Field Study: Landlord Technology Solutions Facilitating Rent Collections

I: Introduction

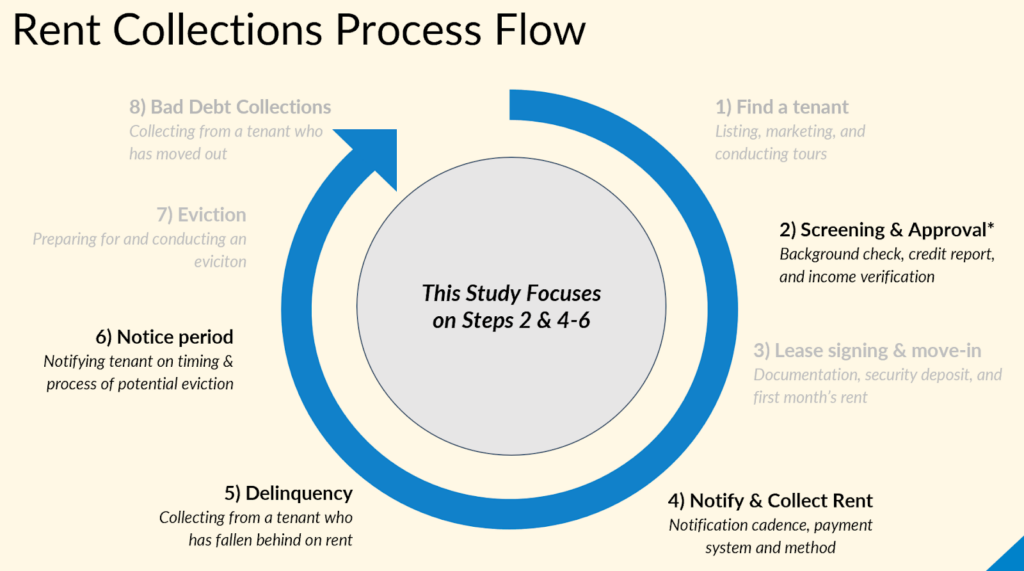

Rent collections have become a major pain point for landlords in recent years as collections rates have consistently declined and property managers have become increasingly burdened by inefficient and manual processes. While plenty of exciting technology solutions and platforms have flooded the property management space, we believe there is still significant need for targeted point solutions that address specific steps in the rent collections process flow.

In this Field Study, we conducted dozens of conversations with founders, industry experts, operators, and investors to better understand the current trends in rent collections, identify deficiencies in the traditional processes, and ultimately uncover exciting products that are bringing innovative, technology-powered solutions to the subsector.

II. Defining the Problem

Multifamily operators have experienced two glaring issues of the past few years which led to the origination of this Field Study:

- Collections rates have consistently decreased

- Property managers lack the right tools and processes to effectively manage the collections flow.

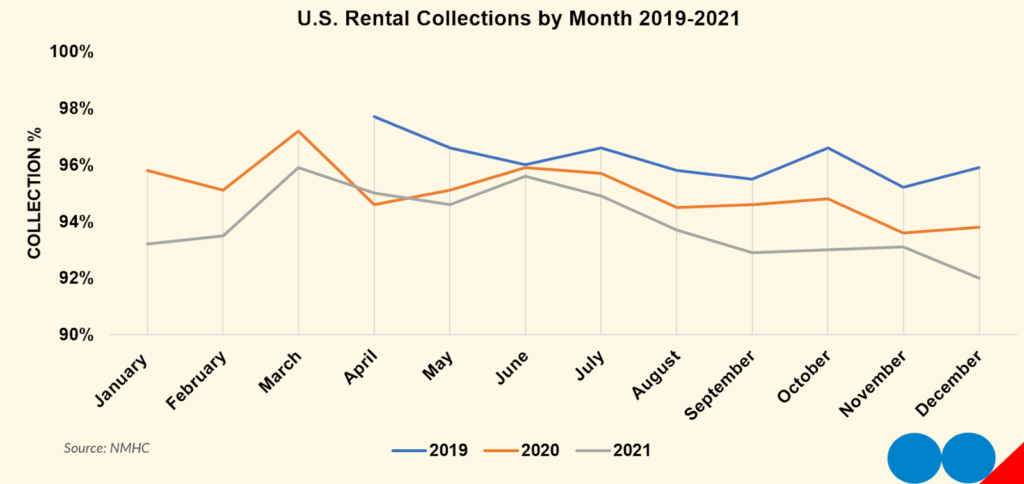

Landlords have witnessed a steady decline in national collection rates from pre-COVID levels of 96–98% to 92–95% in 2021 (NHMC), creating outsized aged delinquency balances and preventing property managers from hitting their pro formas. While some recent reports suggest an uptick in collection rates in 2022, it’s been a persistent issue. Landlords need to be better prepared for future economic shocks that may have adverse effects on collections (RealPage). Then, as a tenant falls behind, operators face an increasingly uphill battle in navigating the operational, legal, and financial aspects of collecting from problem tenants. We began the study by exploring the primary factors that are contributing to the problem on a macroeconomic, operational, and legal level.

The U.S. has experienced steady declines in apartment vacancy rates and unprecedented increases in rental prices over the past 20 years. These trends have only accelerated as rents have increased 25% from 2 years ago and national vacancy rates dropped below 6% for the first time in 2022 (FRED St. Louis Economic Data). We are now estimated to be 6.5 million housing units short of equilibrium levels as the housing shortage crisis continues to deepen (Realtor.com).

The two main sources for rent payments are wages and savings. However, it is estimated that the average American spends 40% of their paycheck on rent, while 40% of renters have less than $400 saved (Pew Research). When you add persistent inflation of the past 24 months and an approximately 3% decrease in real wages (U.S. Bureau of Labor), it becomes clear why renters feel exceptionally burdened today and are struggling to make rent. The housing shortage has been a major tailwind for rental landlords the past 20+ years, but as tenants continue to deal with macroeconomic shocks, rental rates have reached unsustained levels. Landlords are experiencing this in the form of decreased collection rates.

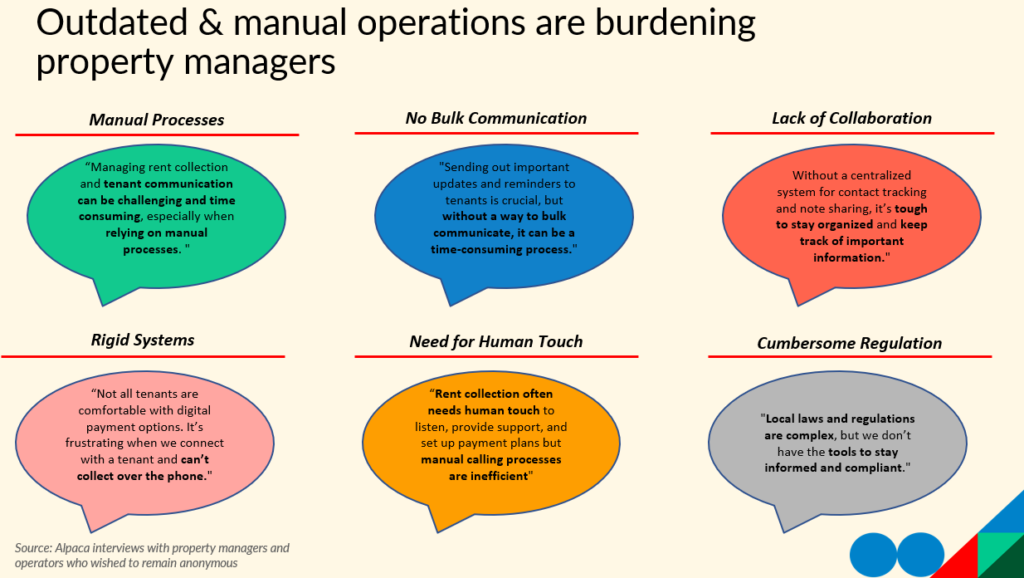

Transitioning to some of the micro factors at play, landlords and property managers are grappling with a myriad of operational challenges. Key among them are outdated and manual operations. Property management is hampered today by the inability to bulk communicate, non-collaborative platforms, rigid systems, and the constant need for human interaction in the rent collection process. These inefficiencies significantly slow down their operations and make it harder to find the right tenants, collect rent on time, deliver notice letters, and evict bad actors.

Lastly, a critical component of maintaining collection rates is getting the right tenants into the building. But recent macro trends have also attracted the attention of both national and local policy makers, leading to a flurry of ordinances the past 3–5 years that make it harder to screen prospective tenants. For example, in Portland, Oregon, property management can no longer deny an application based on a tenant’s income and ability to pay (RentPortlandHomes). Several other cities like Seattle and Minneapolis have limited the scope for when landlords can consider criminal records in the tenant screening process (e.g. MinneapolisMN.gov and Seattle.gov). Meanwhile, fraud is prevalent and growing in the backdrop. Research shows 97% of owners and operators experience fraud in the properties managed, and 95% report difficulties in presenting and mitigating fraud (Rental Housing Journal).

In conducting this Field Study, the following have become abundantly clear to our team:

- Owners and operators are facing significant headwinds that are hindering their ability to collect rent.

- Meanwhile, tenants are suffering from financial hardship and a poor customer experience.

- We believe the need for better solutions in the marketplace is urgent.

III. Industry Overview

We continued our research by surveying the current industry landscape in order to understand shortcomings of existing offerings and formulate criteria for an effective solution. It was clear from our conversations with property managers and operators that major Property Management Software (PMS) platforms controlled a large share of the rental market and thus acted as gatekeepers to innovative solutions in the marketplace. All building files, billing systems, and tenant data are generally integrated with these PMS platforms. The switching costs are therefore incredibly high due to the depth and complexity of their integration and a common consequence is that PMS platforms aren’t incentivized to add new services or features to their offering. This leads to a highly commoditized product among the major players. When a new start-up in the space starts to reach scale, these platforms often acquire the new player or imitate and launch a similar product within its suite of offerings. In either option, integration is difficult, and the end consumer suffers from a clunkier and less effective product or feature. Property managers consistently expressed dissatisfaction with the availability of targeted point solutions for a niche problem like rent collections.

We took these key learnings about the industry and formulated three main criteria for a potential start-up/solution in the space:

- Point solution

- PMS integration

- Attractive return on cost

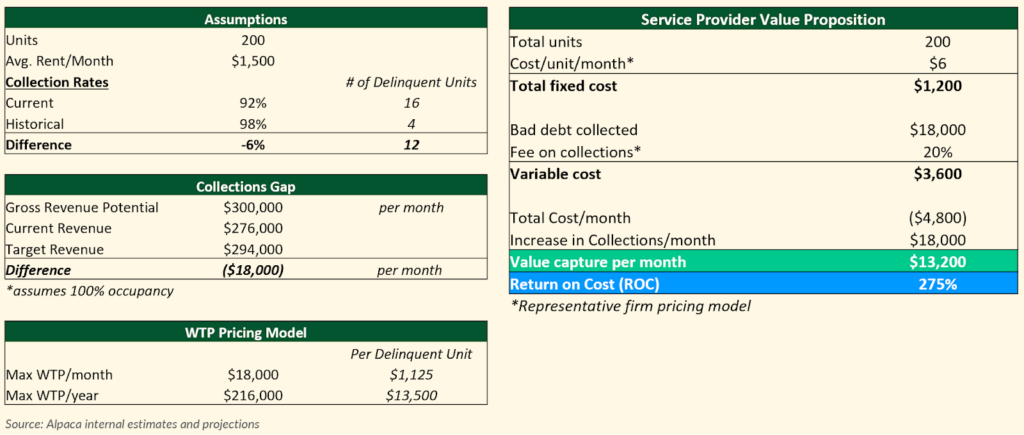

As discussed, major landlords and property managers are heavily reliant on major PMS platforms for storing tenant info and data and processing payments. Therefore targeted point solutions are needed to fill gaps in the current offering, enhance productivity, and improve the resident experience. Enterprise PMS platforms rely on a network of embedded service providers for clients to achieve customization and specialization they need. An integrated solution is therefore necessary to limit complexity while maintaining high levels of accuracy and security. Lastly, we developed a framework for evaluating potential solutions on a return on cost (ROC) basis. The goal is to increase collections and decrease operational time and costs; therefore the total value capture of a service is a function of the increase to bottom-line profit less the cost of the service (example below).

We believe there is significant value capture available to landlords in the rent collections subsector, with internal Alpaca estimates totaling $45 billion (calculated as $1.7K average rent * 12 months * 44M rental housing units * 5% of residents never paying; sources: NHMC, RentCafe, & U.S. Census Bureau). This represents a massive opportunity for operational technology to add value and capture a share of this under-the-radar corner of the proptech market.

IV. Solutions

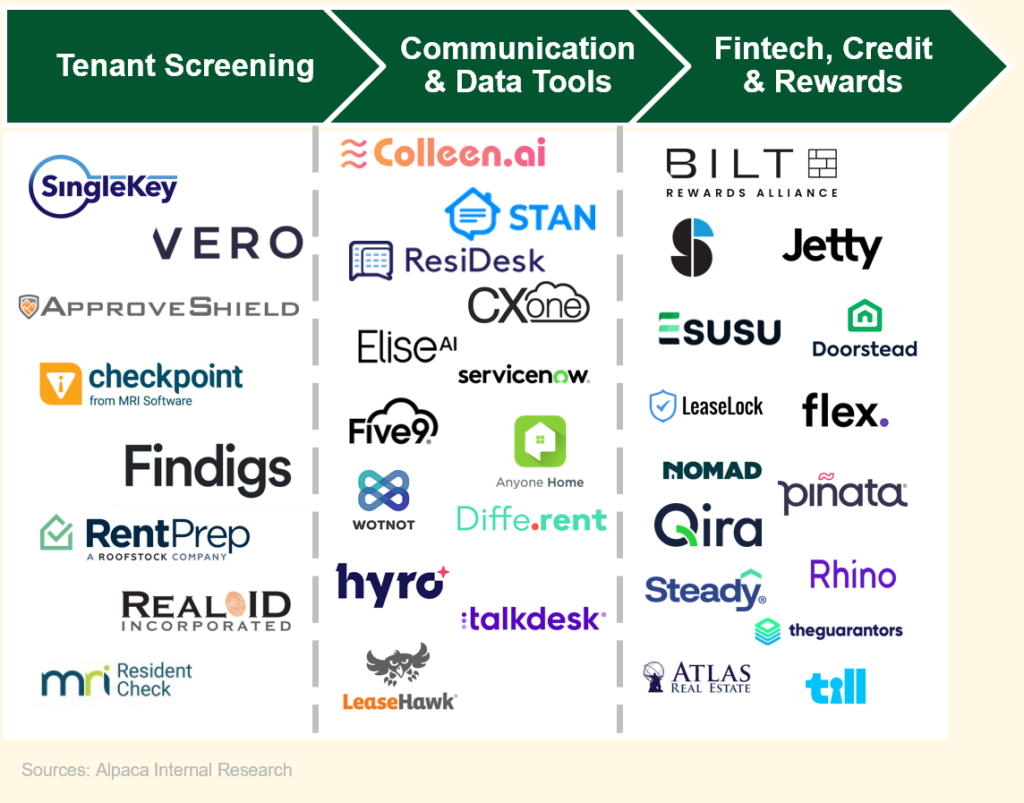

Extrapolating our key learnings and research thus far, we created frameworks for different types of solutions in the marketplace and identified some exciting start-ups. The three categories of solutions that we identified are as follows:

- Tenant Screening

- Communication & Data Tools

- Fintech, Credit & Rewards

Tenant Screening

Tenant Screening contains all upfront solutions centered on the tenant underwriting and lease approval process with the goal of getting the right tenants in your building to prevent future issues down the line. This underwriting process primarily includes ID verification, background checks, and financial due diligence. The first step in preventing fraud is verifying identity and thus it’s the aspect that is most susceptible to bad actors. If a tenant forges their identity at step one then the rest of the approval underwriting process is compromised. Thus we believe that start-ups in this space with the most advanced and innovative identity verification processes are going to be winners in the space.

Communication & Data Tools

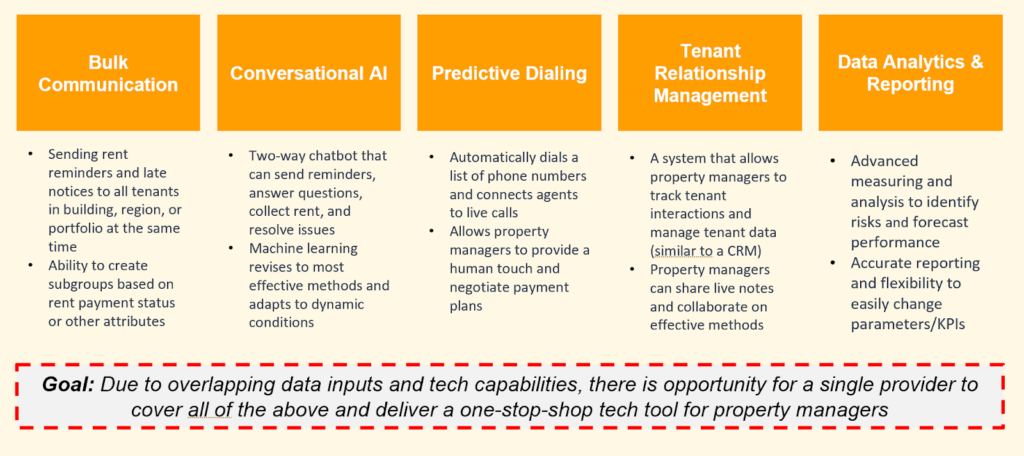

In the Communication & Data Tools category, we are focused on a company’s ability to optimize the collection process and maximize property manager efficiency. In our view there are five main pillars to this type of product: bulk communication, conversational AI, predictive dialing, tenant relationship management, and data analytics and reporting.

Bulk communication will enable PM’s to send mass notices at the click of a button. Next, the ability to interact with tenants throughout the rent payment process via conversational AI can take some of the mundane two-way communication between managers and the tenant out of the hands of the PM (i.e. a tenant requesting further information about their ledger or asking why they were charged a late fee). When the problem is more complex or a tenant is unresponsive it’s imperative that PM’s have the ability to personally contact a tenant — predictive dialing can automatically connect PM’s to live calls with tenants so they can listen, negotiate, and provide a human touch to the collection experience. Next, PM’s need the ability to easily track interactions between management and tenants, so the next time an agent connects with a tenant they can build off previous communications. An integrated Tenant Relationship Management system, similar to a CRM, is not readily available to PM’s today but something like that is sorely needed.

The last piece is data analytics and reporting, where we believe there is significant opportunity for artificial intelligence and machine learning to identify risks and forecast performance by analyzing the vast amounts of data that rental properties and tenants produce. A successful solution would include accurate reporting and dashboard flexibility allowing the manipulation of KPI’s, parameters, and views to present the data in an easily digestible manner. There are several exciting start-ups operating within each of these five pillars, but we believe that due to overlapping data units, integration, and tech capabilities, there is a significant opportunity for a single provider to cover all of the above and deliver a one-stop-shop tech tool for property managers.

FinTech, Credit & Rewards

Another exciting category is FinTech, Credit & Rewards, which encompasses two main subcategories: rent incentives and rent guarantees/payment programs. The rent incentives sub-category includes credit card rewards, credit score reporting, and other benefits programs. The idea is that by offering additional incentives for a tenant to pay rent, you can start to change tenant behavior and increase collection rates. While this is still a relatively new and unproven theory, there is potential for a flywheel effect as tenant’s continue to reach their financial goals and build loyalty to a property. Meanwhile, rent guarantees and flexible payment programs revolve around shifting the risk of nonpayment from the tenant to a 3rd party provider in exchange for a fee. For example, the tenant will pay rent to a 3rd party under a unique structure or payment plan and the 3rd party guarantees full rent will be paid to the landlord on the 1st of every month. Tenants benefit from the added flexibility and landlords benefit from certainty. Both of these innovative business models can be valuable add-on services for landlords that are looking to boost collection rates.

V. Conclusion

This Field Study has shed light on the pressing challenges faced by landlords and property managers in the current landscape. The decline in collection rates and operational inefficiencies have created a significant problem in the industry. We identified four main categories of solutions and each category presents opportunities for innovative start-ups to address specific pain points and provide value to landlords and property managers.

With a total value capture available to landlords of approximately $45 billion by our estimates, there is immense potential for technology companies to make a substantial impact in this segment of the proptech market. We ultimately believe that the start-ups focused on targeted point solutions, PMS integration, and attractive ROC metrics for their customers will win out in an increasingly competitive but exciting subsector.

For more, the slide deck below accompanies our research and offers a closer look at our team’s findings:

Alpaca Field Study: Landlord Technology Solutions Facilitating Rent Collections

Please Reach Out

Are you an entrepreneur or an industry expert exploring this space and actively working with landlord technology solutions facilitating rent collections? Please reach out to [email protected]. We’d love to speak with you.

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2024 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.