Field Study Launch: Real Estate’s Adoption of AI

We’re excited to announce the launch of our next Field Study: Real Estate’s Adoption of AI. Through this Field Study, the Alpaca team will dive into the dynamic place where artificial intelligence meets real estate.

At Alpaca, we are continuously exploring tech-focused solutions with the potential to alleviate major pain points and inefficiencies in the built world. Conversations about AI (artificial intelligence) companies and the high-flying valuations that follow are everywhere today. Through this Field Study investigation, we will endeavor to cut through the noise to understand the ways in which we believe AI will empower stakeholders to efficiently manage their vast data sets, more effectively underwrite, and manage their real estate operations. At the outset, we’re asking the following key question:

- How will real estate harness the power of AI to unlock new potential?

To unpack the answer, it’s important to call out a few factors at play in our current landscape. First, real estate sits on huge repositories of big data. However, the data has traditionally been siloed, unstructured and unactionable. Analysts spend countless hours cleaning and coalescing information in order to build descriptive analytics that show snapshots of properties. In contrast, AI has recently turned the corner in terms of both cost and intelligence. As the global embrace of AI continues, we believe there is potential for more streamlined processes, intelligent decision-making and significant opportunities awaits those at the forefront of innovation. As we’ve observed the technology evolve, we see indicators that AI likely holds the key to unlocking new levels of efficiency and growth.

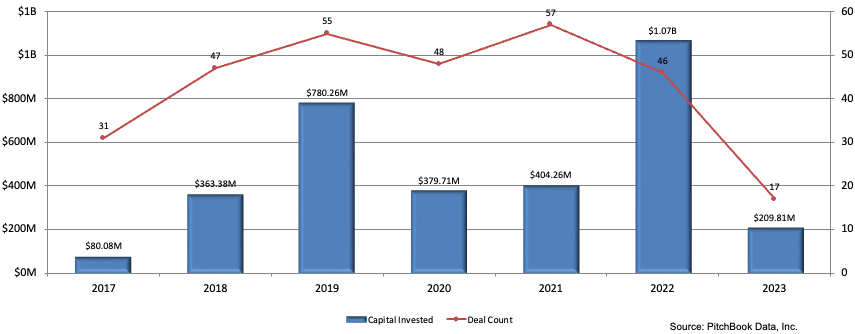

According to Pitchbook data, VCs have invested $461.4B in AI across +40K deals since 2017. In Q1 2023 alone, there was $22.7B allocated across 1,497 deals. Double clicking into the AI/ML investments, only 301 deals were focused on real estate. The industry’s cautious approach to innovation has resulted in a sluggish adoption of AI. However, at Alpaca, we hold a strong belief that this trend is about to change rapidly. In the coming years, we foresee a paradigm shift in real estate as startups leverage AI to tackle industry challenges head-on, empowering cost reduction and revenue growth like never before.

As we begin our deep dive into this Field Study, below are the initial thoughts and theses that we’ll look to prove or disprove as we dig in:

- Initial Investment (company): implementing a new tool requires training and time for effective adoption. Tools with minimal friction to existing infrastructure and impressive UI/UX are critical to quickly reap the benefits.Initial Investment (investor): investors need to be wary of subsidizing a startup’s CapEx with venture dollars; and in particular funding processing power or data storage. The cost curves that have led to the recent explosion of AI will continue, and therefore we are aiming out focus on the underlying solution, not the startup’s expensive infrastructure.Data Privacy: The effectiveness of AI models hinges on the quality of the data they are trained on. However, many companies have invested significant time and resources in accumulating proprietary information and are understandably cautious about the risk of open-sourcing their competitive advantage to rivals. Striking the right balance between data sharing and safeguarding proprietary insights is a critical challenge we believe companies face in the era of AI-driven innovation.Quality: It’s our view that the quality and accuracy of input data play a vital role in determining the effectiveness of algorithms. Consequently, startups face a delicate balance between leveraging the advantages of intelligent automation, such as natural language chatbots, while also being cautious of potential pitfalls like the risk of biases or negative customer experiences.

Over the next few months, our team will explore this exciting and important market. As with every Alpaca Field Study, we will focus on gathering insights and data, as well as engaging with thought leaders, founders, and investors in the space. We hope to contribute to a better understanding of the opportunities and challenges at the intersection of real estate and artificial intelligence, and we’re eager to share our findings when the study is complete.If you’re a founder, investor or expert on the topic, we encourage you to reach out and connect with us. You can email Kevin Grathwohl at [email protected].

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.