Field Study: Staffing Technology

Staffing is one of the world’s largest industries and full of venture-scale opportunities. With two previous investments in the category (TradeHounds and EarlyDay) we are excited to share our survey of the staffing industry, case studies of proven and challenging markets, and an investment framework that demonstrates where we think the best staffing technology opportunities will emerge.

TLDR:

- Staffing ($648B) is global, fragmented, and ripe with venture-scale opportunities.

- Quality staffing technology opportunities target “highly-paid commodity labor.”

- Industries with mission-critical shortages, low automation risk, supply-boosting opportunities are best fit for staffing technology.

- Most business models converge on placement fees at scale, but SaaS plays an important role in employer and candidate retention.

- Segmenting knowledge work is the ultimate opportunity in staffing, but the required technology has yet to arrive.

Why Do a Field Study on Staffing? (AKA the ‘Why Now.’)

Staffing is directly influenced by major secular trends.

From aging populations, to remote work and AI, demographic, technological, and economic trends are upending the traditional employment landscape. Today’s complex inflection point creates new opportunities for venture investment.

Staffing has existing proof of venture-scale businesses.

There are a variety of venture-scale businesses in staffing. Some are directly associated with career placements, while others focus more on gig work and job search. A few examples:

- Staffing/Recruiting: Randstad, Adecco, Manpower, ShiftMed, Andela

- Freelancing: Upwork, Fiverr, Toptal, Freelancer.com, Gigster

- Gig/1099: Uber, Doordash, Taskrabbit, Lyft, Instacart, Rover

- Job Search: LinkedIn, Monster.com, Indeed, Glassdoor, Ziprecruiter

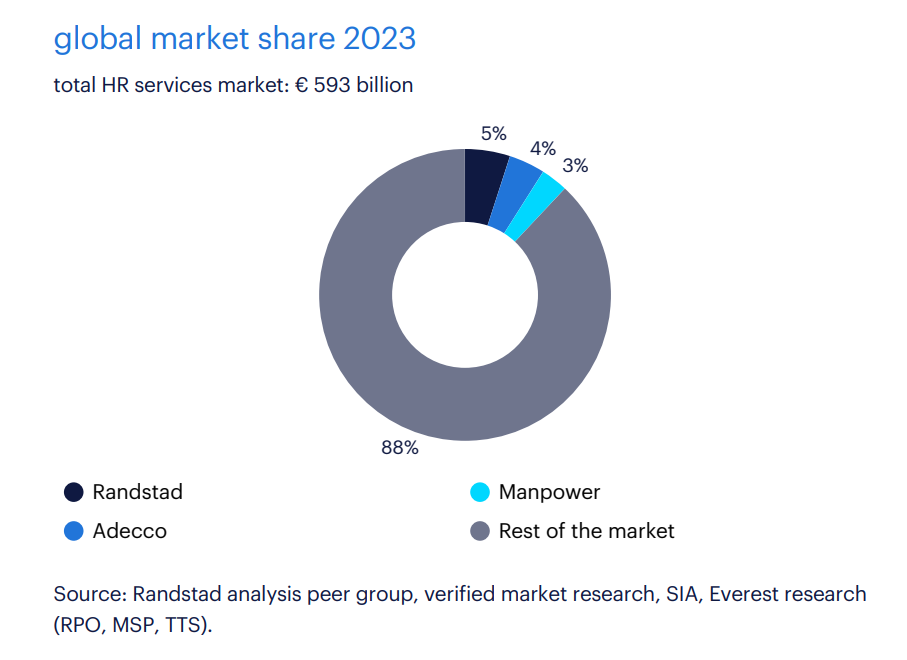

Staffing is massive, global, and deeply fragmented.

The global staffing market was estimated at $648B in 2022, with the U.S. Japan, and the U.K. being the top geographies. The three largest global staffing firms by revenue – Randstad ($27.3B – 2023), Adecco ($25.6B – 2023), and Manpower ($18.9B – 2023) – each have less than 5% market share.

Our first investments in staffing – EarlyDay and TradeHounds – were built to take advantage of gaps left by horizontal platforms like LinkedIn and Indeed. Wonderschool recently acquired EarlyDay, and TradeHounds eventually shut down. We gained a ton of insight from these investments and felt it was high time to revisit the staffing industry with a bottoms-up approach.

We’ll start with a survey of the staffing industry’s history, structure, and trends. We’ll then dive into cases of proven and challenging staffing markets to build out a framework that answers the following questions:

- What are the characteristics of labor pools that “play well” with staffing technology?

- Which industries might support a venture outcome?

- Which business models work – and when?

We’ll take a stab at applying this framework in real time and identify a few industries we think might be fruitful. In closing, we’ll comment on knowledge work as the “final boss” of staffing and how intelligent systems might one day overtake human, trust-based hiring.

Industry Background (1650-Present)

The modern staffing industry emerged prior to the industrial revolution and accelerated significantly in the twentieth century.

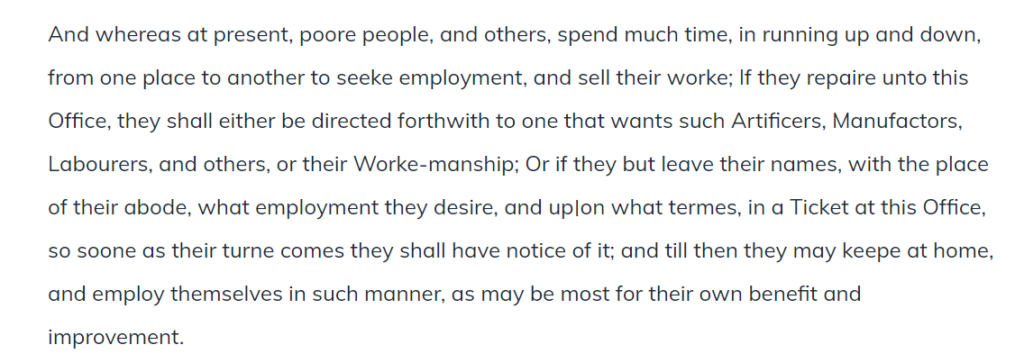

1650: English merchant and writer Henry Robinson distributes The Office of Addresses and Encounters. In it he proposes a single venue (read: a marketplace) on Threadneedle street in London where those seeking work could easily find it, rather than “running up and down, from one place to another.”

1873: Gabbitas and Thring is founded to recruit teachers for top English schools in the United Kingdom. Notably, both H.G. Wells (War of the Worlds) and C.S. Lewis (Chronicles of Narnia) served as tutors. Gabbitas still operates today but no longer provides staffing services.

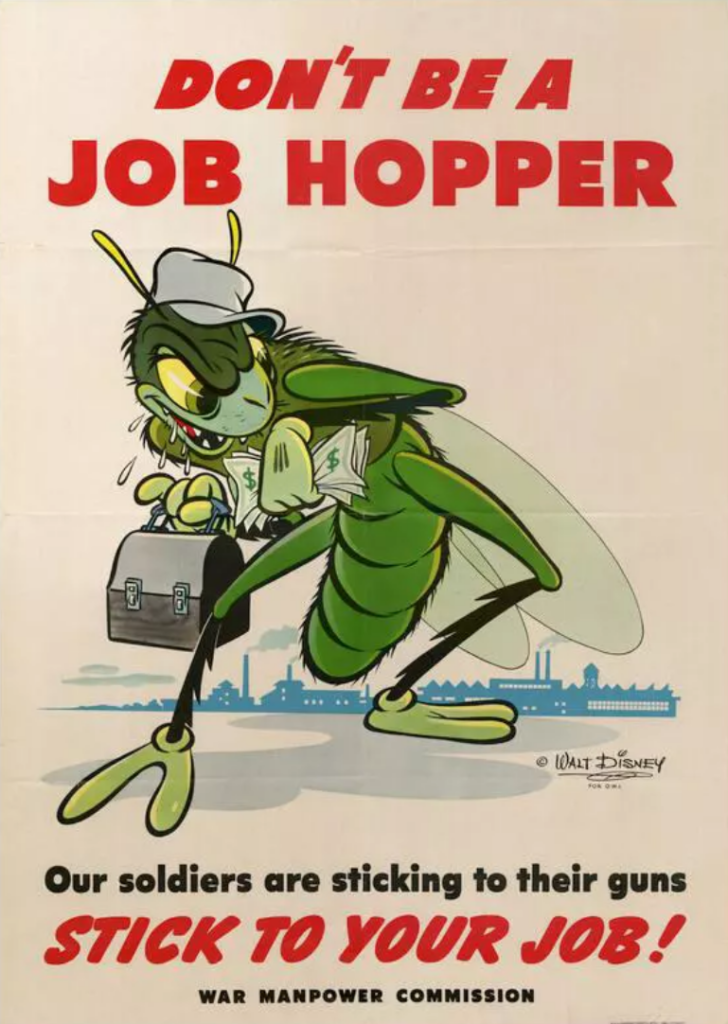

1940s: President Franklin D. Roosevelt calls on American industry and labor to form a “great arsenal of democracy.” By radio broadcast in 1940, he reverses course on isolationist, non-interventionist foreign policy, triggering a war material production (and labor) boom. Many of the major staffing firms operating today are founded in this era: Manpower (1948), Kelly Services (1946), and Robert Half (1948).

1950s to 1960s: The nascent staffing industry rides the wave of postwar economic expansion. Soldiers returning from WWII rely heavily on agencies to find work, and staffing firms diversify into solving specialized workforce issues.

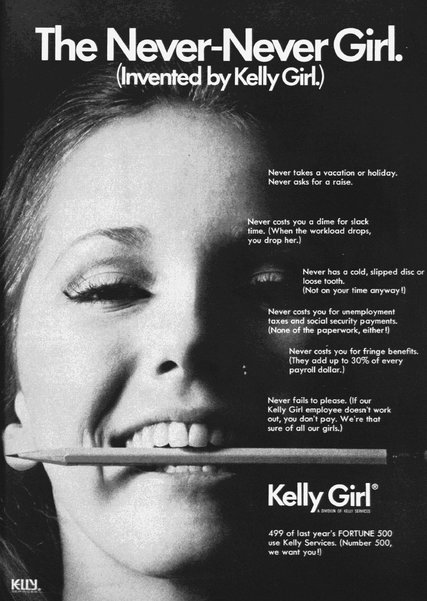

1970s: Staffing expands again into administrative and semi-permanent work. Controversial but highly popular “Kelly Girls” become emblematic of the shift towards flexible, temporary, and fungible work.

1990s: Application tracking systems are introduced as on-premise software. Early job-search platforms emerge shortly after: Online Career Center (1992), Monster (1994), Craigslist (1995). Staffing grows into professional job categories like engineering, accounting, and programming.

2000s to Early 2010s: Career networks and online job search proliferate. Broadband penetration and mobile devices lead to the creation of modern gig/freelance work. Beginning of the modern labor era: LinkedIn (2003), Indeed (2004), Amazon Mechanical Turk (2005), Uber (2009), DoorDash (2012), Fiverr (2010), Upwork (2013).d

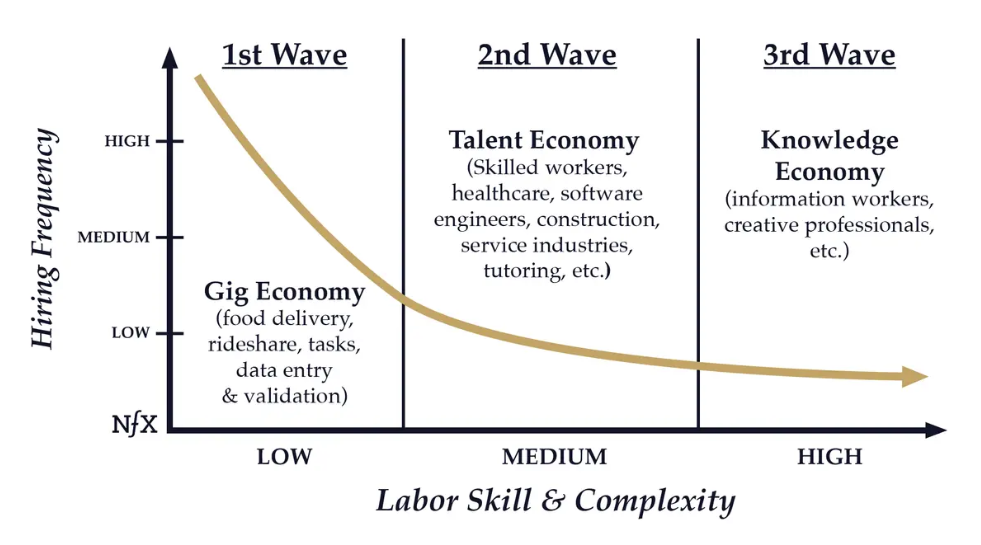

Mid-2010s to Present: Vertical staffing platforms enter the market. Building on the growth of mobile, the newest entrants to leverage machine learning, global talent pools, flexible work offerings to meet employer demands. Notable companies: Workrise (2014), Incredible Health (2017), ShiftMed (2019), Traba (2021).

The Staffing Process

Staffing can be segmented into three fundamental jobs: sourcing, assessment, and matching. In practice, these tasks often blend together (e.g. employee referral programs) but are worth considering separately for clarity:

Sourcing

Sourcing involves identifying, attracting, and engaging potential employees. Historically this process was people-powered: human recruiters, talent agents, and physical offices. Today, digital channels (e.g. job boards, social networks, online communities, candidate databases, and advertising) are prevalent, but firms like Manpower still have over 2,000 brick and mortar offices globally.

Even with the growth of digital, physical presence is still considered critical to effective sourcing. Staffing has an extremely low barrier to entry, so local and regional staffing firms are usually the most intense competitors. Many modern career platforms lack physical locations and thus find their advantage in specialization – building entire systems from the ground up to create network effects in highly specific verticals like nursing.

Assessment

Assessment involves evaluating a candidate’s skills, abilities, and knowledge. Evaluation can include review of professional documents, behavioral interviews, take-home work, and – occasionally – on-site interviews and examinations. Human analysis is prevalent, but some more sophisticated tools like HireVue (founded 2004) are still in use today.

Today, the de-facto assessment (or more accurately, filtering) method is mostly automated with machine learning. From startups to multinationals, virtually every company uses natural language processing to parse candidate data and act as a filter somewhere in their process.

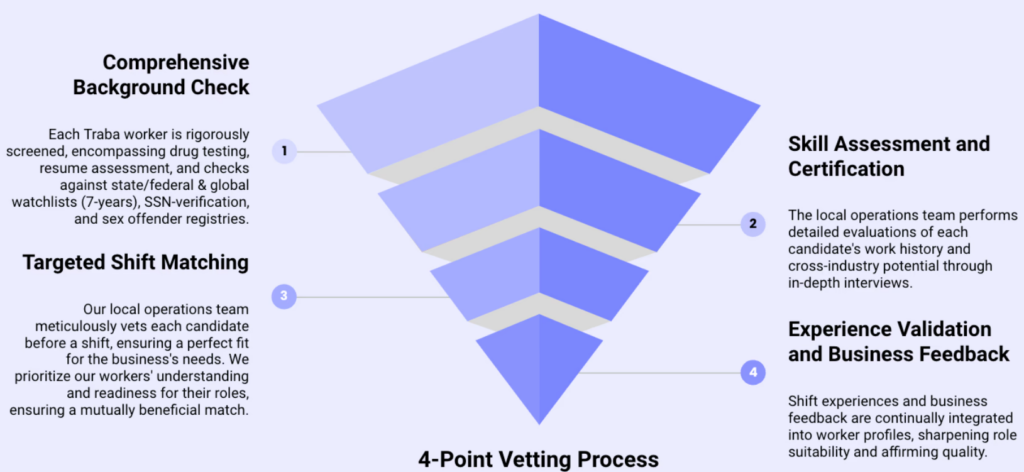

Modern vertical career platforms today are taking this one step further by honing on explicit credentials and experience to fast-track assessment. Labor pools that show clear, standardized skill definitions have attracted the most early-stage investment.

On the frontier, assessment is going beyond traditional skills and credentials. In today’s AI era, resumes, cover letters, and even video interviews are increasingly noisy and unreliable signals of candidate quality. In response, alternative and micro-credentials are growing in popularity.

Alternative credentials use non-standard data sources as evidence of employability. In one company we found, a candidate’s video game performance data could be used to measure soft-skills and behavioral traits.

Micro-credentials are affordable, short-term educational programs to build highly specific skills. They’re typically delivered online and are sometimes bolted onto traditional degree programs. High costs, limited flexibility, and low completion rates in traditional higher education drive micro-credential growth, but some employers sometimes struggle to validate their effectiveness.

Gamified recruiting is also emerging. Jane Street, the proprietary trading firm, released a digital market-making game, Figgie, that emulates open-outcry commodities trading. The game is explicitly being used as a sourcing engine to identify potential trading talent.

Matching

Matching, like sourcing and assessment, is often done by people. Nuanced knowledge of what employers require is one of the major reasons why local and regional staffing firms are fiercely competitive.

For the most part, matching has seen little innovation beyond natural language processing. Modern career platforms add automation and searchability – periodically sending matches to employers, providing on-demand matches, and making opportunities searchable on their platform.

In reality, much of the lift associated with matching actually occurs during assessment. Both Traba and Incredible Health are companies with intense onboarding flows that precisely capture employee qualifications and capabilities. Additionally, modern career platforms are starting to look more like gig work by offering immediate payouts and real-time shift availability.

Secular Trends in Staffing

Staffing has through-lines with nearly every secular trend:

Demographic

- Over two thirds of humans are expected to be living in cities and urban environments by 2050 (United Nations)

- Fertility rates are below replacement level in over fifty-percent of countries (Institute for Health Metrics and Evaluation)

- 1 in 6 people will be aged 60 years or older by 2030 (World Health Organization)

Technological

- Remote, digital, and hybrid positions are expected to represent 92M jobs by 2030 (World Economic Forum).

- Automation is both creating and eliminating jobs in knowledge and skill-based roles.

- The rate of American workers employed by international companies increased 62% in 2023.

Economic

- Unemployment is essentially flat since 2022, yet transportation, technology, and healthcare still show critical workforce shortages.

- Younger generations are questioning the value of work with movements like antiwork, eco-anxiety, and FIRE – where permanently exiting the workforce is a primary goal.

- Traditionally speculative assets – meme stocks, cryptocurrency, sports betting, prediction markets – are becoming mainstream alternative income sources:

Together these trends illustrate some of the fundamental forces at play in staffing: accelerated globalization, a growing desire for flexible, skill-based, often digital work, and a need to adapt to shifting generational preferences.

Staffing boasts an abundance of thematic opportunities, but where has early-stage investment actually been allocated? The next section will cover nursing, arguably the most well-developed and heavily capitalized labor pool in staffing.

Nursing → A “Goldilocks” Market

There are approximately five million nurses in the US. Nurses are trained to handle a variety of tasks from patient care and procedure assistance, to documentation and emergency response. Nursing is also a microcosm of virtually every thematic trend facing labor markets.

For nurses, college enrollment is slowing, the workforce is aging rapidly, and the work environment is exacerbating shortages. In a 2023 survey, 94% of health system executives described the nursing shortage as “critical.”

In response, hundreds of millions of dollars have been allocated towards addressing nurse staffing issues:

- Lantum Health

- Founded 2012. End-to-end workforce management platform for healthcare organizations. Raised $15M in 2022 from Finch Capital, Samos, and Cedars-Sinai Hospital. Estimated $32M raised in total.

- ConnectRN

- Founded in 2014. On-demand staffing platform connecting nurses with flexible shifts at healthcare facilities. Raised $76M in 2021 led by Suvretta Capital Management and Avidity Partners. Over $100M raised in total.

- Nomad Health

- Founded 2015. Online marketplace for healthcare jobs, including travel nursing positions. Raised $22M in June 2024 from HealthQuest Capital, Icon Ventures, and .406 Ventures. Over $200M raised in total.

- CareRev

- Founded 2015. Technology platform allowing healthcare facilities to post open shifts for qualified professionals. Raised $50M Series B from Transformation Capital Partners. Estimated $50M raised in total.

- Clipboard Health

- Founded 2016. Marketplace connecting healthcare facilities with available nurses and aides. Raised $80M Series C in 2022 led by Sequoia Capital. Over $90M raised in total.

- Patchwork Health

- Founded 2016. Digital workforce solution helping healthcare organizations manage temporary staffing. Raised €20M Series B in 2022 led by Perwyn. Over €30M raised in total.

- IntelyCare

- Founded 2016. AI-powered nurse staffing platform matching nurses with available shifts. Raised $115M Series C in 2022 led by Janus Henderson Investors. Estimated $174M raised in total.

- ShiftKey

- Founded 2016. Marketplace for healthcare professionals to find and book open shifts. Raised $300M in 2023 led by Lorient Capital. Estimated $757M raised in total.

- Gale

- Founded 2016. Healthcare staffing platform focused on connecting nurses with flexible work opportunities. Raised $60M in 2022 led by FTV Capital. Bootstrapped prior to FTV’s investment.

- Incredible Health

- Founded 2017. Career marketplace helping nurses find permanent positions at hospitals. Raised $80M Series B in 2022 led by Base10 Partners. Estimated $97M raised in total.

- Trusted Health

- Founded 2017. Career platform for nurses offering job matching and career support. Raised $94M Series C in 2021 led by Greenspring Associates. Over $175M raised in total.

- Vivian Health

- Founded 2017. Job marketplace for healthcare professionals, especially travel nurses. Acquired by IAC/InterActiveCorp in 2019. Last raised $60M in 2022 led by Thoma Bravo.

- ShiftMed

- Founded 2019. On-demand staffing platform for healthcare workers and facilities. Raised $200M in 2023 led by Panoramic Ventures. Estimated $292M raised in total.

- Nursa

- Founded 2019. Mobile app connecting nurses and healthcare facilities for PRN shifts. Raised $80M Series B in 2023 led by Drive Capital. Over $100M raised in total.

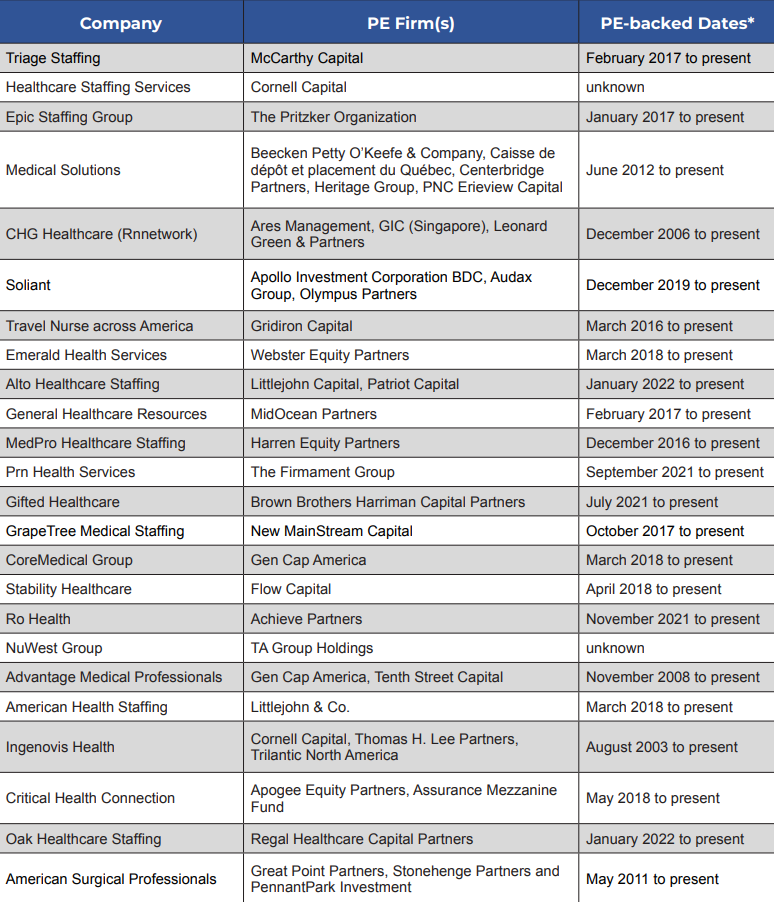

Private equity firms have also made numerous later-stage nurse staffing investments, specifically in travel.

Three fundamental factors drive investment activity in nursing: high compensation, low geographic/economic sensitivity, and robust credentialing.

High compensation → The median registered nurse (RN) earns $86,000 annually. With wages at this level, hiring transactions in nursing can support transactional business models (like placement fees or contract markups) that are necessary for scale.

Low geographic/economic sensitivity → Demand for nursing is consistent across geographies with shortages in every US state. Nursing is also resistant to economic, political, and public health issues.

Robust credentialing → Nurses have detailed licensure and certifications, and their experience can be segmented by factors like the type of care, patient population, and facility.

Investment activity in nursing illustrates the central thrust of modern staffing technology: finding a highly compensated, well-defined labor pool, and leveraging technology to make hiring transactions as frictionless as possible. These platforms enable labor to function more like a liquid, tradeable commodity.

—

Not every market is as readily-investable as nursing. Next, we’ll look at markets that look promising on the surface, but have struggled to support modern staffing technology.

Challenging Markets → Childcare/Behavioral Health/Agriculture

From the outside, each of the following labor pools seems like an obvious choice for staffing technology:

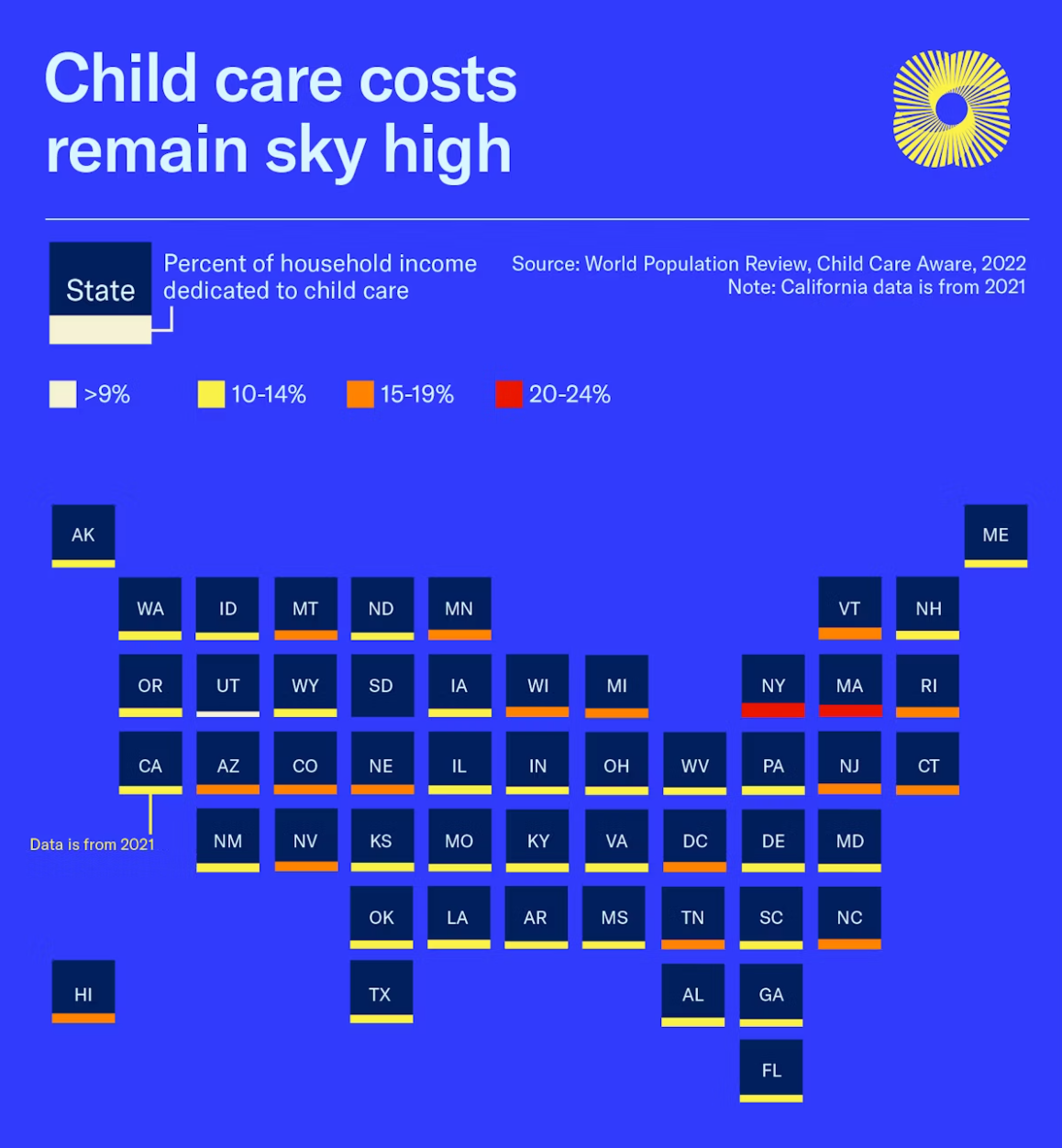

Childcare → Despite a surge of childcare venture funding in 2021, an estimated 50% of childcare centers still under-enroll due to labor shortages. With pandemic-related CARES act funding depleted, the childcare shortage has only accelerated.

Behavioral Health → 169M Americans live in a mental health shortage area. In applied behavioral analysis (ABA) specifically, technician turnover is as high as 75% annually. Venture funding has flowed mainly to software-as-a-service, practitioner enablement, and telehealth. Paraprofessionals make up a significant part of care delivery.

Agriculture (Farmworkers) → 31% of agricultural yield is wasted due to labor shortages. Simultaneously, half of US farm workers lack legal immigration status. Though shortages are rampant, venture funding in agriculture has mostly been allocated to robotics, biotech, and sensors.

Bonus: Construction/Skilled Trades → Tradespeople are rapidly aging out of the business. 30% of union electricians are near retirement and 1 in 5 construction workers are over 55. At the same time, trades are heavily stigmatized. Workrise (formerly RigUp) attempted to enter skilled trades but subsequently folded the divisions to focus exclusively on energy.

Various structural issues prevent broader venture investment: poor compensation/lack of benefits, challenging working conditions, and a lack of robust credentialing.

Poor Compensation/Benefits

Lower pay accelerates turnover, drives away potential candidates, and increases geographic sensitivity as fewer people are willing to travel or relocate for low-paying work. Annual median wages for childcare and agriculture are approximately $32,000 and $34,000 respectively. Behavioral health is more difficult given the mix of professional careers, but most support positions pay well under $50,000 annually. Because these positions are typically hourly or contract, benefits are seldom offered.

Recall that staffing companies rely on placement fees as their core revenue stream. Lower wages translate to lower contract values and require higher placement rates or a larger fee percentage to compensate.

Challenging working conditions

Challenging working conditions create additional complexity. Caring for children can be unpredictable, messy, and emotionally draining. Agriculture is seasonal, outdoor, physically demanding work. As for behavioral health, an anecdote from a recent attempted investment:

In 2023, we performed investment diligence on a pre-seed software company building tools for Applied Behavioral Analysis (ABA). ABA is mainly administered to children struggling to develop social, cognitive, and emotional skills. Although graduate-level practitioners design and oversee treatment plans, junior practitioners called Registered Behavior Technicians (RBTs) actually deliver them. RBTs earn roughly $20/hour, start the job with forty hours of training, and usually quit within six months.

When we spoke to RBTs about their experience, they reported scheduling challenges, excessive workloads and barebones resources. Many also felt ill-prepared for common issues like children hitting, biting, and spitting on them – citing a lack of training and standardization as key reasons they left the industry.

Lack of robust credentialing

Childcare offers a variety of certifications and permits, but few – excluding CPR and First-Aid – are explicitly skill-based. Most are “fuzzy” credentials that signal general knowledge like the Childcare Development Associate Credential, the Nanny Basic Skills Assessment, and Professional Nanny and Childcare Provider Certification.

Behavioral health is similar in that credentials signal general knowledge and higher education, but offer little labor segmentation. Two therapists can hold the same credential with vastly different professional backgrounds and experiences.

Agriculture offers few credentials. A handful of regional organizations, however, are showing more interest in segmenting agricultural labor.

Generalizing to an Investment Framework

Recall that we started with the following questions:

- What are the characteristics of labor pools that “play well” with staffing technology?

- Which industries might support a venture outcome?

- Which business models work – and when?

What are the characteristics of labor pools that “play well” with staffing technology?

Competitive compensation and benefits

Compensation should exceed the median income by some margin. In the U.S., earning at least $50,000 (or $25/hour full-time equivalent) would qualify. Below this level, candidate pipeline and retention issues crop up more often. Common complaints in lower-paid industries (like restaurants) include a lack of applicants, missed job interviews, and frequent “no-call, no-shows.”

Average candidate quality increases with compensation, but also necessitates offering benefits like health insurance, retirement plans, and time off. At high levels where compensation is similar, benefits are often make-or-break. In nursing specifically, benefits packages are table stakes – even for shorter travel and contract placements.

Explicit labor segmentation

A candidate’s credentials should prove skills in absolute terms; Instrument ratings for pilots prove they can fly in low visibility. Holders of Class B commercial driver’s licenses can drive passenger buses and box trucks, but not tractor trailers or flatbeds. Licensed registered nurses can administer medication, manage intravenous therapy, and provide basic life support. When skills are explicit, sourcing pipelines can be readily identified – e.g. vocational schools, certification programs, and targeted training courses.

Candidate evaluation, as well, becomes trivial for automated systems. Does this candidate hold the requisite credentials? Do they have experience with the relevant tools and equipment? Have they worked in this or a similar setting? How many hours or years of experience do they have in each? Hiring managers, accordingly, can spend more time considering candidates holistically and less time verifying basic competence.

Low geographic/economic sensitivity

Staffing entails some geographic sensitivity. Industries like energy and semiconductors are concentrated in specific regions. Healthcare and transportation are ubiquitous, but not uniformly distributed. Even remote work often entails some time zone sensitivity.

Where employers are located and workers’ willingness to travel to them dictates how staffing platforms reach scale. If labor isn’t willing to move or relocate, new staffing markets become demand-sensitive and have to be built geography by geography. If labor is willing to move, new staffing markets can become demand-led and be spun up non-geographically. Note that employer density likely still plays a role in where candidates want to move.

Cyclical industries – those that fluctuate on factors like investment activity, consumer demand, and interest rates – present unique challenges. Consider: how technology companies have hired (and fired) in response to large language models, how plunging natural gas prices affect oilfield labor, and what travel restrictions do tourism-based economies. Though no industries are truly recession-proof, some like healthcare, utilities, and telecommunications experience fewer “booms and busts” with regards to headcount.

Which industries might support a venture outcome?

Aviation (Pilots)

Global aviation is expected to be short 80,000 pilots by 2032. Pilots regularly earn over $75,000 and hold well-defined credentials like instrument and multi-engine ratings in addition to their FAA-regulated licenses. Pilots are also easily segmented by aircraft, flight hours, and operation types.

Air travel exhibits some cyclicality but – excluding pandemic-level economic disruption – maintains a relatively stable pilot workforce. Notable caveats: Flight training is complex, is a years-long time commitment, and regularly costs tens of thousands of dollars. To be fit for early-stage investment, we’d have to understand how complexity, training cost, and timelines to competence affect the candidate pool.

Semiconductors (Engineers/Technicians)

The semiconductor industry is expected to be short by nearly 70,000 technical employees by 2030. Completion rates for technical degrees lag demand, even as average salaries for engineers ($70K) technicians ($60K) regularly exceed U.S. median income.

The CHIPS Act is committing over $50B to build the U.S. semiconductor industry, but existing facilities are struggling to find and retain talent. In Arizona, a hub for semiconductor investment, Intel and TSMC are collaborating with the government and community colleges to shorten the pathway to technician employment.

Though the regulatory and investment tailwinds are strong, the industry is geographically concentrated and still building out credentialing pathways. Fabrication facilities (which hire thousands of workers) cost tens of billions of dollars, take years to build, and are present only in a few large states – namely California, Arizona, and Texas. To be fit for early-stage investment, we’d have to understand the real strength of regulatory tailwinds, how geography affects hiring dynamics, and whether credentialing pathways are advancing quickly enough.

Public Transportation (Vehicle and Light Rail Operators)

The median transit operator earns $50,000 annually, though this can increase depending on the state. Vehicle and light rail operators hold commercial driver’s licenses (CDLs) that can be easily segmented by class, endorsement, and vehicle type.

Shortages in commercial trucking are well-documented, but public transportation (an $80B industry in the U.S.) faces equally critical workforce gaps. Last year, 84% of transit agencies reported labor shortages that impacted service. Public transportation faces unique hiring challenges as well, with 35% of candidates actually rejecting agency job offers. Industry observers point to subpar working conditions, needlessly long application cycles, and competition from other industries as key drivers of shortages.

Early-stage investment dollars to date have been allocated to autonomous vehicles and logistics, though progress in the category is slowing. TuSimple’s co-development plan with Navistar fell apart in late 2022. Waymo discontinued its autonomous trucking operations in mid-2023. Though these early experiments failed, autonomous trucks still seem inevitable.

To be fit for early-stage investment, we’d need to consider if and when human operators might be replaced with autonomous vehicles, how staffing technology might alleviate challenging work conditions, and which business model(s), if any, are optimal for a middle-wage labor pool.

As an added bonus, building a network of CDL holders should reveal auxiliary, if larger, opportunities to match talent to logistics firms.

Bonus: Nuclear Energy

The median nuclear operator earns over $100,000 annually.

Nuclear power is responsible for around 20% of U.S. generation and is undergoing a shift in public perception. Renewable sources like solar and wind have failed to replace baseline generation, struggling with grid intermittency and a lack of utility-scale storage. With new commercial-scale projects like Vogtle 4 launching, weakening demand for fossil fuels, and AI demanding energy for training and inference, nuclear seems to be turning a corner.

At the same time, nuclear power is heavily stigmatized as an industry, technology, and career path. Although nuclear power readily generates emission-free baseload power, its association with atomic weaponry and large-scale disasters has inhibited growth in the U.S. As a result, credentialing pathways are immature and the majority of new reactor construction is in China, India, and Turkey.

Compared to the more near-term industries we’ve identified, nuclear is more of a thematic, long-term opportunity – even though it’s a $40B industry in the U.S. To be fit for early-stage investment, we’d have to determine whether or not regulatory, commercial, and technological tailwinds are strong enough to drive more talent into the space – and that the industry will grow quickly enough to support their employment.

Small modular reactors (SMRs) are an interesting possibility for nuclear industry growth, because they require less capital and have a smaller physical footprint. China and Russia have successfully deployed SMRs. The U.S. has yet to do so.

Which business models work – and when?

Most staffing technology companies have a number of business models that depend on the labor pool. The primary models in staffing are placement fees and SaaS.

Placement Fees

Placement fees are the most common business model in staffing and are popular for permanent and semi-permanent roles. Employers pay staffing firms anywhere from ten to thirty percent of the contract value or starting salary. The actual rate is usually compensation-dependent, with lower-paid positions balanced by a higher take rate.

Contract markups are a subcategory of placement fees. They are prevalent in per-diem and hourly work where engagements are short-term, discrete, and labor is highly fungible. Examples include warehouse workers, nurses covering absences, and event staffing. Take rates and passing-through of costs is similar, but workers are typically classified as independent contractors (1099) rather than W-2.

SaaS

Scaled staffing firms converge on placement fees as a core revenue driver. That said, SaaS is still critically important to boost employer retention and help firms transition from pure labor suppliers to managed services providers. Most modern platforms offer integrations at a bare minimum, with more advanced companies offering full software suites to manage the on-demand workforce they offer.

In general, SaaS is deployed to improve employee experience and embed staffing platforms deeper into employer workflows. SaaS in the long run might actually function as a trojan horse – collecting valuable data and growing into a significant, independent line of business for staffing platforms. This would only be possible if employers readily adopt and pay for SaaS. Industries that rely on legacy or on-premise software like hospitality and aerospace might conflict with current-generation SaaS business models.

—

Note that these opportunities we’ve identified aren’t perfect. There are long credentialing pathways, varying compensation ranges, complex regulations, and markets that still need to ‘take off.’ Still, the secular tailwinds, thematic opportunities, and relatively low risk of automation make these opportunities suitable to at least consider for early-stage investment.

But how might a startup act on these opportunities? In most cases, the obvious (and generic) answer is to boost labor supply in markets that need it.

Boosting Labor Supply: Upskilling, Dormant Labor, and Worker-Driven Social Responsibility

Upskilling

Upskilling, the process of augmenting an employee’s existing skills – is a popular and well-tested pathway. Upskilling is often targeted at existing employees, as in the case of Mastercard’s professional upskilling programs and AT&T’s $1B “Future Ready” program.

More recently, these types of development programs have transformed into recruiting tools, like Verizon’s Skill Forward program that’s now available for free to the general public. Upskilling-as-recruitment is also deployed in the transportation industry – a great example being the Utah Transit Authority’s “early onboarding” program:

The transit authority was losing up to 80% of its applicants to other employers until they implemented a new regime that hired new drivers immediately, paid for their training, and helped them quickly earn CDLs. The program showed 80% driver retention and a 90% CDL pass rate.

Upskilling-as-recruiting is a compelling option for industries with long onboarding and complex credentialing – especially if the program can help shorten time-to-hire.

Dormant Labor

Under or improperly-utilized labor pools also present win-win opportunities to solve labor shortages, increase employment, and better integrate people on the margin of society.

Disabled people, as one example, face roughly twice the unemployment rate of non-disabled people. Disability accommodations also have a reputation for being onerous and expensive, but in reality 49% of ADA employers reported that their accommodations cost nothing to implement. Depending on the type and severity of disability, remote work removes even more barriers to entry. Most hiring of disabled employees today comes from independent nonprofits servicing federal AbilityOne contracts, but we believe there is ample opportunity in the broader private sector.

Formerly incarcerated people represent another challenging dormant labor pool. With an unemployment rate that frequently exceeds 20%, people exiting incarceration face legal and regulatory restrictions that lead to 75% of them remaining unemployed one year post-release. Educational gaps are often a significant barrier.

With more than 600,000 people released from state and federal prisons annually, there must exist opportunities for thoughtfully-deployed technology to help some percentage of them find work, decrease recidivism rates, and address the labor shortages present in nearly every industry.

Worker-Driven Social Responsibility

In the section on challenging staffing markets, we referenced tough working conditions as an aggravating factor and the agricultural workers in Immokalee, FL who created their own workplace heat rules. Surprisingly, this was not a one-off win for labor in an isolated market. The heat policies were an extension of the Fair Food Program – a type of worker-driven social responsibility (WSR) program – that uses major buyers’ purchasing power to ensure “fair play” (i.e. safe, humane working conditions) from growers.

The Coalition of Immokalee Workers (CIW) formalized the program in 2011 in response to “modern-day slavery” in Florida agriculture – including instances of forced labor, armed surveillance, and debt peonage. The program originated after a successful four-year, grassroots protest of Yum! Brands in 2005 that forced the company to pay more for tomatoes and pass the premium on to farmworkers.

Since then, major buyers like WalMart, McDonalds, and Sodexo have signed binding agreements that prefer – and pay a premium to – growers that adhere to a worker-designed code of conduct. Laborers collect the buyers’ premium and are guaranteed fair, monitored compensation, freedom from exploitation, and guaranteed protections around shade, water, and excessive heat. The program has been extremely successful today, earning recognition from both the White House and the MacArthur Foundation.

While historically this kind of action was the purview of labor unions, the Coalition of Immokalee Workers is a 501(c)(3) – a nonprofit organization. Instead of collective bargaining, WSR programs use economic incentives to enforce ethical behavior.

Modern staffing platforms in highly-developed markets are starting to exhibit WSR-like traits. ShiftMed, in particular, hires the over 350K nurses on its platform as W-2 employees, offers comprehensive benefits, and – in some cases – guarantees payment if a facility cancels. As modern staffing platforms shift from labor suppliers to managed service providers, it’s easy to see how a staffing platform at scale could limit or revoke access to demand sources that don’t meet their labor pool’s minimum criteria.

Summarized Investment Framework

In summary, our investment framework suggests that quality staffing technology opportunities:

- Target labor pools with competitive compensation, explicit labor segmentation, and low geographic/economic sensitivity.

- Consider industries with mission-critical shortages, low automation risk, and opportunities to deploy supply-boosting strategies.

- Balance placement fees and SaaS to optimally serve a specific industry.

As a caveat, we believe that there are unlocks for difficult markets that today don’t appear ready to support a venture-scale outcome. Because labor is a complex, human issue, there’s a decent chance that compelling opportunities in those “challenging” labor pools might not adhere to this framework at all. In that case, we plan to consider our research, but ultimately default to our fundamentals – deep, founder-led underwriting.

Knowledge Work – The “Final Boss” of Staffing

Knowledge workers are professionals that differentiate based on their decision making and interpersonal skills. Large staffing firms already agree that their employment is the future of the industry because it offers higher bill rates, better gross margins, longer assignments, and more openness to remote. Notably, even prestigious employers like private equity firms , investment banks, law firms, and nonprofits face difficulties in acquiring and retaining top talent.

The challenge with knowledge work is that most placements are network-based. Sourcing (excluding the entry level) happens through personal networks rather than formal recruiting pipelines. Assessment is tougher too because candidate experience is highly subjective and institutional reputation (prestigious employers, top universities, etc.) are often relied upon as a proxy for competence. Labor can’t be reliably segmented, which is why today’s staffing platforms focus exclusively on highly-paid commodity labor.

Segmenting knowledge work requires assessing candidate quality using disjointed, fuzzy indicators like past experience, institutional reputation, and professional references. Few human evaluators could see enough candidates to meaningfully generalize their evaluations, especially given the cultural and geographic biases involved. Large language models, on the other hand, might offer a solution.

Though their ability to interpret context is limited – and controversial – over time LLMs should make light work of actually interpreting a knowledge worker’s competence. This would entail moving beyond basic keyword matching towards true natural language understanding, though the technology has yet to advance to this degree.

Conclusion

In this piece we covered the broader staffing industry, shared our experience investing in this market, and developed an investment framework to evaluate staffing-tech opportunities.

We looked at the labor pool characteristics of nursing, childcare, behavioral health, and agriculture, comparing their compensation, credentialing pathways, and working conditions.

We found that quality should emerge in well-compensated, recession-proof labor pools with explicit skills. The accompanying industries should exhibit mission-critical shortages, low automation risk, and opportunities to deploy supply-boosting strategies. We found that while most scaled staffing business models converge on placement fees, SaaS plays a critical role in driving candidate and employer retention. We also discussed knowledge work and how it acts as the “final boss” of the staffing industry.

Global staffing is a massive, fragmented – but fundamentally human – industry. As we continue to develop this framework, we look forward to partnering with founders hungry to take on the complexity, nuance, and greenfield opportunities available in the space.

—

Building something in the space? VC (or LP) who wants to learn (and share)? Reach out to David Goldberg (david[at]alpaca.vc) or Noah Williams (noah[at]alpaca.vc).

—

Sources (Section-by-Section)

Why Do a Field Study on Staffing?

- Growth of Global Staffing Market Cools But Still Reaches $648 Billion (Staffing Industry Analysts, 2023)

- Fourth Quarter Results (Randstad, 2023)

- Q4 and Full Year 2023 Results (Adecco Group, 2024)

- Form 10-K (ManpowerGroup Inc., 2023)

- EarlyDay acquired by Wonderschool to further mission to alleviate staffing stresses in child care (Refresh Miami, 2024)

- Trade Hounds Raises $3.2M To Become The ‘LinkedIn Of The Construction Industry’ (Crunchbase, 2020)

Industry Background (1650-Present)

- The Office of Addresses and Encounters (University of Michigan)

- Gabbitas – Supporting the Education Journey (Gabbitas)

- December 29, 1940: Fireside Chat 16: On the “Arsenal of Democracy”

- War Production – Ken Burns (PBS, 2007)

- The Rise of the Permanent Temp Economy (New York Times, 2013)

- Online Recruitment Entrepreneur Bill Warren Dies (Hunt Scanlon, 2019)

- LinkedIn’s startup story: Connecting the business world (CNN Money, 2009)

- Indeed: Tech Start-Up That Broke The Mould

- Research in the Crowdsourcing Age (Pew Research, 2016)

- The history of Uber (Uber, 2024)

- The DoorDash Story (DoorDash, 2013)

- Fiverr’s Road to 797% Growth: The Decision Frameworks Behind Their Success (NFX, 2020)

- Everything You Wanted To Know About The Giant Elance, oDesk Merger & Ensuing Backlash (But Were Afraid To Ask) (TechCrunch, 2013)

- Workrise (Contrary Research, 2023)

- Investing in Incredible Health (Andreesen Horowitz, 2019)

- Empowering Nurses: An Interview with ShiftMed CEO Todd Walrath (Thinc, 2024)

- Working with The Olympians: Inside Traba’s Intense Culture

The Staffing Process

- 2023 Annual Report (Robert Half, 2023)

- The New Generation of Labor Marketplaces and the Future of Work (NFX, 2020)

- ‘Exact same cover letters word for word’: Career consultant says Gen Z are misusing AI (CNBC, 2024)

- Alternative Credentials Key to Meeting Labor Needs (NSPA, 2024)

- Alternative Credentials (Miami University)

- Microcredentials Confuse Employers, Colleges and Learners (Inside Higher Ed, 2023)

- Figgie (Jane Street, 2024)

- Hire your next permanent nurse on Incredible Health (Incredible Health)

- Elevating Worker Vetting: How Traba Sets the New Standard in Staffing (Traba, 2024)

Secular Trends in Staffing

- Around 2.5 billion more people will be living in cities by 2050, projects new UN report (United Natons)

- The Lancet: Dramatic declines in global fertility rates set to transform global population patterns by 2100

- Ageing and health (World Health Organization, 2022)

- The Rise of Global Digital Jobs (World Economic Forum, 2024)

- Jobs and salaries for AI engineer roles are surging (Axios, 2023)

- Duolingo cuts workers as it relies more on AI (Washington Post, 2024)

- North American workers have become top talent targets for international companies (Fortune, 2024)

- The school bus driver shortage remains severe (Economic Policy Institute, 2023)

- America’s Semiconductor Boom Faces a Challenge: Not Enough Workers (New York Times, 2023)

- The rise of the anti-work movement (BBC, 2022)

- How climate change is re-shaping the way Gen Z works (BBC, 2022)

- What is FIRE Movement: Financial Independence, Retire Early? (TIME, 2024)

- Chewy shares fall nearly 7% as the boost from Roaring Kitty’s new stake diminishes (CNBC, 2024)

- Robinhood’s crypto transaction revenue soars 232% from a year ago: CNBC Crypto World (CNBC, 2024)

- American Gaming Association: Legal sports betting hits record revenue in 2023 (S&P Global, 2024)

- People bet on sports. Why not on anything else? (Vox, 2024)

Nursing → A “Goldilocks” Market

- New AACN Data Points to Enrollment Challenges Facing U.S. Schools of Nursing (AACN, 2024)

- The 2020 National Nursing Workforce Survey (Journal of Nursing Regulation, 2020)

- Workplace woes: More nurses consider changing careers due to frustrations over work environment (Medical Economics, 2024)

- 2023 Healthcare Executive Report (Incredible Health, 2023)

- Lantum, a platform to manage healthcare staffing, gets a $15M injection

- connectRN raises $76M for healthcare worker staffing, networking (MobiHealthNews, 2021)

- Nomad Health raises $22M for healthcare job marketplace, appoints new CEO (MobiHealthNews, 2024)

- CareRev Raises $50 Million to Expand App for Health Care Workers (Los Angeles Business Journal, 2021)

- Clipboard Health, an online hiring platform, snags $80M to expand into more cities (Fierce Healthcare, 2022)

- Patchwork Health raises £20m to tackle the NHS staffing crisis (Patchwork Health, 2022)

- Nurse staffing startup IntelyCare scores $115M Series C (MobiHealthNews, 2022)

- Healthcare staffing startup ShiftKey raises $300M (MobiHealthNews, 2023)

- Gale Healthcare Solutions Secures $60 Million Growth Equity Investment from FTV Capital to Remedy National Nursing Shortage (Gale, 2022)

- Incredible Health Raises $80M Series B, Reaching $1.65 Billion Unicorn Status as the Leader in Healthcare Hiring (PR Newswire, 2022)

- Trusted Inc. Raises $149M and Launches Healthcare’s Staffing Platform (Trusted Health, 2021)

- Thoma Bravo leads $60M investment in IAC unit Vivian Health (S&P Global, 2022)

- ShiftMed Raises $200M to Drive Expansion of Leading Digital Health Care Labor Marketplace (PR Newswire, 2023)

- Recruiting Platform Nursa Secures $80 Million in Funding (Hunt Scanlon, 2023)

- Profiting in Crisis: Exploring Private Equity’s Investments in Travel Nursing Amidst a Critical Nursing Shortage and Pandemic (PE Stakeholder, 2022)

- The U.S. Nursing Shortage: A State-by-State Breakdown (NurseJournal, 2024)

- Healthcare workers’ unemployment rates rose post-pandemic: study (Becker’s Hospital Review, 2022)

- The Complete List of Specialty Nursing Certifications (ShiftMed, 2022)

Challenging Markets → Childcare/Behavioral Health/Agriculture

- Clutch of Child-Care Startups Win Over VCs Despite Funding Drought (WSJ, 2024)

- SURVEY: Four in five child care centers in the U.S. are understaffed (NAEYC, 2021)

- With Pandemic Money Gone, Child Care Is an Industry on the Brink (New York Times, 2024)

- Behavioral Health Workforce, 2023 (HRSA, 2023)

- Venture Capital’s Priorities Are Evolving As Behavioral Health Market Matures (Behavioral Health Business, 2024)

- As funding cools, venture capitalists shift investments in mental health (American Psychology Association, 2023)

- America Has a Farming Crisis (Newsweek, 2024)

- Farm Labor (USDA, 2024)

- Seizing opportunities amid the agtech capital drought (McKinsey, 2024)

- America Is Trying to Electrify. There Aren’t Enough Electricians. (WSJ, 2023)

- America needs more skilled trade workers, here’s what’s being done about it (NewsNation, 2024)

- Workrise cuts staff, verticals after being valued at $2.9B last year (TechCrunch, 2022)

- I taught preschool for 15 years. Here’s what I saw: the good, the bad, and the scary. (Vox, 2016)

- Autism Therapy Providers Tie Upskilling to Beating Turnover, Serving More Families (Behavioral Health Business, 2023)

- Low standards corrode quality of popular autism therapy (The Transmitter, 2020)

Generalizing to an Investment Framework

- US oilfield job losses could swell as natural gas prices plunge (Reuters, 2024)

- AI is already linked to layoffs in the industry that created it (CNN, 2024)

- The Airline Pilot Shortage Will Get Worse (Oliver Wyman, 2022)

- Pilot Certificates & Ratings (CFI Notebook)

- What are the differences in the types of pilot licenses (certificates)? (FAA)

- First Officer (Delta Air Lines)

- Chipping Away: Assessing and Addressing the Labor Market Gap Facing the U.S. Semiconductor Industry (Semiconductor Industry Association, 2023)

- Congress Passes Investments in Domestic Semiconductor Manufacturing, Research & Design (SIA, 2022)

- TSMC’s debacle in the American desert (Rest of World, 2024)

- Meet a Millennial Mom Who Resurrected Her Career With a 10-day Crash Course on Semiconductors. She Landed a New Job, Learned New Skills, and Says the Pay Outweighs Long Hours. (Entrepreneur, 2023)

- Navigating the complexities of the truck driver shortage (CCJ Digital, 2024)

- Public Transportation Facts (American Public Transportation Association, 2024)

- Workforce Shortage Synthesis Report (American Public Transportation Association, 2024)

- This Year, Autonomous Trucks Will Take to the Road With No One on Board (IEEE Spectrum, 2024)

- TuSimple and Navistar end deal to co-develop autonomous trucks (TechCrunch, 2022)

- Waymo puts the brakes on self-driving trucks program (TechCrunch, 2023)

- Nuclear Power is the Most Reliable Energy Source and It’s Not Even Close (Office of Nuclear Energy, 2021)

- Rooftop solar panels are flooding California’s grid. That’s a problem. (Washington Post, 2024)

- Utility-Scale Battery Storage (NREL, 2023)

- Vogtle Unit 4 enters commercial operation (Georgia Power, 2024)

- The AI industry is pushing a nuclear power revival — partly to fuel itself (NBC, 2024)

- Nuclear sector ‘lacks appeal to new entrants’ states report (Power Engineering, 2024)

- Power Reactor Information System (IAEA, 2024)

- Nuclear Power in the US – Market Size, Industry Analysis, Trends and Forecasts (2024-2029) (IBISWorld, 2024)

- A Closer Look at Two Operational Small Modular Reactor Designs (Power Mag, 2024)

Boosting Labor Supply: Upskilling, Dormant Labor, and Worker-Driven Social Responsibility

- From mops to megabytes (Mastercard, 2024)

- AT&T’s $1 billion gambit: Retraining nearly half its workforce for jobs of the future (CNBC, 2018)

- Verizon Skill Forward (Verizon, 2024)

- Drivers (Utah Transit Authority, 2024)

- Persons with a Disability: Labor Force Characteristics Summary (BLS, 2024)

- Study Illustrates Cost, Impact of Workplace Accommodations (NIB, 2023)

- Expanding Economic Opportunity for Formerly Incarcerated Persons (White House, 2022)

- A Proclamation on Second Chance Month, 2022 (White House, 2022)

- Recidivism Imprisons American Progress (Harvard Political Review, 2021)

- These farmworkers created America’s strongest workplace heat rules (Washington Post, 2024)

- Worker-driven Social Responsibility Fact Sheet (WSR Network, 2023)

- Slavery in the Fields and the Food We Eat (Coalition of Immokalee Workers)

- Farmworkers in Florida Are Protesting Modern-Day Slavery (Jacobin, 2023)

- Farmworkers win historic deal after boycotting Taco Bell (The Guardian, 2005)

- Fair Food Code of Conduct (Fair Food Standards Council)

- Lucas Benitez, farmworker leader, awarded the 2023 Wallenberg Medal (University of Michigan, 2023)

- Human rights strategist, Hopkins alum Greg Asbed among MacArthur genius grant recipients (Johns Hopkins, 2017)

- Majorities of adults see decline of union membership as bad for the U.S. and working people (Pew Research, 2024)

Knowledge Work – The “Final Boss” of Staffing

- PE Faces Talent Crunch — Even in Senior Roles (Institutional Investor, 2023)

- Investment banks face talent crunch even after deep job cuts (Financial News, 2023)

- New IBA report reveals significant numbers of young lawyers want to leave their current job (IBA, 2022)

- The Nonprofit Workforce Shortage Crisis (National Council of Nonprofits, 2023)

- Can Large Language Models Understand Context? (Georgetown University/Apple, 2024)

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.