AI in Real Estate Underwriting and Acquisitions

Let’s address this head-on: AI-powered vertical SaaS could continue to struggle to eat the real estate world. First, TAM is inherently limited – unless solutions can break out of vertical silos and expand horizontally, scale will be a challenge. Second, functionality cannot be a differentiator alone; with rapid advances in foundational models, building a defensible “AI moat” is more wishful thinking than a viable long-term strategy. And third, economics are misaligned with traditional SaaS: compute costs are squeezing out the days of 80%+ gross margins.

In short, AI-powered solutions are primed to create an immense amount of value for the real estate industry, but the real challenge will be whether founders can actually capture that value and deliver returns.

In our latest Field Study: AI in Real Estate Underwriting and Acquisitions, we set out to unpack this question and come to conviction about the white space for opportunity we see ahead.

Setting the Stage

Last winter, we segmented the AI-powered application space into those that affect asset performance and those that don’t: dubbing these in-asset vs. out-of-asset:

- In-Asset: platforms whose primary value proposition is that they improve property performance. Ideally, this value proposition can be measured quantitatively in an increased net operating income.

- Out-of-Asset: platforms that don’t directly improve asset performance. Instead, most of these platforms enhance the workflows of the real estate deal ecosystem, particularly the investment and asset management teams.

While we concluded that solutions affecting asset performance will be the easiest to adopt, real alpha might be hiding in the out-of-asset tools, where AI can automate and supercharge underwriting and asset management.

This Field Study dives deep into today’s AI moment, specifically as it pertains to real estate acquisition and underwriting processes: Does AI-powered SaaS not only make big data actionable but also unlock non-linear scalability for deal teams? And could AI be the catalyst that finally drives widespread adoption of vertical SaaS in real estate?

We tackled three big questions:

- How can AI-powered solutions drive value for investment teams – beyond just making dashboards prettier?

- What are the barriers to adoption and how do solutions overcome them?

- Where’s the real venture upside, and how do you avoid becoming just another SaaS footnote?

Two-Sided AI Value Proposition

AI’s value prop for the acquisition and underwriting process is two-sided:

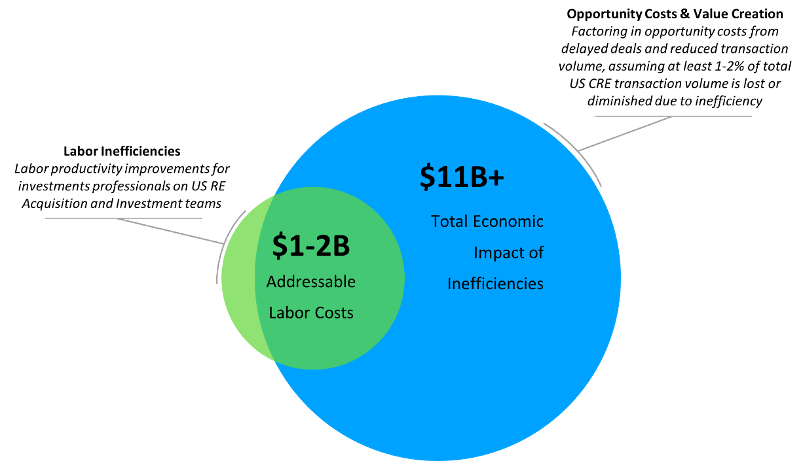

First, AI can automate the mind-numbing stuff – freeing up analysts to do actual analysis. Think data ingestion, standardization, and extraction, compiling comps and market intelligence, and automating entry into model templates. While this is highly valuable for lean-operating deal teams, the total addressable market is limited –

AI-solutions could replace up to $1-2B of addressable labor costs

- ~10,000 US-based real estate acquisition teams, including the myriad of private equity investors, family offices, debt funds, syndicators, and regional owners and investors

- Average deal team of 5 to 7 professionals, 2 of which are analyst or associate-level hires who own these tasks

- Average total annual compensation of $150,000 for these positions

- 3-5 hours per day (37.5-62.5% of the workday) spent on these automatable tasks, data entry, etc.

While automation of existing tasks will translate to some productivity gains, the best opportunities lie in creating new tasks or systems that weren’t previously possible, which brings us to our second revenue opportunity. AI should unlock smarter, faster, higher-quality deals and execution, ultimately generating more value for investors and inducing higher alpha. If just 1-2% of total US commercial real estate annual transaction volume is lost or diminished due to inefficiency or ill-informed execution, we can tap into another $11B+ of total economic impact of the industry’s shortcomings.

“The way you win in real estate is to see things that other people don’t see. Generative AI can help us see the signs that point to hidden ‘alpha’. And then, in a world of perfect information, humans will add the value.” – Joanna Marsh, Head of Venture Investment & Advanced Analytics, Investa²

Curated, thoroughly analyzed pipelines should facilitate execution of higher quality deals, tapping into economic potential of capturing additional value currently lost to inefficiencies and inaction, ultimately leading to greater alpha potential. AI-powered solutions not only help deal teams make more sophisticated decisions but ultimately enable them to scale non-linearly and focus on high-value activities.

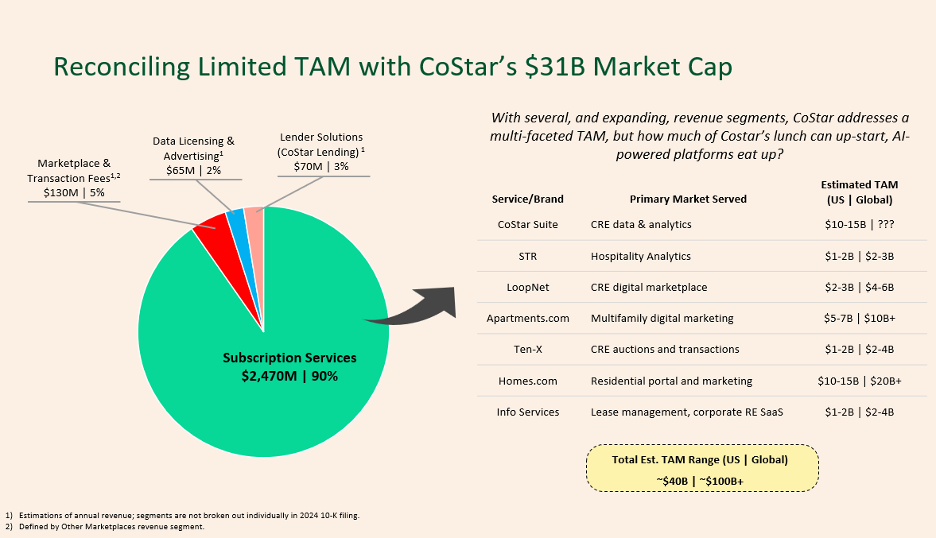

While the TAM for labor automation may be limited and for incremental alpha potential ill-defined, these estimations still beg the question – what about Costar? How do these estimations square with CoStar’s $30B+ market cap and $2.7B in annual revenue? At first glance, it seems contradictory – CoStar’s annual revenue alone eclipses the entire estimated TAM for AI-driven labor automation. But the reality is that CoStar’s business model is far broader and more complex than just automating analyst workflows. The company’s revenues span a wide range of segments: CRE data and analytics, digital marketplaces, auctions, residential portals, marketing, and more. Each of these segments taps into its own TAM, and only a handful – like CRE data & analytics and residential marketplace and management – exceed $10B individually. Most AI-powered SaaS solutions today are narrowly focused, typically addressing just one of these segments as a point solution, which inherently limits their revenue potential unless they can expand horizontally.

It’s also important to recognize that the value AI-powered applications deliver is fundamentally dependent on access to comprehensive, high-quality data. Without data aggregators like CoStar, these AI tools would struggle to generate meaningful outputs. CoStar’s dominance is built on decades of data collection, proprietary databases, and the aggregation of information from its many brands and platforms (LoopNet, Apartments.com, Ten-X, etc.). The company’s recent acquisition of Matterport further deepens its data moat, as it now controls vast troves of digital property tours and related metadata. In practice, most AI applications in real estate don’t compete directly with CoStar; instead, they rely on data providers like CoStar to power their own analytics and automation. This dynamic means that, for now, AI-powered SaaS tools are more likely to augment existing workflows using CoStar-like outputs rather than replace the foundational role that data aggregators play.

Challenging an incumbent like CoStar is no small feat. The company enjoys extreme stickiness, with 96% subscription revenues and 90% renewal rates, and real estate professionals are notoriously slow to change established workflows. For most upstarts, the path to success isn’t to compete head-to-head with CoStar, but to augment and extend the value of existing data and systems, ideally creating new workflows and insights that weren’t previously possible. The real opportunity for AI is not just in replacing manual processes, but in unlocking new forms of analysis, decision-making, and value creation that can “hyper-charge” investment teams. This requires a shift from simply automating what’s already being done to enabling fundamentally new capabilities.

Ultimately, while CoStar’s multi-faceted business model allows it to address a much larger and more diversified TAM, most AI-powered applications in the market today are still point solutions addressing a niche segment. Unless these tools can expand horizontally, either by integrating additional workflows or by serving adjacent markets, their revenue potential will remain limited. Yet, expanding too broadly brings its own challenges, especially in a sector where deep specialization and sector-specific expertise are critical to winning trust and adoption. In short, the path to CoStar-scale success is paved not just with technology, but with data access, workflow innovation, and the ability to serve as a true platform, not just another tool in the tech stack.

Barriers to Adoption

Real estate is (still) the land of handshakes, not hotkeys, and adoption of vertical SaaS has historically lagged other industries, which we chalk up to:

- A conservative (skeptical?), relationship-driven culture – if it ain’t broken, don’t automate it.

- Fragmented players and data with hyper-localized knowledge (or quirks) – one size fits none.

- Data that’s more esoteric than actionable, compounded with vendor lock-in fears and high switching costs of platform dependency.

However, AI-powered SaaS isn’t just another rules-based robot and could be poised to move beyond the limitations of traditional software by enabling adaptive and AI-augmented decision-making. The best solutions will:

- Seamlessly integrate with your existing tech stack, empowering human-AI collaboration.

- Transform your data swamp into a strategic moat, enabling cross-asset insights and allocation optimization.

- Provide modular and interoperable features, ensuring insights remain proprietary and avoiding lock-in with opaque systems.

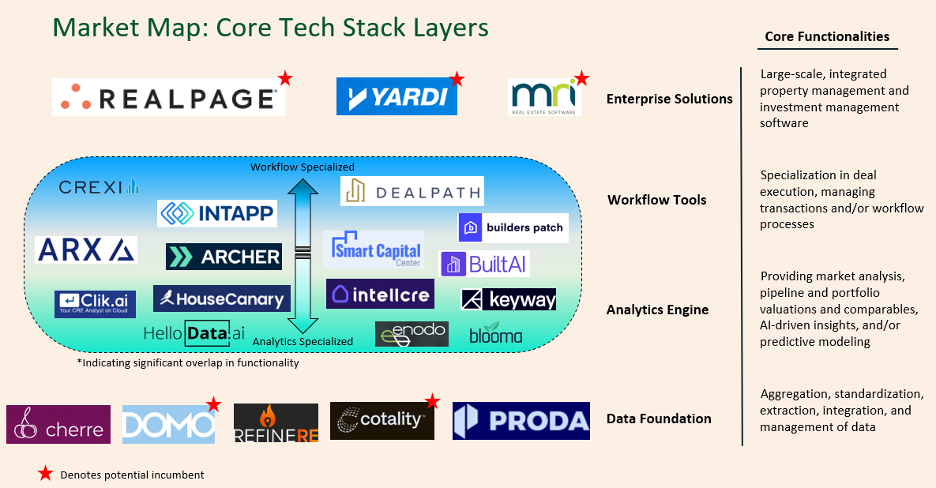

Mapping the Market

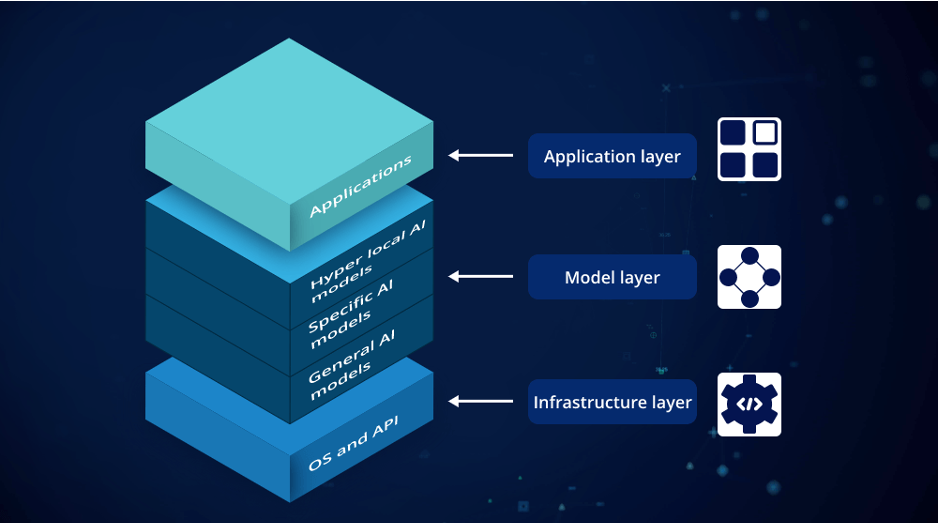

Despite all the buzz about “AI infrastructure,” the tools you actually use – underwriting, analytics, workflow – are sitting right at the top, making your life easier (or at least less painful).

*DISCLAIMER* We broke down the AI-powered Real Estate tools marketplace in a similar “layer” format, but this does NOT translate directly to the above AI infrastructure layers.

Again, the tools you would primarily use and traditionally think of as “underwriting” and workflow automation tools almost sit entirely in the AI application layer in two (kind of) distinct categories: Workflow Tools and Analytics Engines. There’s a lot of overlap, and everyone (or most…) claims to do it all. As such, we defined a functional spectrum depicting perceived specialization to attempt to break down the competitive landscape.

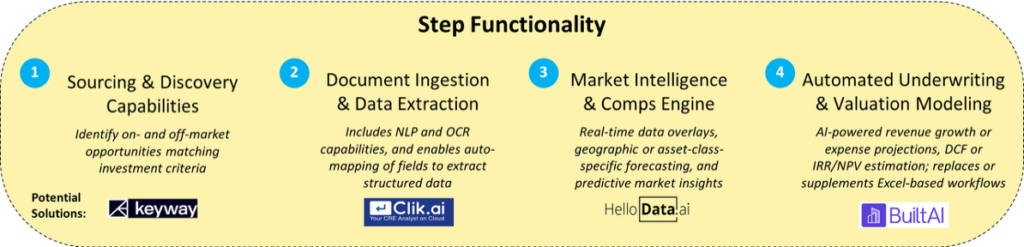

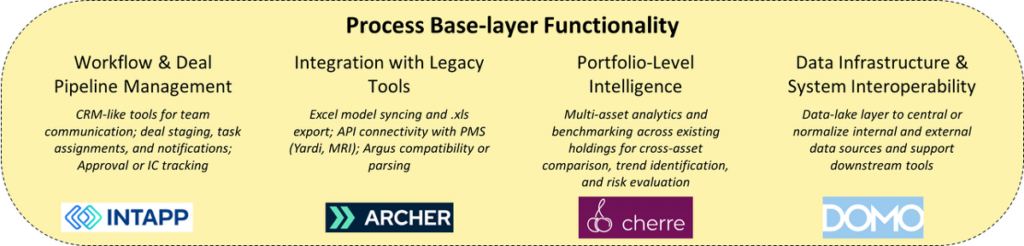

Certain applications are specialized to specific tasks within the underwriting process (“Step Functionality”) while others more broadly serve the data aggregation, standardization, and management that supports these steps along the way (“Process Base-Layer Functionality”).

As we break down the competitive landscape, it’s clear that many AI applications in real estate are specialized to very specific tasks within the broader underwriting process. These “step function” tools automate discrete actions – think rent roll extraction, comp gathering, or data standardization – rather than the full end-to-end underwriting workflow. But here’s the rub: while much of the process is being streamlined, automated underwriting itself remains the final frontier and arguably the most underserved function in the stack.

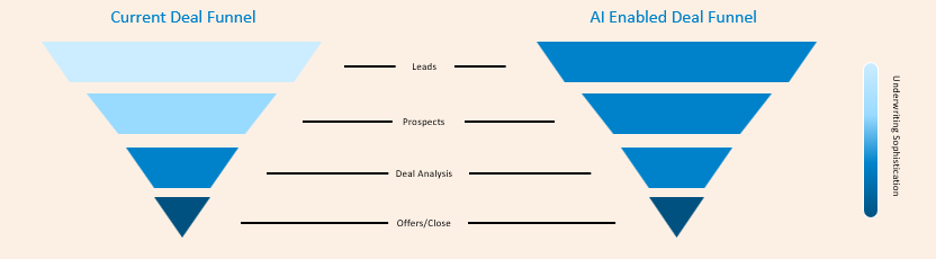

Despite all the buzz, we don’t believe that AI-powered underwriting has reached the sophistication or transparency needed for investment teams to fully embrace “Underwriting 3.0.” The reality is, most professionals aren’t ready to let go of the wheel. Instead, today’s best-in-class solutions are much more suited for preliminary underwriting, serving as a high-powered screening tool to prioritize where analysts should dig in. For example, if you can use AI to take the first 100 deals in your funnel and quickly surface the 10 or 20 most promising opportunities, your team is instantly more focused and better informed. This isn’t about replacing human judgment; it’s about curating a smarter, deeper top-of-funnel so that the deals making it to the bottom are of higher quality and more likely to close.

This is AI-enabled triage. The technology can rapidly ingest property records, financials, market data, and even unstructured sources like images or social sentiment, flagging anomalies and surfacing red flags that would take a human hours or days to spot. But when it comes to the nuanced, asset-specific analysis that makes or breaks a deal, real estate pros still want to see how the sausage is made. Transparency is non-negotiable.

That’s why, for now, automated underwriting solutions must be tightly integrated with Excel or Argus (or offer spreadsheet-like flexibility). The industry’s love affair with Excel isn’t just nostalgia – it’s about flexibility, asset-specific modeling, and the ability to show your work to partners, lenders, or investment committees. Newer tools are gaining traction by offering automation and analytics that still export seamlessly to Excel, ensuring underwriters retain control and visibility over every assumption and calculation.

So, while we’re not quite at the point where AI can fully automate underwriting from soup to nuts, there’s real value in using today’s solutions to supercharge the screening and prioritization process. As adoption grows and trust builds, especially as AI tools prove themselves in automating all the other steps in the workflow, we might eventually see a shift toward deeper automation. But for now, the winning formula is AI for the triage, proprietary models for the deep dive.

Venture Perspective

So how do we pick the winners? AI-powered solutions could facilitate broader adoption of vertical SaaS within real estate; however, many questions and concerns remain:

- The TAM for labor savings is real, but not exactly massive – can we confidently quantify the alpha-generation potential from embracing these solutions?

- Differentiation is tough, and today’s edge is tomorrow’s table-stakes – can task or asset-type specialization create any sort of competitive edge?

- Developing an in-house AI infrastructure moat will be elusive, but how long does it take for core functionalities to be commoditized?

- Margins are getting squeezed thanks to AI compute costs – how do founders adjust their pricing strategies to better suit the new AI-powered SaaS reality?

- Lastly, let’s not forget: selling to real estate folks is still a contact sport.

The bottom line: the AI moment is here, it’s powerful, and it might be coming for some jobs (analysts beware). Winners will focus on augmenting human processes, not replacing them, and quickly targeting the ideal customer base before the next wave of commoditization hits.

The core value props for real estate end-users – automating workflows, streamlining underwriting, surfacing insights – are rapidly becoming table stakes. To break out from the pack, founders need to look beyond incremental workflow enhancements and recognize that sustainable differentiation on features alone is a fleeting advantage. The best founding teams will tailor both their technology and their go-to-market playbooks with this in mind.

In the near- to medium-term, the only real moat is speed. Building an “AI Speed Moat” – getting to market quickly, iterating fast, and capturing logos before the competition – can buy you time and distribution. Yes, AI talent matters, but it’s arguably not sustainable, as the biggest and best-capitalized players are hunting and hoarding the top talent.

Early go-to-market strategies should focus on users where transaction volume is king (think brokerages and high-frequency operators), where driving top-line productivity and throughput matters more than shaving a few points off point-solution costs. And don’t underestimate the power of sector-specific expertise: founders who can speak the language of real estate, understand the pain points, and build for explicit end-user needs will be best positioned to win initial market share and set the stage for horizontal expansion down the road.

See Who’s Building the Future of AI in Real Estate Underwriting and Acquisition

Our Field Study doesn’t just diagnose the problem—it maps out the competitive landscape and investment framework for identifying winning solutions in this space. Curious which startups are leading the way? Download Field Study: AI in Real Estate Underwriting and Acquisition now.

¹ CBRE Research, MSCI Real Assets, Q4 2023

² Marsh, J. (2023). Let’s ChatGPT: What does generative AI mean for real estate? Investa. Retrieved from https://www.investa.com.au/news/lets-chatgpt-what-does-generative-ai-mean-for-real-estate

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.