Alpaca’s Field Study Program: A Repeatable, Thesis-Driven Approach to Investment

At Alpaca, our Field Study program is a cornerstone of our approach to investment. But first, what is a Field Study?

Field Study: Alpaca’s proprietary process for deeply researching a particular theme or topic to understand the investable (and non-investable) areas within a space of interest.

Built internally by our team, the program has steadily grown and proven itself to be a repeatable, thesis-driven engine for deal generation. It has become a hallmark of the Alpaca way of doing business. In fact, several firms have asked us to help them replicate the process internally.

We’re excited to share how and, more importantly, why the program works.

Proof in the Pudding

Across funds, our Field Studies program consistently drives new leads to all our sourcing channels:

In 2022, half of the investments we made were directly related to Field Studies.

Looking at our last 40 deals, 23 were driven by Field Studies. Along with tracking this internally, Alpaca’s David Goldberg publishes an annual Where Do Deals Come From? rundown of each deal we’ve done in the previous year and how it came to us.

Why does it work? Each Field Study conducted by our team drives the following outcomes:

- First and foremost, helps us to take time to get smarter on spaces where we find interest and we think there is potential investment opportunity

- Gets us to a clear point of view in an organized manner, where we can map a market, potential headwinds, tailwinds, risks and opportunities. This way, we have a lucid, prepared mind when speaking with any company

- Gives us research-based conviction on the areas we ultimately believe are non-investible

- Builds our network of potential founders, investors and customers along the way, in areas we want to spend time

- Helps us plant a flag in a particular space and build a reputation as thought leaders that, in turn, generates inbound deal flow through referrals from VC ecosystem partners who know we’re spending time on that particular topic

- Uncovers deal opportunities before they’re in market

- Informs and prepare us for future investment opportunities so we’re armed and ready to move aggressively when something crosses our desks

- Allows us to get to conviction faster and win deals more often, as we’re able to have a third- or fourth-level conversation with a founder on a first call and prove our value

The Alpaca Field Study Playbook

So how do we conduct one of these? A new Field Study begins with a partner identify an interesting, potentially investable area of the market. By focusing on a specific theme, we are able to be very targeted around the deals that we look at and the strategic networks that we build. This allows us to not only uncover opportunities through our research and outreach, but also to establish a reputation as experts.

Once we’ve identified an area of interest, we spend three to four months speaking with investors, founders, customers and incumbents in that space to understand the dynamics of emerging technology, adoption and what the future holds. The Alpaca MBA Associates program is a key component to this stage in the Field Study process. Selected from top programs such as Wharton and Harvard to work closely with our general partners and investment team, each MBA Associate contributes significantly to at least one Field Study during their tenure with the firm. Along with secondary research culled from industry sources, our team conducts in-depth primary research by speaking to founders, VCs and other leaders.

This research phase typically runs 90–120 days into the identified market, which can be on a macro or micro topic. For example, Alpaca’s Global Supply Chain Field Study led by Aubrie Pagano was actually a multi-year investigation encompassing five distinct, but closely-related studies into different aspects of the supply chain.

From this research, and speaking with dozens of industry players, customers, and startups, we produce an extensive deck (20–40+ pages), market map, and deep analysis outlining our market insights and findings about the investable opportunities we believe exist in the space. We then publish the completed Field Study to the broader market via our digital channels (see below for examples).

Next, we amplify the reach and visibility of each Field Study online and offline by hosting dinners, virtual panels, and branded events on our conclusions that bring together our community around focused conversations. The result: founders and co-investors alike know they can reach out to us about the specific areas featured in our Field Study program.

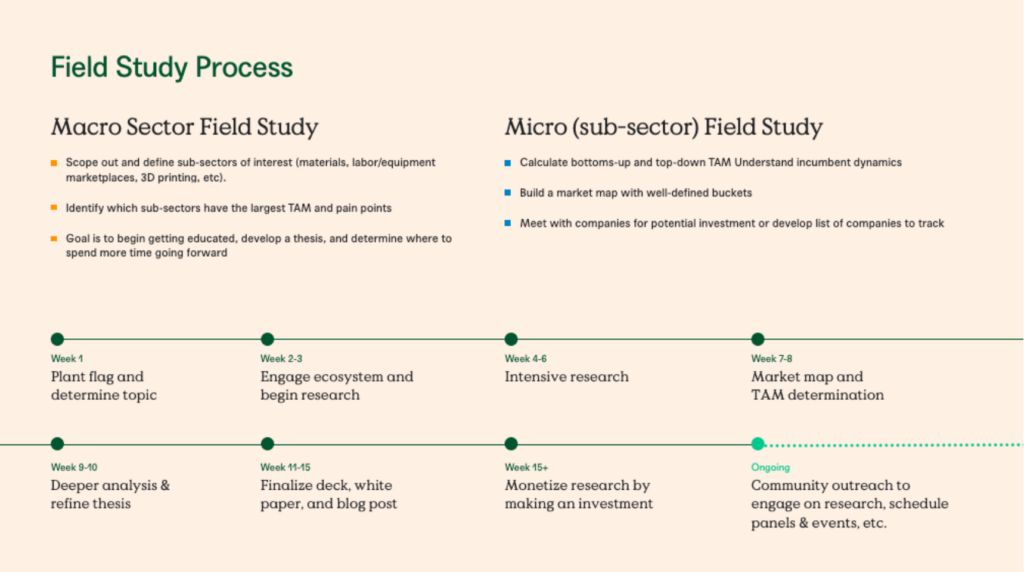

While timing does vary from study to study, here’s a week-by-week rundown of our typical Alpaca Field Study process:

Week 1: Plant Flag

Objective: attract and engage founders, investors and thought leaders in the space.

Actions: announce new topic to our networks through a blog post, social media, firm newsletter, personal networks and word of mouth.

Weeks 2–3: Engage Ecosystem

Objective: get educated and build relationships.

Actions: reach out and schedule calls with thought leaders, investors and entrepreneurs to conduct a high level macro-overview and uncover industry trends. When speaking with incumbents to determine industry dynamics, we ask things like:

- How is technology being used in the industry today?

- Where are the areas most prone to disruption?

- What is the relationship between incumbents and emerging startups? (i.e. M&A, willingness to partner, incubation, etc.)

Weeks 4–6: Intensive Research

Objective: conduct intensive research.

Actions: build data sets using both a bottoms up analysis and a top-down approach to identify all startups in the space, break down existing processes to determine which parts of the workflow startups are tackling, understand the solutions at play and hypothesize which types of technologies can play a role in changing the market dynamics. We find that hypothesizing at this stage results in less prone confirmation bias later. We also define the Total Addressable Market (TAM) by asking:

- What is the size of the market?

- Which part of the market is most susceptible to change?

- How fragmented is the market?

- Who are the public comps and what types of multiples are they trading at?

Weeks 7–8: Market Map

Objective: categorize companies by “modules” or by business model and understand the pros/cons of varying business models as part of the Market Map creation process.

Actions: document modules and business models in the sector and build out handful of company profiles to show varying examples of what’s at play in the market. Use these findings to build out a comprehensive Market Map. Next, we ask:

- Which models are more/less scalable?

- Which models require multiple stakeholders to adopt the technology

- Which models increase/decrease TAM?

Weeks 9–10: Analysis & Opinion Forming

Objective: take learnings and form opinions.

Actions: as a team, we work to use what we’ve learned thus far in the process and translate them into opinions. Both internally and to industry experts, we aim to test our original hypothesis to determine wither it’s valid or invalid. We ask:

- Which business models will be effective given industry dynamics

- Which module(s) are necessary for adoption?

- Does the solution need to be full-stack or is there a point solution?

- Do industry dynamics and TAM allow for multiple winners?

- Do network effects come into play and, if so, how and when?

- How important is founder-market-fit (i.e. category expertise) for this industry?

Weeks 11–13: Finalize & Publish

Objective: publish our findings.

Actions: we format, design, edit and finalize Field Study content in preparation for publications. An Alpaca Field Study includes three deliverables:

- Research Deck or White paper (e.g. The Intersection of Construction and FinTech)

- Blog Post (e.g. Field Study: Landlord Technology Facilitating Rent Collections)

- Presentation (e.g. The Future of DAOs Roundtable)

Weeks 13–14: Polish & Present

Objective: present findings in a “traditional presentation” format to key audiences of interest. The format differs some depending on the research, findings and sector. In each case, we aim to curate an event that will put our research in front of the right audience at the right time.

Actions: organize, host and promote an event for a key stakeholder audience. The event could take the form of a virtual fireside chat featuring industry experts, a private presentation for our LPs or an in-person gathering bringing founders, operators, investors and experts together to connect. For example:

LP Event: Many Field Studies are driven by interest from our LPs. In order to provide them thought leadership and insights, we present our Field Study research to them by hosting an exclusive in-person dinner or hosting a virtual presentation.

VC Community Event: In some cases, we present our findings to the VC community through a live networking event. This further builds our connection to and reputation in the space. Co-investors, founders and experts in the ecosystem know where we are spending time and will keep us top of mind for relevant opportunities in the space.

Weeks 15+: Monetize & Leverage Research

Objective: leverage research for ‘highest and best use.’ Field Studies can be monetized in four forms:

- Pre-seed and incubation opportunities either via an Alpaca Fund or through collaboration with other firms

- Seed investing via an Alpaca ‘core’ Fund

- Mid stage (Series B and beyond) investing into breakout winners via the Alpaca Built World Fund

- Strategic thought leadership delivered to LPs to further justify and add value to their LP investment

Other Benefits

By the time of publication, our team has often identified immediately investable opportunities. Other times, we keep this research in our back pocket. When that killer deal comes across our desk, we are more apt to move quickly and potentially win the deal.

Deals are not the only investment outcome of this work. Sometimes, a Field Study’s value is the opposite: we build research-based conviction around the areas where we do not want to invest. When this happens, our team is primed to pass quickly and early on new deals instead of spending time evaluating opportunities that are ultimately unbackable.

We also see additional leverage and value in continuing to promote Field Study content as part of the brand-building process. In addition to publishing our findings and sharing them with key stakeholder audiences through presentations and live events, we promote our Field Studies through additional ongoing outreach. This includes:

- Social media promotion and distribution via our newsletter, The Rundown

- Media/PR

- Speaking opportunities for our investment team

- Thought leadership pieces and contributed articles authored by our team

At each stage of the process, we endeavor to reinforce our team’s standing as potential thought leaders in the Field Study’s given sector and continue to build connections and generate inbound leads as a result.

Field Studies in the Wild

The best way to keep up to date with Alpaca Field Studies is to subscribe to our newsletter, The Rundown, or follow Alpaca on LinkedIn. For a deep dive, you can find all Alpaca Field Studies here. Below, we share a few recent and notable Field Studies.

The Potential of Generative AI

Led by David Goldberg

Generative AI is one of the hottest topics on the block. Every day hundreds of startups are launched in this space. We launched this study to unpack what the generative AI landscape looks like — and how we intend to evaluate opportunities.

Led by Aubrie Pagano

Brand discovery is broken, and yet more crucial than ever for companies to crack in order to stay competitive. Starting with an industry survey, we’ve cataloged trends — and solutions — in our first Brand Discovery Report.

ESG Data & Reporting in Real Estate

Led by Daniel Fetner and Ryan Freedman

We investigated the Environmental, Social, and Governance (ESG) standards that are tightening across the Real Estate industry. We believe the sector will require innovative data capture, analytics and reporting tools to meet them. We continue to actively monitor the space.

Global Supply Chain: A 5-Part Field Study Series

Led by Aubrie Pagano

This five-part study, spanning more than a year, ultimately honed in on three key areas: enabling Amazon Prime-like delivery for emerging brands (Part 2), end-to-end software solutions that enable cross-border sales (Part 3), and end-to-end solutions for e-commerce returns and circularity (Part 4). We invested behind two of the three themes so far as well, with investments into a cross-border, asset light global 3PL, Mayple; and the returns-to-recommerce platform, Arrive. More potential deals are in the works.

Read the entire Global Supply Chain Field Study Series: Part 1: Global Supply Chains, Part 2: Delivery, Part 3: Cross-Border, Part 4: Returns, Part 5: Conclusion

More Select Field Studies

- DAOs and Tools for DAOs

- Sustainable Building Materials 2.0

- Rooftop Solar Energy

- EV and the Future of Mobility

- Virtual Real Estate & The Metaverse

- The Rise of Recommerce

What’s Next

As a firm, the Alpaca team is continuously conducting Field Studies.

- Do you have a great idea for a Field Study thanks to a pain point you can’t figure out?

- Do you know an expert we should talk to for upcoming studies?

We announce new studies and how you can get involved on Twitter (@alpacavc), LinkedIn and in our newsletter, The Rundown (subscribe here or subscribe on LinkedIn).

Shoot us a note at [email protected]. We’d love to hear from you.

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.