Field Study: Global Supply Chains — Part 2

Investigating the current state and future of global e-commerce supply chains.

This post is part of a five-part Field Study by Alpaca exploring the current state of global e-commerce supply chains and the opportunities we see ahead. Use these quick links to read the entire series: Part 1: Global Supply Chains, Part 2: Delivery, Part 3: Cross-Boarder, Part 4: Returns, Part 5: Conclusion.

I was visiting friends in the Finger Lakes region of New York this past weekend, which famously housed Mark Twain, Harriet Tubman, and the Erie Canal. Built in 1825 for $7.1M, the largest public works project for that time, the Erie Canal put New York on the map as the leader in population, industry, and economic trade. And it allowed for goods from as far as Europe and Asia to make their way to the Great Plains, establishing ties from the Midwestern states to New England that would endear the Union together economically once civil war broke out. But more than anything, it enabled cheap, fast delivery.

Last week, we introduced one of the key investment themes for global supply chain: enabling fast delivery. Just like the Erie Canal opened up quicker, less expensive delivery options for early Americans, new entrants are working to empower merchants to compete with Amazon-like speed.

Why Now?

Let’s first review why the faster deliveries have become normalized and why investment in the last mile has surged.

- Delivering a superior customer experience: Shrewd e-commerce retailers know that a positive delivery experience is key to the overall customer experience. As we mentioned in our intro post, companies without an in-store presence have fewer customer touch points, meaning the delivery process has increased weight when it comes to leaving a favorable impression on a customer.

62% of e-commerce shoppers define a positive experience with a brand as fast shipping.

- An increasing part of all retail sales: As e-commerce continues to make up a larger proportion of retail sales, the last mile will become even more crowded. E-commerce retail sales are expected to makeup almost 20% of all retail sales in the US by 2024.

- Lowering cost and inefficiency: It’s clear why so much capital has been committed to the space — last mile delivery is expensive and inefficient. Lowering last mile costs is the most common concern for last mile logistics providers, followed by providing an on-time delivery. On average, last mile costs make-up 32% of the total e-commerce supply chain cost.

- The Prime-effect: customers expect two-day shipping, they want their package ASAP, and they want it to be delivered for free. Delivery costs are the number one reason for cart abandonment. Retailers typically absorb most of the delivery cost. Organizations globally spend an average of $10.1 million on last mile delivery costs, while the customer willingness to pay is closer to $1.4 million (and they end up paying $8.8 million).

75% of online shoppers in a survey expect free delivery.

Enabling Fast Delivery

Faster delivery hinges on what is commonly known as the last mile. This is the final leg of the product’s journey in the logistics network. And the last mile consists of two primary components:

- Carriers + Couriers: companies with extensive delivery capabilities that can facilitate next-day or same-day drop off to the end customers. FedEx and UPS hold a duopoly in the US (notwithstanding Amazon Flex, which is set to become the largest carrier network), while DHL dominates the international last mile.

- Distributed Fulfillment: depots where goods are stored, sorted and shipped from. A faster delivery depends on where the product is located — and the closer a product is to the customer, the faster it can get to them. 3PL’s are a highly effective way to fulfill orders quickly, but it is an expensive solution that requires scale. Picking a 3PL (or 4PL) requires careful thought as brands are trusting a third party with a critical part of the customer experience. If you hadn’t guessed, Amazon is also a fulfillment solution for brands that don’t mind selling on a marketplace and sacrificing control of the brand experience as well as customer data.

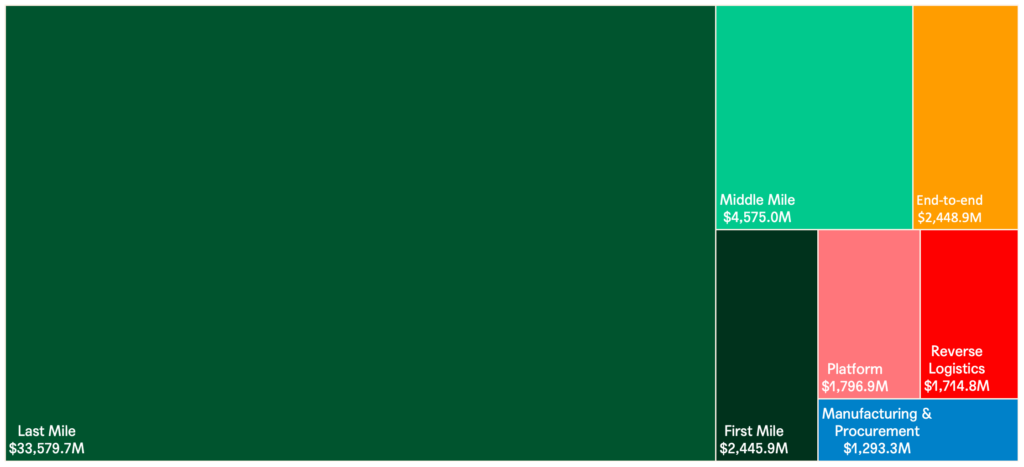

Over the last five years, startups addressing the last mile have raised more capital compared to any other mile in the e-commerce supply chain stack combined. Why? Because it’s complex. E-commerce inventory is expansive and is typically scattered at different locations throughout the country. There’s a lack of communication and transparency between the brand and customer during the delivery process (as the product is typically fulfilled and delivered by different parties). And its complexity is only outshined by its demand.

Thanks to Amazon Prime, 1- and 2-day delivery has become the baseline customer expectation. Amazon has invested in everything from drones to crowdsourced delivery via Amazon Flex, which enables anyone with a vehicle to make local, same-day deliveries. And other brands and retailers must keep up to remain competitive.

Large retailers have the benefit of enabling faster shipping by absorbing some of the high shipping costs for customers and/or by having inventory located throughout the country. Even still, in order to compete with Amazon many of these companies have begun exploring alternate solutions to get packages to customers faster and more efficiently. Wal-Mart bought JoyRun and Parcel. Target purchased Deliv and Shipt. And Shopify just bought Delivrr.

For smaller, emerging brands, however, offering same-day or next-day shipping is an expensive challenge. We see this as an interesting opportunity.

Mapping the Space:

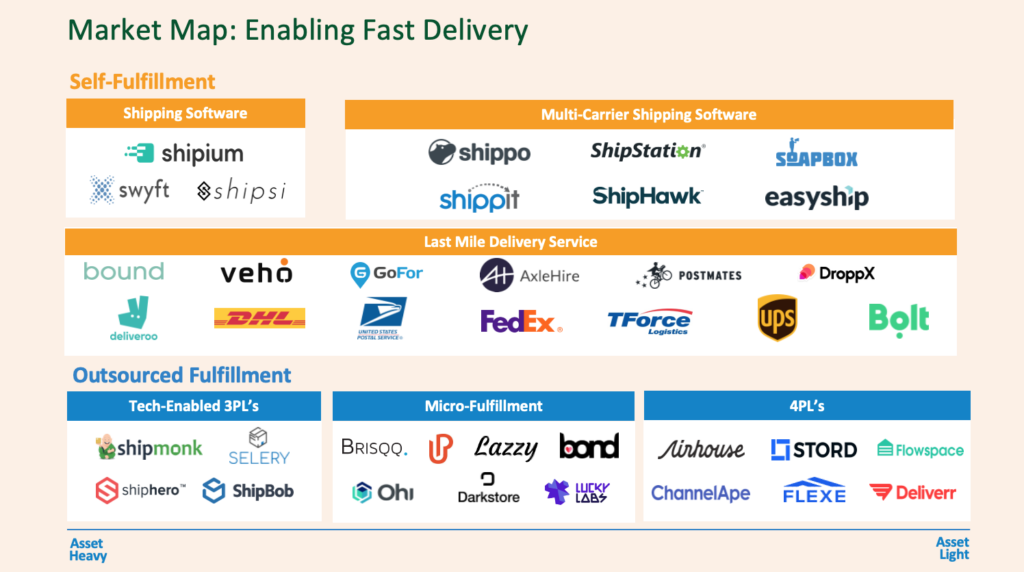

Looking at startups who are enabling faster delivery, we can segment the space as follows. Important to note we’ve also categorized fulfillment players in terms of how asset heavy or light they are.

Self-Fulfillment

- Shipping Software: For brands that use DIY fulfillment, shipping software can provide meaningful savings. There are also shipping software companies that help to enable faster shipping. Shipium optimizes a brands’ existing fulfillment network and makes recommendations to ensure a faster delivery time. Shipsi taps into a network of last mile couriers (like Postmates) to same-day and next-day shipping.

- Multi-Carrier Shipping: software solutions, like Shippo, allow online retailers to compare and secure lower shipping rates across couriers. These platforms offer plug-ins that sync with the e-commerce site and offer the easy printing of shipping and return labels.

- Last Mile Delivery Service: As big carriers like UPS continue to grapple with capacity issues, startups like Fetchr and AxleHire have emerged to absorb the excess capacity. Some of these solutions use a crowdsourced model (DroppX, Bolt), while others operate their own in-house fleet (Roadie, Bound).

Outsourced Fulfillment

- Tech-Enabled 3PL’s: 3PL’s have existed for a long time and the next generation of a 3PL marries traditional functions (pick, pack, ship) with proprietary software (connectivity with e-commerce site, syncing of products). 3PL’s typically lease or rent warehouse space, making them more asset heavy.

- Micro-Fulfillment: Companies like OHi and Darkstore harness networks of dedicated and repurposed real estate to provide warehousing and fulfillment services in prime real estate locations (typically in major cities).

- 4PL’s: 4PL’s are used by brands who seek to outsource their entire supply chain operations (including inventory management and supply chain optimization), including fulfillment. A growing number of 4PL’s (Flexe, Deliverr, ChannelApe) are asset-light in that they tap into a warehouse network or use on-demand warehousing to offer flexible fulfillment options for e-commerce brands, rather than owning or leasing space directly.

White Space: Small Brands Competing with Big Box

We expect consumer demand for fast delivery to remain high. However, we see a gap in the market between the delivery time that big e-commerce retailers can offer versus smaller DTC brands. This gap is widening with the current supply chain crisis. As costs to ship and import rise, container ships will continue to go to the highest bidders (i.e. large, public companies), so consumers will have fewer choices, and will likely have to transact with large, public-traded companies who have a better grip on the supply chain (i.e. Amazon, Walmart). So we see white space for capital-light solutions that place inventory as close as possible to the customer for smaller brands, such as through a micro-fulfillment model. There are also challenges switching from one 3PL to another, so we see a technology to optimize the migration between 3PLs as an opportunity area as well.

We’re particularly interested in solutions that not only enable fast delivery, but also provide features that enhance the customer experience. For instance, Bond uses non-traditional space in prime locations within New York City to house inventory and has a fleet of motorized bikes to reach customers quickly. Bond also offers features like delivery scheduling, direct text with couriers (and the ability to change your delivery location from home to a brunch spot), and the simultaneous pickup of returns and delivery of an exchange. In our following posts, I will dive into some of the circular solutions attempting to better last mile delivery by batching drop offs and pick ups.

While we haven’t seen a startup doing this, we could also see a delivery model where, similar to Prime, customers pay a flat annual fee for fast delivery from a handful of brands. We could see a delivery bundle of brands that target a similar customer (i.e. a package for beauty enthusiasts that includes the likes of Glossier, No B.S., Starface, and Ceremonia).

Next Up

Next week, we will discuss the second investment opportunity we saw: Cross-border. So stay tuned.

In the meantime, please join us in continuing the conversation Wednesday, June 1st for a panel led by Forbes Senior Editor Alex Konrad on the Now and What’s Next for the Global Supply Chain.

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2024 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.