Field Study: Generative AI in the Warehouse

The Alpaca team has always been focused on ‘unpacking’ the impact of technology on the supply chain. In February, Alpaca VC’s General Partner Aubrie Pagano released the conclusion of a five part Field Study series digging into themes in Global Supply Chains. More recently, David Goldberg led a Field Study on the Potential for Generative AI and discussed how our team will approach investments in the space. We are a team obsessed with investing at the intersection of the digital and physical worlds, and combining these two themes was a perfect next step for us. Enter Generative AI in the Warehouse.

Our initial theses centered on the concept that technology combining hardware with Generative AI would create a defensible moat. We struggled to identify defensibility in the influx of sales and marketing enablement, SaaS-based solutions coming to market post-GPT madness and thought hardware could make the difference. We embarked on our unique Field Study process to see if we were onto something.

Spoiler alert: while we think there is tremendous opportunity in SaaS-enabled hardware, specifically in warehousing and manufacturing applications, we don’t believe the market readiness truly exists at large scale at this point in time. We came to this conclusion through numerous conversations with investors, founders, and potential customers of this technology. We are more excited by SaaS tools leveraging existing data sets to better manage inventory, create more efficient and resilient operations, and provide better customer experiences.

We’ll dig into our thinking on this in depth below.

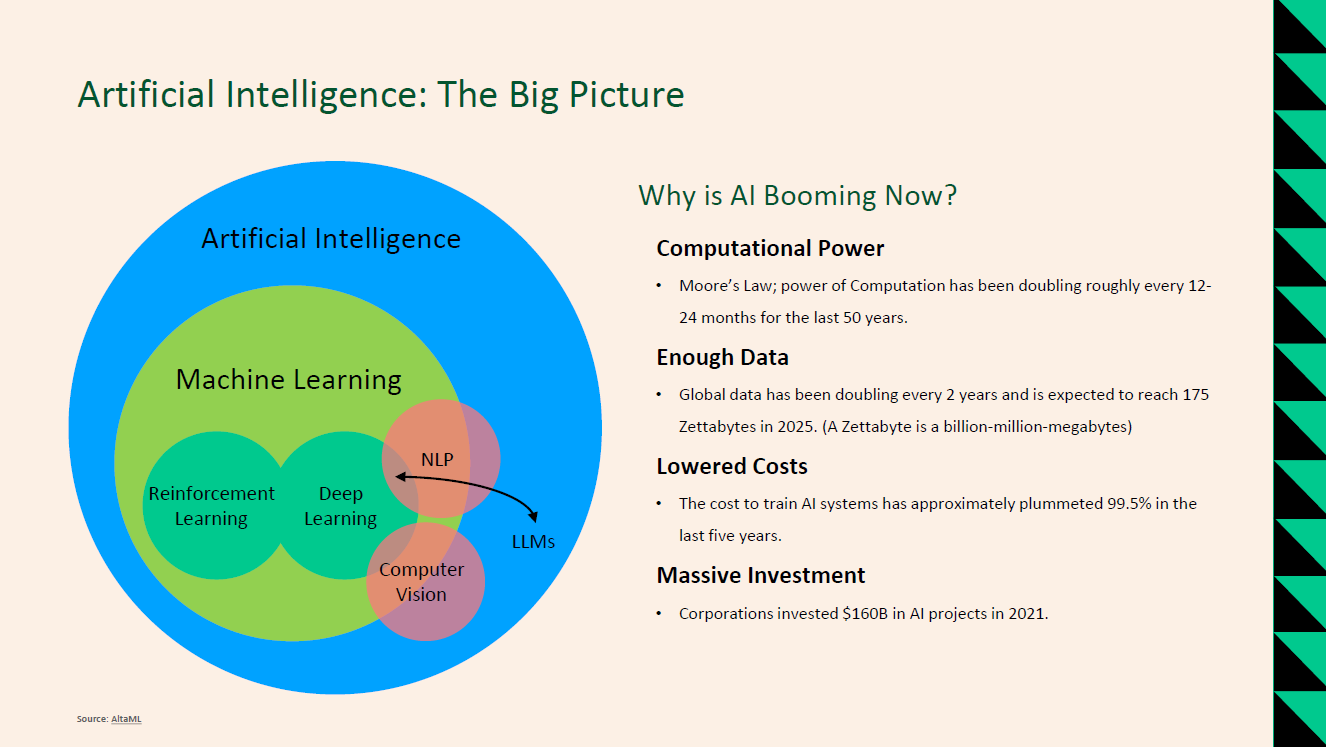

First — a brief reminder on the basics of Generative AI. Simply put, Generative AI refers to deep-learning models that can generate high-quality text, images, and other content based on the data they were trained on. Generative AI is a small sliver of the computational power created by artificial intelligence. Most consumers know generative AI by way of Chat GPT, which amassed nearly 100 million users just two months after its public launch and has recently dominated headlines due to internal turmoil at its parent company, Open AI. While the concept of artificial intelligence has been around since the 1950s, a few key factors are driving its recent exponential trajectory:

- Stronger then ever computational power

- Prevalence of data in organizations

- Lowered operational costs

- Significant capital investment

Digging in on the point of significant capital investment — it’s no surprise venture capital as a whole has been enamored with anything encompassing AI. Despite fundraising headwinds felt by most other sectors through 2022 and 2023, AI powered ahead. Venture capital investment in AI peaked in 2021, with roughly $120 billion invested into the space. This compares to $62 billion invested in supply chain tech companies over the same time period.

We elected to focus on manufacturing and warehousing for a couple of reasons. First and foremost — they are enormous markets, and ones we believed were likely lagging in terms of digitization and technological advancement.

A couple of data points for reference:

- The $2.3 trillion U.S. manufacturing market accounts for 11% of the country’s GDP and attracts 20% of the country’s capital investment.

- As of 2022, there were over 628,000 manufacturing businesses in the U.S. — a number that has remained fairly flat YoY.

- Public storage and warehousing in the U.S. generated $34.6 billion of revenue in 2022.

- Warehouses are operated by over 20,000 companies in the U.S.

- IBM surveyed over 700 ‘high performing’ organizations, where 88% believe AI is inevitable in their industries, and 95% see AI as being central to their innovation success.

We knew the market sizes of those sectors were huge. Combined with a few powerful macroeconomic tailwinds, we were compelled to dig in.

- Nearshoring and improving supply chain resiliency is a hot topic –McKinsey says restoring growth and competitiveness in key manufacturing industries could boost U.S. GDP by more than 15% by 2030

- E-commerce sales in the U.S. are expected to reach 25% of all retail sales by 2025. 330 million square feet of warehouse space dedicated to online fulfillment will need to be added in the U.S. to accommodate this growth. Existing warehouse spaces will need to improve efficiency to keep pace with growth in the category and cost expectations.

- Market volatility, which has been exacerbated by the COVID-19 pandemic, has elevated the need for agility and flexibility –customers are seeking solutions for resiliency and visibility challenges.

It was important for us as a next step to properly understand the pain points felt by operators in these industries. We leveraged our network to speak with a number of 3PLs, manufacturers, and vertically integrated brands.

Here’s what we understand to be topical in each category:

Manufacturing

Shortage of highly skilled manufacturing workers: 2.1 million roles will be unfilled by 2030 due to a lack of skilled labor, and 46% of manufacturers say that they lack the skilled workforce to outpace the competition over the next 12 months.

Sustainability considerations are increasingly important: Reduction in greenhouse gas emissions, waste and water consumption reduction, improved energy efficiency.

Greater productivity expectations: Pressure to achieve the trifecta of higher production, at lower costs, with improved quality.

Production agility and ability to customize: Shorter lead times, improved on-time delivery estimates, lower minimum order quantities, and shortened changeovers.

Improved speed to market: Reduced speed to market and less time spent on design iterations.

Warehousing

Shortage of laborers: Increased lens on warehousing labor conditions; challenges retaining entry level laborer roles.

Warehouse space requirements: Inefficient layouts combined with industry requirements to bring 330 million square feet online.

Picking optimization to meet delivery timeframe expectations: Growth in e-commerce requires efficient omnichannel fulfillment — consumers expect nearly immediate shipping.

Increased focus on quality control: Increased focus on order quality control to prevent errors from being identified once an order reaches the customer.

Optimized inventory requirements: Customers want to reduce inventory levels and improve visibility across fulfillment networks.

These macro trends in combination with conversations with customers, investors and founders in supply chain technology surfaced eight areas where we believe there are major opportunities for innovation and advancement.

- Yard Automation — automated gate entry; real-time tracking of trucks and trailers; real-time capacity visibility and on-time performance metrics

- Robotic Automation — assistive or autonomous picking and packing; palletizing and depalletizing

- Supply Chain Resiliency — what-if analysis to create redundancy in supply chains to prevent losses from shocks; optimized selection of supply, manufacturing and fulfilment vendors; predictive maintenance

- Demand Forecasting — integrated inventory planning to optimize inventory on-hand and forecast demand fluctuations

- Inventory Visibility — complete real-time inventory visibility across the supply chain; reduced gaps in visibility for omni-channel operations

- Quality Control — proactive identification of errors in manufacturing and fulfilment; exceptions management

- Micro-Fulfilment — local fulfilment centers to optimize delivery date and minimize real estate expense

- Reverse Logistics — reverse logistics operations including automated grading and what-if analysis to determine best (most profit, least environmentally impactful) path for returned goods

However, this is where we began to stray from our initial thesis. Many of these themes bring automation and efficiency to manufacturing and warehousing, but only some of them are truly leveraging generative AI.

As we dug further into opportunities for AI in these segments, we uncovered a surprising fact: 79% of manufacturers polled in a recent Rockwell Automation study reported a lack of end-to-end supply chain planning software. Further, 50% of participants are either not using a supply chain planning process or are using manual tools (ie. spreadsheets, sticky notes) or homegrown solutions.

It’s not only challenging to contemplate full robotic automation in a warehouse where a receipt for goods is still hand-signed, but it would be impossible to implement. AI requires data — and a lot of it — to truly add value to a business. With such a significant portion of the manufacturing and warehousing space still effectively offline, we believe there is more opportunity for mass advancement by simply focusing on implementation of ERP and WMS solutions.

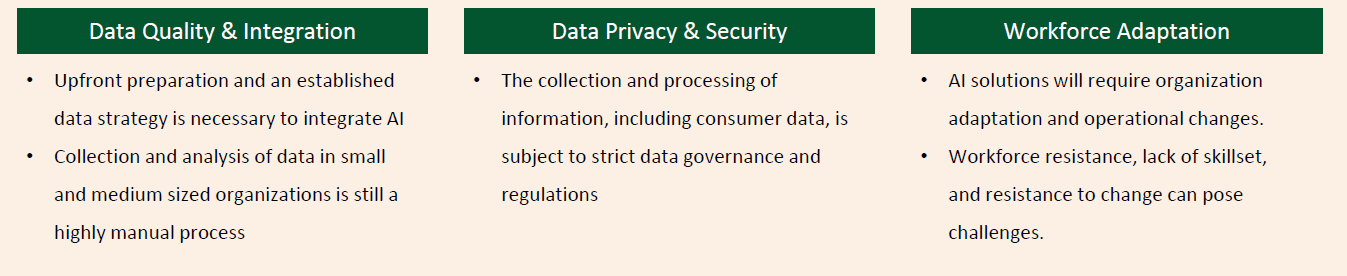

We uncovered a few other challenges of solving supply chain issues with AI, below:

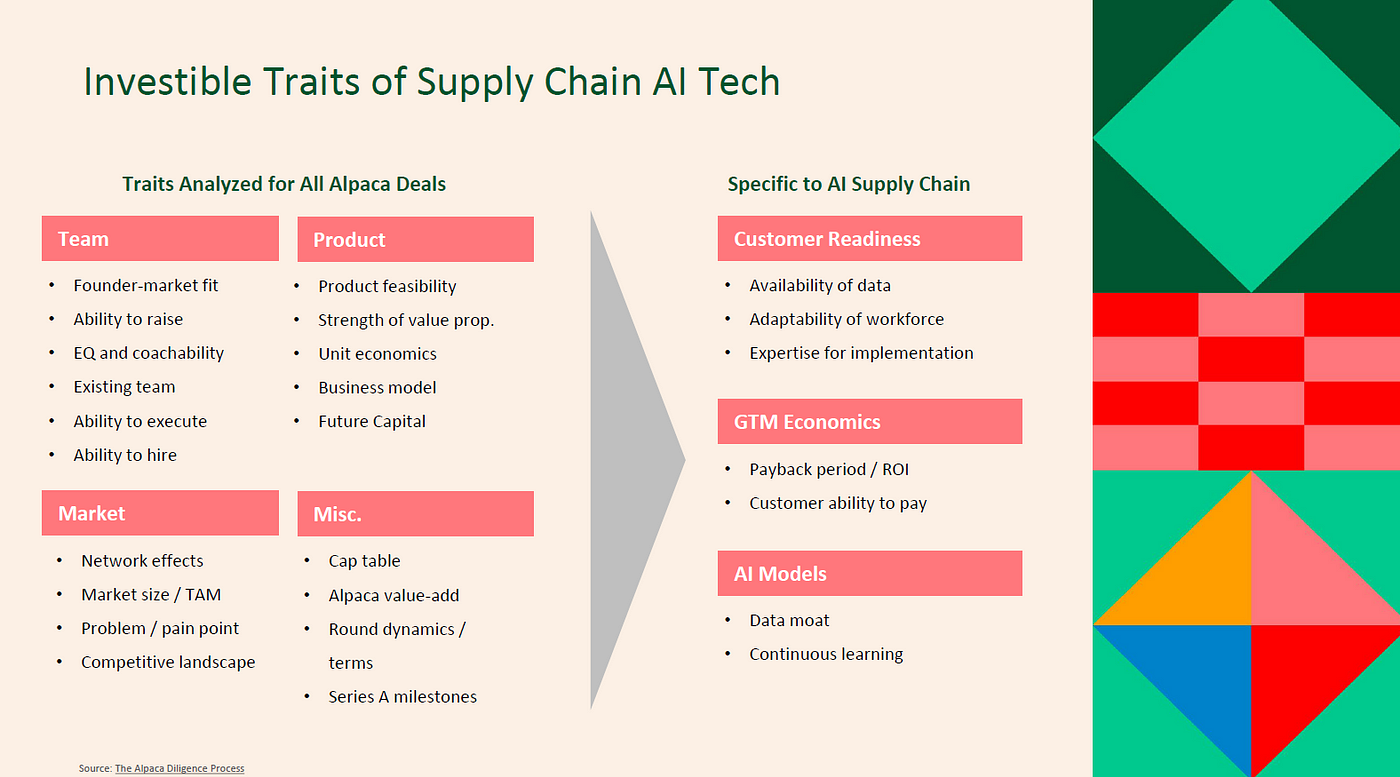

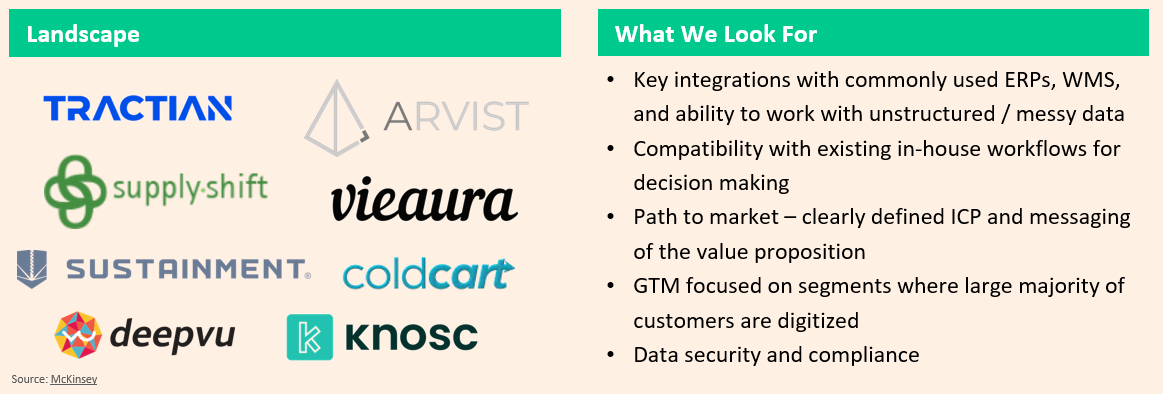

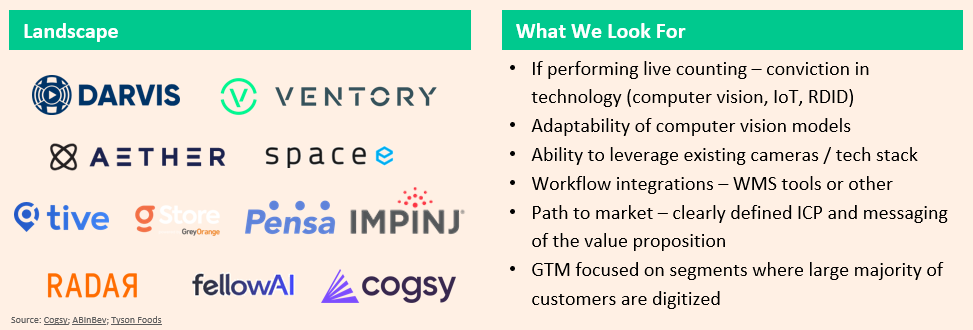

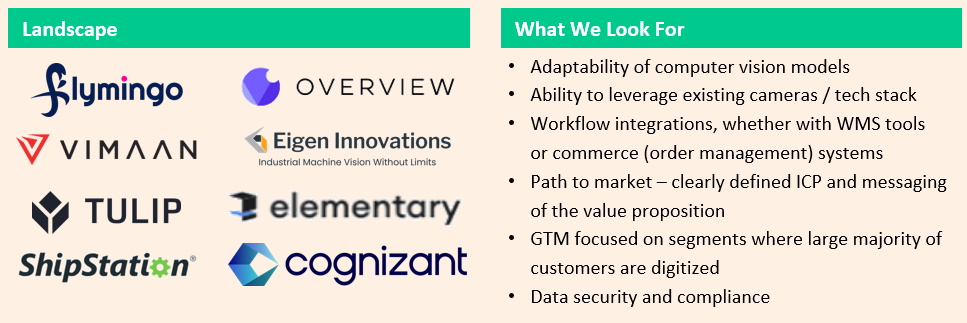

Discovering investable technologies and companies is a key tenant of our field study process. There are a few characteristics of investible companies building AI solutions for the manufacturing and warehousing industries, incremental to our traditional 19-Factor requirements:

Bringing this all together, we identified four themes we believe are investible:

Yard Automation

This is a concept often referred to as ‘Yard of the Future’. Warehouse Management Systems (“WMS”) have advanced technologically, but Yard Management Systems (“YMS”) have been relatively stagnant.

- $10 trillion in goods are transported across the U.S. by trailer annually, and 80% of trailers are parked at one of ~ 140,000 manufacturing plant or distribution warehouse yards

- 92% of these sites lack any technological enablement and processes are highly manual

The Yard of the Future concept includes complete automation of workflow, from trailer entry at yard to dock door management. The technology involved is often a combination of sensor networks (RFID / IoT) and computer vision leveraging existing camera infrastructure. Digitization of the yard will help solve labor and capacity shortages felt throughout the industry, volatile demand patterns, and high on-time, in-full (OTIF) expectations.

Supply Chain Resiliency

Existing supply chains were designed to operate at the highest levels of reliability and at the lowest cost.

- ‘Steady state’ supply chains have had significant disruptions, largely catalyzed by COVID, but uncertainty remains today — whether due to geopolitical factors, ongoing supply shortages, or labor challenges.

The emergence of new technologies for manufacturing and operating supply chains are creating opportunities for relocating production closer to end markets with a goal of making supply chains more resilient. By leveraging existing supply chain visibility tools and AI, companies can proactively address potential risks in their supply chain to mitigate any disruptions. We view supply chain resiliency to include tools for asset management and monitoring, specifically, those focusing on predictive maintenance to reduce any equipment and manufacturing downtime

- McKinsey estimates AI-based predictive maintenance typically generates a 10% reduction in annual maintenance costs, up to a 25% downtime reduction and a 25% reduction in inspections costs

Inventory Visibility

Inventory visibility is the ability to monitor stock levels, ideally in real-time, to evaluate inventory availability and accurately locate specific units within a warehouse, fulfillment center, or while in transit. Accurate inventory visibility results in reduced stock-outs, accurate demand forecasting, smart resource allocation, improved omni-channel management, enhanced customer experience, and ultimately lower supply chain costs. Computer vision solutions present interesting alternatives to physical count-based inventory processes. IHL Group estimates stock-outs cost retailers nearly $1 trillion, annually.

Large enterprise customers have taken steps to improve this aspect of their businesses.

- Protein processor Tyson Foods implemented a computer-vision-enabled inventory tracking system. The system reads SKU information and weight, replacing what Tyson described as communication by hand gestures followed by manual inventory entry, leading to > 10% increase in inventory accuracy.

- Similarly, AB InBev deployed an inventory system leveraging autonomous drones with computer vision to collect hourly and daily data on out-of-stocks and share of shelf — it did so with 98% accuracy.

Quality Control

Automating quality control processes can improve yield, process efficiencies, and ensure businesses never ship defective products to customers with two primary applications:

- Manufacturing — inspecting finished goods before shipment to customer

- Order Picking / Fulfillment — ensuring the right SKUs are being sent to the right customer

Implementation of quality control automation can be very high ROI initiatives. Amazon reduced the cost of its visual bin inspection process by 40% by implementing a computer vision solution. Integration with existing technology stack can help customers with completing root cause analysis and reform workflow to prevent ongoing QC issues. Fulfillment operations (including order QC) will need to scale economically with the growth of e-commerce.

We believe reducing manufacturing and fulfillment errors (and therefore, returns) will drive improved customer satisfaction and ultimately retention across all commerce channels (but especially e-commerce).

Our Conclusion

Our Take on Generative AI

We believe that long-term, generative AI will bring many benefits to manufacturing and warehousing — automating currently expensive, repetitive and timely processes, and helping to solve the macroeconomic pressure in these industries.

- Shortages of highly skilled manufacturing workers and warehouse laborers

- Increased customer expectations for production sustainability, manufacturing customization, speed and quality of fulfillment

- Resilient supply chains that can manage through unforeseen shocks

However, we think manufacturing and warehousing customers are more likely to benefit near-term from basic digitization and machine learning / computer vision solutions.

Why?

- Through our research, we consistently heard feedback that AI is not likely to solve all challenges. There is a very real human component at the bottom of both manufacturing and warehousing supply chains that should be prioritized. We believe it will take time (many years) to implement assistive robotics and automate much of the operations in warehousing and manufacturing.

- It’s estimated that ~ 50% of manufacturers are either not using a supply chain planning process or are using manual tools (ie. spreadsheets). Generative AI does not work without data. Even if messy and unstructured, the data must be available for AI to be effective. The long-tail of manufacturing businesses need to be digitized before broad adoption of AI can be contemplated.

- Customers are highly conscious of upfront costs and need to see strong cases for payback periods and ROI. Technology that leverages existing assets — for example, computer vision software that leverages existing cameras, is exciting to us. We expect robotics, with a high upfront purchase prices or steep Robotics-as-a-Service payments, to require have challenges in GTM, particularly through volatile macroeconomic environments.

Based on these discoveries, we are specifically focusing on opportunities where customer readiness exists. We think of readiness from a technology perspective (data), and at the most basic level — willingness to adopt technology bringing step-change impact to their organizations.

We’re most excited about opportunities in the areas we mentioned above — Yard Automation, Supply Chain Resiliency, Inventory Visibility, and Quality Control. While major incumbents like Rockwell Automation (self-described as the world’s largest company dedicated to industrial automation and digital transformation), ATS, and even the likes of IBM and AWS are active in these spaces, we believe there is significant near-term white space for new entrants. We are excited by founders that have a focused GTM strategy, have proven they can communicate a compelling value proposition, and have built outstanding technology.

Longer term, we believe there is a place for some of the more disruptive solutions — for example, robotics. In Q3, Rockwell Automation announced the acquisition of Clearpath Robotics, a leader in autonomous mobile robotics. We expect to see financing and M&A activity increase in these spaces as the curve for customer adoption steepens and the technology becomes more mainstream. However, we’re focused on solutions where we have high conviction that market readiness exists today.

For a detailed look at our findings, view the accompanying deck for this Field Study.

If you are a founder or know of one building something exciting in Yard Automation, Supply Chain Resiliency, Inventory Visibility or Quality Control for Manufacturing or Warehousing, we’d love to speak with you.

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.