Field Study: Food Tech 2.0 – Innovation in the Cold Chain

Authors: Aubrie Pagano, Alex Morley and Declan Sander

With our previous Field Study explorations into the Global Supply Chain and Food Supply Chain Tech under our belts, we set out earlier this year to dig even deeper into the complex systems through which food traverses the world to land on our plates. At the heart of it all lies the cold chain. Our goal: to discover the coolest parts, from an investable standpoint, that is.

Download the accompanying research deck

We’re excited to delve deeper into the cold chain landscape, which recently became home to 2024’s largest IPO thus far when cold storage warehouse giant Lineage entered the public markets at a $4.4B valuation.

But first, let’s step back 154 years to 1870, when a humble banana sparked a revolution.

As Lorenzo Dow Baker sailed his refrigerated ship filled with the yellow fruit, he unknowingly laid the foundation for an industry that would grow into the multi-billion-dollar behemoth it is today. Baker’s innovative use of ships filled with ice ensured bananas arrived fresh and ripe. This set the stage for today’s sophisticated cold chain systems. This tale of tropical fruit and pioneering spirit continues to inspire advancements in maintaining the integrity of temperature-sensitive products across the globe.

In the 1930s, Frederick Jones developed the first portable refrigeration unit and built a company that revolutionized the transport of medicine, blood, and food during World War II. His company, now known as ThermoKing, has since grown to over $1 billion in annual revenue. ThermoKing’s success is just one example of the thriving cold chain industry, which is predicted to surpass $1 trillion globally by 2030 with a CAGR of 18.6%.

For our own journey into cold chain territory, we decided to focus specifically on the Food & Beverage (F&B) sector. While there’s a distinct and important value chain within the Pharmaceutical sector as well, we wanted to keep our sites narrowly trained on one sector and stay true to the strengths and expertise we’ve developed thus far at Alpaca VC.

Part I: Cold Chain Trends

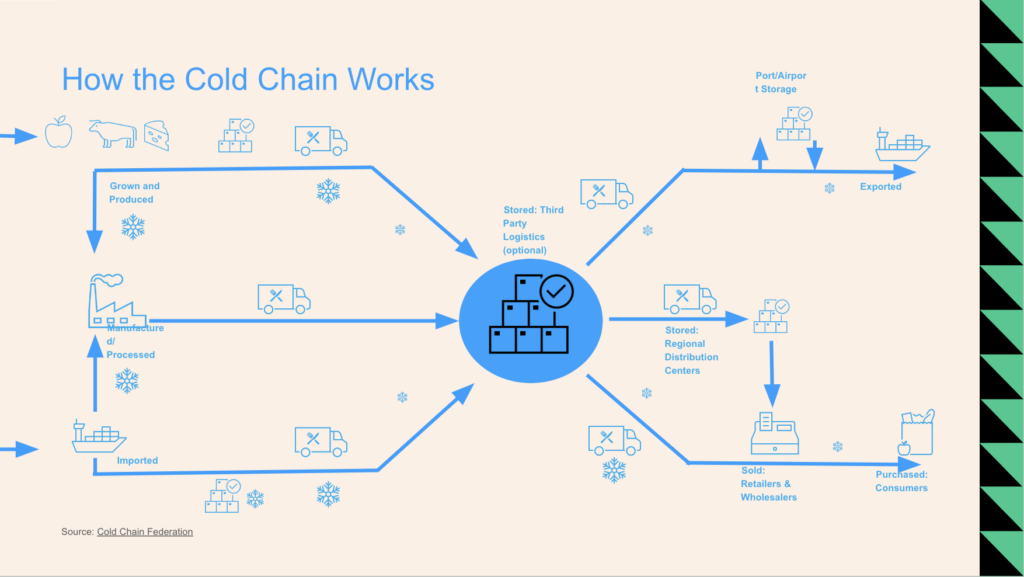

How the Cold Chain Works

The cold chain industry is the unsung hero of modern logistics, quietly working behind the scenes to keep our food fresh and our medicines safe. This network of specialized facilities and vehicles ensures that perishable goods are stored in a secure temperature-controlled environment from the point of production to your local grocery store. Improvements to this system could not only reduce waste, but also feed an incremental 950 million people annually by reducing food spoilage. This data point alone highlights the immense scale and importance of the cold chain. In addition, the industry is growing fast, especially in emerging markets, driven by an expanding middle class and the rise of e-commerce. But the cold chain isn’t just about growth; it’s also about impact. The food cold chain alone is responsible for 1% of all global emissions.

To heat things up further, overall revenue for temperature-controlled supply chains has been growing at twice the rate of the regular logistics industry. As consumers demand fresher products and regulatory requirements tighten, businesses are investing heavily in cold chain solutions to ensure their products arrive in optimal condition. One of the key drivers of this growth is the advancement in monitoring solutions, both hardware and software. Hardware solutions such as sensors, RFID (Radio Frequency Identification), and telematics have become essential tools in maintaining and tracking the temperature of goods throughout the supply chain. These technologies provide real-time data on the conditions of the transported goods, allowing for immediate corrective actions if any deviations occur. This capability is crucial for ensuring the quality and safety of temperature-sensitive products.

On the software side, innovations in grid optimization, supply chain visibility, and logistics optimization are transforming how businesses manage their cold chain operations. Grid optimization helps in managing energy consumption and reducing costs, while supply chain visibility ensures that all stakeholders have access to real-time information about the location and condition of goods. Logistics optimization software improves the efficiency and reliability of transportation routes, reducing the risk of delays and spoilage.

The market for these monitoring solutions is projected to grow significantly, from $6.5 billion today to nearly $30 billion by 2030. This projected growth underscores the increasing reliance on advanced technologies to maintain the integrity of cold chain logistics.

Cold Chain Challenges

Through conversations with customers, investors and innovators operating in the cold chain, we learned of a number of challenges in the space that ultimately helped us determine where to dig in further:

Transportation and Logistics

The cold chain faces numerous pain points due to inefficient transportation, fragmented distribution networks, variable pricing and the lack of real-time data.

Inefficiency in Transportation Networks: A significant number of trucks return empty, leading to wasted resources and higher costs.

Fragmented Distribution Networks: Lack of cohesive network solutions results in inefficiencies and higher operational costs.

Unpredictable Pricing for LTL (Less Than Load) Carriers: Difficulties in finding cost-effective and reliable transportation options due to varying routes and schedules.

Need for Real-time Optimization: The lack of visibility and management in real-time hampers efficient operations and increases spoilage rates.

Cold Storage and Infrastructure

Along with transportation and logistics challenges, the cold chain also suffers from inefficiencies among the existing cold storage solutions themselves.

Limited Cold Storage Capacity: Increased demand for cold storage due to pandemic-induced stockpiling strains existing infrastructure.

High Costs of Cold Storage Solutions: Expensive infrastructure and maintenance costs due to the need for advanced refrigeration and insulation technologies.

Technological Advancements and Adoption: Slow adoption of advanced technologies such as IoT sensors and AI in cold storage, impacting efficiency and cost-effectiveness.

Spoilage and Waste Management

Even 150 years into attempts to innovate the cold chain, we still have a long way to go. The threat of spoilage and waste continue to loom large.

High Rates of Spoilage: Around 2% of products are wasted due to inefficiencies in the supply chain, often sold to secondary channels at a discount.

Circularity and Sustainability Challenges: The need for more sustainable packaging and recycling solutions to reduce waste and environmental impact.

Regulatory Compliance: Meeting stringent regulatory requirements for temperature control throughout the supply chain.

Technological Innovation and Integration

The latest technology innovations have yet to become the norm across cold chain systems, with notable deficits in leveraging data analytics and AI, IoT sensor integration and standardization across the sector.

Data Utilization and AI: Underutilization of data analytics and AI for optimizing operations, predicting equipment failures, and enhancing customer service.

Integration of IoT and Sensors: Challenges in integrating IoT sensors for real-time monitoring and management due to cost and technical complexities.

Fragmented Market Landscape: The market is highly fragmented with numerous small players, making consolidation and standardization difficult.

Part II: Opportunities

Where is there opportunity for investment in frozen assets?

After taking stock of our primary research into the macro trends driving the sector and the challenges we identified as we deepened our investigation, we arrived at eight areas where we believe there are major opportunities for innovation and advancement.

Logistics: Enhancing the efficiency and reliability of transportation routes to ensure timely delivery of temperature-sensitive goods.

Differentiated Cold Storage: Developing specialized storage solutions tailored to different types of perishable products, improving their shelf life and quality.

IoT and Visibility: Implementing Internet of Things (IoT) technologies to provide real-time tracking and monitoring of goods throughout the supply chain, enhancing transparency and control.

Inventory Management: Optimizing inventory levels to reduce waste and ensure the availability of fresh products through advanced analytics and automation.

Advanced Cooling: Innovating cooling technologies to provide more energy-efficient and effective refrigeration solutions, reducing costs and environmental impact.

Infrastructure: Building and upgrading infrastructure to support the growing demand for temperature-controlled logistics, including warehouses and transportation networks.

Transport Refrigeration Units: Developing more efficient and environmentally friendly refrigeration units for transport vehicles to maintain the integrity of perishable goods during transit.

Biotechnology: Leveraging biotechnological advancements to enhance the preservation and quality of perishable products, ensuring they remain fresh and safe for consumption.

We believe these areas present significant opportunities due to the convergence of technological advancements, increasing consumer demand for fresh and high-quality products, and the pressing need for sustainable solutions. Further, the cold chain is undergoing a digital transformation, driven by the integration of advanced technologies such as IoT, data analytics, and automation. This transformation is enabling unprecedented levels of visibility, control, and efficiency within the supply chain. Each of these opportunities addresses a critical pain point in the cold chain logistics sector, from improving efficiency and reducing waste to ensuring product safety and minimizing environmental impact.

Note: This map is not a comprehensive map of the Cold Chain and does not cover the different aspects of the entire food supply chain and ag-tech. For a comprehensive map of that space, check out this one put together by Culterra Capital and a recent map by Buoyant Ventures.

Though we believe there is significant opportunity for investment across the cold chain, we have identified a few challenges we expect new innovators to encounter as they scale across the sector:

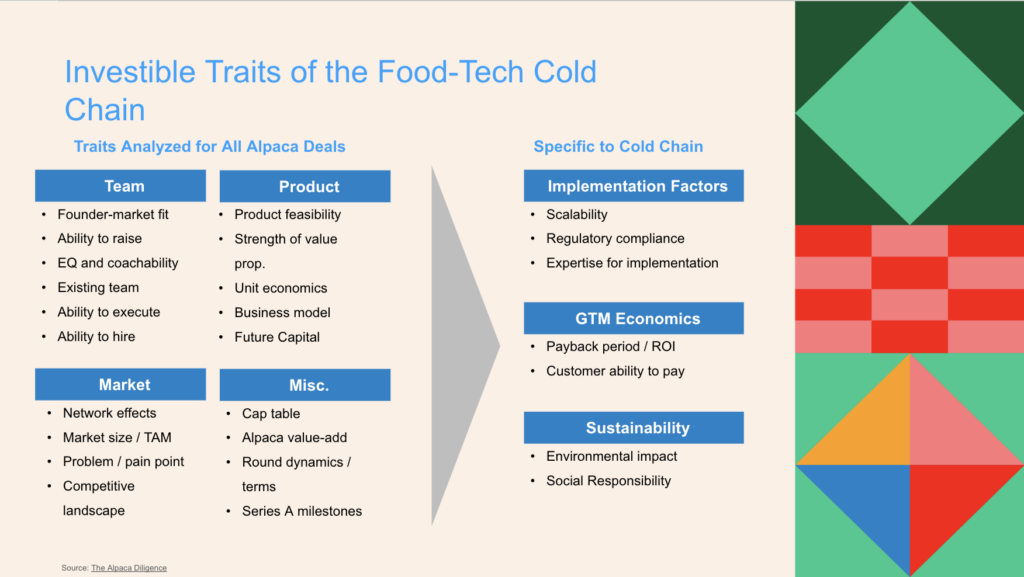

A major goal of each Field Study is discovering what technologies are investible, and what their characteristics are.

Some of the characteristics we found in addition to our traditional 25-Factor are:

Bringing this all together, we identified three themes we believe are investible.

Logistics

- Current cold chains were designed to operate at the highest levels of reliability and at the lowest cost.

- ‘Steady state’ cold chains have had significant disruptions, largely catalyzed by COVID-19, but uncertainty remains today – whether due to geopolitical factors, ongoing supply shortages, or labor challenges.

- The emergence of new technologies for manufacturing and operating cold chains are creating opportunities for relocating production closer to end markets with a goal of making cold chains more resilient.

- By leveraging existing cold chain visibility tools and AI, companies can proactively address potential risks in their cold chain to mitigate any disruptions.

- We view cold chain resiliency to include tools for asset management and monitoring, specifically, those focusing on predictive maintenance to reduce any equipment and operational downtime.

- While large players dominate this space, there is a growing field for companies who differentiate themselves like Fresh X which offers temperature controlled less than load delivery (LTL) and ColdCart which aims to bring together a fragmented cold chain market.

IoT and Visibility

- Cold chain visibility is the ability to monitor temperature-sensitive stock levels, ideally in real-time, to evaluate inventory availability and accurately locate specific units within a warehouse, fulfillment center, or while in transit.

- Ensures product quality, reduces spoilage, accurate demand forecasting, smart resource allocation, improved omnichannel management, enhanced customer experience, and ultimately lower supply chain costs.

- By using IoT sensors and real-time data analytics, companies can ensure that perishable goods are kept within safe temperature ranges, significantly reducing the risk of foodborne illnesses. This is crucial for maintaining consumer trust and meeting regulatory requirement.

Inventory Management

In an industry where one degree can spoil a batch, packaging is crucial, it also allows for waste minimization:

- The cold chain industry is responsible for a significant portion of global CO2 emissions, with refrigerated transport alone accounting for approximately 10% of the food industry’s carbon footprint.

- Increasing regulations on single-use plastics are driving the adoption of sustainable packaging. The European Union aims to make all packaging recyclable or reusable by 2030. For cold chains which currently rely on lots of packaging this could bring tailwinds in for packaging companies with a sustainable view like TemperPack, or TomKat KoolPak.

Data and AI allow for further optimization of the supply chain:

- The global AI in supply chain market is expected to grow from $3.7 billion in 2020 to $21.8 billion by 2027, with a significant portion dedicated to predictive maintenance and inventory management.

- AI and machine learning algorithms can predict equipment failures before they occur, reducing downtime by 30% and maintenance costs by 25%.

- Data-driven inventory management reduces overstock and stockouts, leading to a 20% reduction in holding costs and a 15% increase in inventory turnover rates.

- Companies like Snofox are innovating this space by using data and predictive analytics to optimize refrigeration performance.

Conclusion

Our analysis is based on extensive research and conversations with stakeholders across the cold chain industry. Through this process, we have strong conviction that there is significant opportunity for optimization across the cold chain as it continues to grow and undergoes a necessary digital transformation. However, this evolution is progressing slowly. At present, we believe it is most likely to benefit from digital solutions focused on enhancing logistics and visibility, including:

- The integration of IoT technologies is crucial for real-time monitoring of temperature-sensitive goods. Companies are investing heavily in these technologies to ensure product safety and reduce spoilage.

- Advanced analytics and AI are being utilized to optimize inventory management, reducing waste and operational costs. This shift towards more efficient and sustainable practices is essential as regulations on single-use plastics and carbon emissions become stricter.

- The market for monitoring solutions, including sensors and telematics, is projected to grow significantly, highlighting the increasing reliance on advanced technologies to maintain cold chain integrity.

Looking ahead, we think it’s clear that the integration of advanced technologies is not just a trend, but a necessity driven by increasing consumer demand for fresh, high-quality products, and the need for more sustainable solutions. What’s more, the projected growth in the market for monitoring solutions and the significant investments in IoT and AI indicate a strong trend towards digital transformation. However, the challenges of high costs, slow adoption, and fragmented market landscapes must be addressed to fully realize the potential of the cold chain sector.

The cold chain’s wide reach, and fragmented nature make it a challenge to build and invest. The competition can be strong, and margins are thin. However, with the projected growth of the cold chain, optimizations can mean millions of mouths fed and tons of food saved from spoilage.

To find the next big player in this space, we believe investors need to focus on innovative solutions and technological advancements that address current inefficiencies and bottlenecks. For example, leveraging IoT and real-time data analytics can significantly enhance visibility and control over the supply chain, ensuring that perishable goods are maintained at optimal temperatures throughout their journey. However, it’s important to recognize that regulatory tailwinds can sometimes act as smoke and mirrors, masking the true demand within the industry.

While regulations often drive companies to adopt new technologies and practices, they do not always reflect genuine market demand. Companies might implement IoT solutions and data analytics tools to comply with regulatory requirements rather than to meet an organic need from the market. This can create a situation where the adoption of such technologies appears robust on paper, but doesn’t necessarily translate into improved efficiency or customer satisfaction.

Moreover, regulatory-driven adoption can lead to a misallocation of resources, where businesses invest heavily in compliance rather than innovation that drives real value. It is crucial for investors and stakeholders to differentiate between regulatory compliance and genuine market demand to ensure that investments are directed towards sustainable and impactful innovations.

Ultimately, the key to success in the cold chain lies in identifying and investing in companies that are not only adapting to current challenges but are also pioneering the next wave of innovations. By doing so, investors can contribute to a more resilient and sustainable cold chain, ensuring that the world’s growing population has access to fresh and safe food.

Download the accompanying research deck

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.