Field Study: Alpaca’s Thesis on Web3, Venture’s Most Controversial Space

Following our previous deep dives into web3, we’ve continued to monitor the space closely through often tumultuous times. We’re excited to share an update on our current thinking around the space, key themes at play in the current landscape and the opportunities we see ahead.

TLDR:

- In 2021 and 2022, web3 seemed like a paradigm shift in online interaction.

- In 2023, adoption froze, capital dried up, and startups pivoted.

- Blockchain is the best available technology to drive digital self-sovereignty, but startups must drive adoption with legitimate use cases.

- U.S. regulation will determine the quality and geographic focus of crypto investment opportunities.

- We are still bullish on web3 as an investable space, but our focus areas have changed.

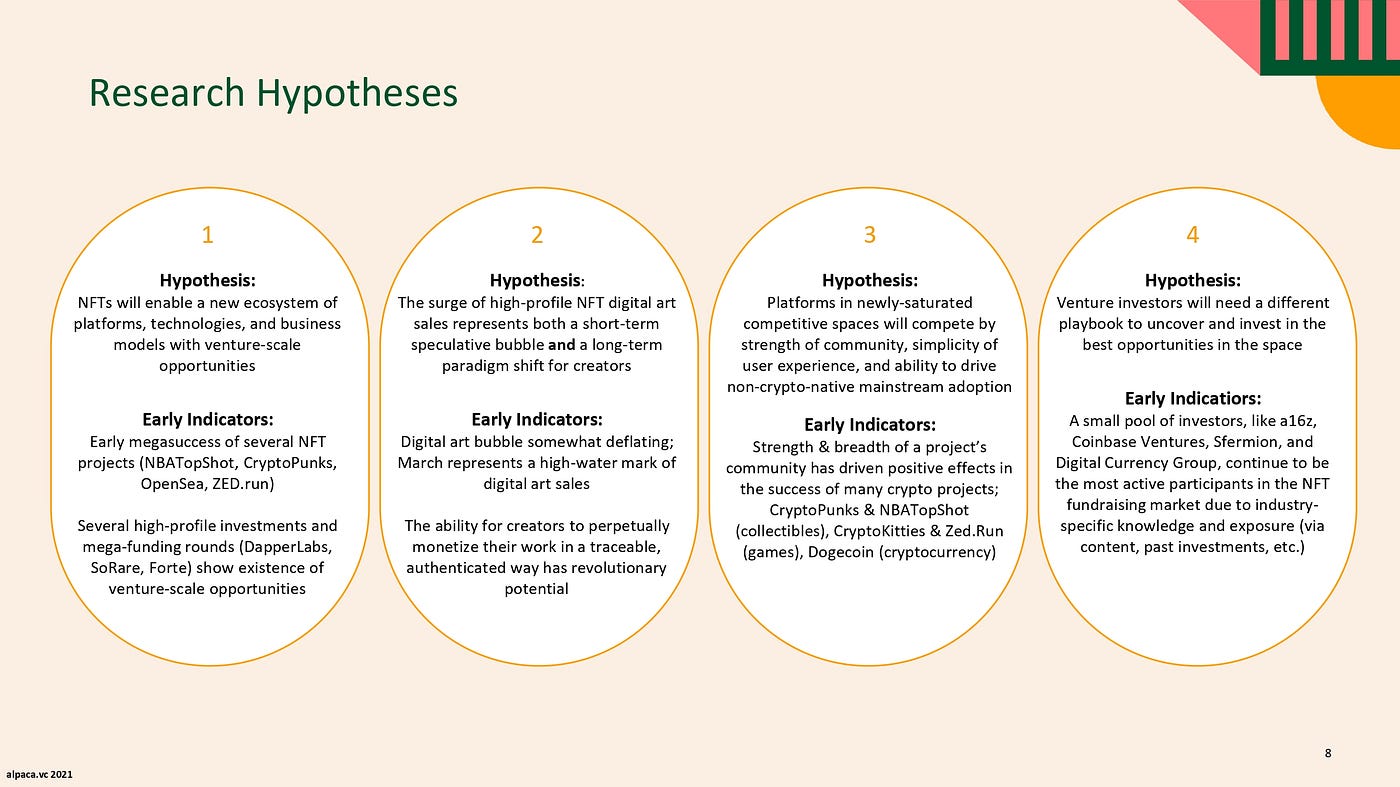

When we published our original Field Studies on web3 in 2021 and 2022, we believed the world was rapidly approaching a paradigm shift in online interaction.

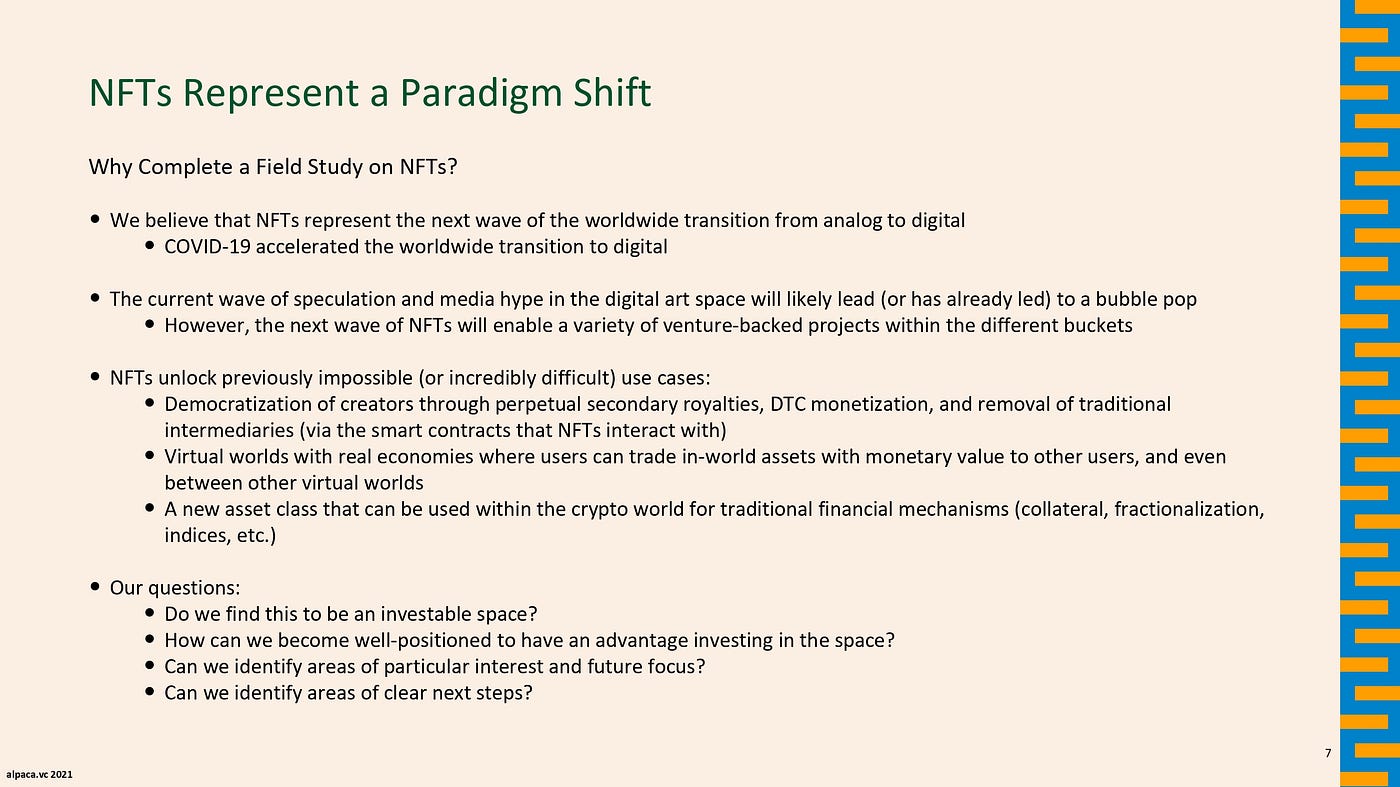

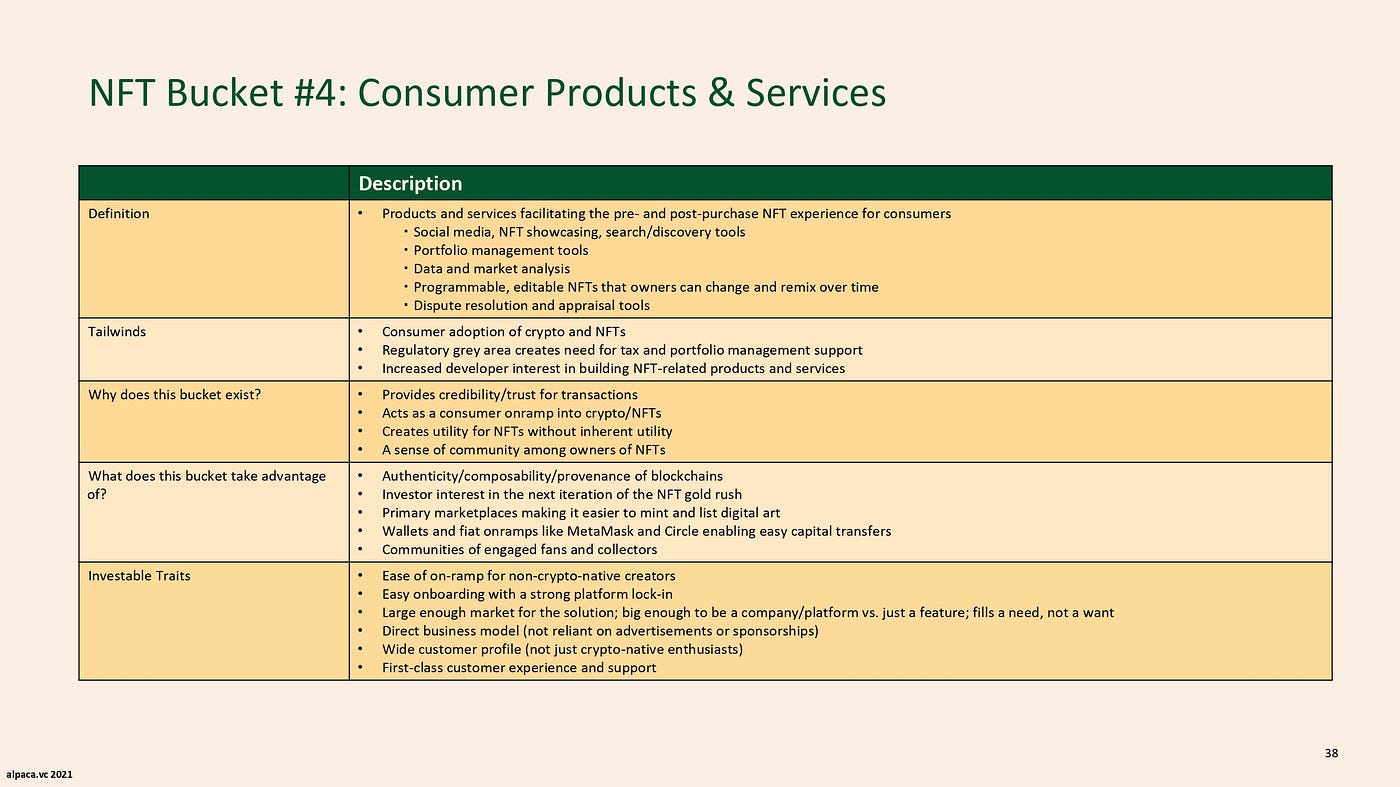

In Making Sense of the NFT Wave, we covered non-fungible tokens — groundbreaking new internet primitives that finally enabled verifiable ownership of digital assets.

Our second Field Study, Virtual Real Estate & The Metaverse, dove into how those same NFTs would play a crucial role in organizing new digital worlds.

Finally, in DAOs and Tools for DAOs, we looked at on-chain organizations: internet-native, decentralized communities attempting crazy projects like bidding on a copy of the US constitution or building a futuristic city from scratch in Wyoming.

2021 was a shot in the arm for the space. Beeple’s “Everydays” NFT sold at Christie’s for $69 million. El Salvador planned to introduce bitcoin as legal tender. NFT sales hit $25 billion. It was happening. Web3 was here, and it was going to permeate every aspect of our digital and financial lives.

2022, however, brought less optimism. Axie Infinity’s RONIN network suffered a $600 million hack. Bitcoin lost over 60% of its value. Terra’s ecosystem collapsed and took Three Arrows Capital with it. Still, amidst broad volatility in the space, the Ethereum Foundation completed the Paris upgrade, one of the more impressive engineering feats in recent memory. The long-awaited “Merge” successfully transitioned the Ethereum mainnet to proof-of-stake, addressing longstanding criticisms of web3’s energy consumption, scalability, and security.

Then, out of nowhere, FTX collapsed.

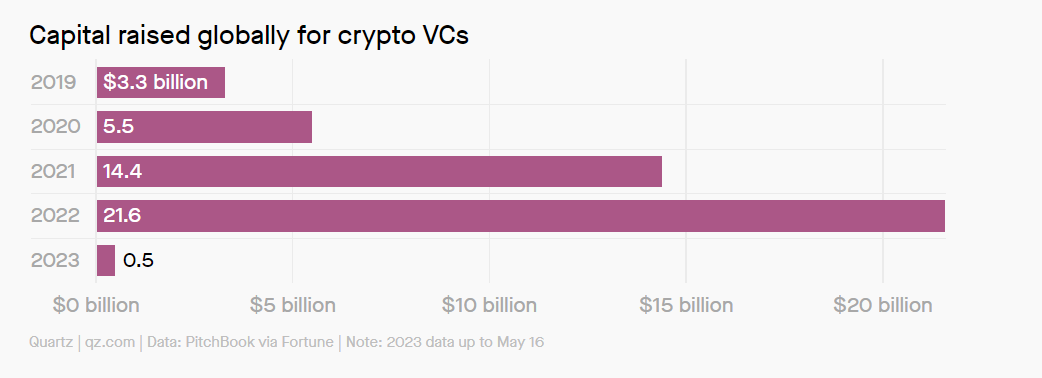

Capital raised for crypto firms went from $21.6 billion in 2022 to less than $1 billion in 2023. Funding for startups dropped, too — down 78% from 2022. Still, there is a contingent of founders and investors quietly building in web3, even as the space comes under increasing regulatory scrutiny in the U.S.

All that said, we figured it was high time to revisit our original thesis, break down how it’s played out to date, and share why we’re still fundamental believers in web3.

Our Original Thesis on Web3

Our initial investments centered around a few core ideas:

- Web3 is a paradigm shift in how we interact online.

For the first time ever, anyone with capital and an internet connection could own proprietary digital assets and transact them using a sovereign digital presence. We believed this transformation would deeply impact online interaction.

2) Consumer onramps and core infrastructure are key to mass adoption.

NFTs, DeFi, web3 games, and DAOs took on millions of users while basic infrastructure like wallets and fiat onramps were still being figured out. We saw an opportunity to improve on core infrastructure blocks while also leaning into consumer use cases.

Investments: Swoops, Rare Circles, The Sandbox, Animoca Brands

3) Legitimate use cases and comprehensible UX/UI are essential.

We recognized that just understanding web3 would be a barrier to adoption, unless products were:

- Compelling enough to acquire web2 users.

- Designed so that web2 users could own assets and transact seamlessly.

Findings From Our Original Thesis

- Web3 use cases never went mainstream.

From decentralized exchanges and lending protocols to prediction markets and peer-to-peer payments, this web3 market cycle did have real consumer applications. The problem was that the core users — even with $40 billion in total value locked across web3 protocols — were almost entirely crypto-native, early adopters.

Product complexity, security risks, and unclear value propositions stopped web2 adoption in its tracks. One investor we spoke with noted the challenge of bridging the gap for web2 users:

“Web3 of the last few years is a hard sell to the average user because there has been limited value proposition (beyond speculative profit) but outsized security risk (one wrong click and your money is gone).”

2) Startups are extending runway, building product, and waiting.

With limited downstream capital available, we’ve seen startups focus on extending their runway, building out product, and pivoting into sectors that might adopt web3 faster. We’ve also seen founding teams backpedal from the term “web3,” — calling themselves “web2.5” companies — or removing references to blockchain entirely.

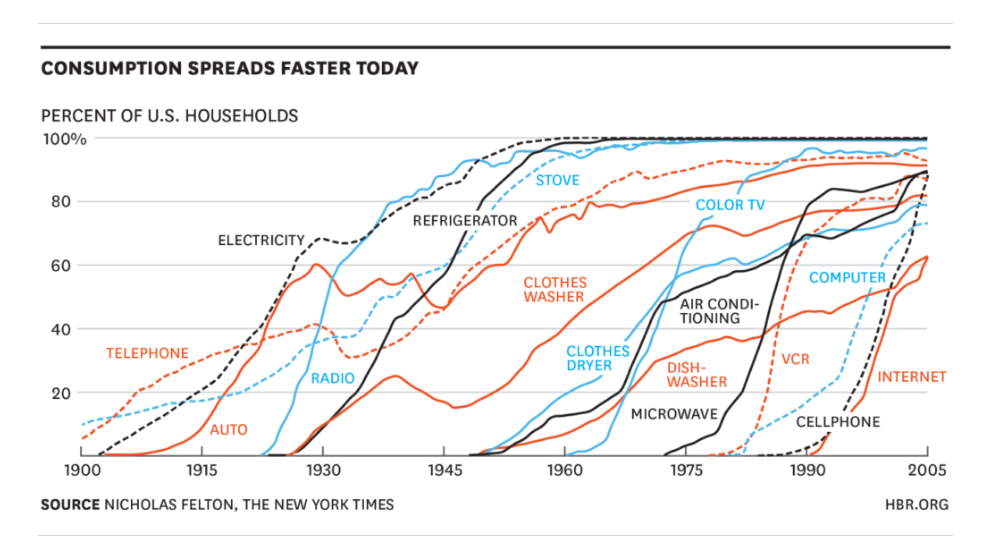

If web3 uptake follows the path of other technologies, the last few years show that we’re likely in a much earlier stage of adoption than we thought.

3) Financial incentive is core to understanding web3 products.

Profit drove adoption for the most popular web3 projects. In January of 2022, Axie Infinity had nearly three million concurrent players, while OpenSea saw nearly $5 billion of trading volume in NFTs. In these use cases, the core value proposition was simple: profit.

For early adopters, profit was enough of an incentive to overcome complex onboarding and security issues. For web2 users, though, the potential profit wasn’t worth creating a wallet, exchanging fiat for crypto, and learning how to interact with decentralized services.

Why We’re Still Fundamental Believers in Web3

We believe that an ideal digital world is self-sovereign. Our vision of a self-sovereign world is one where:

1) People can capture value they generate for a network.

Web2 social networks like TikTok, Instagram, and Facebook are examples of networks where users don’t capture the value they generate. Users create content and spend time on the platform — generating billions of dollars in revenue for companies like Meta and ByteDance — but see little in return. We think a more equitable model that allows users to capture some of the value they create drives uptake and leads to a more sustainable business long-term.

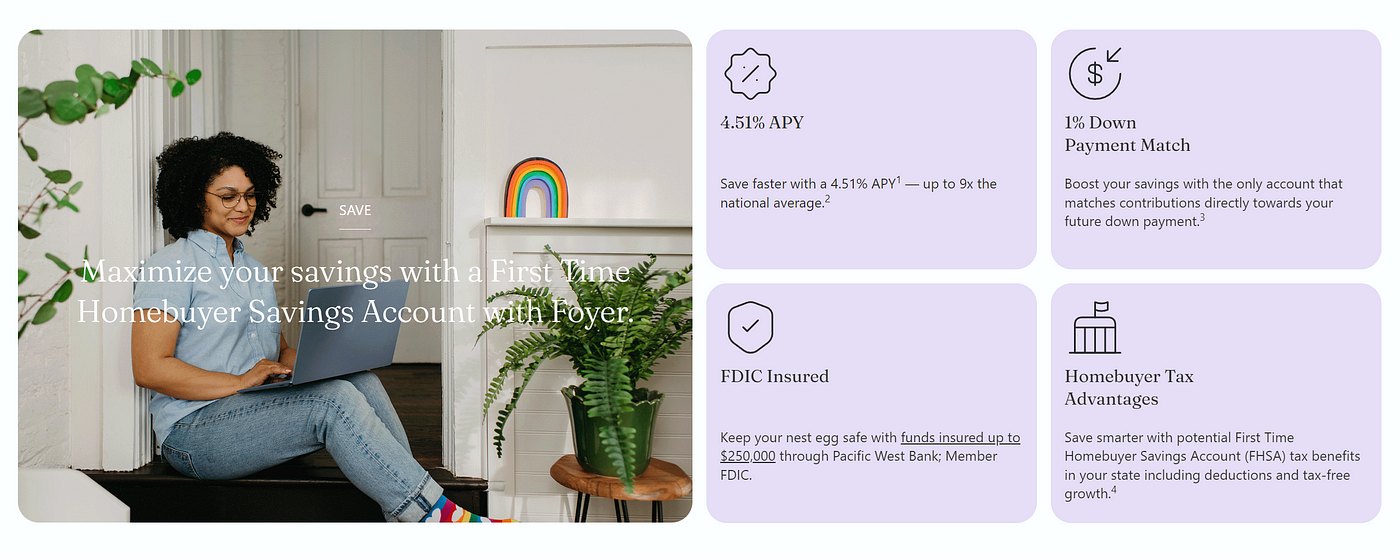

We’ve made other investments like Foyer on this same principle, albeit without the underlying blockchain technology. Homebuyers generate thousands of dollars in value by purchasing a home (e.g., in the form of fees/deal flow for the homebuying “network” of brokers, agents, and lenders) but seldom see any of that value returned to them. Foyer’s specialized home-savings account equalizes that relationship by using those same real estate partnerships to boost buyers’ savings.

2) People can control their assets and transact freely.

Roblox is one example of an ecosystem where users are subject to platform rules that restrict their ability to transact — the result being that most will likely never be fully compensated for their work.

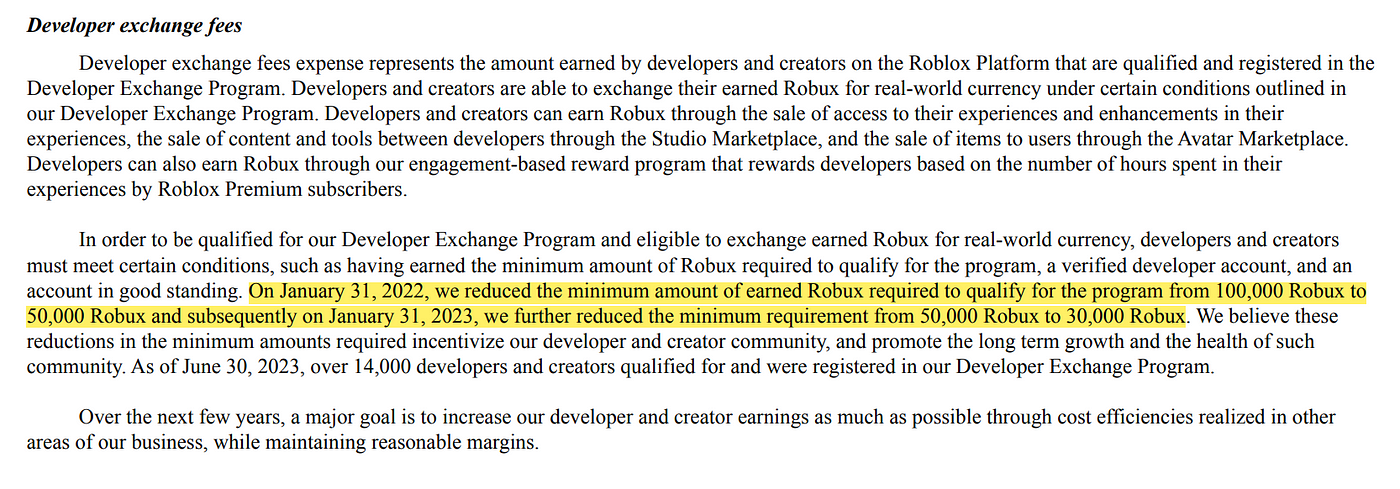

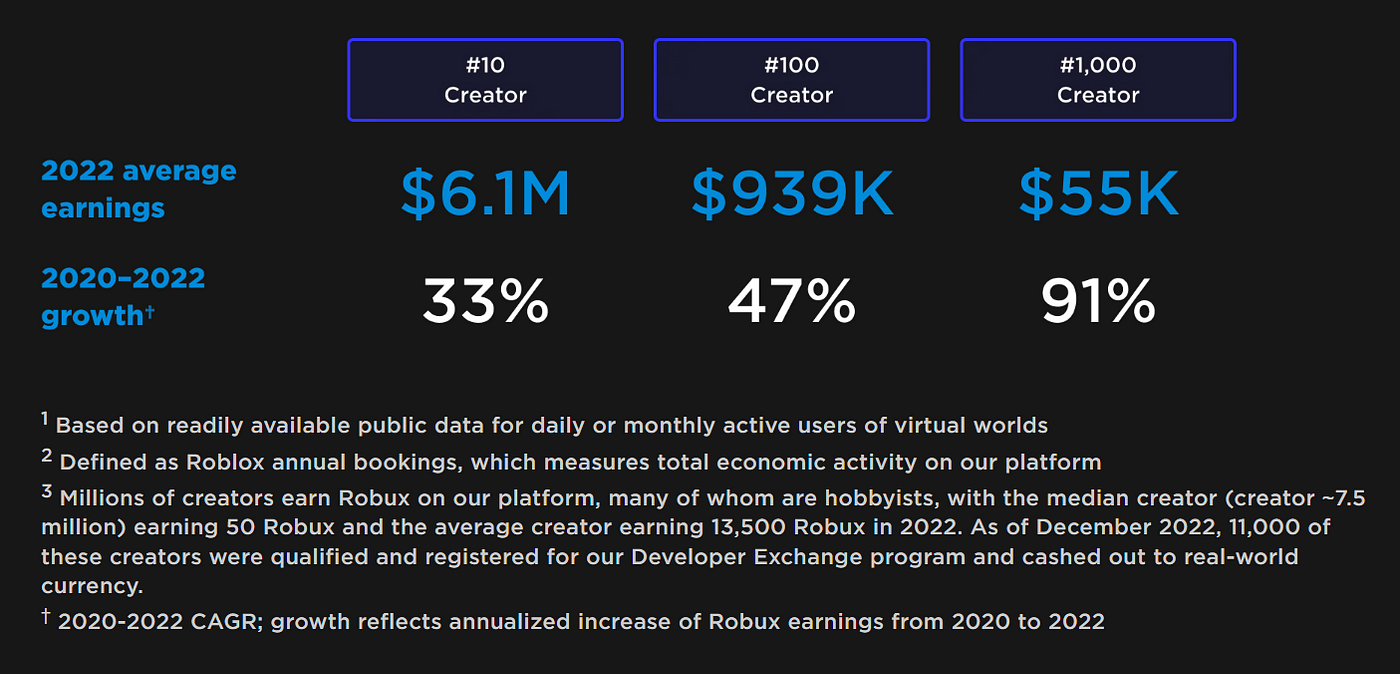

Roblox creators craft experiences, in-game assets, and plugins to earn Robux, the platform’s virtual currency. Using Roblox’s tools, distribution, and infrastructure, creators earned a collective $348 million in the first half of 2023. Those earnings, however, were restricted as each creator must earn a minimum of 30,000 Robux ($105) prior to receiving any real-currency payouts.

In 2022, the top one thousand Roblox creators earned a minimum of $55k, but the average creator earned 13,500 Robux ($47.25) and the median creator earned just 50 Robux ($0.17). Though Roblox has steadily decreased the minimum earnings requirement (down from 100,000 Robux in 2021) just over 14,000 creators are qualified to receive real-world payouts through its Developer Exchange.

** Robux exchange rate = $0.0035 / R$

Web3 brands have taken a different approach to user-generated IP. Azuki, an anime-themed metaverse brand, allows holders to not only display their NFT, but also create and sell derivatives of the artwork. This commercial license is in addition to the usual rights associated with token (NFT) ownership: the right to freely sell, transfer, or dispose of the artwork. Even in a stalling NFT market, Azuki’s June Elementals Drop brought in $38 million in just 15 minutes.

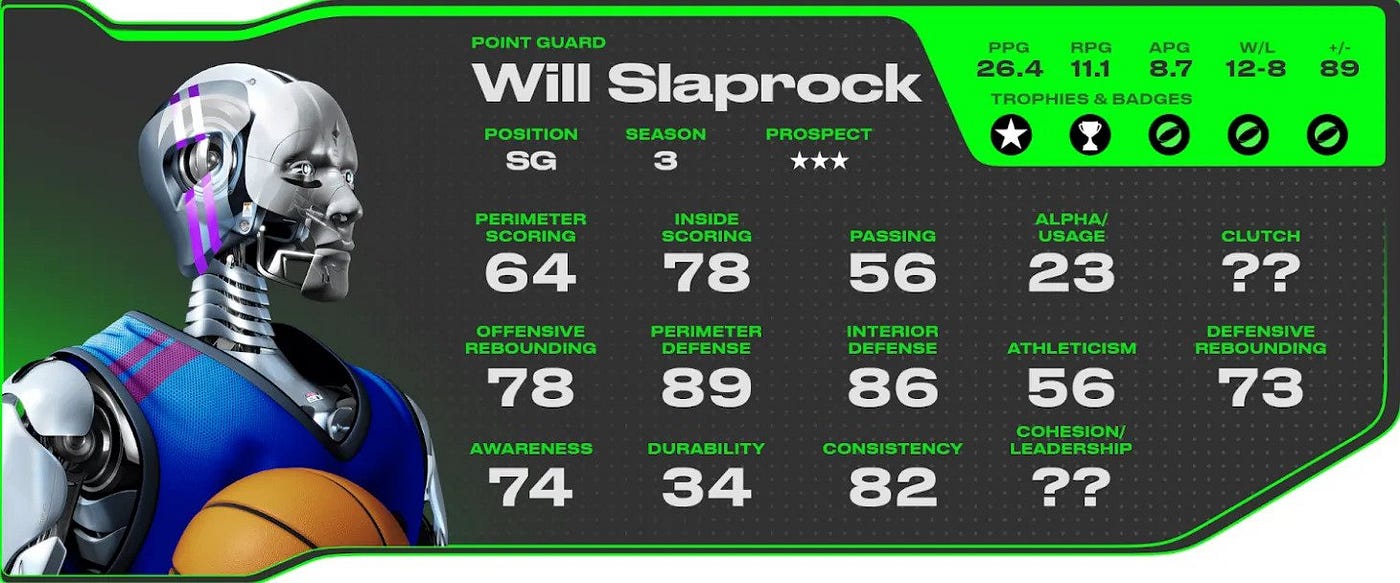

At Alpaca, we’ve made a direct bet on ownership-driven communities with Swoops. Swoops is the basketball simulation game and virtual league that lets you own, manage, coach, and profit from your own digital basketball team. In addition to the entertainment and community from playing the game, Swoops users (known as General Managers or GMs) have financial upside. GMs can earn real money from tournament winnings, head-to-head competitions, and player sales on the secondary market.

We’ve observed that leaning into ownership supercharges network effects. To date, Swoops GMs have played over 300,000 games and created more than 400 branded teams.

3) People help govern the networks they participate in.

While it might feel surprising to reference the July 2023 WGA/SAG-AFTRA strike in a long-form piece about web3, it’s a perfect example of what happens when people can’t help govern the networks they participate in. While the strike covers a range of issues — from pay increases to health benefits — the rise of streaming (and its lack of residuals) has emerged as one of the main pillars of debate.

As arguably the most important stakeholders in the entertainment industry, the strike shows that actors and writers don’t actually have much influence over how the industry (their “network”) operates.

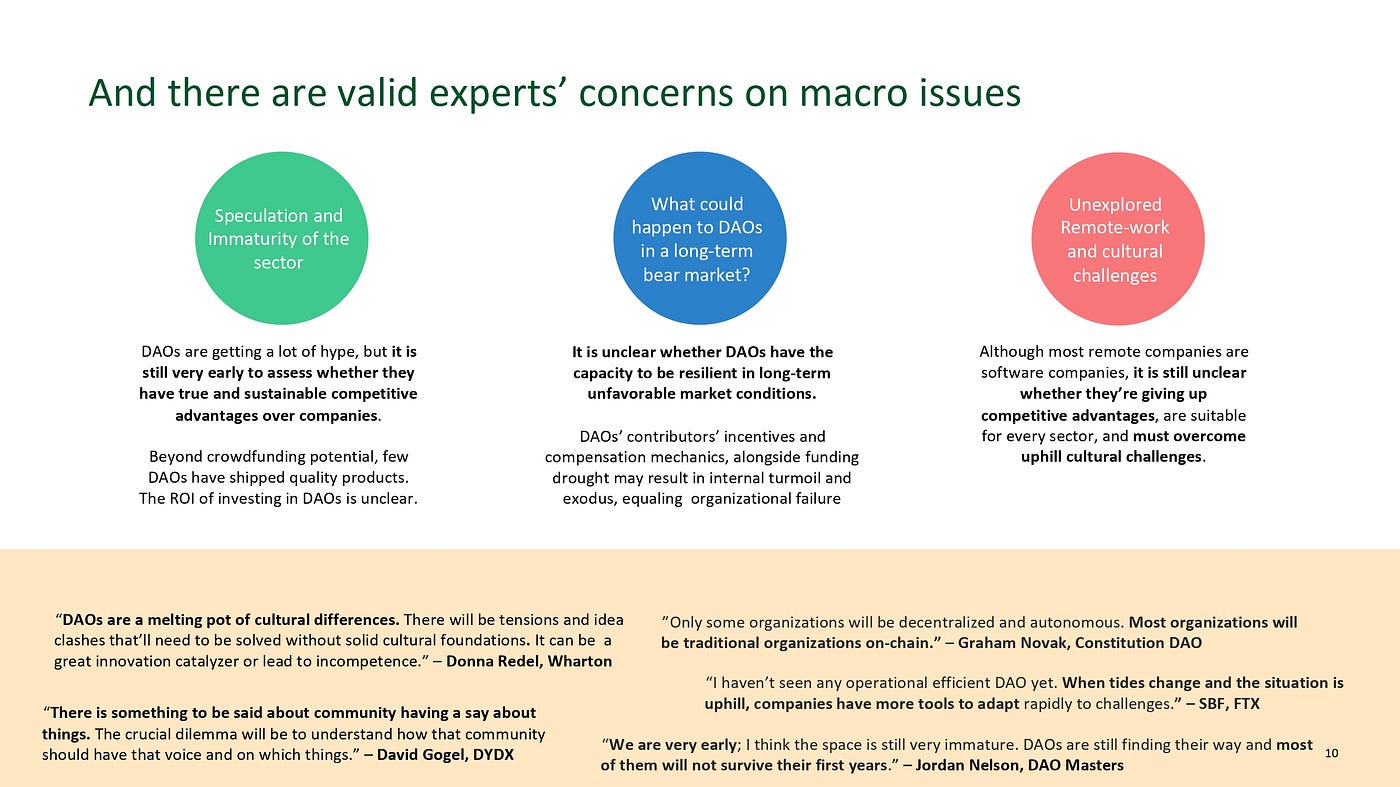

When we explored DAOs in our 2022 Field Study, we recognized that they suffered from a range of inefficiencies from security to regulation. We did identify, though, that they had the potential to enhance trust and transparency in environments where consensus is a relevant priority.**

With the strike reaching a tentative agreement just this week, it’s worth considering how implementing some DAO-like governance could play a part in shepherding the industry’s ongoing transformation.

Our investment in Upstream, a no-code platform that makes it easy to launch a DAO, is one such bet on alternative governance structures. We recognize today (as we did in our 2022 study) that DAOs are still very much in the early stages of deployment. We expect that interest in on-chain governance will re-emerge once the broader web3 market has more time to mature.

** Note: Our original Field Study focused specifically on pseudonymous environments, but we believe this easily extends into communities where people use their everyday identities.

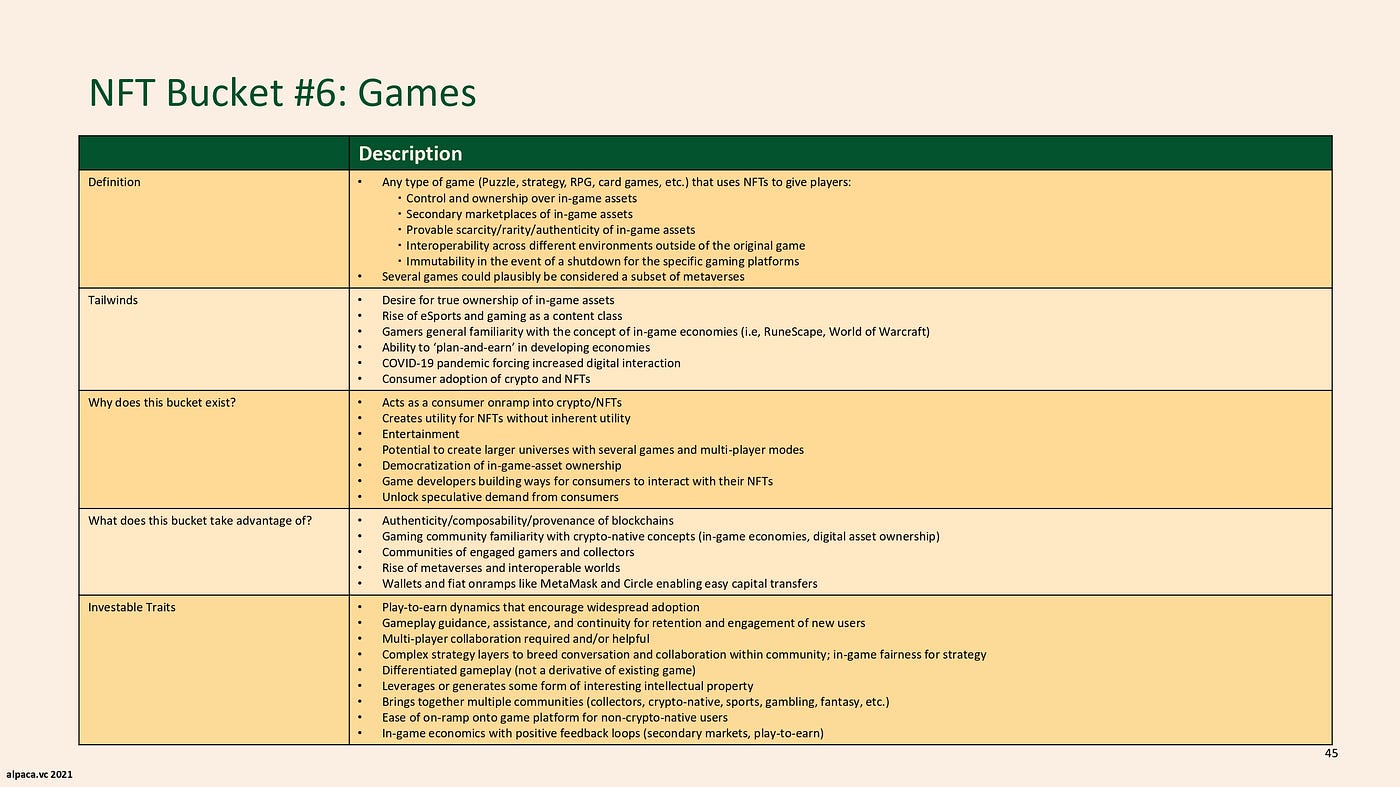

Where We’re Spending Time: Gaming & Consumer

We’ve identified two sectors that we believe best suit web3’s current adoption:

- Gaming

We’re still interested in gaming, with much of our original thesis unchanged:

- Gamers tend to have the most familiarity with core web3 primitives like wallets, NFTs (collectibles), and virtual currency.

- Games like Roblox, Fortnite, and CS:GO already exhibit web3 traits like interoperability and secondary markets, though most are still part of siloed ecosystems.

- There are opportunities for both native and crossover IP that integrate web3.

Gaming also faces unique challenges:

- Existing gaming communities have often rejected web3, most notably with Mojang’s intended ban on NFTs and Valve simply banning blockchain games and NFTs outright in 2021.

- Web3 lacks a native device layer (though Solana is trying) so its development speed and financial incentives are at the whim of web2 platforms like the App Store and Play Store.

- Financial incentives can sometimes interfere with gameplay mechanics. Early financial experiments in AAA games like loot boxes and microtransactions have already upset some users.

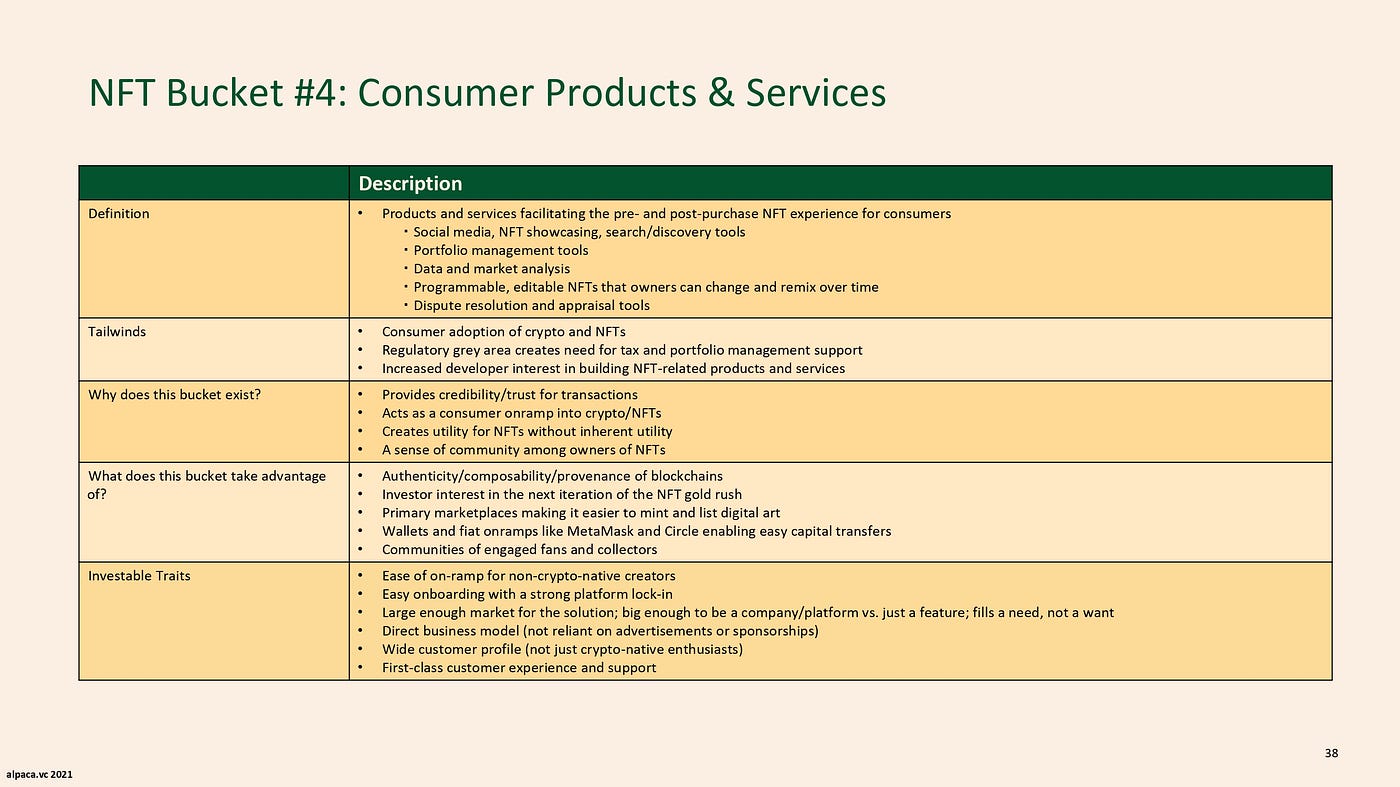

2) Consumer Products & Services

We remain interested in tools, platforms, and products that bridge the gap for web2 users and drive mass adoption. Some tailwinds:

- Core onboarding around web3 (wallets, fiat onramps, general onboarding/safety) is still in the earliest stages.

- There are successful consumer products that integrate web3 without confusing users.

- With just 420 million web3 users globally, there’s plenty of room to grow.

This approach does have its challenges:

- Pure infrastructure for existing web3 users won’t accelerate adoption. Consumer and enterprise applications that bridge the gap for web2 are critical.

- With the past few years of headlines, people are incredibly skeptical of web3. Successful products will need stellar track records of trust and safety to overcome web3’s tarnished reputation and regain the public’s confidence.

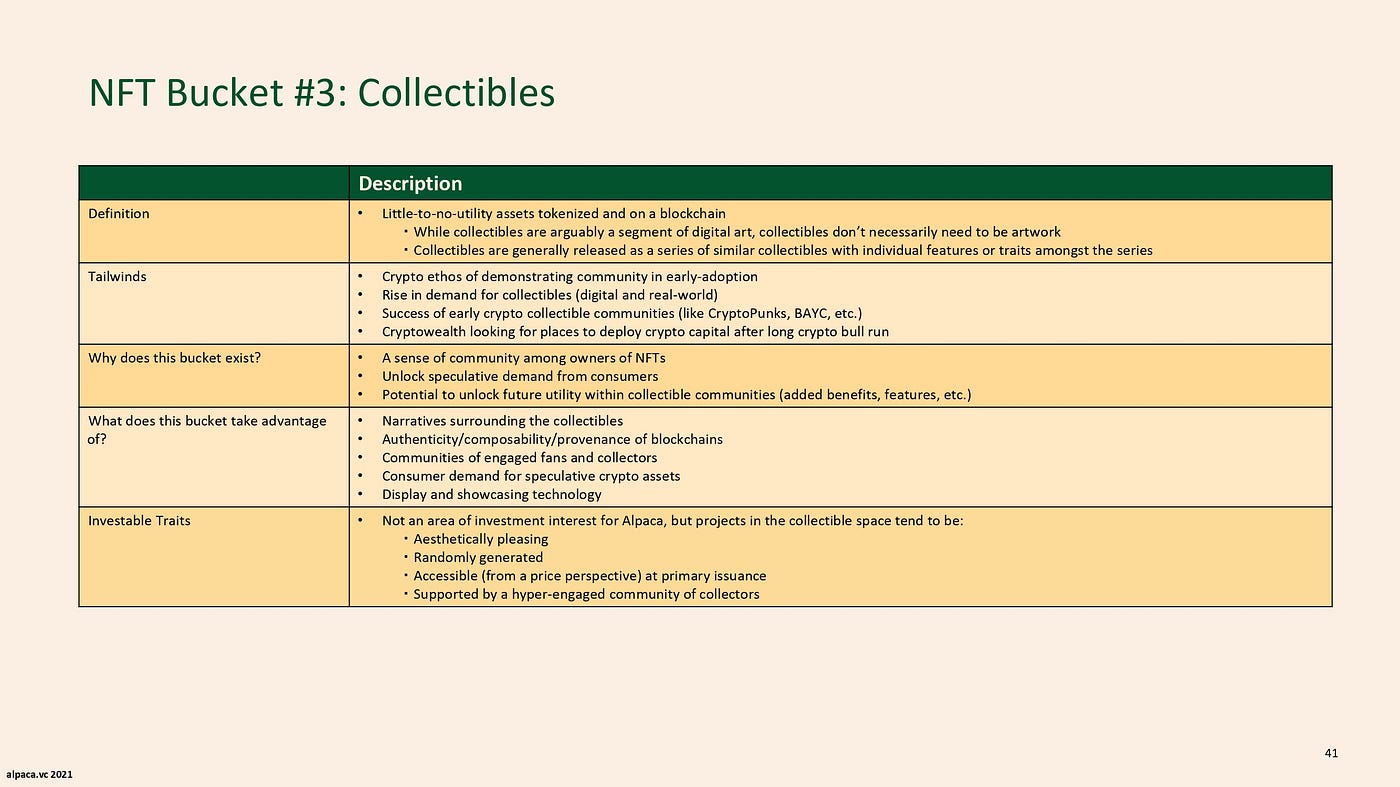

Where We’re Not Spending Time: Collectibles, DeFi, L1s/L2s

Collectibles/Digital Art — “NFTs as NFTs”

In line with our 2021 Field Study, we still don’t view collectibles and digital art as areas of interest. This is primarily driven by their speculative nature and frequent lack of utility.

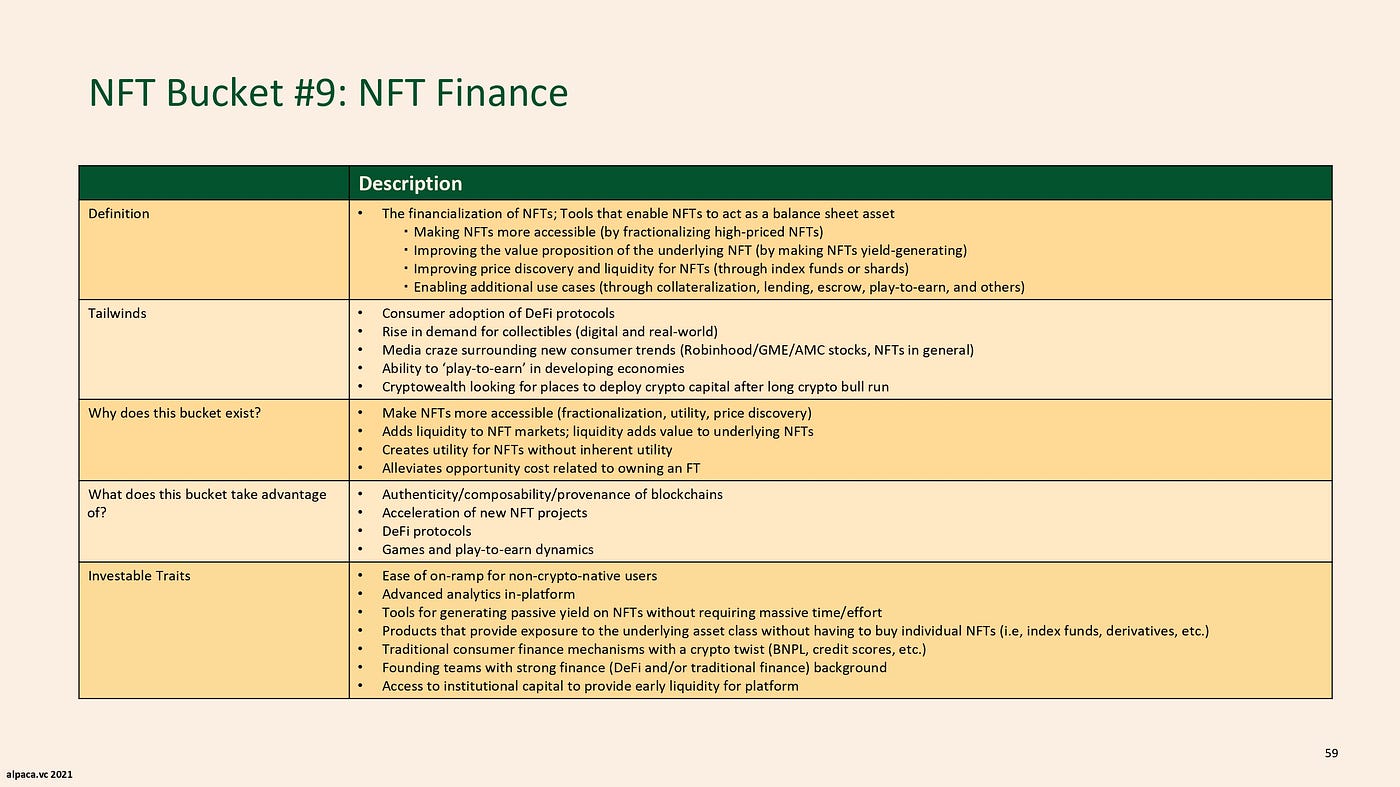

DeFi/NFT Finance

Regulation (discussed in depth below) poses a significant risk to DeFi startups seeking to scale.

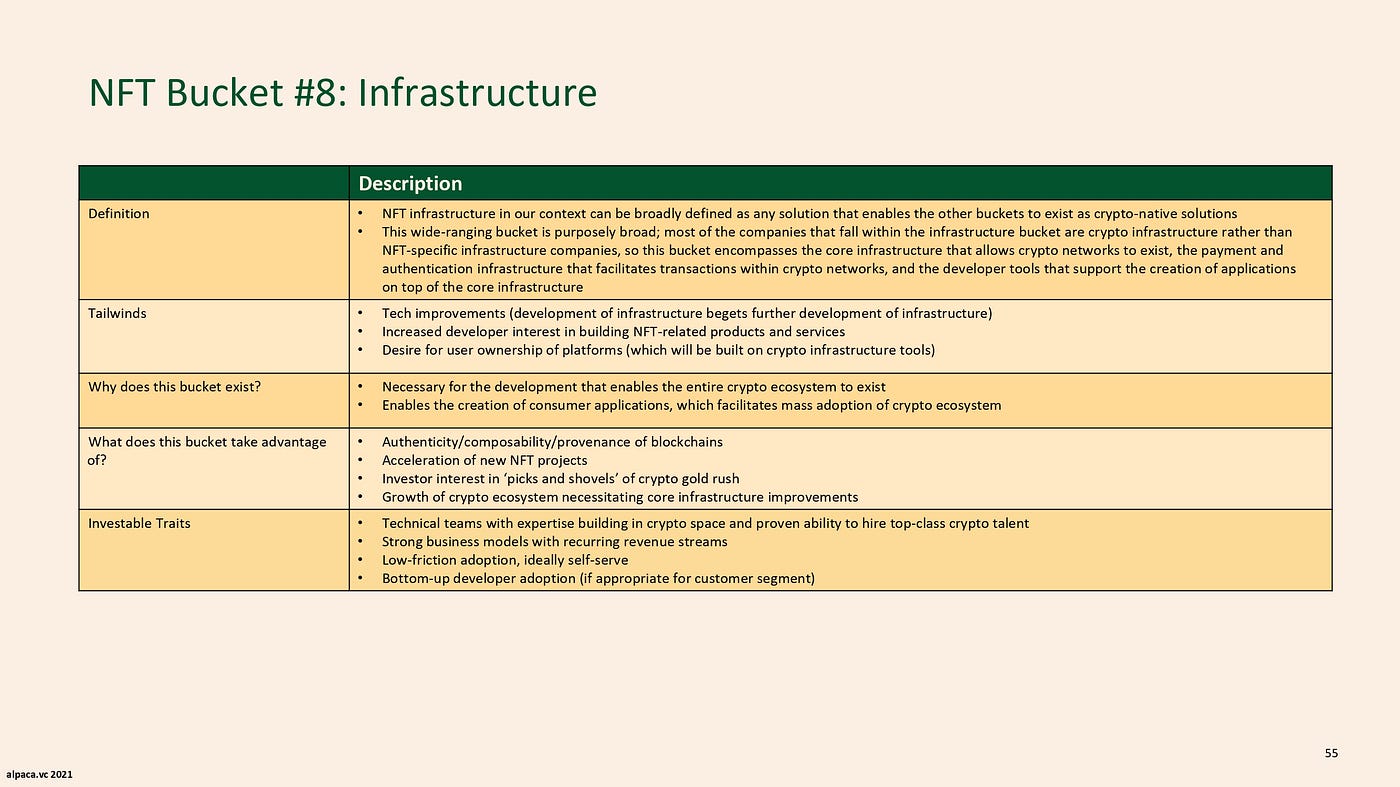

L1s/L2s — New Protocols

With the current state of web3 adoption, we believe that breakthrough use-cases will be built on existing protocols with developed ecosystems.

Regulatory Considerations

Before we discuss the regulatory environment, a word on definitions:

- We use the term “web3” to refer to a new version of the internet built on decentralized, blockchain-based protocols.

- For clarity, this section will use the term “crypto,” as it’s generally used to refer to all blockchain-based products and services, including digital assets.

Where Regulation Stands Today

Since 2013, the U.S. Securities and Exchange Commission (SEC) has used enforcement actions as their primary response to the growth of digital assets.

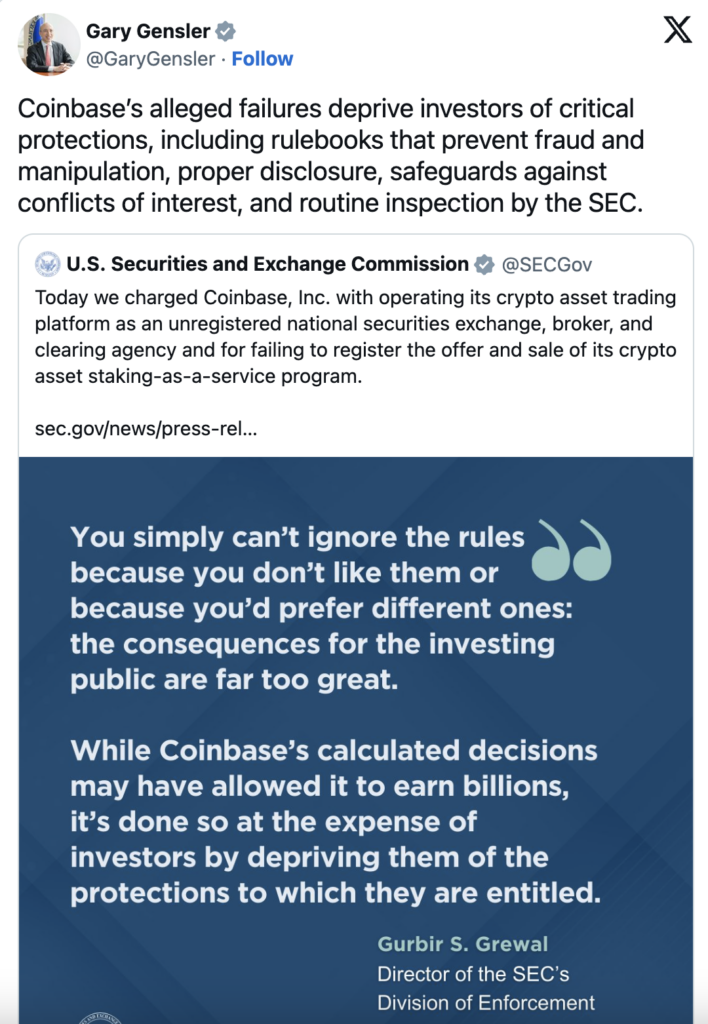

In June 2023, the SEC made its boldest move to date — charging Coinbase with operating as an unregistered securities exchange, broker, and clearing agency.

While there are some signs of life — Ripple and Grayscale notching wins in court, H.R. 4763 circulating in the U.S. House — the crypto industry is stuck in regulatory limbo.

We see two different ways this could play out, each with profound effects on crypto’s investment potential.

Case A: Digital Assets are Securities or “Regulation by Enforcement”

The SEC framework for evaluating digital assets — the so-called “Howey Test” — originates from a 1946 U.S. Supreme Court ruling asserting that an “investment contract” exists when:

- There is an investment of money in a common enterprise.

- There is a reasonable expectation of profits.

- The profits are to be derived from the efforts of others.

SEC enforcement actions demonstrate the agency belief that virtually all digital assets pass the Howey Test, and thus are securities to be regulated accordingly. In 2021, Chairperson Gensler shared his intention to rein in the crypto “Wild West.” Two years later, that intention hasn’t changed:

Critics claim the SEC’s approach is “regulation by enforcement,” and that treating digital assets like traditional securities will threaten U.S. financial and technological leadership.

In the July announcement of H.R. 4763, the Financial Innovation and Technology for the 21st Century Act, Representative Glenn “GT” Thompson (PA-15) stressed the point:

“[H.R. 4763] marks a significant milestone in (…) efforts to establish a much-needed regulatory framework that protects consumers and investors and fosters American leadership in the digital asset space. Over the past several months, our teams solicited extensive feedback from stakeholder and market participants, and worked diligently to produce a legislative product that aims to close existing authority gaps, ensuring U.S. leadership in financial and technological innovation.

Assuming this regulatory pathway, we predict two key transformations:

- Existing U.S. crypto companies will adapt to regulation or modify their offering to avoid the costly administrative and financial “lift” on adherence — sacrificing core features and adoption in the process.

- Investment capital and engineering talent will accelerate their transition out of the U.S. and into friendlier regulatory environments.

For venture investors, the United States’ status as a major geopolitical power presents additional complexity. Hostile U.S. crypto policy could potentially influence adoption and regulation in international markets.

Case B: Digital Assets are Not Securities or “Regulatory Clarity.”

The alternate path — broadly preferred by those in the industry — involves introducing a robust regulatory framework to accelerate crypto adoption and maintain US technological and financial leadership.

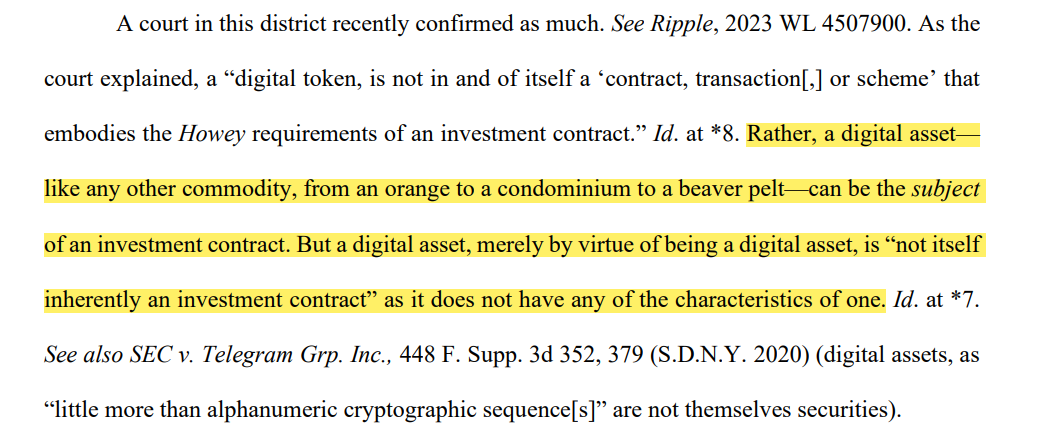

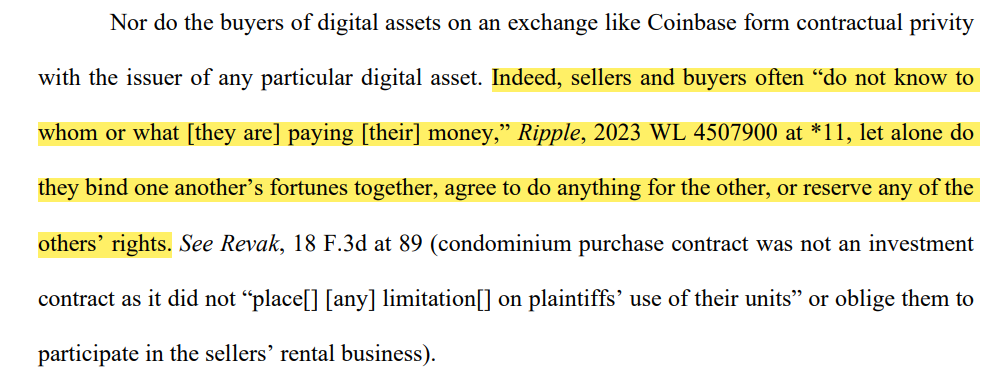

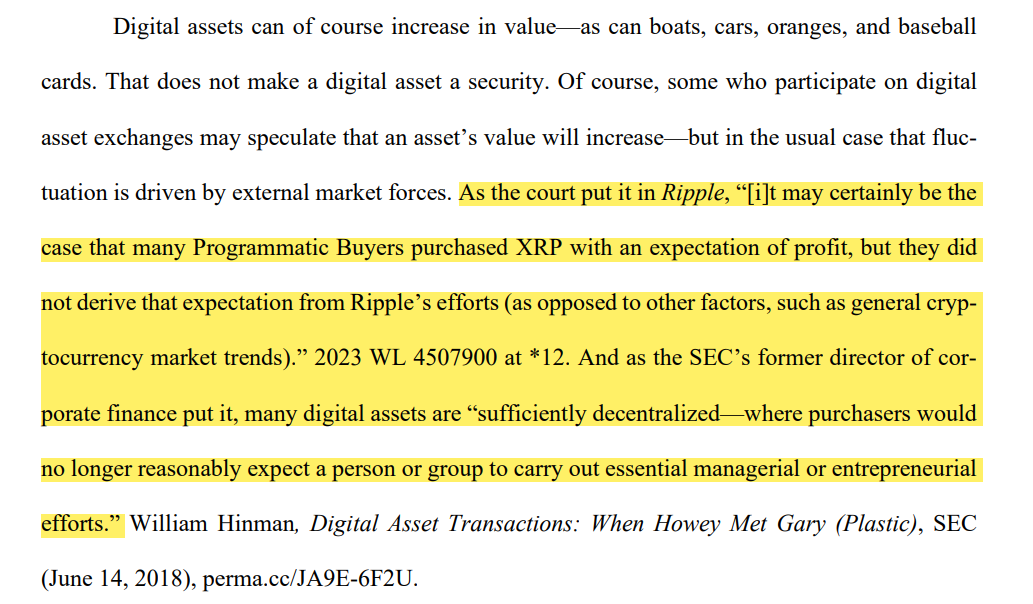

Coinbase’s defense, filed in an amicus brief, details their objection to the Howey test for digital assets, leaning heavily on arguments from Ripple’s overturned court case:

- Digital assets are commodities, not contracts.

2. Because transactions are obfuscated, there’s no relationship between buyer and seller.

3. Digital assets are too decentralized for a single party to control.

Should these arguments succeed, it’s possible that the Howey test — and the Supreme Court ruling it’s predicated on — could come into question. Seemingly aware of this, Coinbase launched a grassroots campaign to mobilize 52 million U.S. crypto users in what is shaping up to be a “last stand” for domestic regulation.

One investor we spoke to agreed that regulation is the lever to pull when it comes to crypto adoption:

“I believe we are three to five years away from a significant inflection point in [crypto] adoption. There are a number of catalysts that might cause it, but I think the single largest binary trigger will be regulatory clarity. There are a number of cases in progress — the most interesting being Coinbase’s defense from the SEC. When regulatory clarity emerges, investors, talent, and capital will leave the sidelines and enter the space.”

We find that regulatory clarity, implemented thoughtfully, will benefit crypto:

- Talent and capital will race back into the U.S. market.

- Historic levels of undeployed capital in crypto venture funds will bolster early-stage dealmaking and support existing startups.

- Friendly U.S. crypto policy will accelerate global adoption.

- A regulatory framework will allow entrepreneurs to exploit the full potential of blockchain technology with products and services that are safe for public investors.

In the interim, though, venture investments in crypto are — at their core — directional bets on regulatory outcomes. Should the U.S. emerge as hospitable to crypto, we believe there will significant global opportunity at all stages of investment.

Conclusion

In this piece we covered our original thesis, our experience in the market over the last two years, and why we’re still believers in web3. We found that while most of our core theses have remained, we’ve had to adapt to the changing regulatory environment and the speculative nature of most early web3 use cases. We’ve also zeroed in on gaming and consumer — the two areas we see the most opportunity — while continuing to shy away from collectibles, DeFi, and new protocols.

We also covered regulatory considerations, finding that crypto policy in the U.S. will determine the quality and geographic focus of investment opportunities in decentralized technologies.

Blockchain took a serious reputational hit over the last few years, but it’s still the best available technology to drive digital self-sovereignty and ensure that people, users, and companies alike get a fair shake from the networks they participate in.

As a firm, the Alpaca team is continuously conducting Field Studies.

- Do you have a great idea for a Field Study thanks to a pain point you can’t figure out?

- Do you know an expert we should talk to for upcoming studies?

We announce new studies and how you can get involved on Twitter (@alpacavc), LinkedIn and in our newsletter, The Rundown (subscribe here or subscribe on LinkedIn).

Shoot us a note at [email protected]. We’d love to hear from you.

Sources:

- Field Study: Making Sense of the NFT Wave | by David Goldberg | Alpaca VC | Medium

- Field Study: Virtual Real Estate & The Metaverse | by Daniel Fetner | Alpaca VC | Medium

- Field Study: DAOs and Tools for DAOs | by Aubrie Pagano | Alpaca VC | Medium

- DAO raises millions in ETH to bid on copy of US Constitution (cnbc.com)

- CityDAO

- Beeple sold an NFT for $69 million — The Verge

- El Salvador looks to become the first country to adopt bitcoin as legal tender (cnbc.com)

- NFT sales hit $25 billion in 2021, but growth shows signs of slowing | Reuters

- Axie Infinity blockchain Ronin hacked for over $600M (forkast.news)

- Bitcoin lost over 60% of its value in 2022 (cnbc.com)

- How the fall of Three Arrows, or 3AC, dragged down crypto investors (cnbc.com)

- The Merge | ethereum.org

- Sam Bankman-Fried and the Collapse of FTX — The New York Times (nytimes.com)

- Venture capital funding for crypto firms has plummeted in 2023 (qz.com)

- Web3 Funding Plummets As AI Steals The Show (crunchbase.com)

- The SEC sues crypto exchange Coinbase for breaking US securities laws — The Verge

- TVL Rankings — DefiLlama

- The Pace of Technology Adoption is Speeding Up (hbr.org)

- Axie Infinity Live Player Count and Statistics (activeplayer.io)

- OpenSea (dune.com)

- Earning on Roblox | Documentation — Roblox Creator Hub

- Developer Exchange — Help and Information Page — Roblox Support

- Azuki Elementals NFT Drop Yields $38 Million in Just 15 Minutes — Decrypt

- How Streaming Has Rewritten the Script for Movies — The New York Times (nytimes.com)

- Writers Strike Deal: WGA & Studios Reach Tentative Agreement — Deadline

- Shrapnel Web3 Shooter Looks and Plays Like a AAA Game — Decrypt

- GTA owner joins Web3, Bitcoin casino, Sunflower Land review: Web3 Gamer (cointelegraph.com)

- Minecraft Still Hasn’t Officially Banned NFTs — But It’s Coming — Decrypt

- Gabe Newell explains why Steam banned NFTs | Eurogamer.net

- Web3 On The Go | Solana Mobile

- MW2 players say increased microtransaction sales are why COD won’t improve — Dexerto

- Sorare: Own Your Game

- Cryptocurrency Ownership Data — Triple-A

- SEC.gov | Crypto Assets and Cyber Enforcement Actions

- SEC.gov | SEC Charges Coinbase for Operating as an Unregistered Securities Exchange, Broker, and Clearing Agency

- Judge says some XRP sales did not constitute a securities offering (axios.com)

- Explainer: Understanding Grayscale’s victory in spot bitcoin ETF case | Reuters

- Markup of H.R. 4763, H.R. 1747, H.R. 3244, H.R. 4768, H.R. 4765, H.R. 2969 | Financial Services Committee (house.gov)

- SEC.gov | Framework for “Investment Contract” Analysis of Digital Assets

- Howey Test Definition: What It Means and Implications for Cryptocurrency (investopedia.com)

- SEC v. W.J. Howey Co. :: 328 U.S. 293 (1946) :: Justia US Supreme Court Center

- U.S. SEC Chair Gensler calls on Congress to help rein in crypto ‘Wild West’ | Reuters

- SEC’s Gary Gensler Had Crypto in His Sights for Years. Now He’s Suing Binance and Coinbase. — WSJ

- Committees Introduce Financial Innovation and Technology for the 21st Century Act | Financial Services Committee (house.gov)

- Cryptocurrency Regulation Tracker — Atlantic Council

- The competing priorities facing U.S. crypto regulations | Brookings

- McDermott And Chamber of Digital Commerce File Amicus Brief In SEC V. Coinbase — McDermott Will & Emery (mwe.com)

- A Call To Action: Mobilizing 52 Million Crypto Owners Into An Army of One Million Advocates For Change (coinbase.com)

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.