Field Study: AI x Real Estate Investment Management

Written by a human without the assistance of AI—really.

Thanks to Kevin Grathwohl for his extensive research and contribution to this piece.

Setting the Stage

Artificial intelligence is hardly new, but from reading the tech headlines these days you’d be forgiven for thinking it was invented last month. Google search queries for the term have quintupled since 2022. My favorite tech podcast, Hard Fork, has basically turned into an AI podcast.

AI has been a part of our daily lives for over a decade now—in your Netflix recommendations, the targeted ads that follow you across the internet, autocorrect forcing you to say “ducking”—but tech companies have historically avoided asking the user to confront AI head-on. Instead it operated in the background, crucial but tangential to the UX. But ChatGPT and similar large language models have dramatically increased user familiarity with AI, ushering in a new era of business models centered around interfacing directly with AI.

Why does this matter for real estate?

Of the top five most well-funded proptech startups, none are SaaS companies (it isn’t until #8 down the list, VTS, that we see a SaaS business). Instead, these platforms were disruptive because of their innovative operating models, financing structures, and asset class solutions, not their software. As a result, while vertical SaaS targeting the real estate business has produced a number of moderately successful exits, their impact on the industry has been similarly moderate.

Looking ahead, I’m hopeful this will change as demonstrable breakthroughs in AI foster investor and consumer confidence. Traditional, rule-based software operates based on predefined instructions and is well-suited for static, repeatable tasks. On the other hand, AI is able to simulate human-like reasoning to adapt and make context-aware decisions—potentially allowing proptech vertical SaaS solutions to finally be truly disruptive. We’ve started to see this internally: while only a few of Alpaca’s proptech investments historically have been SaaS companies, we have already seen an abundance of strong early-stage SaaS deals over the past year, many of them powered by AI.

As a result, while AI is sure to affect all areas of the industry, we chose to focus this Field Study on the areas where AI is likely to serve as maturation of the existing real estate vertical SaaS sector; mainly, the impacts to professional real estate teams and institutionally managed real estate.

What We’re Interested In

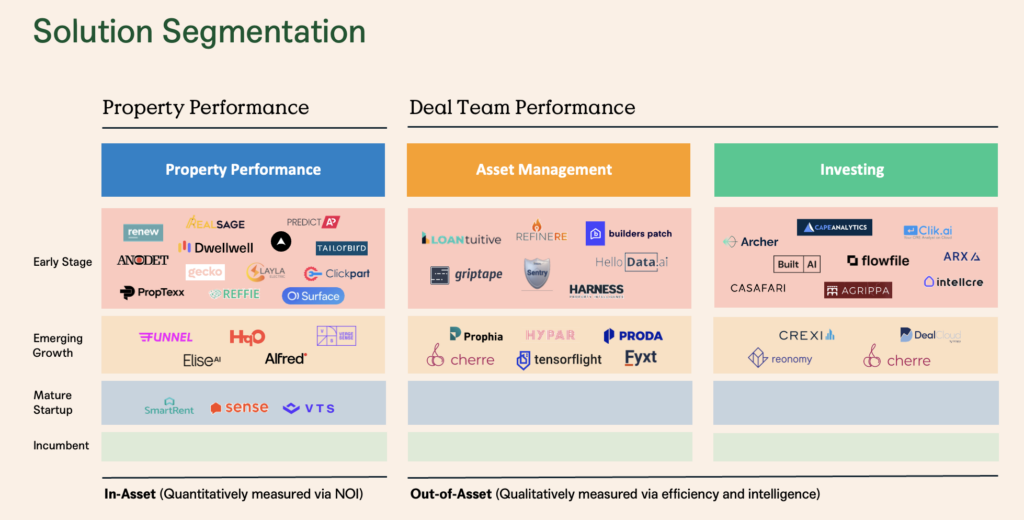

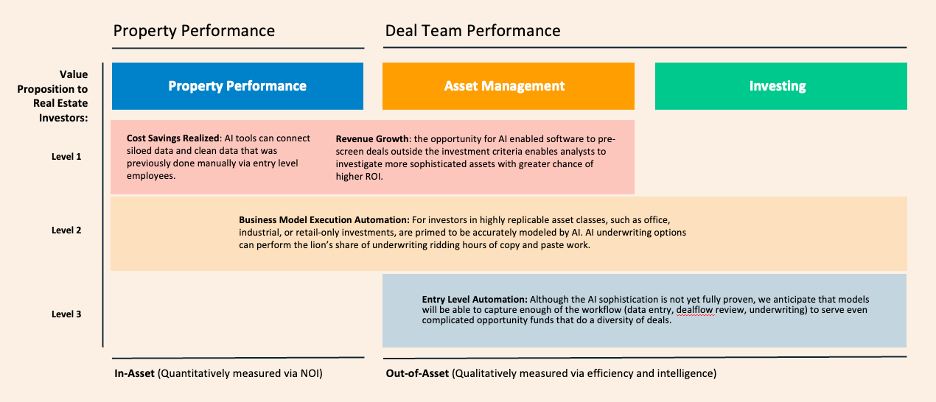

Looking at startups that are trying to supercharge real estate investment management, we can segment the space into ones that affect asset performance and ones that don’t. I’m calling these “in-asset” vs. “out-of-asset:”

- In-Asset: platforms whose primary value proposition is that they improve property performance. Ideally this value proposition can be measured quantitatively in an increased net operating income.

- Out-of-Asset: platforms that don’t directly improve asset performance. Instead, most of these platforms enhance the workflows of the real estate deal ecosystem, particularly the investment and asset management teams.

(While this market map is exemplary and non-comprehensive, you might notice a distinct lack of incumbents across categories. We chose to exclude companies that did not have AI as a central component to the business model from genesis. However, incumbent real estate tech companies are moving quickly to introduce new features and even rebrand as AI companies, creating challenges for new startups. More on this later.)

These two categories have divergent considerations depending on if you’re a VC or real estate investor, so let’s dig a little deeper into each one.

Property Performance Impact Areas

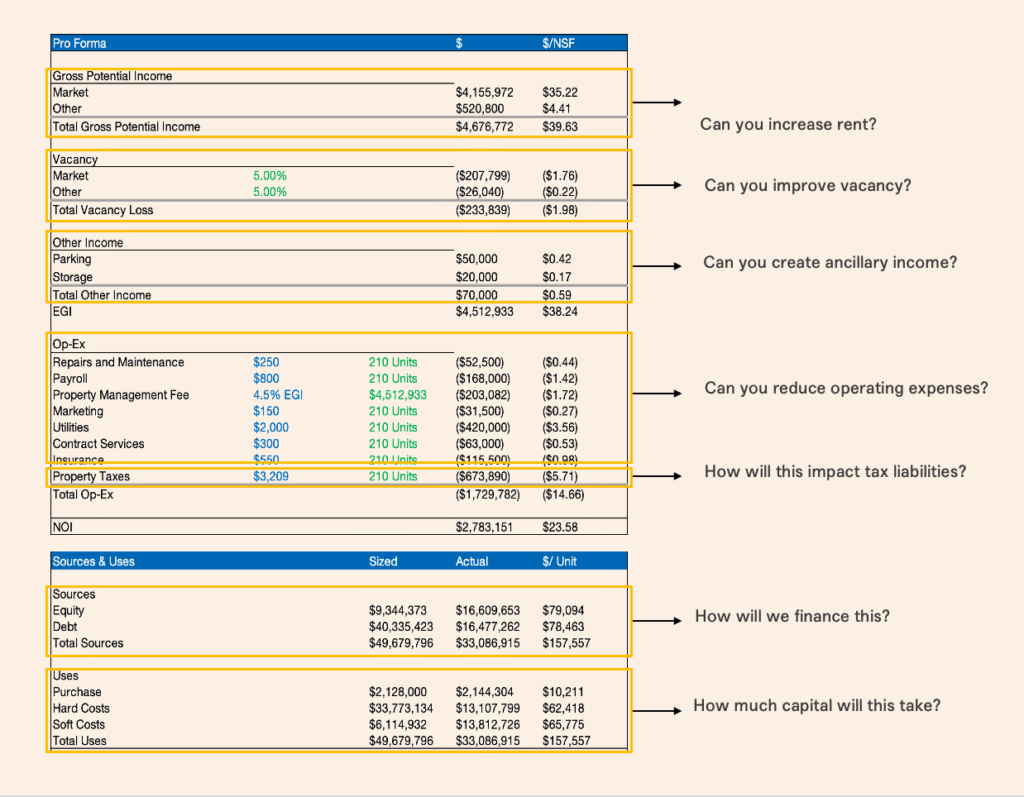

A longstanding disconnect between proptech and real estate is that tech operators might think about data, analytics, efficiency, time-savings—but real estate operators think about real-estate-as-a-spreadsheet (h/t Eric Roseman for coining the term). As elegant and well-built as a tech solution may be, if it isn’t affecting one of the blue numbers in a pro forma, it’s going to be difficult to underwrite and therefore difficult to justify the cost. The most adoptable solutions in the short-term will have immediate ROI by targeting one of the outputs on the spreadsheet.

Where AI-powered tools have the potential to one-up the previous generation of proptech SaaS is in operationalizing nontraditional real estate variables. In 2018, McKinsey declared that up to 60% of the variation in rent was correlated to non-traditional metrics (mobile phone signal patterns, tone of reviews for local restaurants, frequency of elevator movement—anything, really). But six years later, and we still have yet to incorporate this data into real estate decision making because humans are inefficient at collecting and analyzing it.

Bringing it all together: recent AI-powered platforms are not only incorporating far-flung, esoteric data into everyday decision making, but the better ones are also aligning themselves with the ROI considerations of asset owners. Some examples:

- Anodet solves the problem of multifamily surveillance data going to waste. Anodet’s trained neural networks analyze surveillance footage to automatically detect anomalies, which can include anything from crime to pipes bursting to lease violations, and flag them for the property manager. This allows the data to be actionable, such as through shortened maintenance response times and streamlined insurance claim documentation.

- Dwellwell‘s AI-enabled hardware analyzes acoustic data and vibrations to detect maintenance issues humans and traditional sensors would overlook (high humidity leading to mold growth, outlet wiring faults and conductivity issues, water leaks) allowing maintenance staff to predict and prevent costly repairs.

- Reffie is creating lead prioritization and lead nurturing software for multifamily leasing agents. Reffie identifies high-propensity renter prospects and targets them with automated campaigns, reducing days-to-lease and therefore vacancy loss.

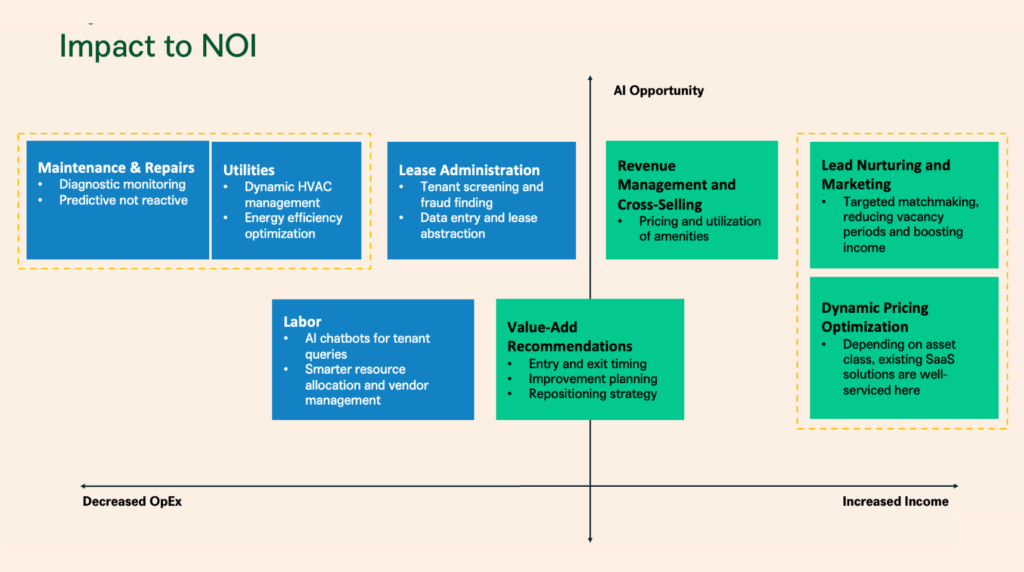

The areas where we see the most potential are where both the AI value-add increment over traditional SaaS and the impact to NOI are highest. Namely: maintenance and repairs, utilities, leasing, and, for high-turnover asset classes such as hospitality, dynamic pricing optimization. However, AI is far less useful for business planning, such as entry and exit timing or making value-add renovations; these decisions still require the deal team’s human touch.

Deal Team Performance Impact Areas

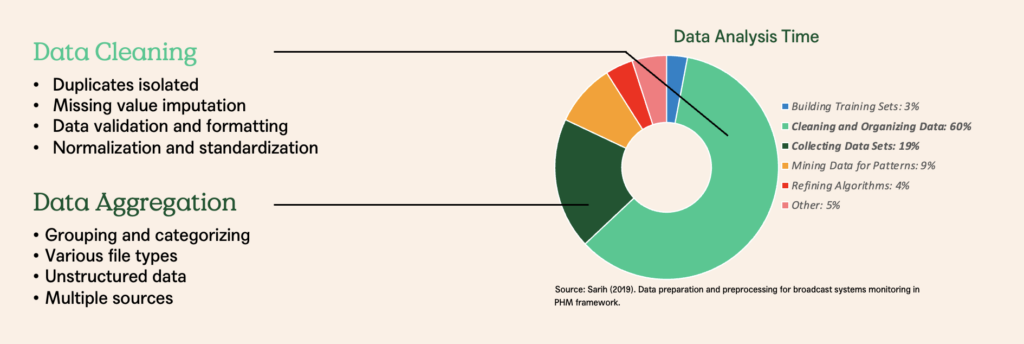

Fortunately for real estate teams, the most time-intensive segments of asset management are also where AI has the most potential to be impactful. It’s well documented across industries that the majority of data analysis time goes into information gathering, cleaning, and aggregation, with relatively little time spent on pattern recognition and refined decision making. In fact, AI is more efficient and accurate than human labor at categorizing data and detecting errors, which applies to many workflows in asset management.

Rent roll cleaning, utility bill categorization, lease abstraction—hand the work to AI and don’t look back…or at least that’s what I hope the future looks like. Here are some of the startups building towards that vision:

- Cherre ingests internal and external asset data to automate asset reviews, reporting, and re-forecasting.

- HelloData leverages real-time market data from millions of rental listings to automate in detail unit-level rents, concessions, and trends across a market. The platform can be used for not only rent decisions but also unit mix and positioning for new developments.

- FYXT uses AI to digitize complex net leases, creating a streamlined workflow for commercial property operations that automates facility management and vendor payments.

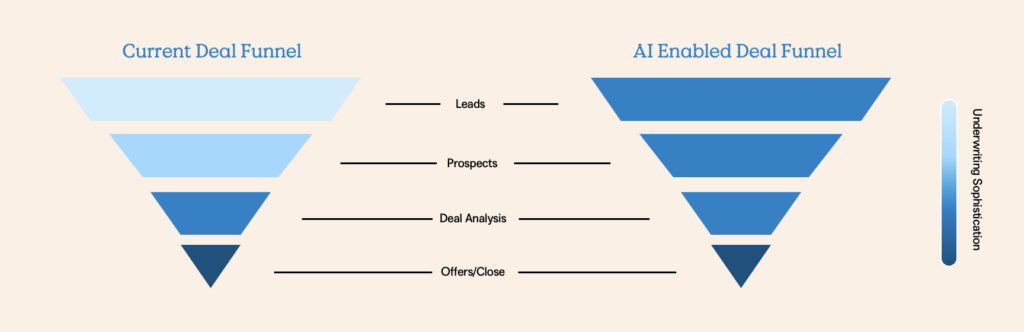

Perhaps the most interesting impact area for deal teams is around the investment funnel and deal underwriting. I used to work in real estate acquisitions, so I know how this goes: for every 100 deals you source you might only select 15 to do preliminary underwriting, of which you might do deep diligence on 5, of which you might bid on 3, of which you might win 1. But what if you could automatically get all 100 deals to the same level of base underwriting? The final 3 deals might look quite different, or at the very least would have substantially more sophisticated analysis informing them.

Historically, the real estate technology market has seen limited success from SaaS companies reshaping the deal underwriting process. But platforms like Built AI, Archer, Clik.AI, and Arx have made substantial improvements upon legacy software by being able to both automate and finetune models to align with investment strategy. This AI inflection point has the potential to not only help deal teams make more sophisticated decisions but ultimately to enable them to scale non-linearly and focus on high-value activities.

Investor Framework: Venture Capital

As VC investors, we feel the need to be very careful about how we invest in the aggressively hyped AI sector. As previously mentioned, industry incumbents such as Yardi, CoStar, and Zillow are building AI products rapidly and benefit from having a data advantage at scale. It’s not just real estate tech incumbents either; traditional big tech companies like Google and Microsoft are giving away massive amounts of AI capabilities and tools to consumers through existing product channels. Headlines like this

are perhaps overly alarmist, but point to a very real zone of commoditization within AI.

So where is the white space for founders? We identified four potential ways new founders can differentiate themselves from the majors:

- Niche Focus and Specialization: Overall, startups are best suited to the application side of AI in areas where big players are less likely to focus or are unable to due to existing business model constraints.

- Proprietary and Unique Datasets: Data is a tricky (and sometimes costly) moat, but companies that can accumulate unique datasets and leverage them to train models can get a massive head start in creating solutions tailored to their customers’ needs.

- Superior User Experience: B2B SaaS isn’t always the prettiest. Depending on the use case, AI can offer significant improvements in intuitive, user-friendly interfaces.

- Innovative Business Models: Some business models simply don’t work without an AI-centric product. For example, SurfaceAI is building an AI-powered ask tool for property managers that integrates across systems, stitching together disjointed point solutions.

Revisiting my in-asset/out-of-asset binary, from a venture standpoint we are particularly interested in the former. Platforms that can successfully generate insights both actionable and valuable to the user have the potential to unlock tremendous ROI, overcoming some of the scaling difficulties of the previous generation of real estate vertical SaaS.

That’s not to say that out-of-asset tools have no place in venture—in fact, they are very compelling from an adoption standpoint. However, selling into deal teams can be a pretty small TAM, and many platforms are buildings towards similar visions, meaning that we would need strong conviction in either penetration or value proposition.

Investor Framework: Real Estate

If we take off the venture hat and put on our real estate hat, it’s an inverted story.

For real estate investors, in-asset tools are more likely to be adopted at the property manager level rather than the owner level. By the time these startups are delivering on their promised ROI, they may simply exist in the market as norms, meaning any owner can underwrite to the same outputs by hiring a manager using those tools (or insisting on their use). For example, we heard frequently that AI-powered hotel revenue management systems consistently create a 20% revenue uplift; it’s fully expected that any institutional-grade asset managers will be using one. However, until these platforms are the norm across the board, there will still be tech arbitrage opportunities for forward-thinking operators willing to work closely with management teams.

Out-of-asset platforms, on the other hand, are poised to supercharge the processes in real estate investment management. These tools not only offer time savings and accuracy improvements, but also the opportunity to institutionalize previous underwritings within a firm and underwrite en masse. Imagine the next time you look at a workforce housing deal in Chattanooga, you can underwrite it against not just the one or two previous Chattanooga housing deals you’ve spent time on, but every deal in that market from the past several years.

Firms like large, single-asset class REITs and brokerages are likely to benefit from these tools the earliest, while more complex opportunity funds that do a diversity of deals will require more AI sophistication. But regardless of investment strategy, early adopters will have the competitive advantage as they begin to accumulate a dataset and build an AI-powered technology stack…

Walking the Walk

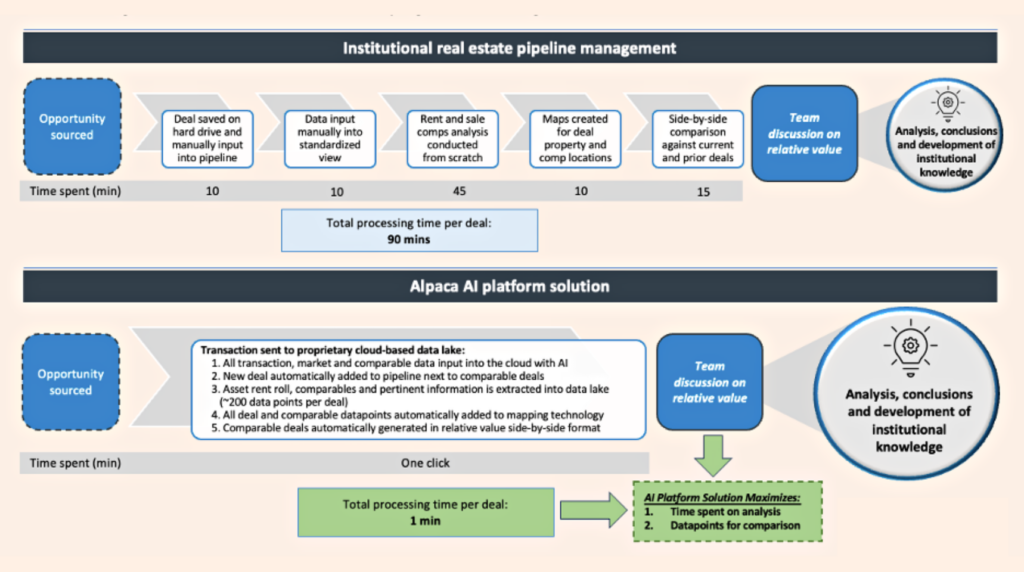

…which is exactly what we are doing at Alpaca Real Estate (“ARE”). We recently launched our own real estate private equity platform headed by industry veterans Dan Carr (formerly Ares) and Peter Weiss (formerly Prospect Ridge / AllianceBernstein). While our Field Studies are written from a venture perspective, much of the research is also actionable for real estate investors, and ARE is our turn to do exactly that: create a next-generation real estate PE firm powered by technology.

We’ve established a symbiotic relationship between the two sides of Alpaca: ARE gets a constantly-updated market map of technologies to assess as accretive real estate overlays, and in return Alpaca VC gets a built-in consumer reference and potential customer pipeline for new venture deals.

As part of building a new real estate platform from scratch, ARE has the opportunity to create its own tech stack by leveraging all the solutions Alpaca VC has been evaluating. For the past nine months, we’ve been hard at work creating a bespoke platform that turns public and private information on pipeline opportunities into actionable analysis with the click of a button—meaning more and better conclusions in a shorter time period.

As a pioneering effort to streamline pipeline and data utilization, these nine months are just the beginning of how the ARE team is thinking about paving the way for AI powered efficiencies. We are confident this upfront time and effort to get this platform off the ground will enable us to be smarter investors with a process that is equal parts sophisticated and efficient.

As always, if you see any interesting companies in this space, please don’t hesitate to reach out [email protected].

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.