Field Study: U.S. Power Availability

Authors: Andrew Peng and Josh Jagota

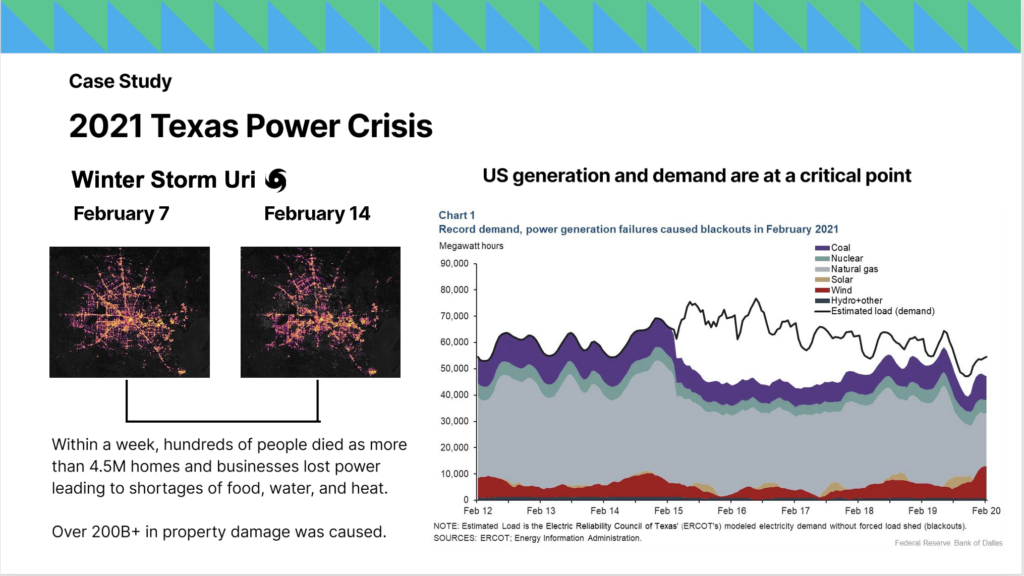

Just over two weeks ago on November 18, 2024, Texas was hit with storms that caused power outages for over 40,000 people. In Texas, power outages no longer feel like a surprise; when Winter Storm Uri shocked the nation in 2021, Texas incurred over $200B in infrastructure damages and almost 70% of the state went without electricity for several days.

At the same time, during last month’s storm, an upstart company called Base Power posted the following advertisement:

Base Power installs home batteries that are large enough to keep the lights on in residential homes. Base is more than just a battery business; they are building a modern utility company by providing virtual power plant services.

Wait, what’s a virtual power plant? Why would a team of former SpaceX engineers set out to compete with Tesla’s Powerwall? And why, as residents, can we not keep the lights on even though we can query LLMs on our phones!?

Today, we’re excited to share Part One of Alpaca VC’s Field Study: U.S. Power Availability to cover the basics and start unpacking the opportunity we see ahead, which we’ll fully delve into in Part Two.

Load Growth is Here to Stay

In the past, much of the conversation around climate and sustainability focused on decarbonization, energy consumption, and energy generation. At Alpaca VC, we’ve invested in decarbonization solutions through companies like Intramotev, EV Realty, and Xeal—but this time we wanted to answer a key question about energy infrastructure and the grid:

Despite years of public and private sector climate investments, what is preventing grid resiliency?

To understand this problem, we need to start with a history lesson. After the postwar mid-century era, U.S. electricity demand began to slow dramatically, and in some years even declined. The decline in load growth was caused by a number of macro forces:

- A transition from a manufacturing intensive economy to a service-based one, characterized by postwar deindustrialization and the offshoring of production

- Energy efficiency improvements, including the development of better energy-efficient appliances, machinery, and building codes

- And finally, good old saturation. By the mid-20th century, most homes and businesses were already electrified, meaning the rapid growth phase of electrification had plateaued.

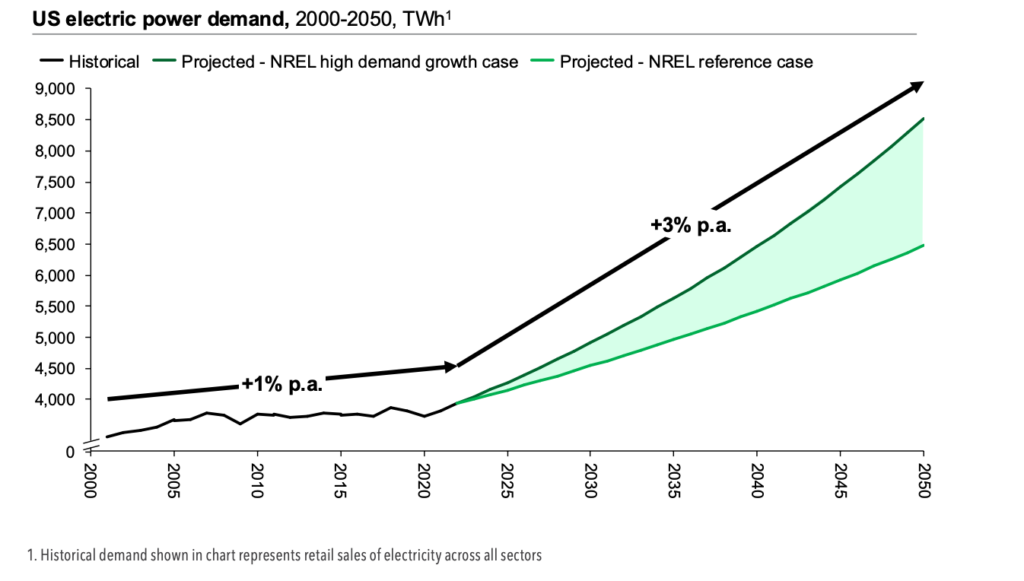

In recent years, however, load growth has reversed course dramatically. Today, the U.S. is experiencing unprecedented growth in electricity demand. While it’s easy to blame the explosion of generative AI and the associated race for data center connection, there are other accelerants including a renewed focus on manufacturing onshoring, the electrification of industrials, and increased household electrification (particularly EV adoption).

For the foreseeable future, none of these trends are going away. Load growth is here to stay.

It’s Not Just A Supply-Demand Problem

Closing the electricity supply-demand gap will be no easy feat. As of January 2024, the U.S. has nearly 1,300 GW of generation capacity. We need 200 gigawatts (GW, a unit of power equal to one billion watts) of new resources to come online by 2030 just to serve peak demand, and an additional 700-900 GW in firm resources by 2050 to achieve net zero.

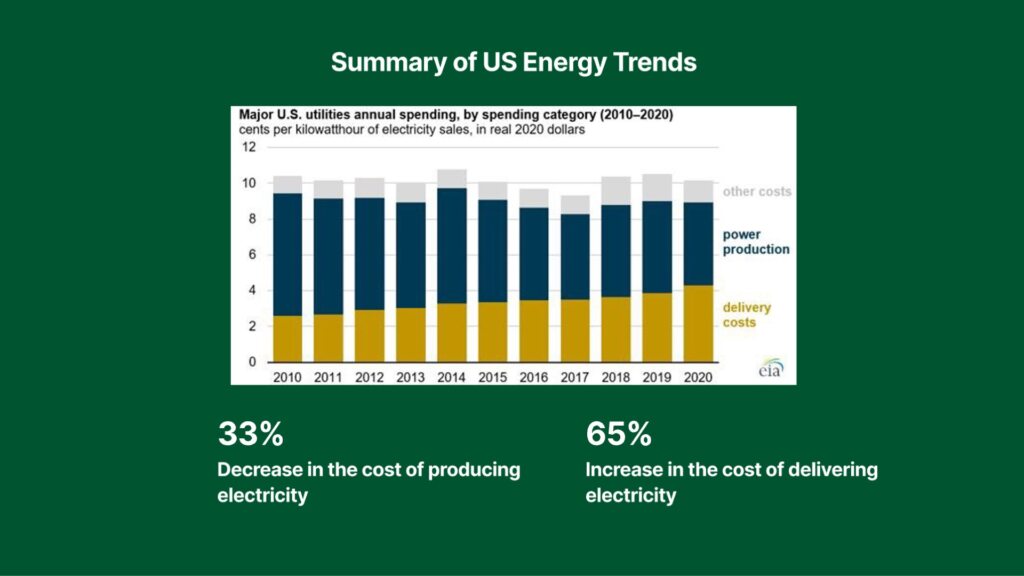

On the one hand, thanks to recent clean investing mandates, the cost of producing renewable energy has dwindled. In 2016, the average costs of renewable energy fell within the range of fossil fuels; by 2020, most renewable projects were cheaper than the least expensive fossil fuel buildouts. Cheaper energy should work for increased demand—easy, right?

On the other hand…infrastructure. Activating energy resources is not as easy as just switching on new power plants.

In fact, we have more than twice as much electricity as we generate in one year “stuck” waiting to connect to the grid.

What’s preventing us from upgrading our infrastructure and bringing renewables online?

Unpacking the Grid’s Design Issue

Modernizing our power infrastructure might seem like a solvable problem at the outset, but there are significant challenges including the shift to decentralized power, the transmission bottleneck, and the interconnection backlog. Diving into these problems informed our thesis: unpacking why we’re in a crisis today will help stakeholders understand how emerging technologies can add flexibility to the grid.

While common discourse about “the grid” usually refers to it as a single entity, the grid is in fact a complex system with three interconnected parts:

- Generation: Power plants produce electricity from diverse sources like fossil fuels, renewables (wind, solar, hydro), and even nuclear energy, forming the starting point of the grid.

- Transmission: High-voltage lines transport electricity over long distances from power plants to local substations, ensuring efficient delivery with minimal energy loss.

- Distribution: Low-voltage networks deliver electricity from substations to homes, businesses, and other end-users, completing the journey to your outlets. In both transmission and distribution, transformers step down the electricity voltage to levels safe for use.

While the grid was a marvel of engineering in its time, it was never intended to be used for renewables. In short, transmission and distribution were not designed for the power flows enabled by energy decentralization.

Intermittency: The grid was built with predictability in mind, relying on fossil fuel plants that could burn on demand to generate power when needed. But renewables like solar and wind depend on weather and time of day, making their output unpredictable and uncontrollable. Grid operators now face the challenge of balancing fluctuating supply and need more sophisticated management and storage solutions than we originally anticipated as a nation.

Decentralized energy flows: Traditionally, the grid operated as a one-way system, delivering energy from centralized power plants to end-users. Now, the rise of decentralized energy resources (DERs)—think EVs, home batteries, and rooftop solar panels—has upended this model. These systems can feed energy back into the grid, which is great in theory, but our transmission and distribution infrastructure were not designed for bi-directional energy flows.

Aging infrastructure: 60% of U.S. distribution lines have surpassed their life expectancy. There are over 5 million miles of distribution lines exposed to the battering of powerful storms, and these storms are only getting worse and more frequent.

The Transmission Bottleneck

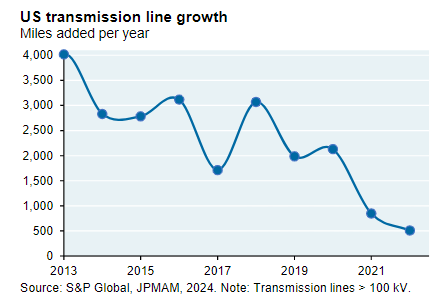

Evidently, while we’ve made significant strides in renewable generation, transmission and distribution infrastructure needs major upgrades to keep up with with increasing demand

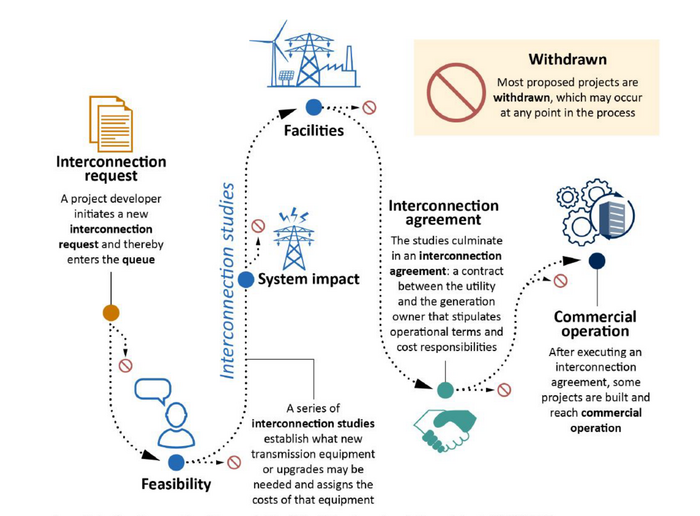

The growth in renewable energy projects signals that developers still believe in the economic value of their generation projects. However, developers pay to apply for interconnection but have to wait three to five years to receive an approval and start building. This compels developers to submit multiple proposals and to withdraw applications late. When projects are withdrawn, operators must often re-study projects in the queue, further burdening an already lengthy process.

On the utility side, transmission lines must receive multiple approvals in each state regardless of where these lines are meant to be placed. Lengthy studies are required to evaluate infrastructure requirements and feasibility. New overhead electricity transmission lines can thus take over 10 years to complete, with over half of that time dedicated to planning and permitting alone.

If utilities knew that there was a focus on renewable energy, and that renewable energy requires new transmission lines, why then are we so behind on infrastructure?

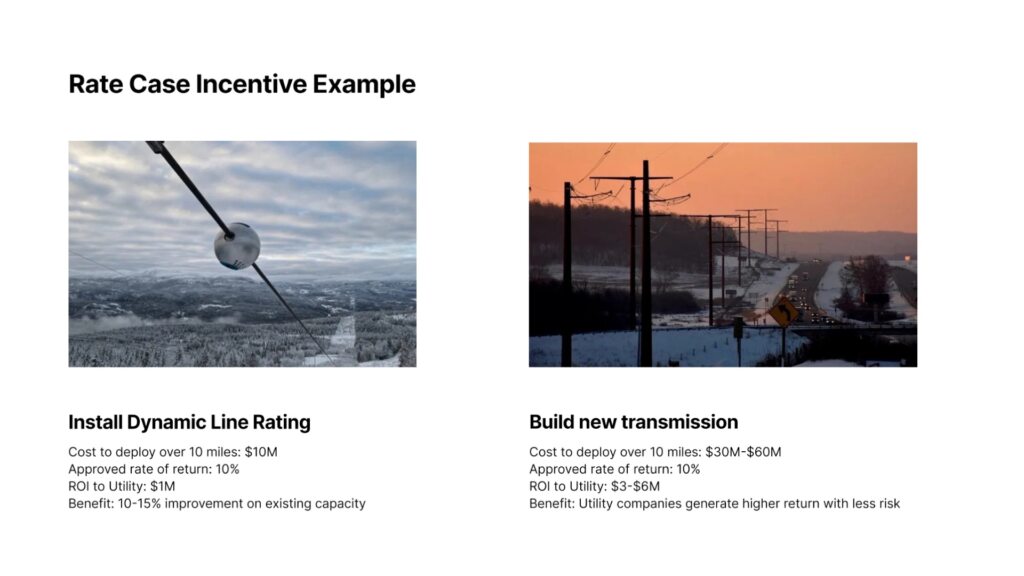

Double Click: Rate Case Incentives

The grid interconnection process today mostly resembles a design that was put in place in 2003. During that time, there was little to no load growth and only the unilateral flow of power.

Not only are new lines costly and slow to build, but even existing lines have been poorly optimized. A wealth of grid enhancing technologies exist that could improve the infrastructure we have—dynamic line rating, high performance conductors, power flow control devices—but historically these solutions have seen low adoption.

These technologies aren’t as pronounced as they should be, with utility incentives at the center of the issue. For decades, utilities have earned a fixed rate of return on approved CAPEX related investments, known as the “cost of incentive structure.”

In the example above, a utility would always choose the option of building a new transmission line, which would take 10+ years to deliver, as opposed to installing novel dynamic line rating technology. While DLR technology could improve existing lines immediately, it would net a lower financial return to utilities when compared to building out new lines.

Even if a utility company chooses to build new transmission lines, the high voltage lines that can connect clean wind energy from Wyoming to consumers in Vegas often take a back seat. These companies have been better off building local transmission projects that have an immediate short term benefit and an expedited approval process.

Overall, while IoT devices and projects that retrofit existing infrastructure can help alleviate the bottleneck quickly and efficiently, the rate case incentive structure slows adoption as publicly traded utility companies do not take on more financial risk than necessary.

To summarize, the last decade has seen a decline in the cost of producing energy, but a sharp increase in the cost of delivering energy. Thankfully, regulators have taken notice.

Regulatory Tailwinds

In 2018, Tesla, focused on Powerwall 2, engaged with FERC on the importance of electric storage resources.

Soon after, FERC issued Order No. 841, Compliance, an order that enabled energy storage resources to participate in all capacity, energy, and ancillary services “for which they are technically capable.” In essence, battery companies that typically have high payback periods could now monetize for performing critical grid services.

A few other key FERC rulings highlighted here:

- FERC order 2222 (Sep 2020): enabling distributed energy resources to participate in wholesale energy markets

- FERC order 2023 (July 2023): mandates transmission providers evaluate advanced transmission technology and promotes structural changes to the interconnection application process

As investors, major regulatory changes act as a signal to look for companies capitalizing on momentum. A slew of state and government incentive programs, including the infamous IRA, Infrastructure and Jobs Act, and spotlight on new energy technologies illustrate the significance of not only the energy problem – but the energy opportunity.

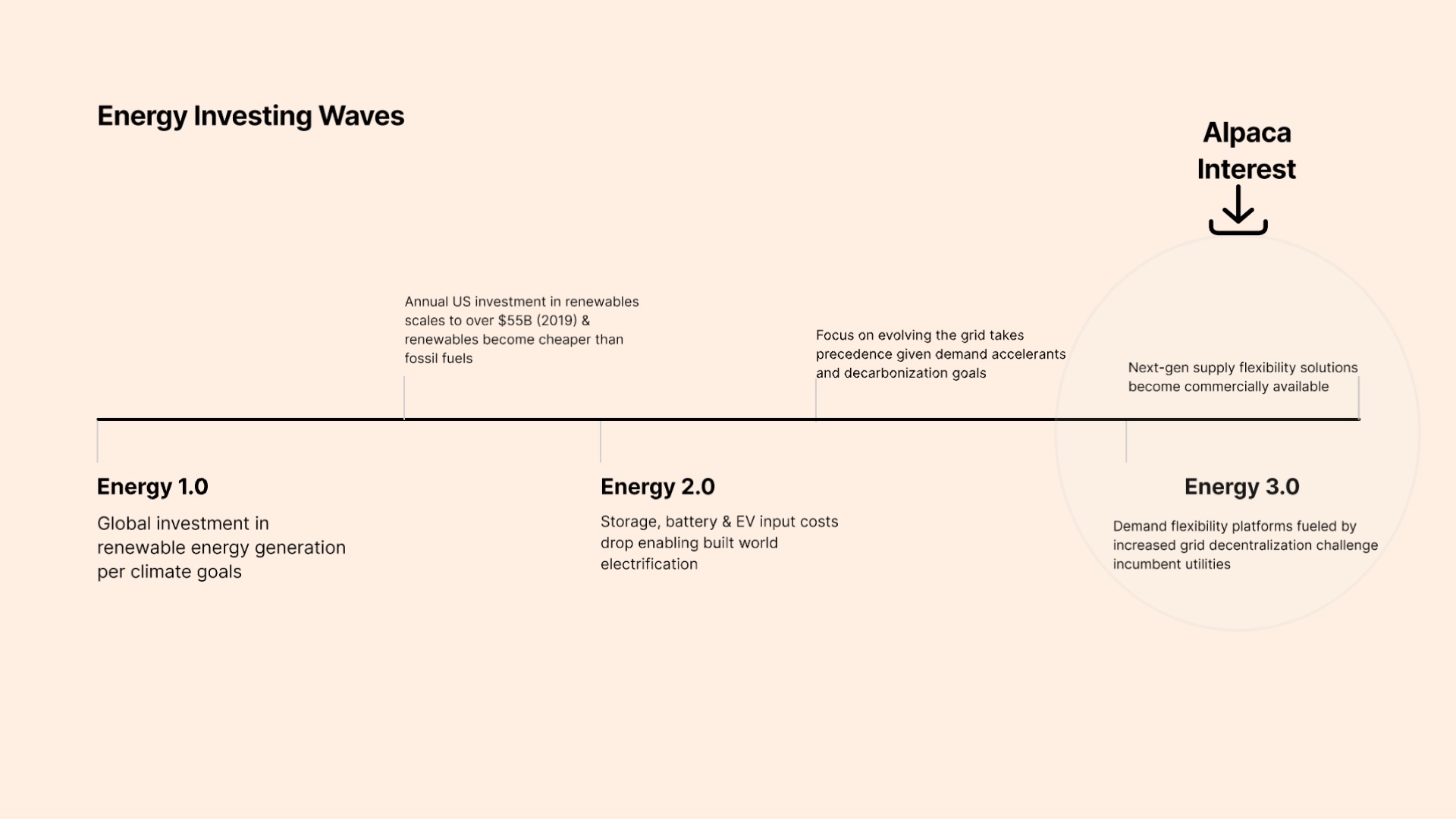

Energy Investing Waves

A massive national problem, an unpredictable demand accelerant, and significant regulatory tailwinds have ushered in a new era of power availability. We call this Energy 3.0.

Energy 1.0 was marked by a global realization of the long term need for renewable energy advancement. Energy 2.0 was the last decade – solar, wind, and storage cost curves declining as DER adoption and deployment advanced.

Energy 3.0 is already underway. Demand aggregators can add flexibility to the grid by fundamentally shaping load requirements in real time and adding resiliency to grid infrastructure. At the same time, the commercialization, development, and deployment of breakthrough energy resources is underway as the need for power puts nuclear, geothermal, and other novel ideas in scope.

Now that we have set the stage in Part One of this Field Study, we’ll discuss investable sectors in more depth and our framework for assessing standout companies in Part Two.

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.