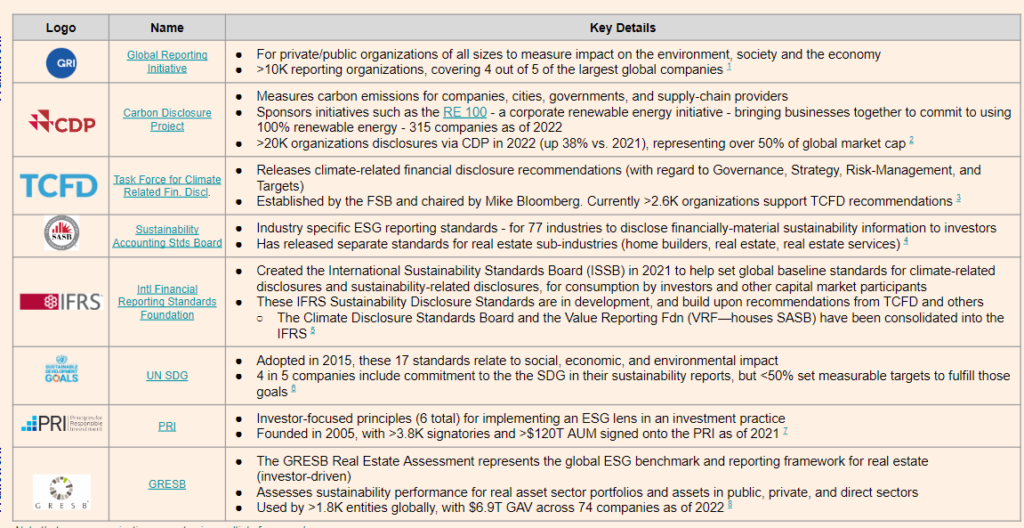

Since that time >600 ESG frameworks have arisen to conceptualize the three factors.

These frameworks are used by regulators, investors, and operators to measure and report on ESG factors, similar to GAAP standards for accounting. However, there is no single agreed-upon “GAAP” standard for ESG today.

At this time:

- There’s low standardization across the frameworks.

- There’s no clear consensus on which frameworks should be used.

- Many ESG frameworks are industry-specific (e.g. GRESB for real estate assets), so many companies will report using multiple.

These are problematic because they make comparing performance across companies and industries difficult. To reduce confusion, there are efforts underway today to standardize the general ESG frameworks. In the meantime, there are several main frameworks to note, which are shown in the table below.

The main driver of ESG framework adoption and standardization in the US is regulation at the federal, state, and municipal levels.

Federal-level: In March 2022, the SEC announced a plan to enhance and standardize ESG reporting and regulation in the US, with a goal to make ESG reporting more “consistent and reliable” in SEC filings. The proposed rules would require mandatory climate disclosures in SEC documents, and also consider potential general ESG-strategy disclosures. The SEC received comments on the rule in 2022 and the final rule has not yet been released as of Jan. 2023.

State-level: Certain states, such as California (Title 24), are driving investment in ESG factors via building codes. On the investor side, states have created controversy by choosing to either require ESG factor consideration in state-funded investment decisions (e.g. pensions) or banning it. As of Jan. 2023, > 10 states had introduced pro-ESG legislation and >10 had introduced anti-ESG investing regulation.

Municipal-level: At the municipal level, cities are implementing two main types of ESG-related policies: reporting requirements and targets/standards. One example is New York City’s Local Law 97, which mandates that buildings report carbon emissions, and sets carbon caps for large buildings, with financial repercussions for non-compliance.

With the above in mind, how do real estate companies determine which framework to use for ESG reporting, and ensure they are complying with all the latest ESG-related regulations?

Firms will often partner with consultants and conduct third-party materiality studies to set up ESG programs. Consultants help companies determine what’s important and which frameworks are relevant, and help set up ESG data collection, processing, and reporting systems.

These regulatory changes are driving a need for better ESG data collection and reporting technologies, and the global ESG reporting software market is projected to grow at a 15.9% rate from 2021–2027, to a total size of $1.5B. This represents a large opportunity for new tech companies in the space, which are explored in the Field Study below.

Before we dive into the next section, we’d like to share an important clarification to the ESG definition by sharing what ESG is not:

ESG is distinct from Impact Investing and Socially Responsible Investing. Impact Investing is when investors monitor both financial returns and a measurable impact, and socially responsible investing is when investors use screening and activism to drive positive outcomes.

ESG is simply a framework for understanding ESG factors, is generally focused on risk management, and is generally seen as a compliance check that is distinct from these active, investment strategies.

III. Deep Dive — Environmental Factor in Real Estate

Real estate represents approximately 40% of global carbon emissions, and the most measurable ESG reporting factor today is the Environmental category.

We identified four major macro drivers that are driving investment in the environmental factor in real estate:

- Climate change

- Regulatory pressure

- Capital markets

- Consumer attention

We’ll dig into these further below.

Climate change: Climate change creates new risks and vulnerabilities for built assets that investors and managers must track. As climate concerns rise, there is more focus on sustainability-related building certifications among residents, investors, and other market players.

Regulatory pressure: Regulatory attention is driving corporate investment in sustainability reporting, reduction of environmental impact, and climate resilience investment. Considerable funding in recent regulations (such as the Infrastructure Jobs Act), will go to real-estate-related assets. Regulatory pressure can take the form of incentives and fines.

Capital markets: The majority of investors incorporate ESG criteria in investment strategies today (e.g. 60% of respondents (investors) in CBRE’s 2021 Global Investor Intentions Survey). Capital providers look to environmental reporting for evidence of compliance with regulatory requirements, potential savings opportunities, potential negative impact on financials, and reducing climate risks on returns.

Consumer Attention: Consumers can track corporate commitments and performance more easily online and with social media. Younger generations have been shown to care more about environmental factors, and are more likely to hold companies accountable for their commitments and social impact.

IV. Environmental Reporting Technology

One of the main challenges for environmental reporting in real estate today is the lack of consistent, reliable, and high-quality data. As businesses adapt to changing regulatory and investor standards, they will need to invest in ESG-related technology to meet reporting goals and hit sustainability targets.

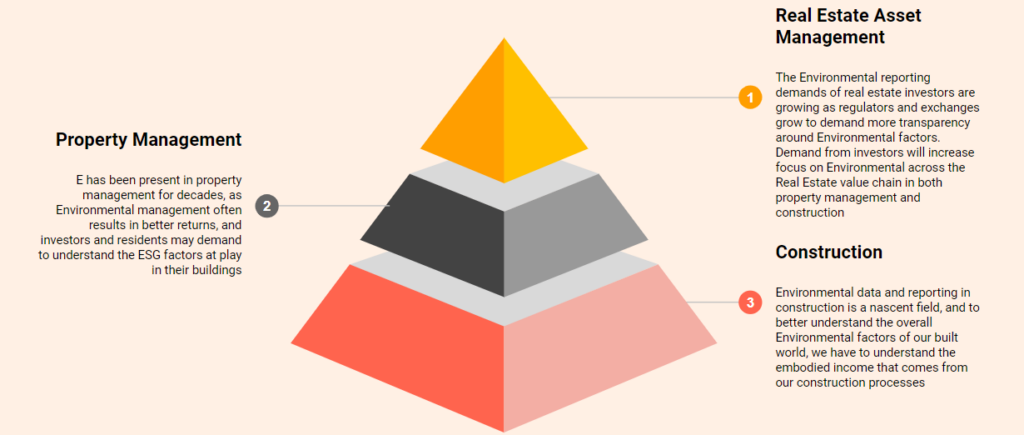

In order to understand the tech ecosystem that enables Environmental reporting in the industry, we analyzed three major stakeholders of that data: asset managers, property managers, and construction leaders.

Environmental Reporting for Real Estate Asset Managers

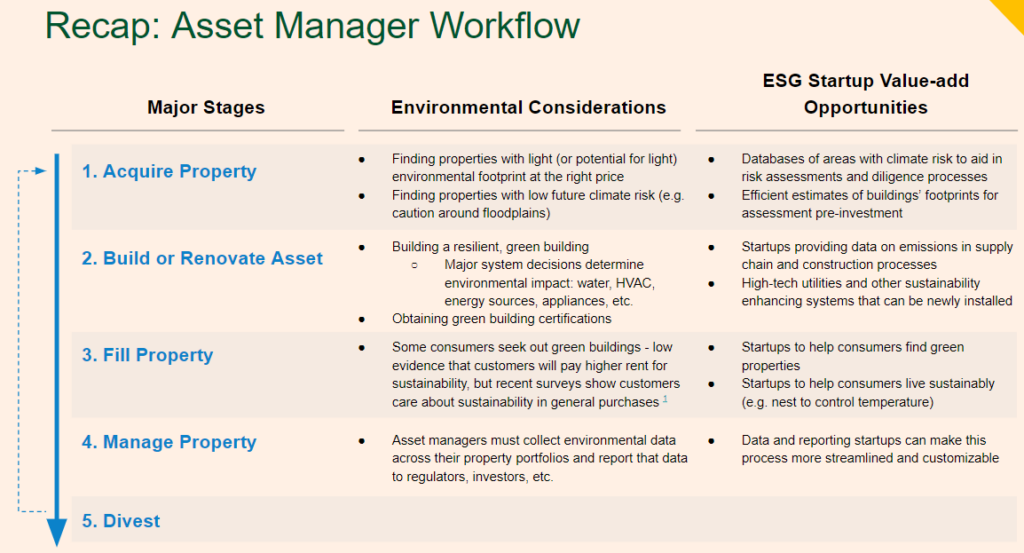

Asset managers will often assess environmental factors at both an asset-level and a portfolio-level. Investors analyze these factors during initial due diligence on an asset, and over the lifetime of that asset, usually on an annual basis. Today, firms are motivated to invest in environmental reporting software to meet the requirements of impending compulsory legislation to create proprietary ESG practices, policies, and frameworks.

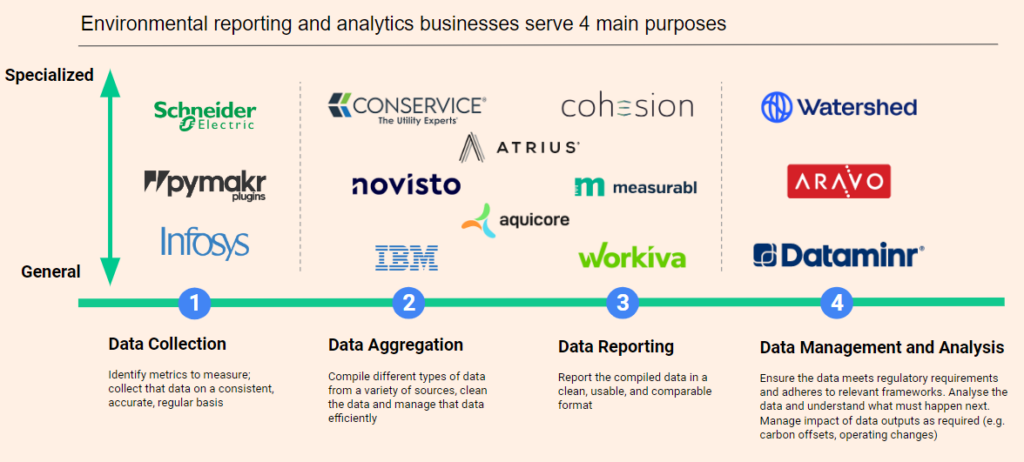

These technologies fit into several main buckets within the asset manager workflow below, and serve four main functions:

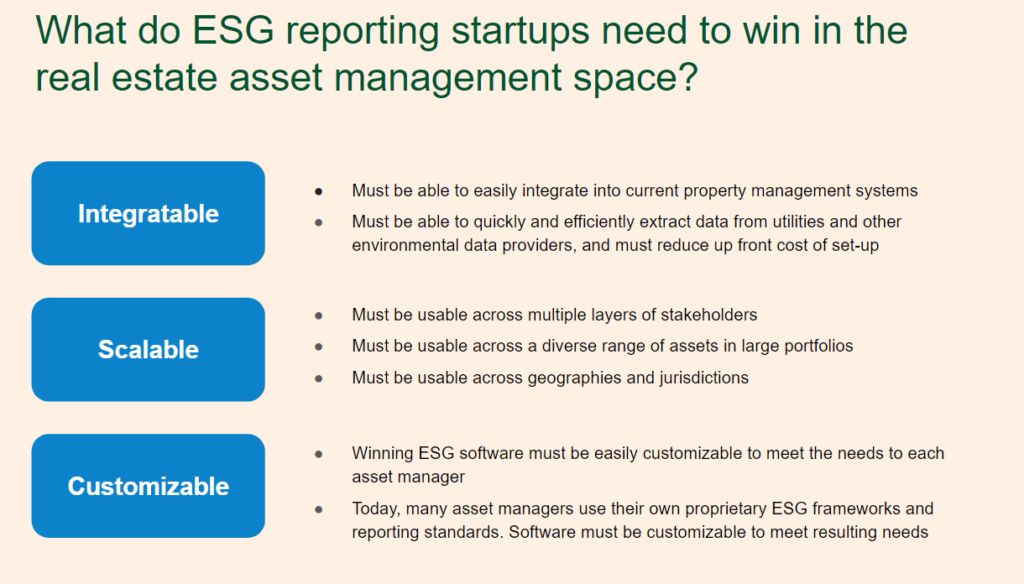

In order to win in this space, startups will need to be:

Today, the market leaders in real estate ESG reporting are measurable and conservice, but there is room for specialized startups to gain market share if they meet the above criteria.

Environmental Reporting for Property Managers

Today, most property managers already manage Environmental factors to save money and to obtain green building certification. There are countless tools for Environmental management at the property level, and the data for Environmental reporting often comes from three major types of sources: IoT sensors, automatic sensors, and manual review. This presents a growth opportunity for Environmental technologies that can help increase the consistency and quality of data by moving services from manual to internet-enabled with low upfront costs to properties.

There are a variety of key areas where startups are improving Environmental data and reporting via new technology: water systems, HVAC systems, heating/cooling/gas, electricity, solar panels, EV charging stations, on-site recycling, and green landscaping.

Construction

Construction is the first opportunity to develop a sustainable real estate portfolio, and ESG data management and reporting in the space is more nascent than in any other area of real estate.

Construction is a $2.7 trillion industry (per IBIS World), and along with the building materials industry, it produces up to 11% of annual CO2 emissions. As public and government interest in sustainable real estate increases, attention will continue to shift to the construction process as the initial opportunity to reduce the environmental footprint of our built world.

The first step in tracking embodied carbon (the emissions resulting from the building process), is accurate ESG data collection and management. In the coming years, interest from investors and regulators will continue to create growth opportunities for startups that enable ESG data and reporting, and that make the construction process more efficient and sustainable.

Within construction today, ESG-related innovation is growing in four main areas:

Construction Materials and Sourcing: Building material choices have a long-term impact on building sustainability.

The follow trends are emerging to meet new demands for sustainable building materials:

- New technologies are being developed, resulting in higher-quality, and lower-cost sustainable options.

- Building codes are being re-evaluated to make room for sustainable buildings.

For example, today, most American cities have a height limit of about seven stories for timber buildings, but these limits are being widely re-evaluated as the latest International Building Codes have been revised to support tall mass-timber buildings up to 18 stories.

Construction Firm Management: A variety of tools are available for construction firms to manage their ESG factors. These tools cover areas including supply chain management, workforce management, financing processes, contract and invoice management, and progress tracking tools.

Cross-party Collaboration: Construction processes require input from a variety of parties including developers and architects. Cross-party collaboration is required in order to reduce a building’s environmental footprint, therefore new tools to support collaboration can be useful for ESG factor management. These tools include technologies such as digital twin software, process simulation technology, and resource planning tools.

Job-site Processes: A primary area for reducing a building’s environmental footprint is in increasing job-site efficiency. Areas for ESG-related innovation in job-site processes include robotics and automation, testing, quality control, and compliance tools, off-site and modular building technologies, and training and labor management tools.

V. What’s Next and Key Takeaways

Our Overall Thesis:

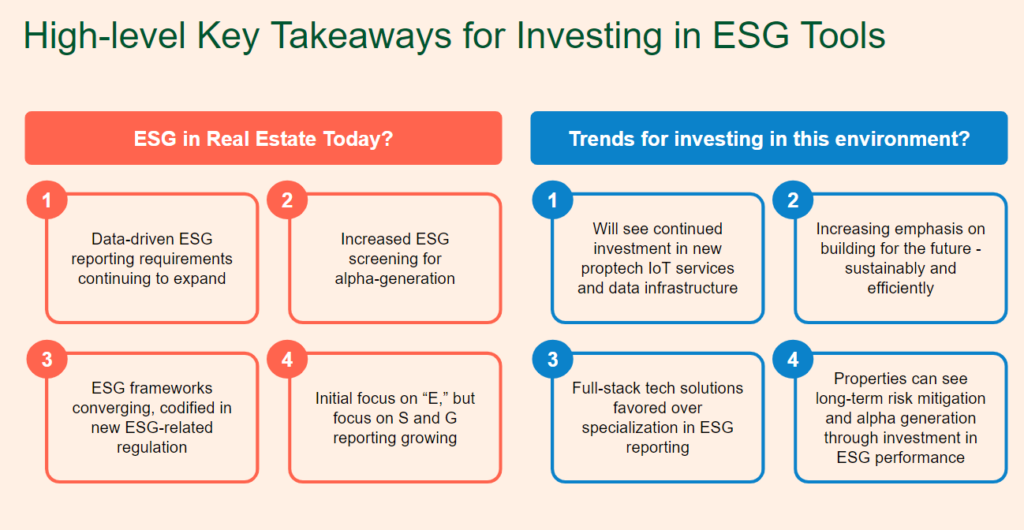

Key themes emerged from our research, forming a high-level investment framework for the space:

- Soon qualitative ESG compliance checklists won’t be enough — Investors and regulators will increasingly look for data-driven benchmarking and performance data.

- ESG is no longer a “nice-to-have” — A growing body of literature on the alpha-generating properties of ESG strategy implementation is indicating the upside of ESG compliance and disincentivizing “green-washing” practices.

- ESG Frameworks are Converging — As regulations become more stringent and offer more subsidies, initiatives by both public and private entities to standardize and clarify ESG frameworks are already in progress.

- S and G Will Follow — Greater awareness of, and investment in, the Environmental component of ESG will be followed by similar trends with regard to ESG’s Social and Governance components.

- Moore’s Law for Big Data & AI/ML — Big Data and AI/ML offerings will experience their own Moore’s Law evolutionary process, improving exponentially in terms of capacity and quality and spurring a new generation of startups in the space — many focusing on environmental issues.

- Full-Stack Solutions Over Specialization — Industry players will prefer full-stack solutions for all ESG-related data needs. Though customer demand will wane, there will be an M&A market for more specialized offerings which can be integrated into larger platforms.

- Tech as a Standard, Not a Luxury — Regulatory emphasis on environmental reporting practices will make the inclusion of IoT, Big Data, and AI/ML technology standard in new builds for both residential and commercial properties.

- Built for the Future — Properties with built-in and retrofitted utility-efficient materials will outperform outdated properties — yielding higher rents, achieving more efficient utility usage, and mitigating risks from regulatory creep.

Conclusion: Future Outlook

ESG influence in real estate is here to stay.

The dust is still settling on what reporting and which standards will be required by law, but regulators at all levels of government are already beginning to push harder on incentives and consequences for ESG performance. Due to the fact that installation costs for new ESG data and reporting technologies are often high and the ROI is not always clear up-front, managers will likely drag their feet on investing in ESG data and reporting until it’s required by law. However, new technologies that will enable better ESG data quality, reporting consistency, and factor management are emerging every day to help real estate businesses adapt to the changing landscape.

The tech players that are integrative, scalable, and customizable will win long-term, and the early movers will have an advantage as real estate operators will often have high integration costs and high switching costs for new data and reporting tools.

For more, the 46-slide deck below accompanies our research and offers a closer look at our team’s findings:

Alpaca Field Study: ESG Data & Reporting

Please Reach Out!

Are you an entrepreneur or an industry expert exploring this space and actively working with ESG data and reporting? Please reach out to [email protected] and [email protected]. We’d love to speak with you.

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.