Field Study: Global Supply Chains — Part 3

Investigating the current state and future of global e-commerce supply chains

This post is part of a five-part Field Study by Alpaca exploring the current state of global e-commerce supply chains and the opportunities we see ahead. Use these quick links to read the entire series: Part 1: Global Supply Chains, Part 2: Delivery, Part 3: Cross-Boarder, Part 4: Returns, Part 5: Conclusion.

Buon Giorno dall’Italia! It took some time to get Part 3 written this summer (see Part 1 and Part 2), but now I am sipping espresso in my family’s house on the Amalfi Coast thinking about a supply chain issue I have experienced most of my adult life having a multi-national family: cross-border logistics.

Una storia: Half of my family lives in Italy, so gift-giving has always been tough, especially for Christmas. My littlest sister, Emanuela, adores American culture and desperately follows the Biebers and the Kardashians on social media, not unlike many GenZ here who aspire to American pop culture royalty.

A couple of years ago when it launched, all Emanuela wanted was Kylie’s lip kit (for those living under a rock, Kylie Jenner’s beauty brand Kyle Cosmetics catapulted her to be named the youngest self-made billionaire in 2019). There was an issue, though: my sister couldn’t get a lip kit shipped to her in Italy.

This doesn’t make sense, though, right? An international fan, who knows and loves the Kylie brand and is willing to pay, found it nearly impossible to get the items she wanted delivered. So I took it upon myself to be a good older sister and paid nearly $100 in shipping and customs to send her a $30 lip kit much to her surprise and delight. Here in lies the problem and opportunity of cross-border logistics.

The Problem

With the rise of social media and the now 50 million creators globally, it is easier than ever to discover interesting content and commerce from all corners of the earth. The rise of K Beauty serves as a standout example of this trend for me. There is a halo effect, in particular, for US brands shucked by internationally recognized celebrities like Bella Hadid, Emily Ratajkowski, The Kardashians, and Kanye West (just to name a few) who help people all over the globe discover the latest lifestyle and beauty trends.

“Consumers have changed their behavior and how they connect with brands. They find them on Instagram, Snap, and Facebook now.”

Rathna Sharad, Founder & CEO @ FlavorCloud

However, if you’ve ever ordered something from an international store and dealt with customs delays or a lack of end-to-end tracking information, then you probably know cross-border e-commerce has room for improvement. As the world becomes more global, so must the e-commerce supply chain. So, why is cross-border selling so painful?

Customs, logistics, returns and managing the customer expectation are all more difficult when shipping internationally. A few reasons why:

- Taxes and customs — both are a headache to maneuver and can vary by the product and by country. Predicting the landed cost for customs is a challenge. Different countries also have different trade agreements. Figuring out what to put on customs declarations can mean the difference between a multi-day delay and a quick delivery. Additionally, certain countries have different rules around what can be imported (type of product, materials, etc.)

- Fulfillment — figuring out where your fulfillment partners should be located and finding the right, trusted partners is a challenge. And what if you find one and they don’t work out? Switching international facilities without someone on the ground is tricky.

- Returns — returns further complicate the process as it’s often too costly to send items back to the domestic fulfillment center and better to keep them in-country. Research shows that 70% of customers want clear information on delivery charges pre-purchase, while 57% want an easy and free returns process.

- The shopping experience itself — From the customer perspective, cross-border shopping is also a challenge. Page translations can be inaccurate or provide poor product descriptions. International payments can be rejected and some local preferences for payment (e.g., debit) may not be accepted. Shipping costs can be miscalculated, and it’s common for return costs to be charged to the customer.

“The big unlock [for cross-border] is making it not painful…brands who sell only 10% abroad will just drop international orders because of the pain [to facilitate those sales and because] it’s a marginal part of their business”

Passport Co-Founder Aaron Schwartz

A recent study by Visa revealed that 87% of e-commerce executives see cross-border sales expansion as the area with the most growth potential. Despite that, most companies do not sell internationally.

Why Now?

Now more than ever, brands need to figure out how to unlock global e-commerce. Why? For one, competition is at an all-time high because startup costs for an online brand are at a low. For example, in 1999, the average cost to build an e-commerce site was $100,000 (excluding inventory purchases, warehousing, and shipping logistics). Today it’s closer to $30, thanks to platforms like Shopify. With more brands starting up all over the world, e-commerce penetration is close to 65% globally.

With a glut of brands saturating the market, it has also become harder and harder to find customers and compete on price. Besides TikTok, in our current marketing environment, there is little-to-no acquisition arbitrage left. Facebook, Amazon and Google properties are more expensive than ever post iOS14. Brands need to find new avenues and locations to sell product, especially if they are not the cheapest alternative.

That said, the top reason online shoppers in the US shop internationally is lower prices. Younger generations are more price-sensitive and have a lower spending power than Boomers, which explains why international fast fashion brands like SHEIN, Romwe, Missguided, and Boohoo are so popular. Most of these brands serve the US market by shipping from an international fulfillment center to one within the US and are notorious for delivery delays and poor customer service. Customers are willing to undergo the online ordering pain for low prices on trendy clothes.

Cross-border e-commerce is growing at 2x the rate of domestic eCommerce per Accenture. Even as of last week, Pinduoduo, a social commerce platform aggregating buyer demand, announced its US expansion plans. In order to remain competitive, US brands must think without borders and compete on brand equity and super customer experience.

How cross-border is currently enabled

The order threshold to start considering global sales is around $10 million GMV. I know this first hand: I founded Bow & Drape, the cult favorite women’s mass customization brand, and internationalization proved incredibly difficult for us in the beginning. We had 15% of our site traffic from countries like Canada, the UK and Australia, but fulfilling to those customers was challenging (not to mention, at the time, we had built a custom checkout using Braintree and so had to build our own internationalization at checkout — y’all have it easy now with Shopify + GlobalE!). Doing it ourselves resulted in inefficient customer service, but finding international 3PLs that would scale with us also proved difficult. Most 3PLs were focused on enterprise-level brands (>$100M in revenues). We actually ended up using the help of HBC in several cases and piggy-backed off their importer networks.

Brands $10M+ have relatively few options to quickly start selling abroad:

- In-house: some brands decide to sell internationally by simply adding the option to start shipping abroad. However, as outlined above, selling internationally requires much more than just shipping to be successful.

- FBA: Amazon offers an all-inclusive solution for brands looking to sell internationally, making it an easy and logical choice for many. In fact, a growing number of third party sellers on Amazon are international. We see this as an indicator of the demand for solutions that enable global selling.

- Using a Consultant or 3PL: seeking advice from a party with cross-border experience is valuable, but expensive. Global-e is an example that comes to mind here.

When it comes to cross-border shopping, the “consumer experience needs to feel like you are buying locally, even though you’re not.”

Rathna Sharad, Founder and CEO of FlavorCloud.

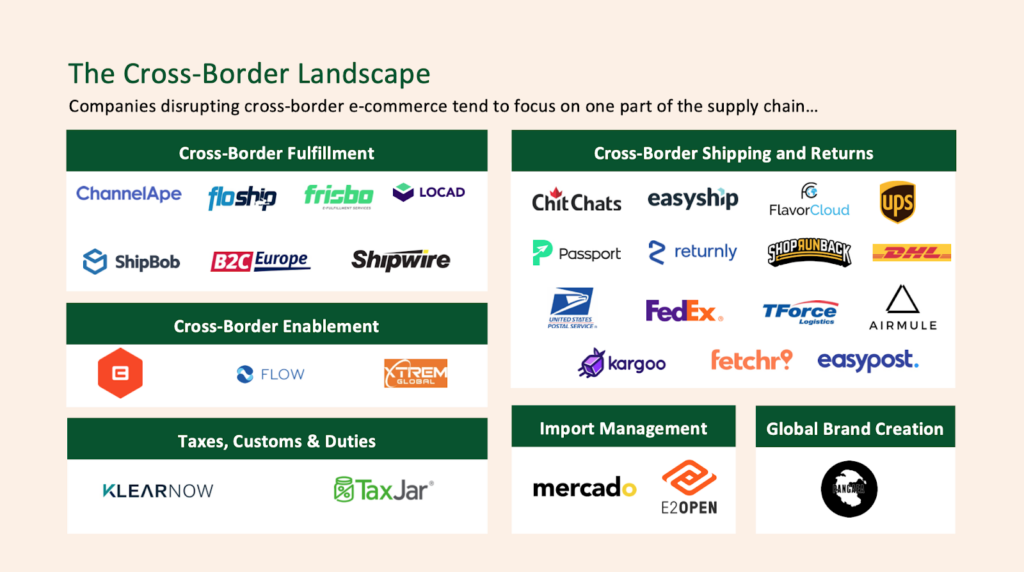

Mapping the space

Many of the startups that we’ve seen who are trying to unlock cross-border sales focus on a point solution for a given part of the supply chain, such as fulfillment, customs, or local payments. Below, we are cataloguing a few of the current solutions that help brands scale internationally:

- Passport is one company that offers more than just a network of carriers — it also offers customer service that’s tailor made for international e-commerce. Passport offers end-to-end tracking and acts as the main point of contact for customer inquiries like “where’s my package?” or “why is my shirt stuck in customs?” Passport handles all of these customer inquiries and deals directly with any customs delays to completely absolve the brand of the international shipping burden.

- ChitChats is addressing international shipping by collecting US-bound returns from drop-off points in Canada and then driving them over the border to avoid the cost of international shipping.

- Kargoo crowdsources space in people’s luggage to bring back products from the US to Colombia and Ecuador.

- FlavorCloud offers solutions like localized payments and pricing, as well as AI-driven estimates for landed costs that have 99.9% accuracy.

- Pangaea focuses on building brands that can scale internationally.

- Browze is a cross-border marketplace with a curated selection of high-quality, low-priced goods that ship direct from factory.

The White Space

We see an opportunity for end-to-end software solutions to help brands from Day 0. It would be great to see more software that helps to localize the e-commerce experience for international shoppers, with features that help to localize merchandising, marketing, and browsing. We’d also be interested in any companies that help smaller brands scale internationally, perhaps by bundling orders for international shipping and fulfillment.

Drop-shipping could be a cost-effective way to facilitate cross-border sales and we haven’t seen a lot of solutions that are doing this. Brands like Italic ship direct from manufacturer to locations around the world. We wonder if a software solution could unlock drop-shipping for other brands in a similar way.

Next Up

Next, we’ll close out this 4-part Field Study series by discussing the last global supply chain opportunity we cataloged over the course of our year of research into the Global Supply Chain: end-to-end solutions for e-commerce returns and circularity. Enjoy your final days of summer — we’ll be back with more soon!

Reach Out

Our request: if you know entrepreneurs or industry experts exploring this space, please reach out to [email protected]. We love talking about this stuff and are looking to invest.

Disclaimer: Alpaca VC Investment Management LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Alpaca VC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy. Past performance is not indicative of future results. Statements may include statements made by Alpaca VC portfolio company executives. The portfolio company executive has not received compensation for the above statement and this statement is solely his opinion and representative of his experience with Alpaca VC. Other portfolio company executives may not necessarily share the same view. An executive in an Alpaca VC portfolio company may have an incentive to make a statement that portrays Alpaca VC in a positive light as a result of the executive’s ongoing relationship with Alpaca VC and any influence that Alpaca VC may have or had over the governance of the portfolio company and the compensation of its executives. It should not be assumed that Alpaca VC’s investment in the referenced portfolio company has been or will ultimately be profitable.

COPYRIGHT © 2025 ALPACA VC INVESTMENT MANAGEMENT LLC – ALL RIGHTS RESERVED. All logo rights reserved to their respective companies.